Summary:

- I previously issued a bear call on Vale in Jul-23, I am even more bearish now.

- Construction accounts for over 50% of Chinese steel demand, whereas new home sales have fallen by a third and new housing starts fallen by over 50% from their 2021 peak.

- I believe there is a significant risk China’s property market downturn will materially negatively impact steel demand, iron ore prices and Vale’s stock price beyond market expectations.

- Vale’s P/E of 6 and dividend yield of 6% comes with this underlying risk, which I believe to be significant. Dividend investors should be aware of and cautious about it.

dt03mbb

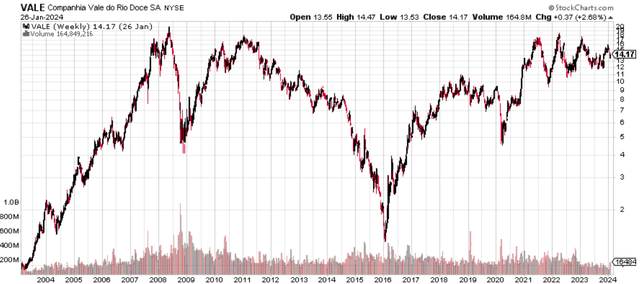

My previous article in Jul-23 was very bearish on Vale (NYSE:VALE) as I expected lower iron ore demand from China to negatively impact iron ore prices and eventually Vale. Since then the stock price has gyrated up and down but not declined materially.

I am even more bearish on Vale now, as the case supporting my original bear call is even stronger. Though Vale currently has a P/E of 5-6 and dividend yield of 6%, I would argue there is a large downside risk to this seemingly low valuation and high yield. I believe that investors should take into consideration the possibility that Vale is headed for cyclical lows not seen since the financial crisis in 2008 or before the China boom in the early 2000s.

Vale stock price (stockcharts.com)

I will draw some key points from my previous article and then supplement them with new information since Jul-23:

My original bear call was based on the following:

- Australian government estimated iron ore prices would be $63/ton by 2028, assuming China steel production and iron ore demand is relatively flat for the next 5 years compared to 2023. Vale’s breakeven production costs for iron ore are estimated by Management to be $52-54/ton in 2023 (on page 11 of source), which is low-cost compared to China (typically above $100+/ton) but high cost compared to Australia.

- China’s slowing property market is likely to massively decrease new property development, which will negatively impact demand for steel and therefore iron ore prices.

- The negative impact will be on a magnitude which may cause iron ore prices to fall to a level that may be near breakeven for Vale, which would materially reduce its profitability.

How have things evolved since then? Iron ore prices and Vale’s stock price haven’t moved too much, yet.

- Iron ore future prices have rose 15% from $112/ton in early Jul-23 to $128/ton at Feb 9, 2024.

Iron ore prices (Seeking Alpha)

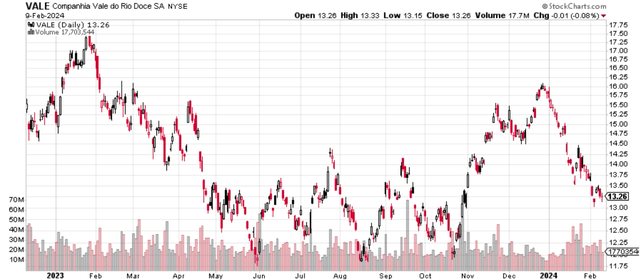

- Vale’s stock price has performed more tepidly, from $13/share in Jul-23, rising to $16/share in Dec-23 in line with the overall market but recently dipping to $13/share.

Vale stock price (stockcharts)

However, I believe there is mounting evidence of the scenario I propose above:

Despite strong hopes for a “post COVID rebound” in early 2023 after China relaxed its zero COVID policy, economic activity has not picked up, especially for steel relevant areas such as construction.

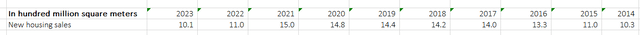

1. Large decline in new housing sales

New home sales (Chinese statistics)

Source: Chinese National Bureau of Statistics

New housing sales have declined to 1 billion square meters, down a third from a peak of 1.5 billion in 2021. There is a plethora of analysis on reasons why this downturn occurred and will be ongoing (recent example). There was even a rare admission that this would probably being longer than typically touted, as a former Chinese central banker explained that this would likely continue to fall into 2025, which is uncharacteristic as official/retired officials are generally upbeat in these forums. Suffice it to say that new housing sales at a level significantly lower than previous years is likely the new normal for at least a few years if not longer.

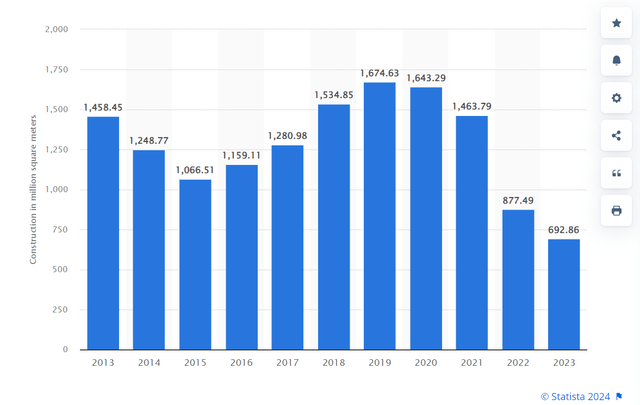

2. Collapse in new residential housing starts

As a result of weak demand for new home sales, the floor space of residential real estate construction started by real estate developers from 2013 to 2023 has collapsed to 692 million square meters, less than half the levels seen in most years in the prior decade.

Chinese residential housing starts (statista)

Source: Statista

Lower new residential housing starts will likely feed through to construction steel demand through three mechanisms:

- Some property developers (e.g. Evergrande) run out of cash and stop new property developments

- Property developers that still have cash focus on delivering existing projects rather than new projects. Also, there’s not enough demand for new homes anyway, so why bother building new ones.

- Fewer new projects eventually means a smaller amount of area under development, which translates into lower steel demand.

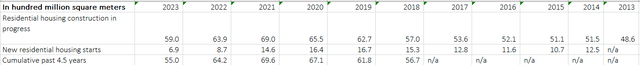

If we take a closer look at residential housing construction figures (which is about 70-80% of total construction area):

Residential construction demand (Chinese National Statistics Bureau)

Source: Chinese National Bureau of Statistics

We can see that the residential housing construction area in progress is a lagging indicator, which is relatively close to the new residential housing starts of the cumulative past 4.5 years. This would suggest that the new residential housing starts which began a precipitous decline in 2022 and further declined in 2023 to less than half of 2021 levels would be fully reflected after 4.5 years. Residential housing construction in progress began declining in 2023, but this should accelerate in the next year or two, assuming new housing starts remain low.

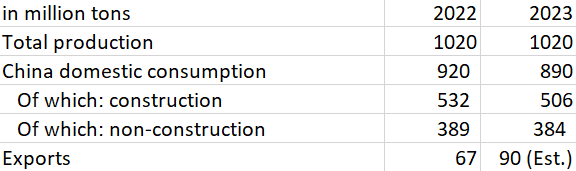

3. Feedthrough into steel demand:

The math is pretty straightforward: Construction steel accounts for over half of total China steel consumption in 2023 as shown below.

Chinese steel production and demand (Reuters)

Source: Reuters

Once residential housing construction in progress declines to half those of peak amounts in 2020/21, I would expect residential housing construction steel usage to eventually halve as well, estimated impact on iron ore demand below:

Table: Potential impact from 50% decline in China residential housing construction use

|

In million tons/annually |

||

|

Total construction demand |

A |

506 |

|

Estimated percentage used in residential housing |

B |

70% |

|

Decline in residential housing demand |

C |

50% |

|

Estimated tons of iron ore used to produce 1 ton of steel |

D |

1.5 |

|

Impact on iron ore demand |

E=A*B*C*D |

265 |

|

For reference: China total iron ore imports in 2023 |

1,100 (estimated) |

Source: Author’s estimates/calculations

There is no alternative short term source of demand growth that can fill up a c.265 million ton decline in iron ore demand:

- Shift in monetary policy by the Federal Reserve is unlikely to move the needle as there needs to be demand for this commodity in particular rather than just easy money sloshing around the monetary system.

- Despite China’s much touted economic stimulus programs, as shown above, non-construction demand only managed to not decline rather than increase in 2023.

- Demand from India is not growing fast enough to make up the shortfall. Though India is expected to grow rapidly, Indian steel demand is only 120 or so million tons a year, with about 10% forecast annual growth. The decline in Chinese residential construction demand alone more than exceeds 150% the steel demand of the entire Indian economy. While in time Indian demand could become more prominent, there is no possibility that Indian demand is able to fill this gap in the next two or three years.

Potential impact on Vale

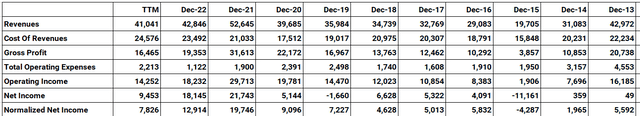

For Vale, which derives 80-90% of its revenue/EBITDA from iron ore, its financial results have suffered as iron ore prices fell from 2021 highs:

Iron ore prices (Seeking Alpha)

Source:Seeking Alpha

Vale income statement (Seeking Alpha)

Source:Seeking Alpha

Normalized net income per seeking alpha has fallen back to 2019 levels despite average iron ore prices realized in 2023 at $108/ton.

If iron ore prices fall to $63/ton (as forecast above by Australian government to happen in 2028) in next year or two from the 2023 average of $108/ton, this $45/ton decline in price multiplied by c.300million tons/year that Vale produces would be a $13.5bn hit to operating income, which would effectively cause Value to be in a breakeven/near loss position.

I believe it is pretty evident and the numbers are on a magnitude that can withstand a large margin of error, but the authorities and mining corporations probably don’t want to spook people, so they stick to their projection of “moderate declines”. This is why you see a sudden decline in the stock price when expectations finally coalesce and cascade in these situations (with “surprise” earnings below forecast and dividend cuts).

Overall conclusion:

- Chinese new residential housing starts and home sales have massively declined in past two years and are expected to continue declining and/or remain at their current levels, this is already proven by the actual figures in 2022-2023 and is not conjecture. There is a real risk iron ore demand enters a period of faster than expected declines, which cause iron ore prices (and Vale earnings) to massively collapse.

- The expert mining analyst reader might disagree with me and figure Vale has some more upside left in it, and this could well be the case. But if I were a mom-and-pop investor, I would view the current P/E of 5-6 and dividend yield of 6% with a huge grain of salt, as a potentially large loss of principal is lurking behind this seemingly low valuation and high yield. If an investor is searching for yield, there is probably some other asset with 6% yield that has stronger fundamental cashflows and is not so exposed to the vagaries of the Chinese economy.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.