Summary:

- Vale’s investment thesis focuses on delivering shareholder returns through dividends and buybacks amidst operational challenges and political noise.

- The company’s competitive advantages as a low-cost producer and its robust cash generation support its ability to provide consistent returns to shareholders.

- Vale’s dividend policy aims to distribute profits to shareholders, with an expected average yield of around 8% per year.

- Despite recent turbulence, Vale’s discounted valuation and operational strengths position it well for delivering attractive shareholder yield in the long run.

andreswd

In my recent articles covering the Brazilian mining company Vale (NYSE:VALE), my investment thesis revolves around its ability to generate shareholder returns through dividends or share buybacks. Moreover, despite its performance closely tied to commodities, Vale enjoys an operational advantage as a low-cost producer. This allows it to remain profitable even during low iron ore prices when many other industry peers struggle.

Given that Vale doesn’t have significant investment plans and maintains low debt relative to its cash generation, the company has adopted a policy of distributing its profits to shareholders. Consequently, Vale is known for offering excellent dividends and conducting significant share buyback programs.

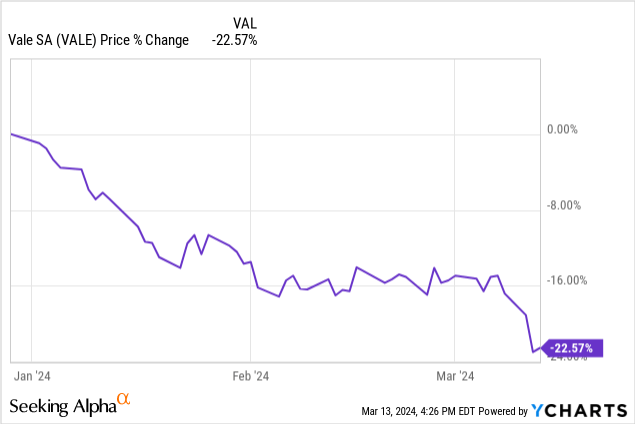

However, despite being a corporation with limited government involvement in its governance, Vale is exposed to political risks. Recent speculation about potential political interventions, which would be inappropriate given the current shareholder composition, has led to a decline in the company’s share value this year. This, coupled with fluctuations in commodity prices due to the complex situation in the Chinese economy, has contributed to the downward trend.

While these risks are inherent to Vale’s investment thesis, I believe the company is currently trading at a heavily discounted valuation. With solid operational metrics against a price level in line with the historical average of the last decade, I still see Vale well-positioned to provide attractive returns to shareholders this year. There’s potential for a shareholder yield approaching or exceeding double digits through dividends and buybacks.

Corporate governance issues have been causing disruptions

It’s important to acknowledge that the company has recently faced significant turbulence, which can be attributed to attempts at governmental interference and uncertainties surrounding Chinese demand prospects.

Recent media reports have speculated about pressure from Brazil’s Federal Government on Vale shareholders to appoint Guido Mantega as CEO. Mantega, who served as Brazil’s Minister of Finance from 2006 to 2015 under the presidencies of Luiz Inácio Lula da Silva and Dilma Rousseff, both Worker’s Party governments, is allegedly being pushed forward for the position.

First and foremost, it’s crucial to understand that Vale is not a state-owned enterprise, nor does the federal government hold any shares in it. Consequently, the government lacks the voting power to elect or influence the selection of Vale’s CEO or Board of Directors.

Currently, Vale operates as a corporation without a defined controlling shareholder, meaning there isn’t a single entity with the authority to appoint a new CEO. While Previ, Banco do Brasil’s (OTCPK:BDORY) (state-owned) employee pension fund, holds the largest stake at approximately 8.7%, other significant shareholders include Mitsui (6.3%), Blackrock (6.1%), and Cosan (CSAN)(almost 5%). These entities, being major stakeholders, are unlikely to support any intervention that could harm Vale’s operations, particularly interference by an unqualified executive, which could adversely affect shareholder interests.

Aside from Previ’s stake, the government’s only leverage over Vale lies in possessing golden shares. These are forms of indirect ownership retained by the federal government in companies previously state-owned and subsequently privatized, such as Vale’s case. However, this mechanism is limited in scope, granting the government veto powers over certain decisions, such as the sale or closure of specific assets and the election or dismissal of Supervisory Board members.

While the government may exert influence through various means, including environmental arguments, to bolster its sway, Vale boasts robust layers of corporate governance and processes designed to counter unjustified governmental interference.

The CEO transition has been a rollercoaster

Vale has chosen to extend the tenure of current CEO Eduardo Bartolomeu until December 31, 2024, to ensure a smooth transition to new leadership. The selection process for the incoming CEO will follow the company’s Succession Policy. Bartolomeu has pledged to support this transition, with the new leader expected to take over at the beginning of 2025.

Additionally, Bartolomeu will continue to serve as an advisor to Vale until the end of 2025. To assist in selecting the new CEO, the Board of Directors will seek the support of an internationally recognized firm.

However, recent reports have disclosed the resignation of a member of Vale’s board of directors. José Luciano Duarte Penido, who has been a board member since 2019 and has extensive experience in the commodities sector, expressed concerns in a letter to the board’s president. He cited fears that the CEO succession process was influenced by “evident and nefarious political influence.”

This development undoubtedly casts a negative shadow over the company, highlighting issues that have received significant media attention. The appointment of a new CEO is not solely a matter of individual interests but also involves the Federal Government’s efforts to increase its influence over the mining company and the considerations of private shareholders like the Cosan Group and Mitsui.

Nevertheless, this transition has stirred more controversy than usual, impacting Vale’s share price. In 2024 alone, Vale’s shares have experienced a sharp decline of approximately 21%.

Why I’m not losing sleep over this

In my view, despite the disruptive noise surrounding Vale, which introduces volatility to its results and diverts the market’s focus away from the robust Q4 earnings reported by the company, where the company showed progress across all indicators, I don’t anticipate a direct impact on a bullish investment thesis for Vale in the long term.

This is primarily because major shareholders hold substantial positions in Vale, collectively worth hundreds of billions, and are unlikely to make decisions that undermine the company, especially private investors.

Unlike other Brazilian state-owned companies such as Petrobras (PBR) and Banco do Brasil, Vale’s impact on the country’s economy is markedly different. While the former tend to wield more influence on the domestic market, Vale’s operations are predominantly international, with most of its production exported, mainly to China, representing approximately ten times more sales volume than the Brazilian domestic market.

As a result, Vale has minimal control over domestic prices or related public policies, setting it apart from companies with a solid domestic presence that are more susceptible to political influences.

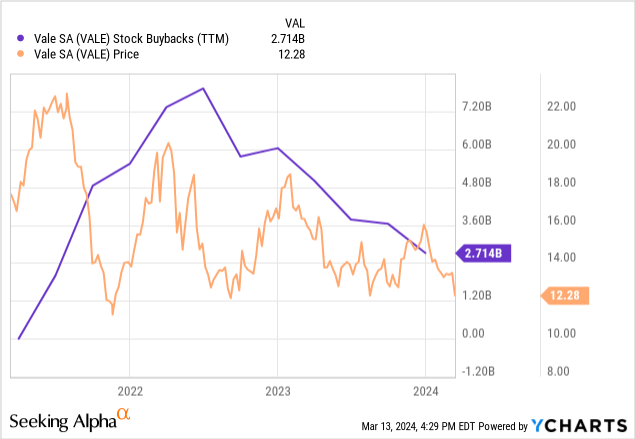

However, lingering concerns persist regarding the potential impact of political appointments on Vale, particularly regarding investment projects that may not align with shareholder interests. Investors seek investment returns through growth, dividends, or share buyback programs. Vale has received commendation for its track record of paying dividends and executing efficient share buyback programs, with approximately 20% of shares repurchased in recent years.

Vale’s leadership has been lauded for its commendable efforts in capital allocation, which may have been overlooked in the past, leading to suboptimal decisions. Examples include the acquisition of Inco in 2007 and investments in sectors beyond the iron ore market, such as coal and nickel. Unfortunately, these ventures failed to deliver satisfactory returns for shareholders, indicating that the company’s diversification strategy did not meet expectations.

However, questions arise regarding whether a new CEO would repeat past mistakes, such as making investments that fail to add value for shareholders, whether through diversification or ventures into areas like logistics, which may be politically popular but not necessarily beneficial. These uncertainties underscore the importance of the company’s future direction.

In my opinion, what benefits Vale also benefits Brazil. Therefore, the company must be led by a market executive such as Eduardo Bartolomeu, who has demonstrated competence. I hope his successor maintains this standard of excellence in Vale’s management, regardless of their background.

The thesis is all about maximizing shareholder returns

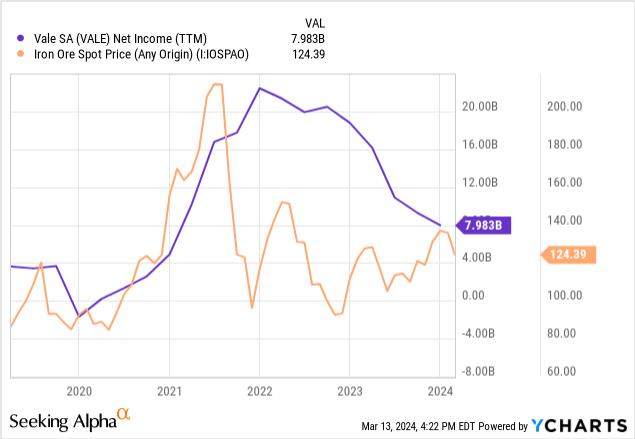

The current price of iron ore, fluctuating between $110 and $115 per ton, has been at least favorable for Vale. With an estimated production cost of $50 to $55 per ton, the company maintains a competitive margin and generates cash flow, enabling it to execute share buyback programs.

While Vale was once a prominent growth company during the 2000s, its current profile no longer reflects this trajectory. This is partly due to the slower growth in global iron ore consumption, mainly attributed to the deceleration of industrialization in China. The company now prioritizes returns to shareholders, primarily through dividends, over aggressive expansion.

The mining sector, mainly iron ore, is notorious for its volatility stemming from price fluctuations. Although this volatility can impact Vale’s financial results, it does not necessarily reflect the underlying quality of the business. Vale boasts significant competitive advantages, including access to high-quality mines, allowing it to achieve higher production levels with fewer resources than its industry counterparts worldwide.

Despite Vale’s governance challenges, its fundamental competitive advantages remain robust and should endure for decades. This stability underscores Vale’s competitiveness and adeptness at adapting to market dynamics. The company remains a crucial player in the sector despite governance issues and iron ore price volatility.

Robust cash generation aimed at generating an attractive shareholder yield

Understanding the sensitivity of Vale’s dividend or cash generation to the price of iron ore is crucial for assessing its financial performance.

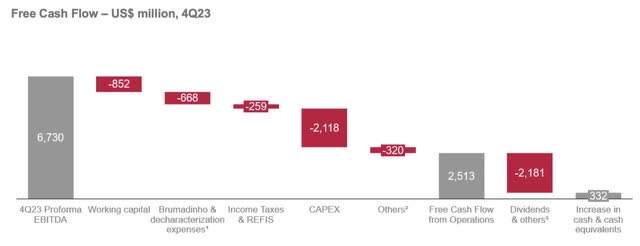

In terms of cash generation, the company excels. Between 2015 and 2023, Vale generated $68.7 billion in free cash flow after expansion investments, averaging $7.6 billion annually. In 2021, a standout year with product prices reaching their highest levels in recent history, the company delivered $21 billion in free cash flow to shareholders, a remarkable achievement.

With such robust cash generation, Vale could remunerate its shareholders generously. From 2020 to the end of 2023, the mining company distributed approximately $43.2 billion to shareholders, comprising $14.3 billion in buybacks and $28.9 billion in dividends.

The current iron ore price, near the last decade’s average, presents favorable conditions for the company. In 2016, prices hit $40 per ton; in 2022, they peaked at $230 per ton. Over the past ten years, the average has hovered around $110 per ton.

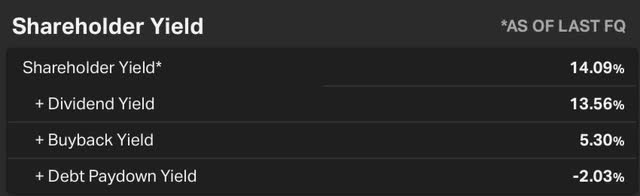

In this scenario, Vale can distribute at least 15% of its shareholder yield through dividends or carry out share buybacks, depending on the decision of the Board of Directors.

Vale’s Shareholder Yield (Koyfin)

Regardless of the chosen method, Vale tends to emerge as one of the top dividend payers in the industry, given the current conditions of the iron ore market. This underscores the company’s financial strength and ability to generate shareholder returns consistently.

The company’s dividend policy currently aims at a payout of 30% of EBITDA minus current investments. With no significant investments on the horizon, we anticipate the company delivering an average distribution yield of around 8% per year, aligned with estimates provided by Seeking Alpha, based on a market value of $52 billion, a satisfactory figure for an income stock, in my opinion.

In conclusion

I maintain my bullish stance on Vale because external noise has influenced the stock’s recent performance more than the company’s operational performance.

While I acknowledge that Vale has encountered challenges, such as provisions for the Mariana tragedy and government pressures, I remain highly optimistic due to the company’s competitive advantages, low production costs, robust cash generation, adaptability, and resilience. Additionally, Vale has demonstrated the capacity to provide significant returns to shareholders.

Furthermore, Vale’s current valuation appears extremely attractive, with a forward EV/EBITDA of 4.4x, approximately 57% below the industry average and notably 15% below its historical average.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of VALE, BDORY either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.