Summary:

- Vale’s results in 1Q24 were decent and in line with expectations, the only surprise was the provision guidance.

- The company has been showing a sequential increase in iron ore volumes, which indicates resilient demand from China despite doubts.

- Vale has a 31% discount to its peers in terms of EV/EBITDA multiple, making it an attractive investment with strong margins and competitive cash costs.

dt03mbb

Investment Thesis

I recommend buying Vale S.A. shares (NYSE:VALE) after the 1Q24 results. As I said in my coverage initiation report, China is seeking a new model of economic growth to complement the real estate sector, which previously contributed 20% of China’s GDP.

The businesses that should complement the real estate sector are electric cars and renewable energy, such as manufacturing solar energy panels and wind generators. In this sense, Vale has the highest quality iron ore in the world, which is a great competitive advantage for the manufacture of these products.

Vale reported 1Q24 results in line with expectations, with its adjusted pro forma EBITDA of $3.3 billion. In this specific result, the macroeconomic scenario did not help, such as the drop in iron ore prices throughout the 1Q leading to a weaker price realization. On the positive side, iron ore volumes have been recovering, and free cash flow has reached $2 billion.

Review of Vale’s 1Q24 Results

Vale released its 1Q24 results. The decline in numbers was already expected, due to lower iron ore prices. Let’s understand the results below in more detail.

Revenues – Few Surprises

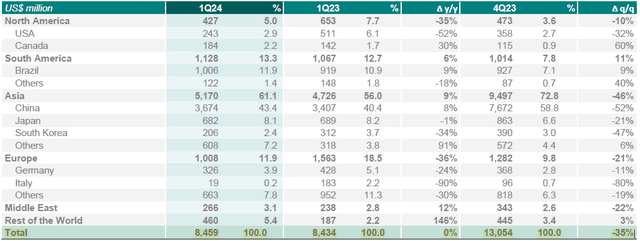

Net revenue was $8.4b (-35.2% q/q and +0.1% y/y), the company had to deal with: (i) lower iron ore prices and (ii) seasonality of the Q1 in relation to the volume of rainfall. In the annual comparison, where the seasonality factor is excluded, there is stability in revenue.

Net Operating Revenue By Destination (IR Company)

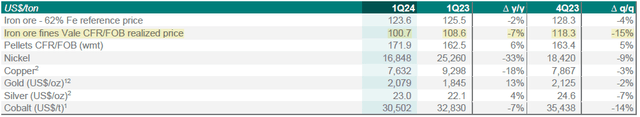

In terms of price realization, the average was $100.7/t for fines ($17.6/t below 4Q23), impacted by provisional price adjustments in relation to the closing of the quarter.

Price Realization (IR Company)

In my opinion, based on the production report and iron ore prices in the quarter, expectations were low for great results. However, I highlight that the volume of iron ore has been increasing sequentially over the quarters, and this is positive. As a reference, iron ore production was 66.8 million tons in 1Q23, 78 million tons in 2Q23, 86 million tons in 3Q23, 89 million tons in 4Q23, and 70.8 million tons in 1Q24 (higher than 1Q23 but lower than 4Q23 due to seasonality). Now, let’s look at the results from a cost perspective.

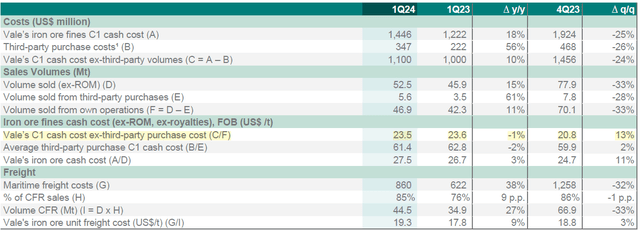

Costs and Margins – Competitive Cash Cost

In the iron ore business, cash cost C1/t in 1Q24 fell 1% YoY to $23.5/t, mainly impacted by the exchange rate effect (a negative effect of $0.7/t YoY).

Iron Ore Fines Cash Cost And Freight (IR Company)

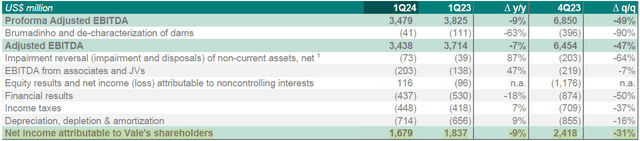

And reflecting an increase in iron ore sales volume (+8.2 Mt YoY), offset by lower realized prices and higher freight rates, adjusted EBITDA reached $3.3 billion (-2% Y/Y and -49% Q/Q).

A negative highlight was the base metals division. A stoppage in Onça Puma operations resulted in higher costs. This, coupled with a 33% YoY reduction in nickel prices resulted in EBITDA reaching $257 million (-51% Q/Q, -55% Y/Y).

However, it is important to remember that 90% of Vale’s EBITDA comes from the iron ore segment. Furthermore, despite being considerably far from China compared to Australia, the company has one of the lowest cash costs in the world. The sequential improvement in volumes and the stability of cash costs corroborate my bullish thesis for the company.

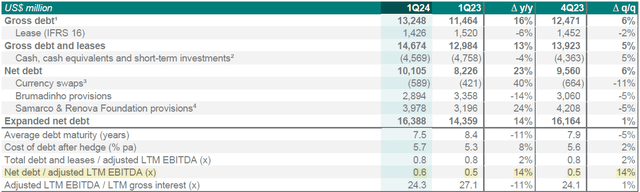

Debt and Provisions – One Of The Risks Is Here

Expanded net debt stood at $16.4 billion at the end of 1Q24, $0.2 billion higher q/q. This is due to new loans raised by the company within a liability management plan. However, it is important to highlight that the number is within Vale’s expanded net debt target ($10-20 billion). The company still has a healthy level of net debt/EBITDA at 0.6x.

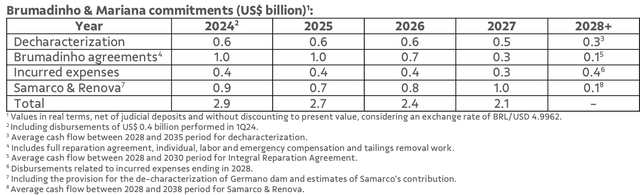

However, the highlight of the quarter was provisions:

The values related to Samarco remained stable in 2024, however, the years 2026 and 2027 were the most penalized in the new guidance vs. the old one, now being disclosed at $0.8b (2x more vs. $0.4b) and $1b (3.3x more vs. $0.3b), respectively.

However, the total dilution period was also announced as increasing, at +3 years compared to the past provision curve. As I said in my initial coverage report, one of the major risks of the thesis is the low visibility of the company’s provisions.

Net Income – Decent

Due to EBITDA impacted by lower realized prices, Vale achieved a net income of $1.679 billion, a 9% drop compared to the same period of the previous year.

On the other hand, free cash flow reached a strong level of $2 billion (driven by one-off working capital relief). In general, the results were decent, it is worth noting that the macro scenario did not help with lower iron ore prices and the appreciation of the Real against the dollar impacting costs. However, volumes have been recovering healthily.

My view remains positive for the company’s shares, especially when we see their valuation.

Valuation Remains Attractive

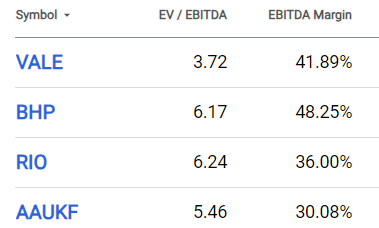

When analyzing the commodities sector and carrying out a comparative analysis, the EV/EBITDA multiple is very useful, as it does not account for the financial result, and EBITDA is a good proxy for cash generation.

EV/EBITDA (Seeking Alpha)

When we analyze the sectoral EV/EBITDA multiple, we conclude that Vale is extremely discounted compared to its peers. The company has a 31% discount to the peer average of 5.4x EV/EBITDA. This great risk-return ratio corroborates my bullish thesis for the shares. Now, let’s see what Seeking Alpha’s valuation tools indicate.

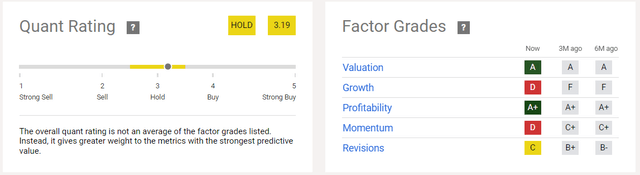

Seeking Alpha Quant and Factor Grades

According to Seeking Alpha Quant, Vale has excellent valuation and profitability:

Quant Rating and Factor Grades (Seeking Alpha)

However, the Quant tool indicates holding the shares. This is due to other indicators, mainly momentum. And to complement the skeptical assessment of Seeking Alpha’s tools, let’s recap the risks of the thesis.

Potential Threats To The Thesis

As occurred in this result, one of the major risks to the thesis are new liabilities related to Brumadinho and Samarco. Low visibility into cases and the possible loss of new licenses can impact operations.

And complementing the risks that I mentioned in the coverage initiation report, the Government plans a new mining policy to force the exploration of mines. In the Government’s view, there are several idle mines that can be better explored, and this includes changing legislation (and consequently improving government revenue).

Along the same lines, political intervention is one of Vale’s risks. Recently, there was a dispute between Lula and the company when he tried to put one of his allies in charge of the company. Vale’s risks are complex, and investors must understand them well before investing in the company’s shares.

The Bottom Line

Vale trades at a 31% discount to its peers when we analyze the EV/EBITDA multiple. This doesn’t make sense in my opinion, given that the company has great margins, the most competitive cash cost in the sector, and healthy debt.

Another positive point is that iron ore volumes are recovering every quarter, indicating that there is demand for the product. It is worth remembering that the company has the highest quality iron ore, which is important for promising businesses such as the manufacture of electric cars, solar panels and wind generators.

Based on this analysis, I recommend purchasing Vale shares. Investors should pay attention to improving operational activity in conjunction with the company’s competitive advantages. In my opinion, the risk-return ratio is very attractive.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.