Summary:

- Vale is the largest iron ore producer in the world. Its performance is largely a function of the Chinese economy, due to 50% of total revenues being derived from China.

- Last quarter, Vale reported growing production figures across all segments. However, the declining commodity prices in 2022 and 1Q23 adversely impacted the company’s bottom line.

- Vale has robust financials and solid growth prospects and is for sale at a 12% discount, as well as dividends with a respectable yield at 5.66%.

- The company has two risks in the face of China as a major buyer of Vales’s iron ore, and Brazil with its political peculiarity. Despite the risks, I give Vale a buy rating.

Opla

Thesis

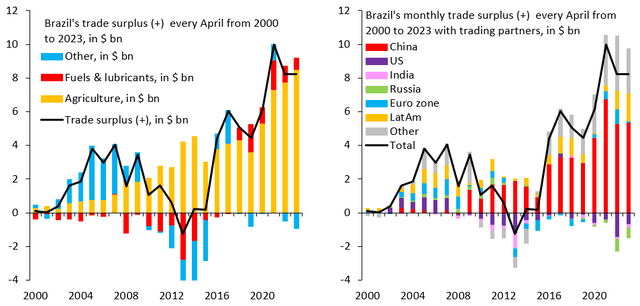

My adventure as a Seeking Alpha analyst started with analyzing Gerdau (GGB), one of the largest steel producers in the Western Hemisphere. Today, we take a step back, looking at Vale (NYSE:VALE), one of the major iron ore producers. Brazil’s economy is a function of the Chinese economy to a large degree. As seen in the chart below, many Brazilian exports go to China.

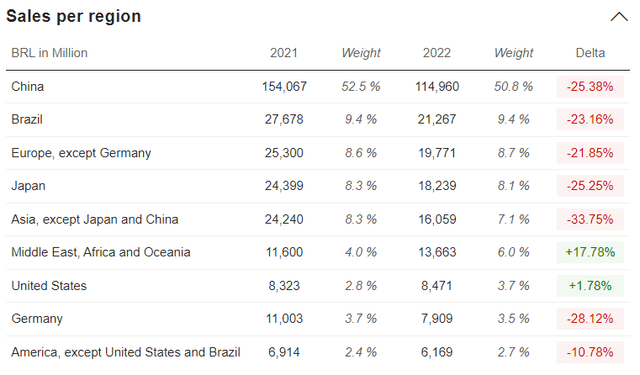

Vale is China’s largest iron ore importer. Hence, its output and earnings heavily rely on China’s economic recovery. The following table from Market Screener shows Vale’s dependence on the financial strength of China.

Going further, I think Vale is a wager betting on a strong Chinese economy. The company has robust financials and solid growth prospects and is for sale at a 12% discount. A bonus is the dividends with a respectable yield at 5.66%. The company has two idiosyncratic risks in the face of China as a major buyer of Vales’s iron ore and Brazil with its political peculiarity. Given the company’s strengths, despite the inherent risks, I give Vale a buy rating.

Big Picture and Vale

By the end of 2023, China’s economic growth should recover to 5.4%, then slightly decline to 5.1% through 2024. Lifting zero-COVID limits boosted demand for service sectors like travel and entertainment, precisely in line with other businesses.

By easing restrictive financial laws, supply-chain constraints will be lifted as construction will increase to satisfy rising demand in every industry. It is also important to note that the government’s loosening of monetary policies plays a significant part in boosting the economy.

China has started a series of interest rate and reserve requirement reductions throughout the larger economy. They have also enacted tax regulations to aid small enterprises. In addition to accelerating output and building, excessive unemployment will likely decrease consumer demand. Higher unemployment rates may result in slower consumption growth as more recently graduated students join the work market due to the reopening.

Overall, I’m optimistic that new infrastructure investment flows will succeed, which would increase imports of iron ore, a key component of China’s steel sector.

Given China’s economic recovery, how will iron ore prices change over the next few years? After a sharp decline of more than 50% in iron ore prices in the second half of 2022, this market saw a price increase in the early months of 2023 following China’s reopening. But it should come as no surprise that the increase is anticipated to fade over the ensuing years, creating a new equilibrium between slower demand and more excellent supply. China has forecast a slight decrease in steel production over the next five years due to its goal of reducing carbon emissions and reaching its peak steel production by 2030, resulting in a 0.9% annual growth rate in demand for iron ore globally.

Vale appears to fully understand the implications of dependence on one consumer and diversity in base metals mining operations. The demand for commodities is poised to rise due to the clean energy transition, US infrastructure renewal, and rapid growth of the middle class in India, Indonesia, and parts of Africa. The supply has been constrained for years due to declining CAPEX. On top of that, we have geopolitical fragmentation, thus dismantling the existing supply lines and creating brand-new ones. That said, the base metal deficit will increase, and we are at the first inning of that process in my view.

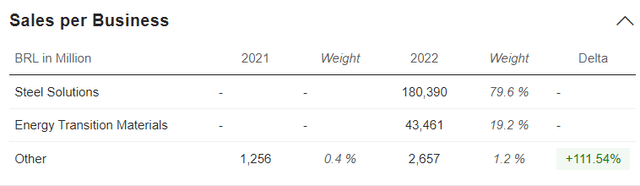

Vale has a well-known production facility for nickel, copper, and zinc. They still represent less than 20% of total enterprise revenue.

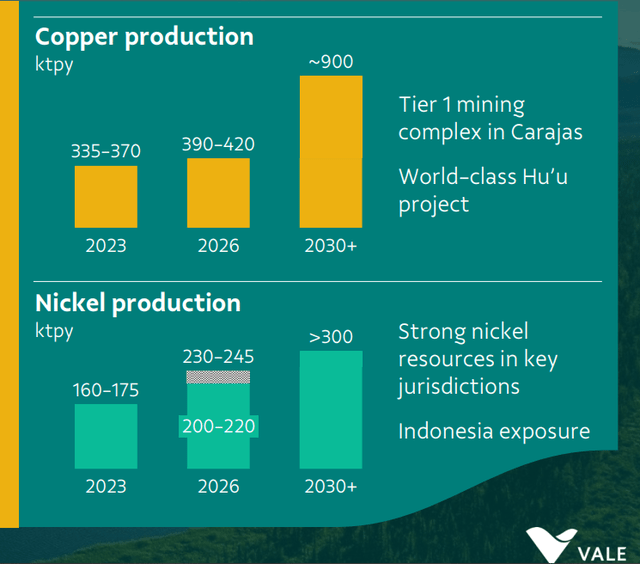

The management is investing $25-30 million in the upcoming years to increase their copper production from 350 thousand tons to 900 thousand tons per year to capitalize on their energy transition metal prospects. Additionally, it is intended to increase nickel production from 175 thousand tons per year to 300 thousand tons per year.

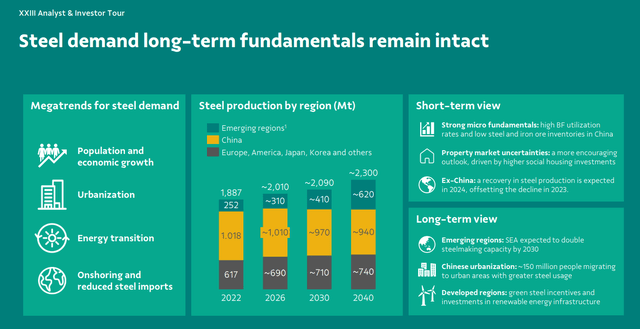

Considering all macro trends, the steel demand will grow consistently in the following decades. The chart below from the last company presentation shows Vale’s forecast for future steel demand.

The main driver is still China. However, emerging Asian and African markets are catching up. India is the most significant source of demand; thus, a larger part of its population is entering the middle class, thus creating a strong need for housing, infrastructure, and energy. The same applies to more developed and populous African countries like Nigeria, Algeria, and Egypt.

Q2 Results

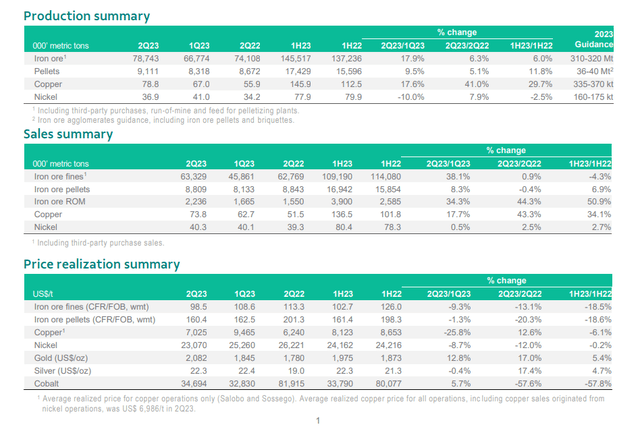

Vale production and sales have increased compared to 1Q23 and 2Q22, especially its production levels for copper and nickel. Compared to 2Q 2022, copper production increased 41% yearly due to the Salobo III section. Notably, they produced 16 thousand tons of copper in the first half of 2023. Salobo III is expected to increase its copper production from 30,000 to 40,000 tons by 2024. Additionally, compared to 2Q 2022, their nickel production rose by 8% in the most recent quarter. The table below shows the production and sales figures. The image is from the Vale 2Q23 production and sales report.

Vale production and sales report

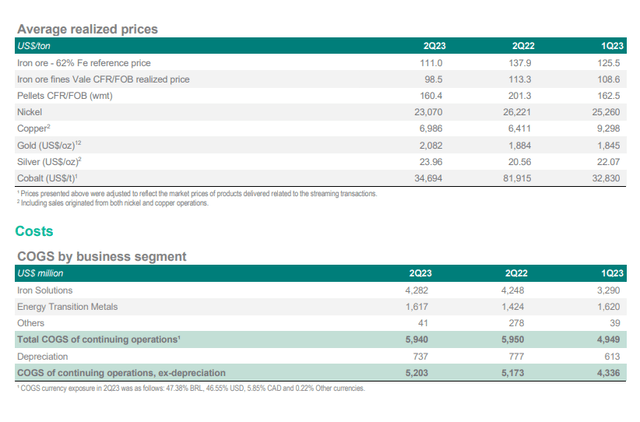

The table below shows Vale’s realized revenues and cost of goods sold (COGS).

Vale 2Q23 production and sales report

The major contributor to declining revenues is the price of iron ore products, which dropped from $137.9/ton to $111/ton. On the other hand, COGS has been stable for the last two quarters. The average realized prices of copper and precious metals have risen, but they represent a tiny part of total revenue and thus did not impact the company’s bottom line.

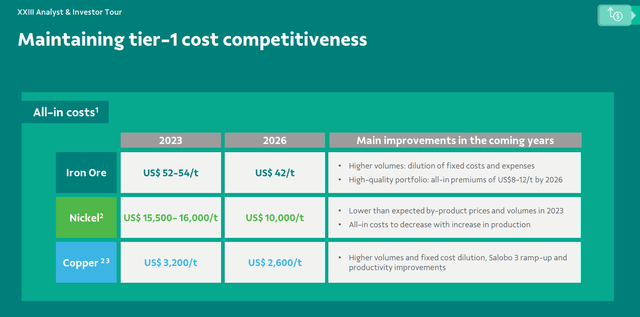

Vale’s plans to reduce all-in cost (AIC) are worth mentioning. The table below provides more details.

The goals are very ambitious. If the company achieves them even partially, its bottom line will notably improve. Given the macro environment with rising structural inflation, higher for longer interest rates, and geopolitical fragmentation, those figures seem farfetched. However, considering management commitment, I expect to see AIC reduced significantly.

Vale has bold plans to increase nickel and copper production, as shown in the graph below.

Vale Indonesian subsidiary PT Vale Indonesia is the country’s largest nickel producer. Unlike AIC projections, those plans are achievable in my view. Vale has proven its ability to develop Tier 1 projects.

Company Financials

Vale’s financials are stable, given the declining iron ore and base metal prices. The company has adequate liquidity and solvency, as seen in the table below. The data is taken from the Q2 financial statement.

|

EBITDA/Interest expenses |

19.6 |

|

EBITDA – CPX/Interest expenses |

13.2 |

|

Quick ratio |

1.15 |

|

Current ratio |

0.70 |

|

Net debt/EBITDA |

0.55 |

|

Net debt/EBITDA – CPX |

0.83 |

|

Long-term debt/Equity |

35% |

|

Total debt/Equity |

37% |

|

Total liabilities/Total assets |

55.9% |

Vale’s profitability metrics are excellent, too. They exceed the company’s five-year average and industry average figures.

|

FCF/EV |

8.6% |

|

Sales/EV |

13.8% |

|

FCF Margin |

13.2% |

|

Gross Margin |

39% |

|

ROI |

15.9% |

|

ROE |

30.5% |

|

Net income per Employee |

$ 160,000 |

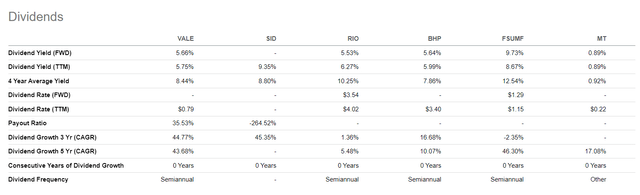

Like all major iron ore producers, Vale distributes generous dividends. The image below compares Vale with its major competitor’s dividend metrics.

Given the stable free cash flows, I expect the dividend yield to grow further.

Valuation

Assumptions and inputs from Professor Damodaran’s database:

- Risk-free rate is equal to the 5Y average of the US long-term Government bond Rate – 2.2%

- Perpetual growth rate, g, is equal to the 5Y average of US long-term Government bond Rate – 2.2%

- Brazil’s market equity premium is 9.57%

- Vale unlevered Beta is 1.09

- Vale Debt/Equity ratio is 37%

- Brazil’s effective tax rate is 34%

- Vale FCF forecast 2024 is $6.529 billion

The above parameters are inputs in the following steps:

1. Calculate Levered Beta with the formula below:

Levered Beta = Unlevered Beta * (1+D*(1-T)/E)

2. Calculate the discount rate (discount rate as the cost of equity) using the resulting value for leveraged beta. The formula I use is:

Cost of Equity = Risk Free Rate + (Levered Beta * Equity Risk Premium)

3. Stage 1: I calculate the present value of discounted free cash flows for ten years using 2024 FCF estimates from Market Screener.

4. Stage 2: I calculate the Terminal Value of the free cash flows over ten years at stable growth into perpetuity, g, and the resulting discount rate. Then, calculate the present value of the Terminal Value:

Terminal Value = FCF2033 × (1 + g) ÷ (Discount Rate – g)

Present Value of Terminal Value = Terminal Value ÷ (1 + r)10

5. Sum the final results of stage 1 and stage 2. Their sum is called the Total Equity Value (TEV);

Total Equity Value = Present value of next ten years cash flows + Terminal Value

6. Divide the TEV by the total number of company-issued shares. The result is the intrinsic value of the acacia, which I compare against the current market price.

Cost of Equity 10.62%

Total Equity Value = $67.89 billion

Fully diluted shares = 4,343 million shares

Vale intrinsic value per share = $15.6

Vale current market price = $13.75 (22/09/2023)

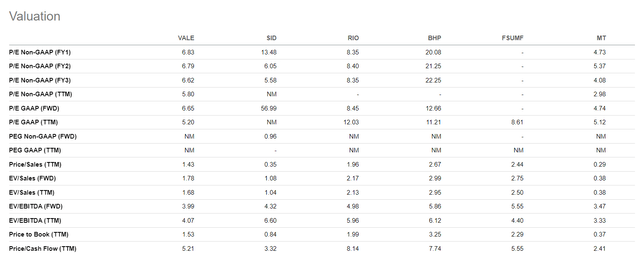

To estimate Vale’s relative value, I compare the company with its major competitors.

- Companhia Siderurgica Nacional (SID)

- Rio Tinto Group (RIO)

- BHP Group (BHP)

- Fortescue Metals (OTCQX:FSUMF)

- ArcelorMittal (MT)

Following a simple heuristic, “Earnings are opinion, cash flows are fact,” I use it for relative valuation EV/Sales and Price/Cash Flow. Sales and cash flows represent both sides of the company’s value-generation process. Earnings being in the middle of the flow too often are a subject of accounting shenanigans in my view. That said, Vale, based on EV/Sales, holds a middle ground with 1.68. Using Price/Cash Flow gives similar outcomes. Vale seems fairly valued against its competitors.

Risk

Like all commodity producers, Vale carries the usual operational, financial, and country risks. The operational risk includes geological and metallurgical, while the finances depend on the company’s ability to raise funds and meet its debt obligations. In my opinion, Vale’s leadership has managed those risks well. More interesting is country risk, which has two-fold implications. One is China, and the other one is Brazil itself.

The equation is simple: the higher the growth of the Chinese economy, the higher the demand for iron ore. The latter means rising iron ore prices and increased sales for Vale. The opposite is valid, too: the shrinking Chinese economy leads to stagnant demand for iron ore and declining revenues for Vale.

Conclusion

Vale is a solid company well-positioned to capitalize on the rising global demand for steel and base metals. The company has robust financials and solid growth prospects and is for sale at a 12% discount. A bonus is the dividend, yielding 5.66%.

Vale bears two risks in the face of China as a major buyer of Vales’s output and Brazil with its political specifics. Given the company’s strengths, despite the inherent risks, I give Vale a buy rating.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.