Summary:

- The DOJ and 38 states allege that Google maintains its monopoly power through exclusive contracts, violating antitrust laws.

- The trial is expected to last several months, with a decision possibly not being expected before Q1 2024.

- Google denies the allegations and argues that its search distribution deals are not anti-competitive and do not harm consumers.

- Although the USA vs. Google trial may appear scary on the surface, I see it as quite insignificant for Google’s commercial and financial success.

bpperry

The Department of Justice and Attorneys General of 38 states allege that Google (NASDAQ:GOOG) (NASDAQ:GOOGL) maintains its monopoly power in the search & search advertising market through a set of exclusive contracts that make Google the default search engine on a range of products in exchange for a share of the advertising revenue generated by Google searches. These agreements, made with (i) web browser developers, (ii) original equipment manufacturers, and (iii) wireless carriers are allegedly exclusive, and thus–so the reasoning goes–violate Section 2 of the Sherman Act, which “makes it unlawful for any person to monopolize, or attempt to monopolize” any part of commerce.

While the outcome of the trial could impact Google’s freedom to engage in distribution deals with partners like Apple (AAPL) and Android OEMs, investors should consider that even if Google loses, the impact of the loss must not necessarily be negative for the company and its investors, as users might still prefer Google’s technology and user experience, while the search giant may save billions in traffic acquisition costs spent through distribution agreements. In this article, I discuss everything that investors need to know about the USA vs. Google trial.

What The DOJ Claims

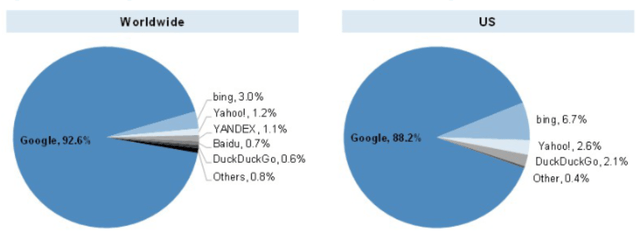

The trial, which began on September 12, 2022, is a result of a lawsuit filed by the US Department of Justice (DOJ) and several states against Google in 2020. The lawsuit alleges that Google’s search deals with Apple and Android Original Equipment Manufacturers (OEMs) are non-competitive and violate antitrust laws. The DOJ claims that these deals are exclusionary and harm consumers by limiting their choices. Consequently, the DOJ also claims that these deals have allowed Google to maintain its dominant position in the search market, stifling competition. According to Kenneth Dintzer, a government lawyer, Google allegedly became a monopoly by at least 2010 and today controls over 89% of the online search market.

Data: Statscounter, Graph: JPMorgan

The trial is estimated to last several months, with a decision possibly not being expected before the first quarter of 2024, at best. In addition, it is important to note that the trial is a bench trial, meaning that there is no jury, and the judge will make the final decision. Moreover, proceedings are expected to be mostly public, meaning that we as investors and analysts may have the opportunity to follow arguments and evidence.

Overall, the DOJ sees that Google’s search distribution deals with Apple and Android OEMs are crucial to Google’s business model, as these deals ensure that Google’s search engine is the default option on millions of devices. In return for being listed as the default option for search on devices, Google pays its network partners a fee, often defined as a portion of advertising revenue and known as “Traffic Acquisition Costs”. In that context, the DOJ has claimed that the Google pays about $10 billion a year to be the default search engine on many devices and browsers. However, while precise figures remain undisclosed, doing some research reveals that this figure may be anywhere between 2-3x higher than what DOJ proposes, with about $18 billion possibly going to Apple alone.

Why Google Disagrees With The DOJ

Google has denied allegations that its search distribution deals are anti-competitive. And while most of Google’s arguments remain clouded, with the purpose of not giving the DOJ a head start on formulating counter-arguments, I see a few notable considerations that will give Google a strong position in this case: First and foremost, I expected Google to argue extensively that the payments it makes to technology competitors, smartphone manufacturers, and wireless providers are not necessarily anti-competitive, because users can easily switch their default search engine away from the Google, and certainly without costs. Second, Google may argue that its monopoly status in search does not cause any consumer harm, because the Google platform still is the best search product on the market, by far. In fact, making Google the default search provider on phones supports ‘uninformed’ consumers to connect with the most valuable product in search. This is certainly my personal view. Third, and this is perhaps a less strong argument, Google may argue that the contracts are similar to the deals that food companies strike to get prominent placement on supermarket shelves, making these type of deals a regular part of commercial life. Finally, Google will likely argue that the DOJ’s definition of its competitors as general search providers like Bing and DuckDuckGo are too narrow and that there are other competitors in the market, most notable ChatGPT by Open AI.

Implications For Google, And Its Investors

Interestingly, the USA vs. Google trial has drawn parallels to the Microsoft antitrust case of the late 1990s. In that case, the DOJ accused Microsoft of using its dominant position in the PC operating system market to block competition in the web browser market. According to the case arguments, Microsoft had bundled its Internet Explorer browser with its Windows operating system, thus rendering Microsoft’s search offering the default option for millions of users. If an analyst accepts the parallel as informative, which I do, then it is suggested that the outcome of the trial and consequent remedies sought by the DOJ are similar as well. While the in the Microsoft case, the DOJ initially sought to break up the company, the DOJ ultimately settled for a series of behavioral remedies reducing Microsoft’s commercial freedom to bundle its offerings.

Now, if the court rules in favor of the DOJ, I expect a similarly soft “penalty” for Google: In my opinion, the judge will likely prohibit Google from having exclusive, multi-year contracts with Apple and/or Android OEMs that require Google Search to be the default search engine. In that context, I expect the “exclusive” to be dropped at a minimum; but deals that (slightly) favor Google’s technology may still be allowed, to some extent. In any case, if the judge rules in favor for DOJ in the ongoing trial, then there could be another hearing on the remedy sometime down the road, probably six months or a year later. Accordingly, a decision on remedy should not be expected until late 2024/2025.

Optimally, Google would emerge victorious in all aspects of the trial, essentially preserving the status quo–suggesting no concern for investors. That said, I would like to point out that even if Google loses the trial, this wouldn’t necessarily spell doom for the tech giant. In fact, investors should consider that the downside scenario here relates to a situation where Google would need to stop paying as much a $25-30 billion a year for certain search distribution agreements. Paradoxically, this could be value accretive for the search giant, if the overall impact on search volume and market share remains relatively limited. And this is in fact my personal opinion: I believe that even if Google were to lose the position of being the default search engine installed at devices like Apple, OEMs may either continue to give preferential treatment to Google, or users themselves will actively seek out the Search giant’s applications–simply as a function of Google’s leading technology and user experience.

All that said, Google remains an excellent business. And although the USA vs. Google trial may appear scary on the surface, I see it as quite insignificant for Google’s commercial and financial success. I remain “Buy” rated.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of GOOGL either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

not financial advise

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.