Summary:

- Vale S.A.’s share price has dropped 30% YTD due to declining iron ore prices and a prolonged CEO succession battle.

- New CEO Gustavo Pimenta’s appointment and iron ore prices stabilizing have positively impacted market sentiment.

- While Vale is positioning itself to meet an anticipated demand for high-grade ore in the years ahead, uncertainty regarding Chinese iron ore demand weighs on its prospects.

- Vale’s dividend is irregular, and while it has some exposure to copper and nickel, diversification remains limited. Coupled with its associated political risks, it ultimately lands on a neutral recommendation.

Maksym Isachenko

Investment Thesis

The share price of Vale S.A. (NYSE:VALE), the world’s largest iron ore producer, is down 30% year to date, from about $15.70 to $10.89 as of August 27. Declining iron ore prices, from which more than 80 percent of Vale’s revenues derive, amid uncertainty regarding future Chinese demand, have contributed to this fall. Additionally, a lengthy leadership battle, which included attempts by the government to intervene, has most likely also weighed on the share price.

In the past few days, two important events have taken place. Iron ore futures (SCO:COM) have bottomed out at $98/ton – at least for now – and even rallied. Vale’s leadership struggle also concluded with the announcement of a new permanent CEO. Current CFO Gustavo Pimenta will take the helm, a decision that pleased the markets.

Vale remains a bet on Chinese iron ore demand in the short term, despite its production of copper and nickel. It will diversify its product mix to meet an expected supply shortfall of high-grade iron ore products.

For an investor not subscribing to China as it is past its peak or the expected demand from emerging economies and high-grade ore taking up the slack, this could be the time to add Vale to one’s portfolio. While I have a generally positive view of this company, its lack of diversification, irregular dividend policy, and associated political risks, means my rating is a neutral Hold.

Company Overview

Vale S.A. is a Brazil-based iron ore and metals miner listed on the NYSE. In 2023, it produced over 320 Mt of iron ore, making it the world’s largest producer. It is also the second-largest producer of nickel. While its production is centered in Brazil, it also produces some copper in Canada.

In Q2 2024, it derived about 83 percent of its revenues from iron ore and 17 percent from energy transition metals, mainly nickel and copper. In other words, while it has some exposure to transition metals, its primary exposure is iron prices and, by extension, China.

Two critical factors have dragged Vale down this year: falling iron ore prices and delayed CEO succession.

Eventually, A Promising CEO Was Selected

Earlier this week, Vale announced the naming of current CFO Gustavo Pimenta as its next CEO. According to the article referenced by the SA news bulletin, the drawn-out process “included government interference attempts, information leaks and quarrels among board members.” The market responded by pushing Vale up about 2.7% early Tuesday.

“Pimenta’s unanimous approval at Vale’s board” is essential, as it adds confidence that the new leader will consider all company stakeholders and not just a select few. In a country known for its additional risks, dispelling suspicions of alleged installing “someone’s people” into important positions is crucial. Pimenta’s extensive and international experience in energy, finance, and mining provides him with excellent relevant experience. I have yet to find information that purports he is of a specific political affiliation.

Brazil’s Political Risk… and Mitigating Factors

Allianz Trade ranks Brazil “sensitive risk,” listing “political and social tensions on the back of corruption” as one of its weaknesses. Transparency International ranks Brazil 104th (of 180) on its corruption index.

Vale faces a double whammy: Its main product is iron ore, and Brazil’s leading trading partner is China. In other words, Vale is highly sensitive to developments in Chinese policy and its economy. On the other hand, both China and Brazil form part of the BRICS coalition.

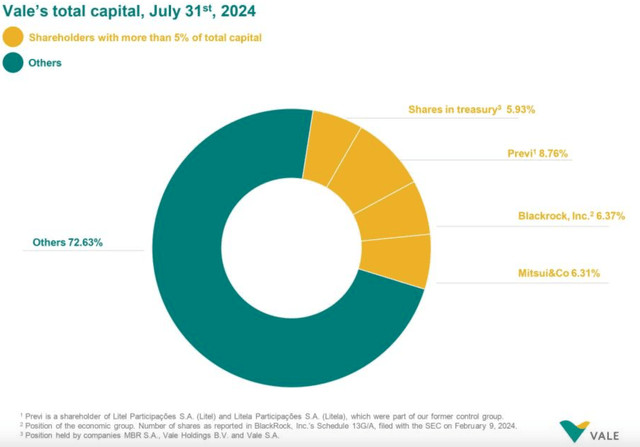

Another factor motivating Vale to remain shareholder-friendly is its large institutional owners, mainly from the U.S. and Japan. This overview from its investor pages shows that about 12.5 percent is split between BlackRock and Japan-based Mitsui:

Vale ownership as of July 2024 (Vale’s investor pages)

This ownership structure implies two things:

- Institutional ownership is a sign of quality, in my view, given that such investors cannot quickly move in and out of their holdings.

- In a hypothetical scenario where Vale was to be nationalized, or regulatory actions taken by the government destroyed shareholder value, the messaging to the markets would be devastating for Vale and Brazil.

Those factors, coupled with the stringent reporting and transparency requirements from trading on the NYSE, mitigate some of the risks Vale faces. In a political climate where interventions are favored, the government must consider the costs of its actions-which has a disciplinary effect, as it limits what influence can be exerted on Vale without devastating costs.

Has Vale Been Trading at a Discount?

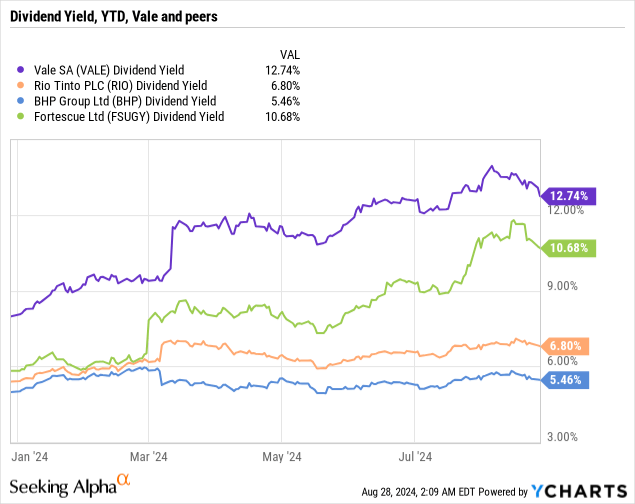

For much of the year, Vale has offered a much higher dividend yield than its closely listed peers, which also carry significant exposure to iron ore prices. It’s fair to say that the leadership debacle has dragged the share price down, causing increased yields.

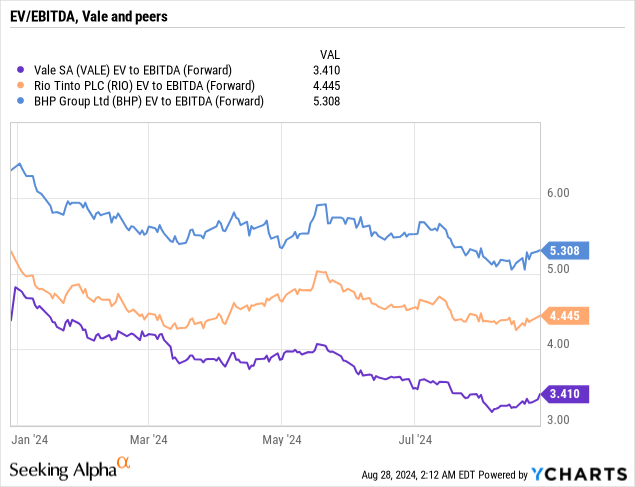

Measured by EV to EBITDA, Vale has been trading at a lower ratio than its peers:

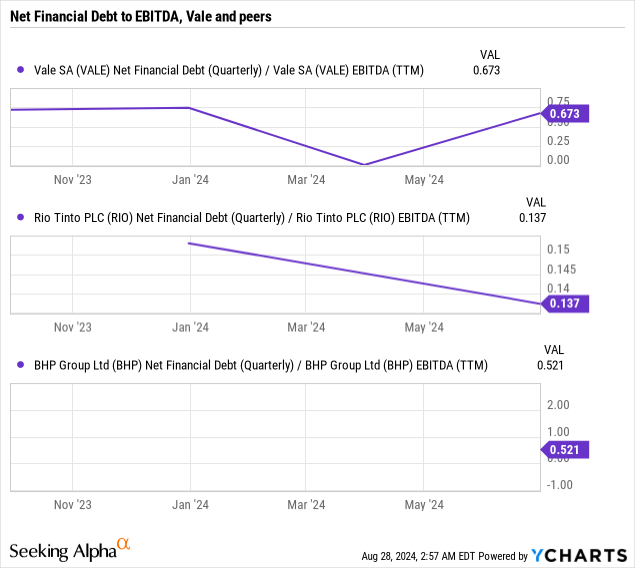

Finally, let’s consider its net financial debt to EBITDA. Vale is slightly more indebted than its peers, but not by a large margin:

In conclusion, Vale has been trading at a discount. Depending on the investor’s outlook, that’s an actual discount or a reflection of its political climate and high exposure to iron ore prices (a commodity in which demand might be plateauing).

Dividend Policy and Share Repurchase Program

Vale does not explicitly state a payout target but considers available cash after debt service obligations and capex requirements. Its share repurchase program began in October 2023 and will expire in early 2025. The program is valid for up to 150 million shares. In its Q2 2024 performance report, Vale stated that 33.1 million shares (22%) have thus far been repurchased.

Vale has not operated on a set dividend payout schedule in the past few years. Instead, it has paid semiannual dividends, with special dividends occurring.

Market Outlook: Less Ore, But Higher Grades?

Declining Chinese Demand and Market Oversupply of Iron Ore is on the Horizon

Two relatively recent reports, from Wood Mackenzie in late 2023 and the IEEFA in July, argue that Chinese demand is in long-term stagnation and possibly decline. Increased use of scrap and lower blast furnace production, coupled with challenging times in China’s property sector, are drivers behind this decline. The IEEFA estimates a supply glut of at least 200 Mt in 2026-2028.

Emerging economies will matter more in the years ahead. India, especially with its increasing steel production, will become a more prominent player. However, one must put that into perspective: in 2023, India produced 140.8 Mt of steel-about one-eight of China’s production of 1,019 Mt, according to the World Steel Association. For example, a 10 percent decline in Chinese production requires a 70 percent increase in Indian production to equalize total production. It is a simplified thought experiment, but it illustrates the massive difference between the world’s largest producer of steel (and thus iron ore importer/producer) and the world’s No. 2.

However, All is Not Lost: Demand for High-Grade Ore Could Outstrip Supply

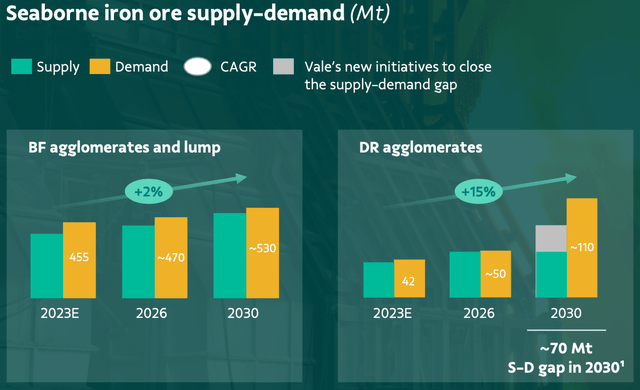

Vale, in its 2023 Vale Day, presented an expectation of a 70 Mt gap for DR agglomerates by 2030:

Supply-demand gap for DR agglomerates, 2030 (Vale Day 2023, p. 48) (Vale Day 2023 Presentation)

Anglo American’s Climate Change Report 2023 (p. 11) discusses this coming supply gap and the change of focus to iron ore quality (edited for clarity by the author):

Scrap supply is unlikely to be sufficient to meet demand [..] There is thus a risk that failing to accurately acknowledge the role of high-grade iron ore [..]

DRI production is expected to grow rapidly, [..] resulting in an additional demand for direct reduced (DR) pellets of almost 400 Mt. [..] before 2030 a deficit will emerge between the DRI production [..] supply of DR pellet feed. From 2030 to 2050, an additional ~300 Mt of DR pellets or other raw material will need to be brought online [..] driving a move to iron ore quality, and increasing premiums for DR pellets.

Vale’s Response: Higher-Grade Mix in its Production

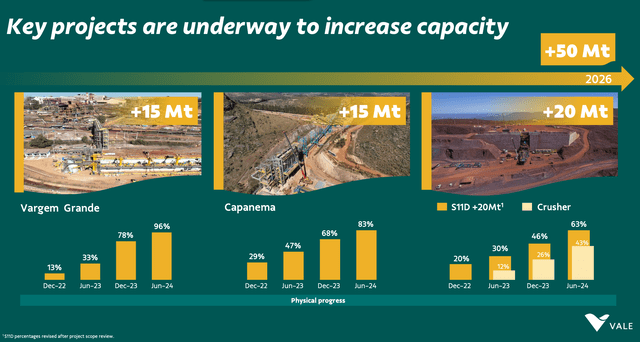

Toward 2026, Vale expects to increase capacity in its S11D high-grade mine by 20 Mt, out of a 50 Mt total capacity increase:

Capacity Additions Through 2026 (Q2 2024 Conference Call Presentation)

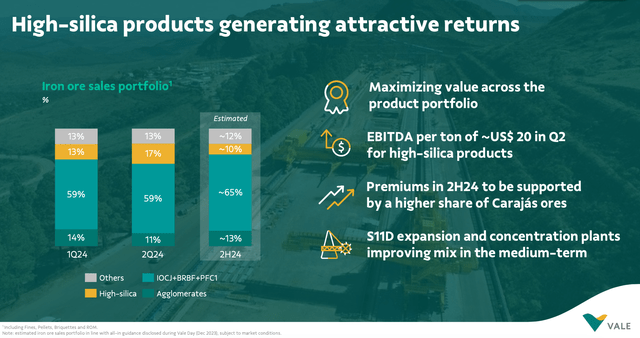

It expects its high-grade product share of its total portfolio to increase to 65% in the second half of 2024, as shown below. Its new concentration plant in Sohar, Oman, is planned to start operations in 2027. That plant will improve its product mix.

Expected Iron Ore Production Mix (Q2 2024 Conference Call Presentation)

Copper and Nickel Demand Likely to Stay in High Demand, Providing Some Lift for Vale

In a recent report, Wood Mackenzie forecasts that demand for copper will increase by 75% by 2050 due to its key role in electrification. Nickel, an essential ingredient in EV batteries, experienced a supply glut last year but is forecast to remain in high demand. Vale derived about 16 percent of its revenues from these two commodities in the previous quarter, which shows that Vale has some exposure to these booming markets. However, one must remember that as a share of Vale’s total revenues, copper and nickel will remain low.

Conclusion

This analysis has considered Vale as an investment for dividend-oriented investors looking for exposure to the iron ore mining sector. After a recent leadership change and iron ore prices that appear to have bottomed out, at least for now, it found that Vale has several strong aspects to its business. It can benefit from a changing demand profile tilted toward higher-grade ores. However, its lack of diversification into other minerals and associated political risk caused this investor to stay out, despite a generally positive view of the company.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.