Summary:

- Vale, the largest iron ore producer in the world, is facing short-term challenges due to falling iron ore prices and concerns about China’s property crisis.

- Despite these challenges, Vale reported strong 4Q23 earnings driven by higher iron ore prices and cost management initiatives.

- Vale’s strategic initiatives, including expansion projects and partnerships, position the company for sustainable growth, but conservative investors should approach with caution due to market volatility and Chinese uncertainty.

Maksym Isachenko/iStock via Getty Images

Introduction

It’s time to talk about the largest iron ore producer in the world. That company is Vale S.A. (NYSE:VALE), a miner I have covered multiple times in the past, as it serves as a fantastic proxy for iron ore.

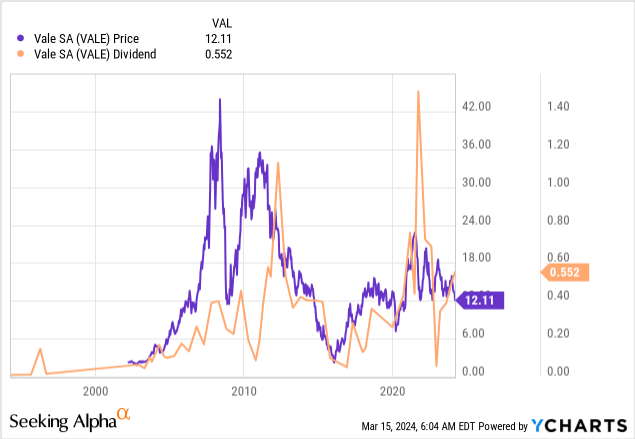

On top of that, it has an elevated dividend yield and a history of huge stock price surges whenever the market turns bullish on China/commodity demand.

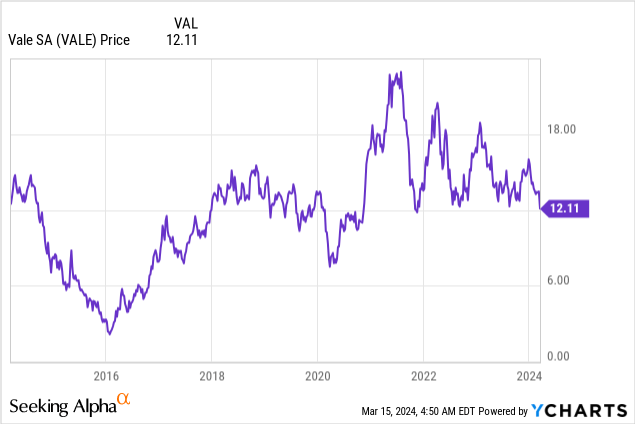

Currently, the company is struggling a bit. Since November 13, the stock has fallen 15% (13% including its dividend), which has underperformed the S&P 500 by almost 29 points!

Back then, my most recent article on the stock was published, titled “Vale Is A Terrific Rotation Play With Significant Long-Term Potential.”

Here’s a part of my takeaway (emphasis added):

[…] the company’s strategic share buyback program reflects confidence in long-term value creation and the potential to significantly boost per-share earnings in the years ahead.

Trading at a compelling valuation, Vale presents an enticing opportunity for patient investors, particularly with potential growth amid a shift toward emerging markets.

While short-term volatility may persist, the long-term outlook suggests significant shareholder value in the years ahead.

What we are currently seeing is short-term volatility clouding the longer-term outlook as the stock is pressured by bad news from China.

Hence, in this article, I’ll update my bullish thesis with a bigger focus on current events and what they imply for the risk/reward.

So, let’s dive into the details, starting with some macroeconomics!

What’s Up With Iron Ore?

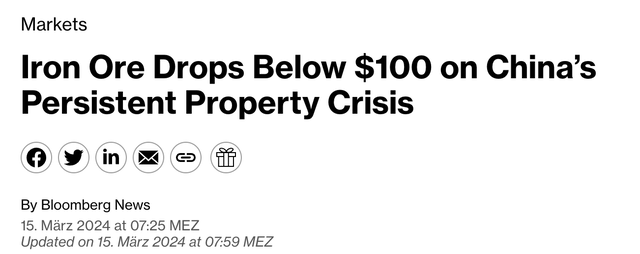

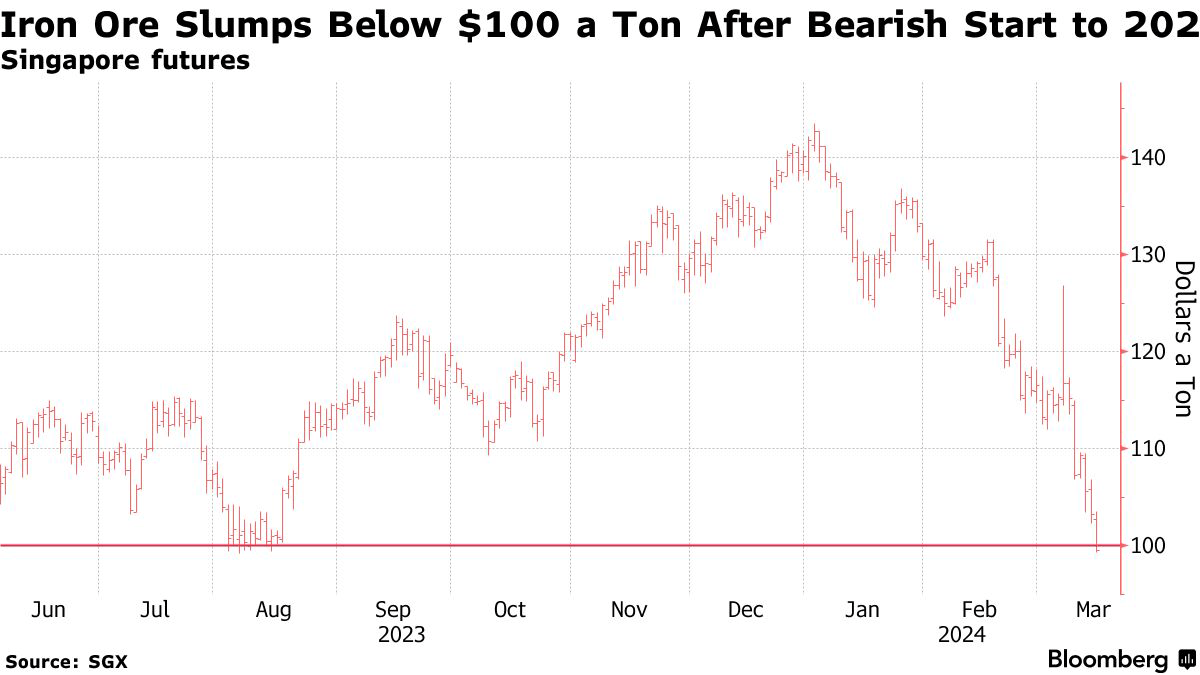

On March 15, Bloomberg reported a further drop in iron ore futures.

According to the article, iron ore futures have dropped below $100 per ton, which marks a seven-month low, as investors are worried about China’s ongoing property crisis.

Even worse, this crisis is expected to persist through 2024.

Essentially, the ongoing crisis has led to falling expectations for construction activity, resulting in a significant decline in demand for steel, which is the primary driver of iron ore consumption.

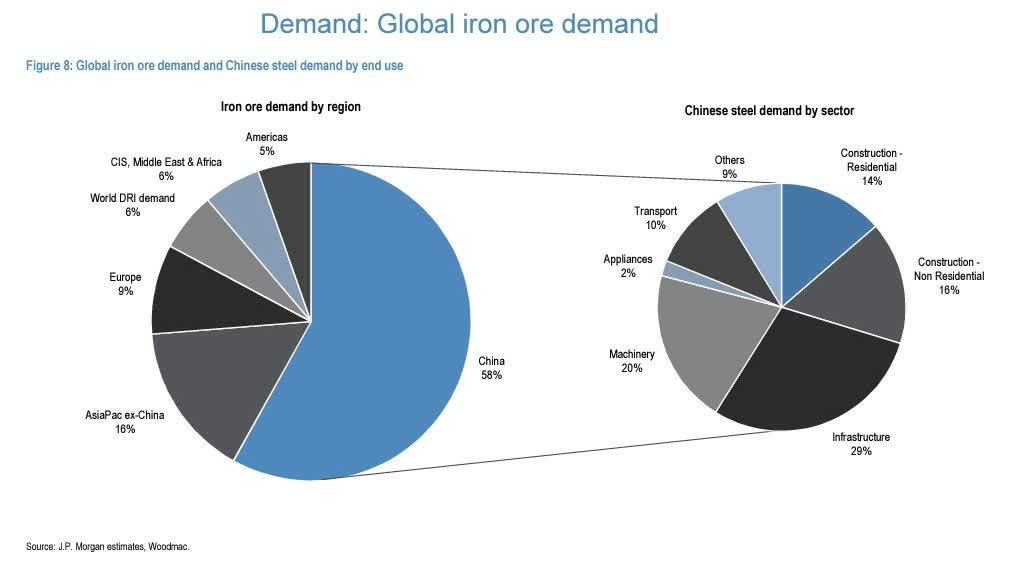

Using JPMorgan (JPM) data from 2020, we see that China accounted for more than half of global iron ore demand. Most of its demand was used in infrastructure and other construction-related activities.

JPMorgan

Going back to the Bloomberg article, iron ore prices have fallen by more than 30% since the start of this year!

Bloomberg

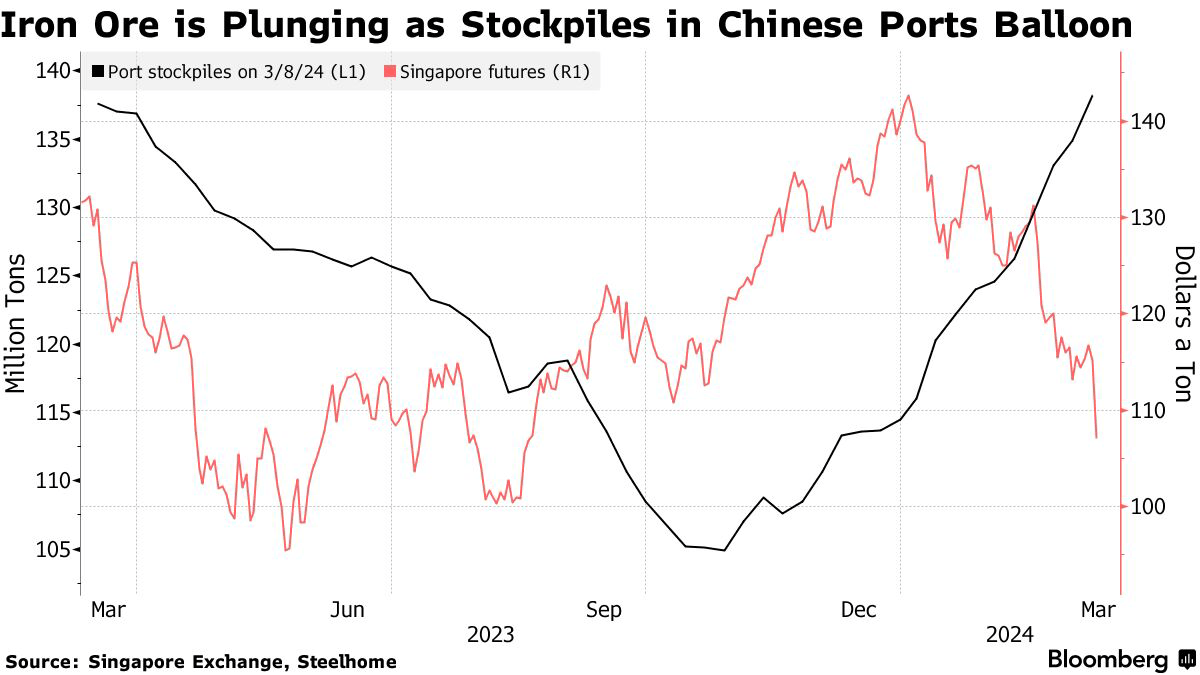

Because demand is lower, inventories are starting to rise.

Earlier this month, a different Bloomberg article reported a very steep surge in inventories. This is visible in the chart below.

Bloomberg

Moreover, I believe the quote below hits the nail on the head (emphasis added):

“It’s hard to build a bullish case for iron ore over any time horizon at the moment,” Price said by phone by from London. “There’s probably a speculative element at work today, with investors looking at what it will take for China to hit its growth targets for the year, and deciding that it’s just not going to happen.”

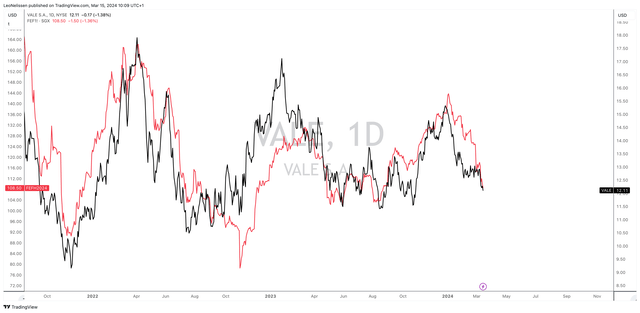

As Vale is the world’s largest iron ore producer, the data above explains why it is having such a hard time. After all, its stock price has moved in lockstep with Singapore iron ore futures (red line):

TradingView (VALE, SGX Iron Ore)

With all of this in mind, let’s take a closer look at the star of this article.

How Vale Is Doing In This Environment

Vale is surprisingly resilient in this environment – yet not immune to headwinds.

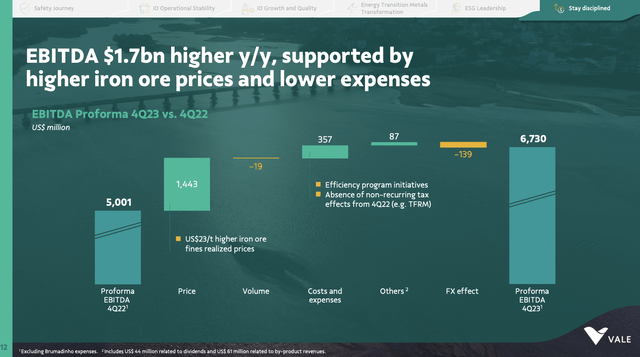

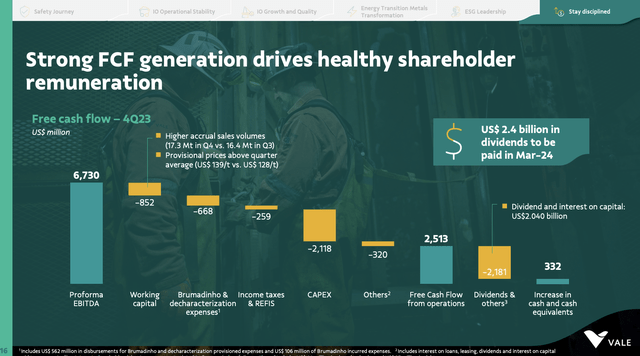

Last month, the company reported its 4Q23 earnings, which included $6.7 billion in pro-forma EBITDA. That’s a $1.7 billion increase on a year-over-year basis.

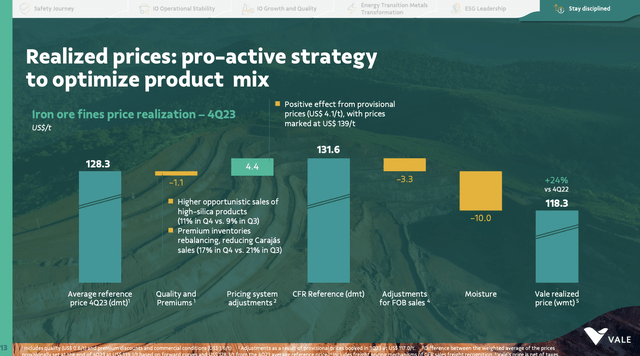

As we can see below, growth was primarily driven by higher realized iron ore prices, which increased by 24% compared to the previous year.

Moreover, the company attributed the improvement in operating performance to lower operating expenses. This was the result of efficiency and productivity programs.

Adding to that, Vale strategically managed its product mix, as it favored high-silica iron ore to maximize pricing.

Based on this context, please be aware that in 4Q22, iron ore futures were very weak. This allowed the company to report stronger year-over-year prices in 4Q23. It does not at all mean that the company is immune to the current decline in iron ore prices.

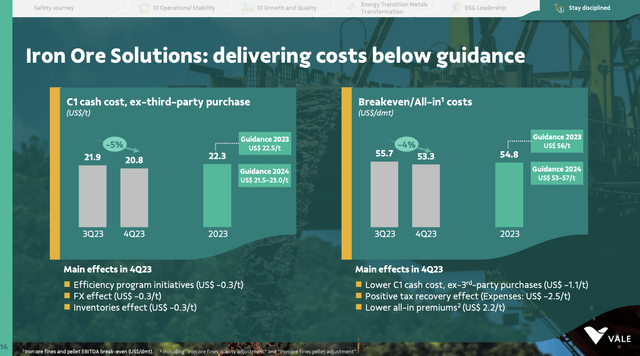

Going back to operations, the company’s cost management was a huge tailwind in the quarter, as it decreased iron ore EBITDA breakeven costs to $53.3 per ton. That’s below guidance – despite inflationary headwinds.

According to Vale, its C1 (C1 = direct production costs) costs fell to $20.8 per ton. This was supported by efficiency program initiatives, favorable exchange rate impacts, and inventory carryover effects.

Even better, for 2024, the company expects costs to remain in line with 2023 levels, with C1 guidance of $21.5 to $23.0 per ton.

Adding to that, cost savings have gone beyond iron ore, as Vale made progress in boosting efficiency in other metals as well.

Vale, which is working on a 2-3 years asset review, was able to lower nickel breakeven costs by 19%. Copper breakeven costs were lowered by 2%.

Both metals are key in the ongoing energy transition, as the VanEck overview below shows.

VanEck

Furthermore, efficiency gains had a positive impact on free cash flow, as the company reported a significant increase in free cash flow from operations. FCF rose by roughly $1.4 billion to $2.5 billion.

As we can see in the overview above, this bodes well for shareholders, as the company approved $2.4 billion in dividends to be paid this month.

In fact, Vale, which pays a semi-annual dividend, went ex-dividend on March 12. The dividend will be paid on March 26. The dividend will be $0.5519 per share. That’s an annual dividend of 9.1%.

As we can see below, the dividend is highly volatile, as it is tied to free cash flow. Hence, we find a very high correlation between the semi-annual dividend and the VALE stock price.

In other words, it’s perfectly fine to buy VALE for its yield. Just please be aware that the company is not a consistent dividend payer.

With all of this in mind, looking beyond 4Q23 and efficiency improvements, VALE is paving the road for sustainable growth in the future.

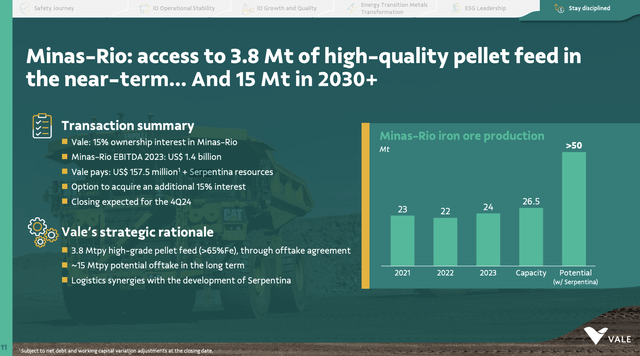

For example, the company announced a partnership with Anglo-American in Brazil, where Vale acquired a 15% stake in Minas-Rio’s existing business for $157 million.

Essentially, this agreement involves leveraging each other’s infrastructure and securing access to high-quality iron ore deposits.

As part of the deal, Vale will contribute its iron ore deposit in Serra de Serpentina, which is expected to enhance the total production capacity of the complex to over 50 million tons per year in the next decade. This is visualized in the overview below.

Additionally, Vale will have the option to purchase another 15% stake in Minas-Rio at market terms. This would provide potential access to an additional 15 million tons per year of pellet feed.

The sheer scale and quality of the Serpentina orebody offers significant value, including through the scope to expand the production of the premium grade pellet feed products we sell to steelmaking customers as they focus on decarbonizing their own processes for decades to come. The Minas-Rio DRI-grade product sells into one of the most attractive growth segments available in our industry today. – Vale Press Release

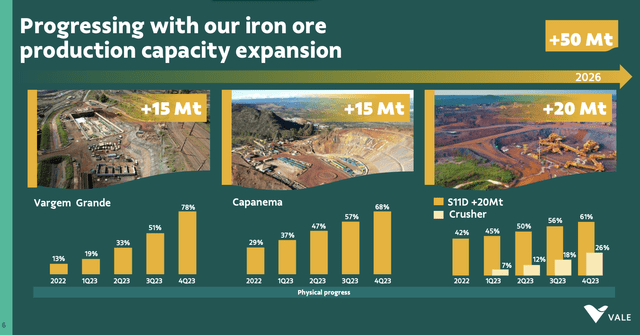

Beyond this, the company is growing through other initiatives, like the development of major projects that include the Vargem Grande complex expansion, the Capanema project, and the S11D expansion.

These projects are strategically designed to leverage existing infrastructure to boost output. Meaning, it does not require major investments to boost output.

It’s comparable to building an airport. Once you have the existing infrastructure, it’s easier to add new landing strips and terminals over time.

The combination of expansions at Vergem Grande, Capanema, and S11D is expected to result in 340 to 360 million annual tons of production by 2026.

Valuation

The valuation is tricky. After all, EBITDA (and other financial metrics) is entirely dependent on the price of iron ore. While ongoing expansion projects will increase earnings power over time, we saw in this article that VALE’s stock price moves in lockstep with iron ore futures.

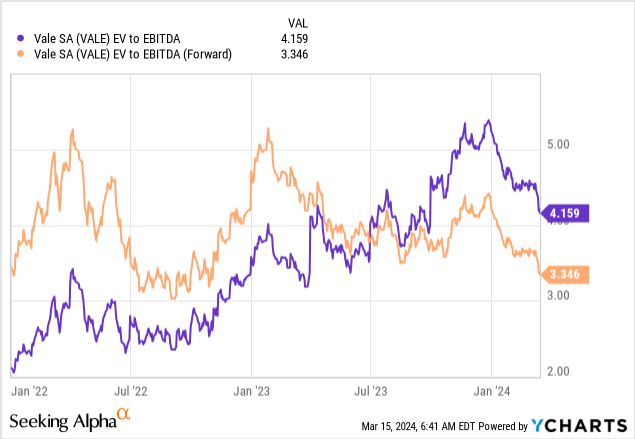

As we can see below, the stock currently trades at just 3.3x NTM EBITDA.

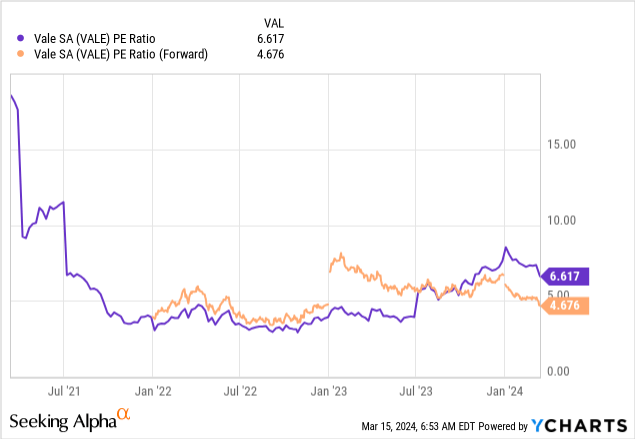

Furthermore, the stock is trading at just 5.7x forward earnings. In my prior article, I wrote that the company had a normalized P/E ratio of 9.6x, going back to 2002.

The numbers above imply a forward EPS estimate of $2.58. Using its normalized P/E multiple, we get a fair price of $24.80. That’s 100% above the current price.

The current consensus price target is $17.50, which is 45% above the current price.

While I will remain bullish, it needs to be said that Chinese uncertainty is weighing heavily on the stock. This can continue for at least a few more quarters.

The Wall Street Journal confirms this (emphasis added):

“Currently, the economy contends with significant challenges marked by numerous uncertainties and adverse factors. Specifically, they are tepid demand, heightened employment pressures and subdued market expectations. This status quo has yet to experience a fundamental reversal,” Wang added.

All things considered, I like VALE. However, I do not have the data to make the case that it will bottom in the weeks ahead. If I were looking for more mining exposure, I would buy a small stake in VALE and add to it gradually over time.

If the stock takes off, I have a foot in the door, if it keeps dropping, I can average down.

I believe this is the safest way to buy a great company in an uncertain environment.

However, please do not touch VALE if you are a conservative investor. VALE is volatile and needs to be handled with care. I have personally invested in Caterpillar (CAT), which sells equipment to miners. Although CAT is volatile as well, it gives me diversified exposure to the entire mining sector.

So far, this has allowed me to avoid some China-specific risks that players like Vale are dealing with.

Takeaway

In a volatile market, Vale stands out as a resilient mining player despite short-term challenges.

While its stock price reflects the current turmoil in iron ore markets, Vale’s strategic initiatives, including cost management and efficiency programs, position it for sustainable growth.

Amid uncertainties, mainly regarding Chinese demand, patient investors could find value in Vale, considering its compelling valuation and potential for long-term upside.

However, given its volatility, conservative investors should approach Vale with caution.

Pros & Cons

Pros:

- Resilience: Despite short-term challenges, Vale has shown resilience in its operations, with strategic cost management and efficiency programs driving improvements in earnings power.

- Valuation: Trading at just 3.3x NTM EBITDA and 5.7x forward earnings, Vale presents an attractive valuation.

- Strategic Initiatives: Vale’s ongoing expansion projects and strategic partnerships, such as the recent agreement with Anglo-American, position the company for consistent growth.

Cons:

- Market Volatility: Vale’s stock price is heavily influenced by iron ore prices, which means that investors require higher commodity prices before the low valuation unlocks value. This also means that lower prices can hurt capital gains in the future.

- Chinese Uncertainty: Ongoing concerns regarding Chinese demand and economic outlook could continue to pressure VALE’s stock price.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

Test Drive iREIT© on Alpha For FREE (for 2 Weeks)

Join iREIT on Alpha today to get the most in-depth research that includes REITs, mREITs, Preferreds, BDCs, MLPs, ETFs, and other income alternatives. 438 testimonials and most are 5 stars. Nothing to lose with our FREE 2-week trial.

And this offer includes a 2-Week FREE TRIAL plus Brad Thomas’ FREE book.