Summary:

- Vale SA’s stock price may see a significant decline, presenting a buying opportunity for long-term investors.

- Q3 results were decent, and Q4 is expected to be even better due to higher iron ore prices.

- A global economic slowdown could lead to increased demand for infrastructure projects, driving up the demand for steel and iron ore.

- If Vale’s stock price will see a decline of 20% or more from current levels, I intend to add to my existing position.

SergeyZavalnyuk

Investment thesis: Betting on Vale S.A. (NYSE:VALE) might not make much sense if one is expecting a more or less stagnated global economy or worse in 2024. There is a distinct possibility that at times its stock price will see a significant decline from current levels. I see such a possible decline in its price as an opportunity to buy and hold for a longer-term bet. If there is a decline in global iron demand, it will not last, because a global economic slowdown will be counteracted by fiscal stimulus measures, including infrastructure projects that tend to be a classical go-to government policy for such occasions. Infrastructure projects need steel as an input, which will probably mean that an increase in global iron ore demand will precede an overall global economic recovery. My current strategy is to maintain my current position in Vale stock, while I intend to treat any retreat in its price greater than 20% from current levels as a window of opportunity to add to my current position.

Q3 results were decent, while Q4 could potentially be even better on higher iron ore prices.

For the third quarter of the year, Vale saw an increase in revenues from just under $10 billion in Q2, 2022, to $10.62 billion. Higher revenues did not translate into higher net earnings, as they declined from $4.46 billion in Q2, 2022, to $2.84 billion for the latest quarter. Certain expenses were higher, with some that are of note from my point of view, including higher gross interest expenses of $192 million for the quarter, which amounts to 1.8% of revenues. This is an important data point from my perspective because I follow the interest expense to revenues ratio as the most important measure of a company’s financial health. I tend to worry when interest costs cross above 5%, while anything in the 10% range I see as being outright dangerous to a company’s survival prospects.

It should be noted that when we are talking of measurements such as interest costs/revenue ratios, it comes within the context of a company that depends a great deal on volatile raw material market prices when it comes to revenues, profits, and so on, thus this measure can fluctuate a great deal.

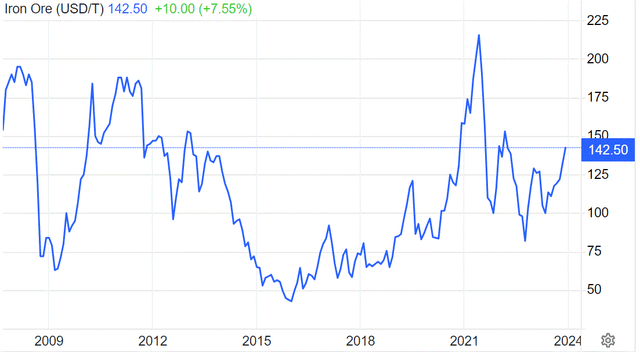

Trading Economics

Iron ore prices were significantly lower in Q3 of this year compared with Q4, therefore we can assume that the interest/revenue ratio, as well as other measures, will see an improvement in the latest available quarterly results when Q4 results come in.

Fears of possible iron demand weakness due to a potential global economic slowdown make sense until we remind ourselves that economic slowdowns are usually countered by stimulative government spending, often focused on infrastructure projects.

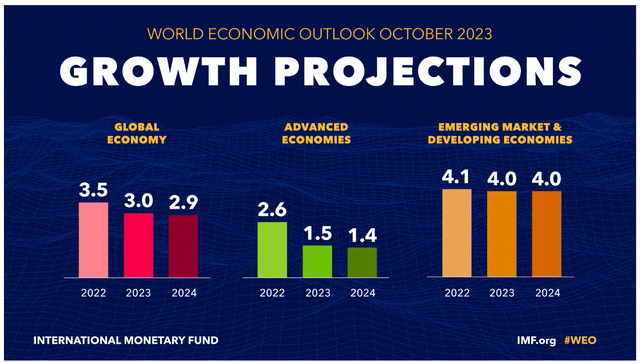

Major institutions such as the IMF are sounding the alarm on a global economy that already saw less than ideal growth in 2023 slowing down even further.

IMF

The IMF currently projects only a slight slowdown in global economic growth for 2024 compared with 2023. In my view, there is far more downside risk to its current forecast than there is potential for upside surprises.

The prospect of a global economic slowdown may seem like a bad time to invest in iron ore mining companies at first glance. An economic slowdown might counterintuitively spark a spike in demand, as governments tend to react to economic slowdowns with stimulus measures, which often include infrastructure projects. In other words, less steel may be needed in the production of consumer goods, but it may be more than compensated by a rise in infrastructure needs.

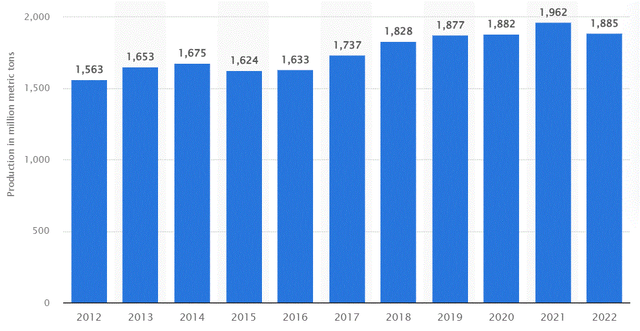

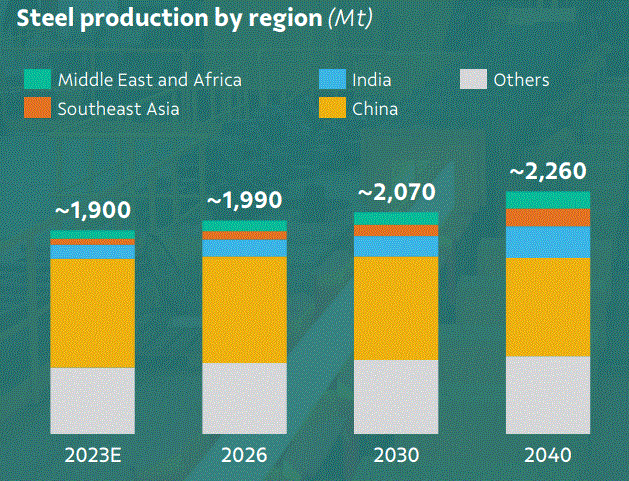

Global steel production (Statista)

As we can see from the chart, global steel production did not decline in 2020 from 2019 levels, despite the deep economic slowdown, and then it increased significantly in 2021, which in my view is a reflection of global efforts to keep the economy going, including through infrastructure projects, which tend to require significant volumes of steel.

I should note that one possible impediment to a replay of the past global responses to economic slowdowns may be a lack of fiscal room for a growing number of major economies. The US debt/GDP ratio is at over 120% currently, and deficits are approaching $2 Trillion. China seems to also have its troubles, including some overbuilding in the residential sector which would make it less likely to see a boom in steel demand. On the public infrastructure side, however, it seems determined to keep building, at least for now. The EU, Japan, and the UK are all shrinking in terms of global economic relevance and are unlikely to engage in large-scale infrastructure projects. The only bright spot might be a collection of developing nations, led by India, where infrastructure is sorely needed and at least some governments have enough fiscal room to engage in infrastructure projects to stimulate their economies.

Investment implications:

Iron ore prices may experience a few months of weakness in 2024, as an initial reaction to what can potentially be a weaker global economy than current institutional forecasts may suggest. Vale’s stock price might even see an outsized decline, as investors will most likely sell the entire mining sector in response to an economic slowdown. I currently have a relatively modest position in Vale stock, of about 1.5% of my stock portfolio and I intend to hold on to it, even though I believe that there is a decent chance of a short-term decline in its stock price this year. If there is no decline, I will most likely continue to ride out my current position and I will be content to continue collecting on the generous dividend of 5%, while I wait for a favorable stock price to start reducing my position. If the stock price sees a decline of 20% or more from current levels, I intend to start buying.

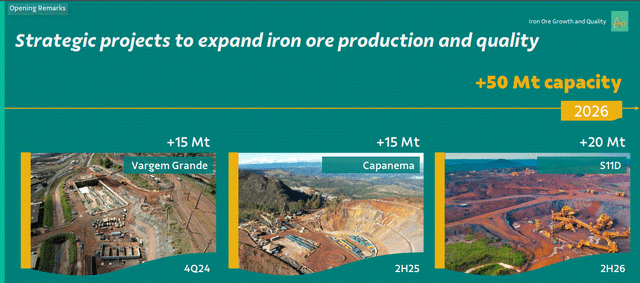

The argument in favor of buying Vale stock rests on the potential external factors I laid out in the article, as well as internal factors that could potentially play well within the context of an assumed increase in global iron ore demand in the shorter term, as well as for the longer term. For instance, Vale is set to increase production by an estimated 50 Mt/year between now and 2026.

Vale

The increase in production represents about 19% compared with Vale’s current iron ore production levels.

Vale’s planned increase in production is more or less in step with estimated supply and potential demand growth for the same period, given that recent forecasts put global supply growth at 2.7% per year for this period.

It remains to be seen whether or not the industry is gearing up to ramp up production by more than what the world needs, as demand growth is not necessarily going to materialize at a similar pace, in which case, it could trigger a collapse in iron ore prices in the next few years. It should be noted that Vale has a more subdued forecast for global steel production growth of just about 5% by 2026 from the estimated 2023 levels.

Vale

There is a potentially more bearish outcome for Vale and all other iron ore miners, and that would be a potential sustained upward shift in global energy prices. Higher energy prices would most likely lead to a further decline in global economic activities, which would create downward pressure on iron ore prices and at the same time, it would push production costs up. Higher inflation in most major economies would also make it less likely that governments will have fiscal room to engage in infrastructure spending as a way to restart economic growth because higher inflation tends to keep borrowing costs high.

While Vale’s internal fundamentals are solid, with a low debt servicing burden, and a decent profit margin, which suggests that its current dividend is safe, the potential external risks are significant enough to warrant caution when investing in this stock. Risk management is why I intend to consider adding to my already existing position, only if a more favorable buying opportunity arises in the coming months.

I am looking for a pullback of about 20% before I decide to add more Vale stock, which might or might not happen in the short term. In case Vale’s stock price goes in the opposite direction, I am looking to start selling once it approaches $20/share, from the current price level of under $16/share. Since the start of this decade, I changed my approach to managing my portfolio, to reflect my overall view that today’s market carries far more risk than what the market is currently pricing in. If these were ordinary times, a mining company with a 5% dividend, a forward P/E ratio of 7.5, and a solid financial performance in terms of maintaining a low debt-servicing burden as a proportion of its revenues would seem like a safe long-term bet. Unfortunately, we are no longer living through ordinary times and I am adjusting my approach to investing accordingly.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of VALE either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.