Summary:

- The stock has been thoroughly discounted vs peers that prices in ESG issues.

- Chinese steel production and iron ore demand should remain stable on exporting over capacity.

- Vale´s 14% capital return yield and 30% discounted valuation provides solid carry protection.

- On a 4x P/cash earnings multiple (vs 5.7x at peers) the YE25 price target of US$12.5 +16%.

Monty Rakusen/DigitalVision via Getty Images

Introduction

Last October I updated my view on Vale (NYSE:VALE) citing that iron ore prices were likely to remain higher for longer given that its main customer, the Chinese steel sector, was exporting its “over capacity” and maintaining a steady demand for iron ore while the supply was generally balanced. While this has been the case that I believe will continue, the stock price is down 10% (-2% with dividends) worse than its Australian peers, and suggests the market has fully derated the sector with a negative growth outlook. However, Vale can continue to generate substantial cash flow and dividends that provide a solid carry until the negative sentiment dissipates, especially surrounding its corporate governance issues.

Performance

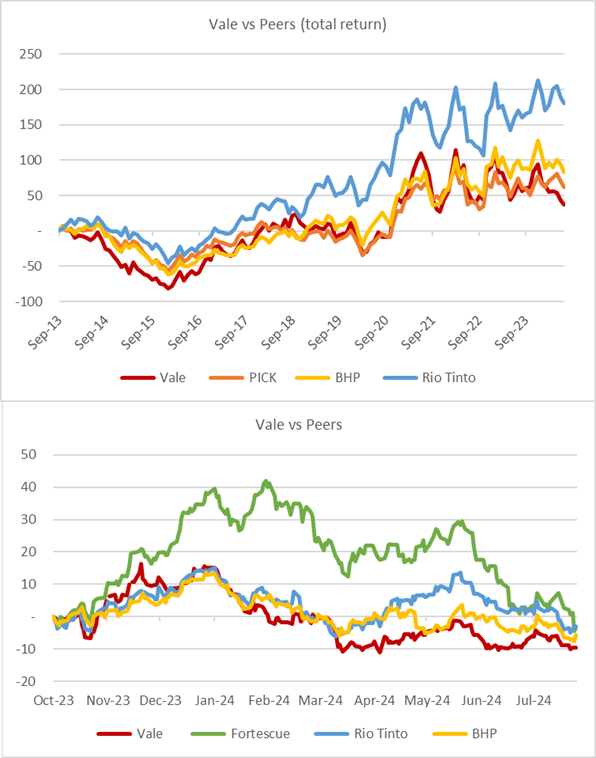

The iron ore sector, along with other commodities, has been volatile over the last 10 years as the China-led Supercycle ended and the real estate bubble burst. Nonetheless, Vale and Australian peers such as Rio Tinto Group (RIO), BHP Group (BHP), and Fortescue (OTCQX:FSUMF) have eked out positive returns when one accounts for dividends. In 2024 the sector has further derated, which may be due to continued China demand uncertainty as well as investors selling to buy the US tech sector.

Created by author with data from Capital IQ

Chinese Steel Production & Iron Ore OPEC

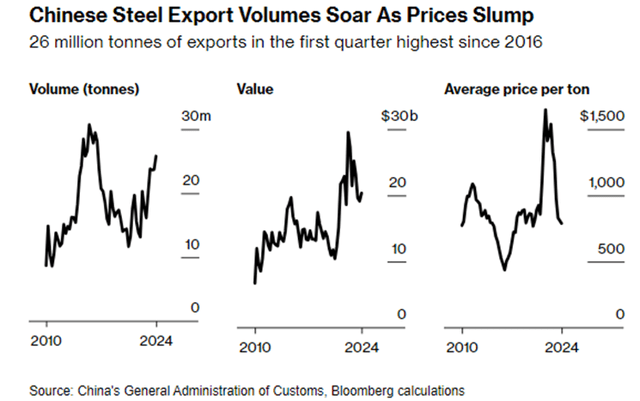

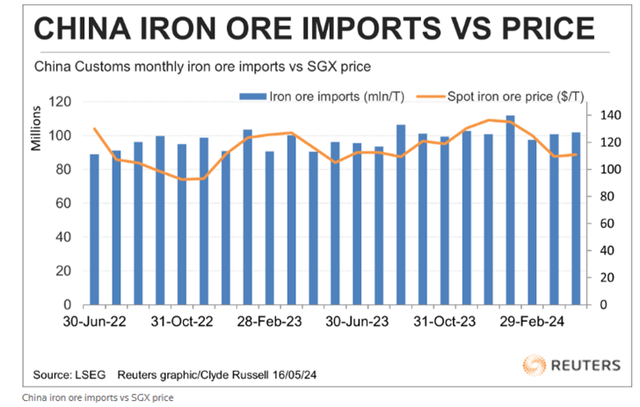

As discussed earlier and in my October article, the demand for Seaborne Iron Ore (exports) has remained consistent despite the end of the Chinese real estate boom as steel production has been exported and the Chinese plants operate at near full capacity with subsequent iron ore needs. This export-based solution, for what some call overcapacity and dumping, has caused a disruption in many domestic steel markets which is leading to tariff protection. Thus, the market fears that Chinese steel production and iron ore demand may decline and lead to a sharp price correction. However, given the concentration of the seaborne market in four players there may be a supply reduction to meet lower demand, an OPEC of iron ore. The top iron ore miners continue to enjoy solid margins and free cash flow generation that can be paid out in dividends, share buybacks, and business diversification. BHP’s recent bid for Anglo American (OTCQX:AAUKF) is one example.

Bloomberg

Reuters

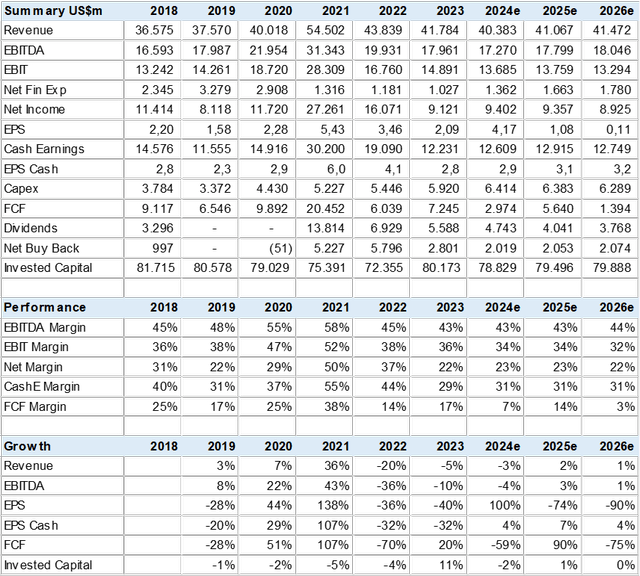

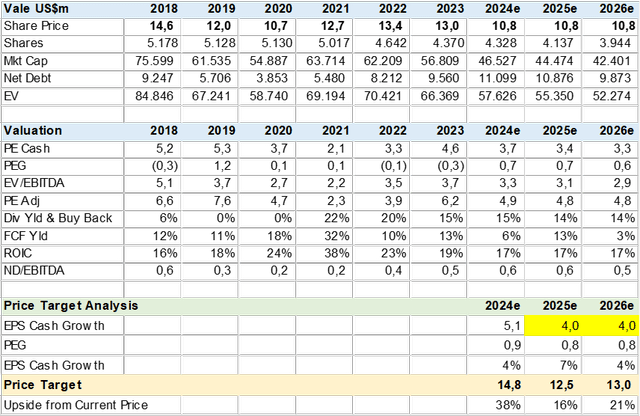

Vale Consensus Estimates

The market consensus from 11 analysts suggests that Vale will not see any growth in the next 3 years but should continue to generate over US$17bn in EBITDA and US$9bn in net income that allows for a US$4bn in dividend and US$2bn in share buybacks. The main hurdle to higher dividends has been to resolve the legal and compensation suites of the Brumadinho accident, which is 75% complete. Unfortunately, growth and diversification initiatives remain under-explored due to the uncertainty and political interference surrounding top management appointments. The Brazilian government, via state-owned pensions, has been attempting to place their politicians on the board and in management positions to better align Vale´s development with the government’s agenda.

Consensus Estimates (Created by author with data from Capital IQ)

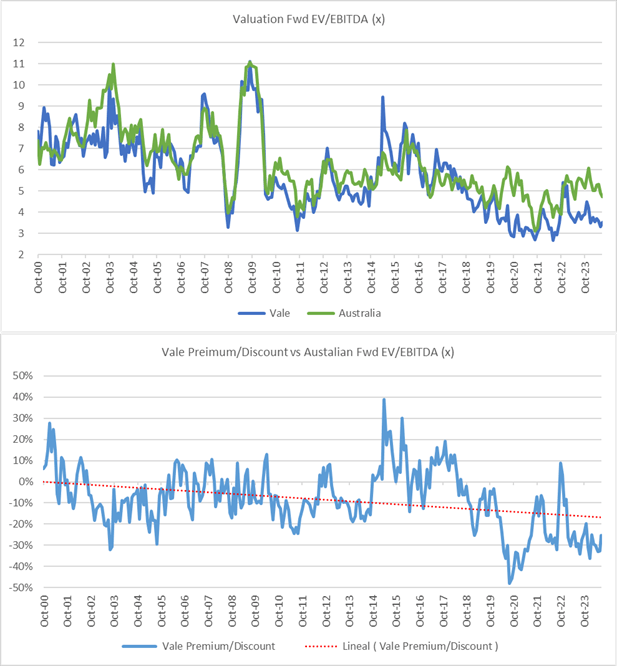

Valuation & Peer Discount

Vale´s valuation has been de-rated post the Brumadinho accident and on corporate governance concerns given the golden share voting rights that can be used to attempt to steer the company to the benefit of government policy. Normally this is not an issue until it becomes one.

The consensus has a US$14.8 price target that backs into an implied 5.1x PE (cash) target multiple that is in line with global peers. However, the current valuation is at a 30% discount to global peers, which has been present since 2017 and is unlikely to dissipate until Vale gets past its ESG issue.

If I use a 30% discount to YE25 estimates, Vale´s price target is US$12.5 for a 16% upside that in conjunction with 14% capital returns makes the stock attractive despite the ESG and low growth issue.

Consensus Valuation (Created by author with data from Capital IQ)

Valuation Discount vs Peers (Created by author with data from Capital IQ)

Risk

There are two overwhelming risk factors to Vale. The first is the price of iron ore, which is largely dictated by the demand of Chinese steel producers as well as the supply by the big four iron ore miners. If China’s steel production declines, below US$80 per-ton, perhaps due to increased tariffs, Vale could see a material impact on cash flow. The second is if the Brazilian government institutes export tariffs on iron ore and/or appoints board and management positions to politicians. That could result in lower margins and much lower valuations.

Conclusion

I rate Vale a buy: The stock has been thoroughly discounted on low growth, iron ore price risk, and ESG concerns and yet can still generate US$6bn in capital returns, or a 14% yield while waiting for the issues to resolve. I see a limited downside with a conservative total return of 30% to year-end 2025.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.