Summary:

- Vale is the largest global iron ore producer, with 80% of its revenue coming from iron ore and the remaining 20% from energy transition materials.

- It is well-positioned to meet the growing demand for iron ore, especially in China, and has expanded into copper and nickel mining.

- The company has strong financials, with low production costs and a solid balance sheet, and offers attractive dividends and share buybacks to shareholders.

- Vale is the cheapest by a wide margin compared to its direct competitors, BHP and RIO. Vale’s present EV/Sales and EV/EBITDA trade at low multiples compared to its ten-year figures.

- Vale has been part of my portfolio over the last two years, and I plan to hold it for longer. I give Vale a buy rating.

CUHRIG

Introduction

Last week was dedicated to shipping. Now it’s time to turn to the shippers, the cargo owners who charter the vessels. Iron ore is one of the commodities that come to mind when we talk about shipping, and the company synonymous with iron ore is Vale (NYSE:VALE). It is one of the largest iron ore producer globally.

Rio Tinto (RIO) and BHP Group (BHP) are in the top three, too. However, iron contributes half of their revenues. In Vale’s case, it is 80%. The company has expanded its ventures into copper and nickel mining. Financially, the company is sound, with 41.6% total debt to equity and excess liquidity to cover its debts. Vale takes care of its shareholders with its value creation policy. Since 2020, Vale has paid $25 billion in dividends and repurchased 17% of its shares.

One red flag is the dependence on the Chinese economy. Nevertheless, the curse may become a spell if China escapes a recession. At the end of 2023, China had started fiscally to stimulate its economy. Time will tell if the stimulus provokes economic recovery, boosting the demand for everything commodities. Iron ore demand is the first to respond to China’s recovery. I am arguably biased about Vale because it is part of my portfolio, but my verdict is a buy rating.

Iron ore market overview

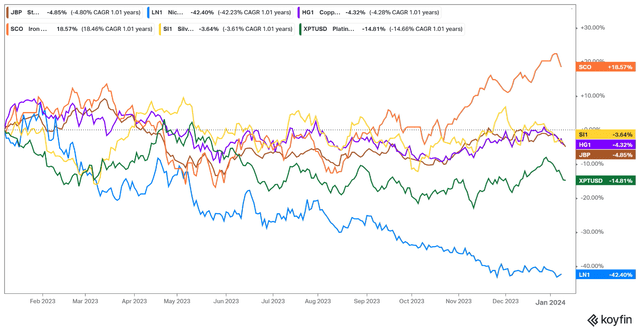

Iron ore was one of the few metals performing well in 2023. The chart below compares iron ore, copper, nickel, silver, and platinum 12 months returns.

Iron ore outruns them all by a high margin. I know uranium was the top commodity, but its market is too tiny compared even to platinum.

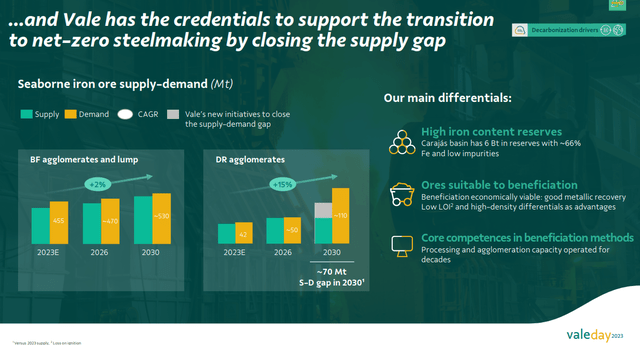

The price of iron ore is a function of supply and demand. The former equates to the global steel demand. China, India, and the US are the primary steel consumers globally. The chart below from the Vale Day presentation illustrates the future iron ore demand and supply gap.

Both bar charts show demand/supply for the two most common Fe agglomerates, Blast furnace (BF) and Direct reduction (DR). The DR supply-demand gap is expected to reach 70 Mt in 2030. Vale is perfectly positioned to fill the gap and reap significant profits.

Vale at glance

80% of Vale’s revenue comes from iron ore. The remaining 20% originates from energy transition materials (the definition used by the company). Geographically, more than 50% of company revenues come from China, 9% from Europe, 8.6% from Brazil, and 3% from the US. Chinese sales grew by 15% YoY, while Europe and the US sales declined by 30% and 28%, respectively. Vale adds nickel and copper assets to gain an advantage on the rising metals demand driven by the energy transition.

The company aims to reach 375-410 kt copper production capacity by 2026. It plans to start production in Vargem in 4Q24. S11D mine. In November 2023, Vale announced its progress with the Salobo III project. The expansion will boost Vale Copper’s annual production by 20-25 kt. Vale plans to increase its nickel yearly output to 190-210 kt by 2026. VBME project is expected to ramp up in 2026. Vale’s Canadian mine Sadbury will increase its production, and Onca Puma Furnace and Furnace 2 are planned for restart in 1Q24 and 2H25.

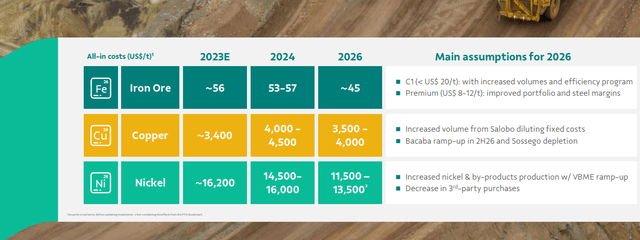

Vale’s production costs are $56/t iron AIC, $3,400/t copper AIC, $16,200/ton. Cu and Fe AIC fall in the lower percentile among significant miners.

At the current spot prices of $140/t iron ore, $8,863/t copper, and $16,145/t nickel, Vale profits handsomely. Iron ore AIC in 2026 is assumed to decrease to $45/t. It is a considerable drop from $56/t. If Vale succeeds in cutting its production costs, it will enhance its already strong results.

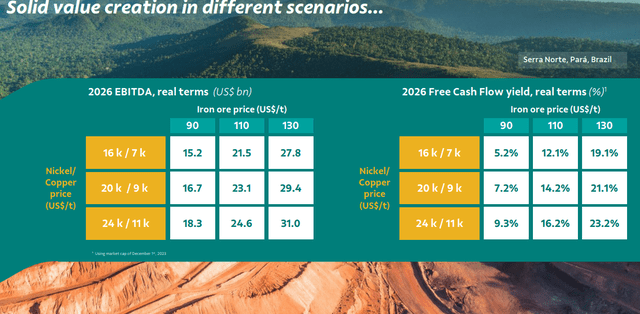

Vale 2026 projections at $110/t iron ore, $7,000/t copper, and $16,000/t nickel and stable AIC are promising with 12.1% FCF yield and $21.5 billion EBITDA.

At $21.5 billion EBITDA and current market cap and liabilities, Vale would trade at 3.6 EV/EBITDA. Today, the company trades at 4.2 EV/EBITDA.

3Q23 results

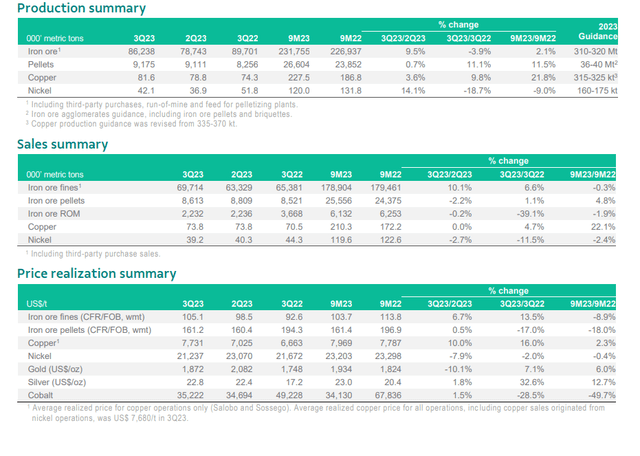

The table below shows the production and sales summary for 3Q23:

Iron ore production grew by 9.5% QoQ but declined by (3.9)% YoY. Copper production improved YoY and QoQ. Salobo 1 and 2 plant availability increased to 90%, and Salobo 3 reached 80% capacity. Nickel output brought mixed results. YoY dropped by 19%, though QoQ jumped by 11%. The transition to underground mining in Voisey Bay is in progress. Onca Puma Furnace 1 revamp is underway.

Copper and iron ore realized prices improved and YoY QoQ, while nickel declined.

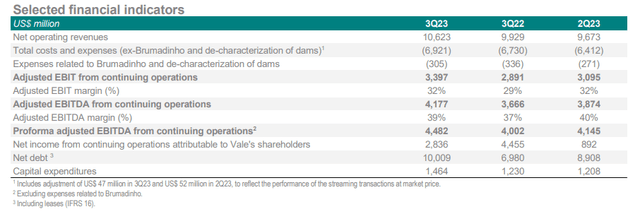

Vale’s revenue and adjusted EBITDA grew 15% and 12%, respectively. Iron ore cash costs decreased by 7%, aligning with the company guidelines ($21.5/t-$22.5/t). Free cash flow to EBITDA reached 25%. On every dollar generated as earnings before interest, taxes, depreciation, and amortization, Vale retains $0.25.

That $0.25 is used to create shareholders’ value. Vale completed its third buyback program for $500 million. The 4th program was approved for buying another 150 million shares. Over a few years, Vale repurchased 17% of its shares. Another $2 billion was approved for dividends.

The company’s CAPEX increased due to rising growth and sustaining costs. Vale invested $144 million in Serra Sul expansion and $123 million in Visey’s underground transition. The most significant portion of the CAPEX covered sustaining costs, $996 million.

Vale balance sheet

Vale’s net debt increased in 3Q23 due to a reduced cash position by $1.2 billion. The company’s cash shrunk because of the $1.7 billion debt repayment.

Vale’s debt repayment schedule is well structured. In 2027, $2.3 billion must be repaid. In the 2024-2026, debt payments are $1.1-$1.4 billion. The company’s current cash position is $3.9 billion. Vale’s strong operational cash flow ($10.4 billion LTM) and operational income ($14.7 billion LTM) guarantee the company’s ability to face its debt obligations. The average maturity of company debt is 8.2 years at a 5.6% average interest rate. Covering its debt obligation would not be an issue even in declining iron ore prices. Given its excellent cost profile, even in a bear market, Vale will remain profitable.

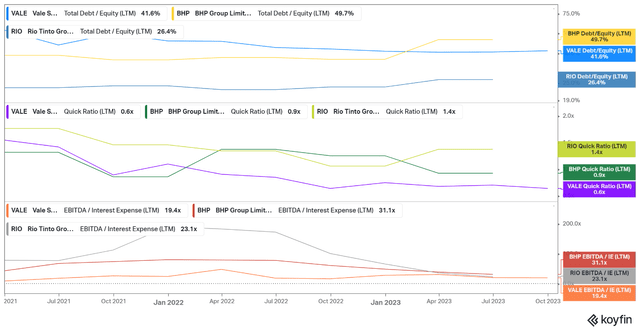

The graph below compares VALE, BHP, and RIO on total debt to equity, current ratio, and EBITDA/Interest coverage.

Vale scores inferior figures compared to its peers, with a 0.6 quick ratio and 19.4 EBITDA/Interest expenses. However, such statistics are far from disappointing. The company’s strong results support its debt payments and capital investments. Vale generates impressive cash flows and has a well-structured debt schedule and conservative capital structure.

Dividends and buybacks

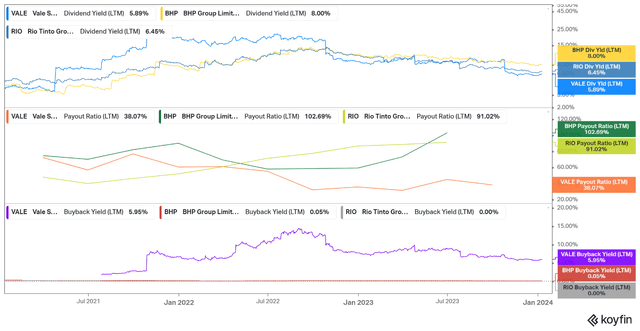

Vale pays regular dividends with attractive yields. Besides that, the company approved another round of share buybacks. The chart below compares BHP, RIO, and Vale yields.

All companies on the list pay dividends with attractive yields. However, Vale practices regular share buybacks. Besides that, Vale has the lowest payout ratio. It seems counterintuitive to consider it positive. Paying generous dividends is only part of the strategy to create value for the shareholders. Share buybacks and intensive CAPEX are the other two ingredients. Each of them has pros and cons. I like Vale’s approach using all three. A lower payout ratio means the company has spare firepower. The available cash can go into additional buybacks, capital investments, or the company’s coffers. Conversely, a higher payout ratio deprives the company of the optionality of how to invest its free cash.

Vale valuation

Mr. Market does not like the political risk inherent in Brazilian stocks and the high dependency on the Chinese economy. Our first task as investors is not to get lured by Mr. Market’s opinion.

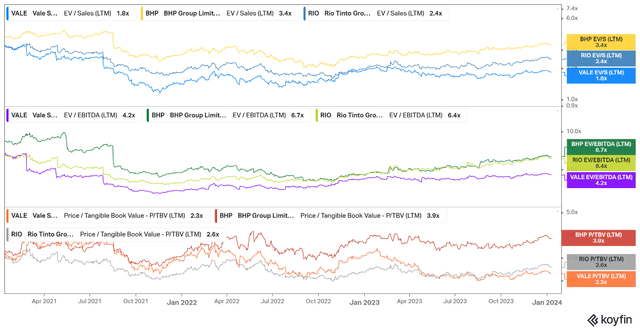

Brazilian stocks and Vale are not the most popular investments. They are undervalued compared to their peers. The graphs below compares BHP, RIO, and VALE’s EV/Sales, EV/EBITDA, and P/TBV.

Vale is the cheapest by a wide margin. BHP is on the other side of the boat, commanding the highest multiples. BHP is one of the most recognized companies when we talk iron and copper. I like it a lot, but my favorite iron producer is Vale.

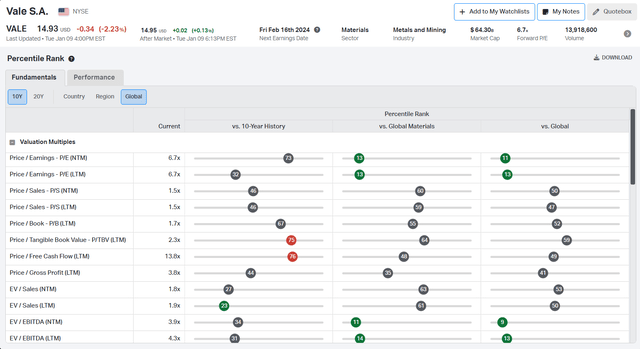

Let’s look at the big picture: how expensive or cheap is Vale compared to its ten-year values, global equity markets, and the global materials sector?

Vale’s present EV/Sales and EV/EBITDA trade at low multiples compared to its ten-year figures. Overall, the company falls in the lower percentiles globally. Given Vale dividends and buyback yields, the company offers much value for its price.

Risks

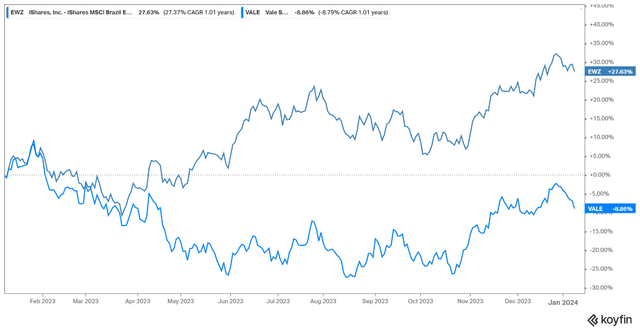

Vale carries two significant risks, China and Brazilian politics. However, the latter depends heavily on the former. I believe both risks are calculated in the stock price. Vale lags significantly behind the performance of Brazilian equities. The latter outperformed S&P by 3%.

The strong iron prices pushed Vale stock in the last months of 2023. Chinese economic recovery will boost iron ore demand and reduce investors’ fears further. I expect Vale stock prices to match Brazilian equities and iron ore prices.

The risk of a declining stock market is always around the corner. 2023 was an exceptional year for broad equities but mediocre for energy and materials stocks. We had assets rotation in motion. 2024 might be another year with asset rotation from tech stocks to energy and mining.

Investors takeaway

Investing in emerging markets is not for the faint-hearted. Neither is Vale stock. However, the proverbial alpha resides outside the majority’s focus. Vale is a bet for income-minded investors looking for exposure to emerging markets. I like Vale’s venture into copper and nickel mining. It diversifies company revenue streams and mitigates its revenue correlation to the global steel demand.

Vale had a solid last quarter with growing revenues and declining costs. The company is flush with cash, which is returned to its shareholders via dividends and buybacks. Vale is the cheapest by a wide margin compared to its direct competitors, BHP and RIO. Despite being diversified, major miners BHP and RIO share more similarities with Vale. I did not add Fortescue (OTCQX:FSUMF) because it is a pure-play iron ore company with operations only in Australia, and 89% of its revenue depends on China. Vale has been part of my portfolio over the last two years, and I plan to hold it for longer. I give Vale a buy rating.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of VALE either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.