Summary:

- The next 5 years project a lower dependence on Chinese demand for the iron ore market, indicates Vale’s Investor Day.

- In a scenario of lower demand and the same supply, lower costs can be decisive for the sustainability of a mining company.

- Vale has made great strides in terms of environmental liabilities, and with an upside of 30%, it could be the big beneficiary in the next 5 years.

Monty Rakusen

Investment Thesis

I recommend buying Vale (NYSE:VALE) shares. The company held its Investor Day on December 3, and there are several insights and projections that investors need to know and understand.

Many of them concern revenue and cost projections, as the iron ore market prepares to be less dependent on demand from China in the next 5 years. Uncertainties generate greater discounts in prices due to risks, but we will see that the worst-case scenario already seems to be in the price.

Revenues – Who Will Replace Chinese Demand?

Vale’s big business is the production and sale of iron ore. In 3Q24, for example, the company reported that 83% of its net revenue ($9.5 billion) came from iron ore sales, while the rest came from energy transition.

Until China faced its housing crisis, it was a voracious buyer of iron ore, and I talk about this in more detail in my initial coverage article. The fact is that Vale itself no longer exonerates China by increasing its demand for iron ore.

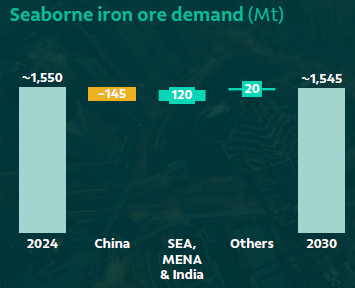

As we can see below, Vale projects that China’s demand will fall by 145 Mt by 2030 (remaining at a high level), while regions such as Southeast Asia, India, North Africa and regions around the Middle East will partially offset demand.

Seaborne Iron Ore Demand (IR Company)

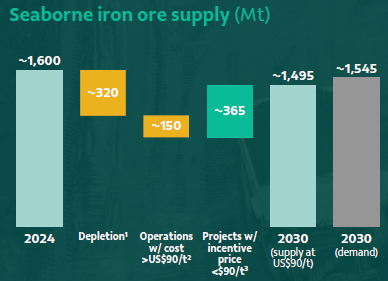

On the other hand, Vale projects that supply will reduce by 3.4% by 2030, as a result of depletion, when there is an exhaustion of natural resources in mines, and with fewer operations based on a less attractive iron ore price.

Seaborne Iron Ore Supply (IR Company)

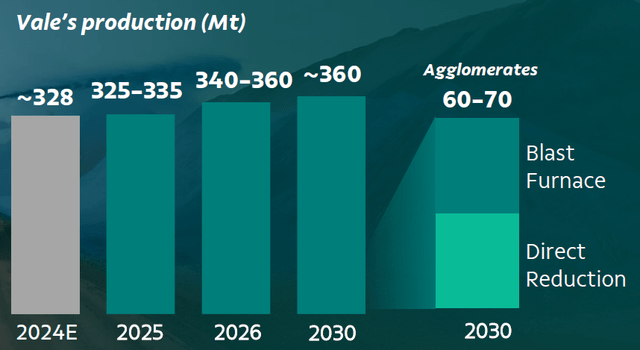

In this way, the company plans to increase its production volume from 328 Mt to 360 Mt by 2030. Vale (and I) believe that its major competitive advantage, its cost structure, will be decisive in facing a scenario of tighter prices.

Costs – The Big Competitive Advantage for a Mining Company in the Next 5 Years?

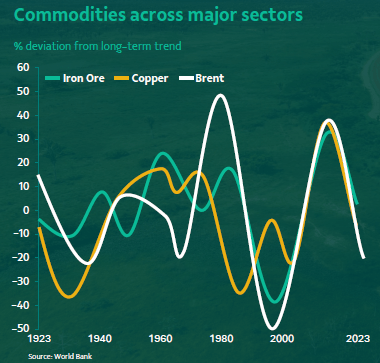

As we know, companies that operate with commodities are exposed to price volatility, and since 1923, with the rise of economies, there have been sudden variations in the prices of commodities such as oil, copper, but also iron ore.

Commodities Across Major Sectors (World Bank)

One of Vale’s major competitive advantages is its highly competitive cost. The company has a C1 cash cost of $22/t in 2024, but projects that with efficiency programs, higher volumes and a better mix, its C1 cash cost could reach $18/t by the end of 2030.

This is one of the major attractions in my view, since in a scenario that appears to be more hostile in the next 5 years, Vale would be able to navigate calmly in rougher waters, which corroborates my buy recommendation.

In short, my reading is that the iron ore market between 2025 and 2030 should see a smaller contribution from China, and this contribution will be replaced by several emerging countries.

Despite this, volumes should increase (which will bring price pressure), and the most efficient and least leveraged companies should do well. Vale will be very competitive in terms of costs, and now we will see the debt.

Debt – Great Developments in 2024

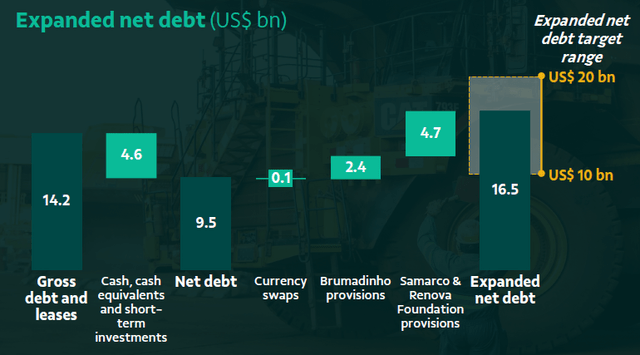

Vale has a very comfortable debt situation. The company has a range for its net debt that is between $20 billion and $10 billion, and currently stands at $16.5 billion, and recently a major risk was resolved.

Expanded Net Debt (IR Company)

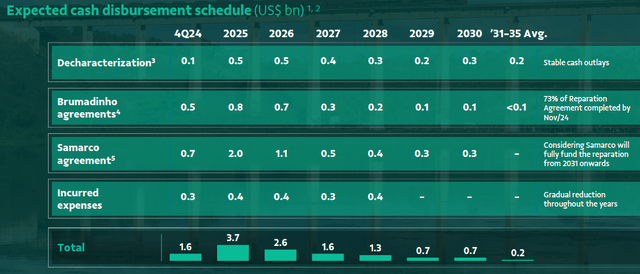

The company recently obtained full compensation for the damages caused by Samarco, which are already included in the schedule below, which corroborates the purchase recommendation. Once the company resolves Brumadinho, it will have resolved all the main environmental impasses.

Cash Disbursement Schedule (IR Company)

Valuation Extremely Cheap

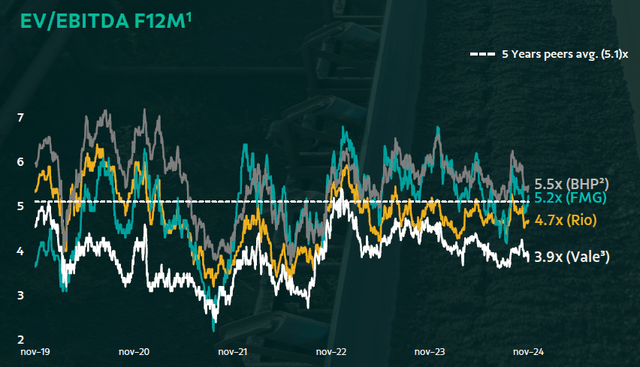

At the end of the Investor Day presentation, Vale compared its EV/EBITDA over the last 5 years against competitors BHP Group (BHP), Fortescue (OTCQX:FSUMF) and Rio Tinto Group’s (RIO).

As we can see above, Vale trades at 3.9x Ebitda, a 30% upside if the company returns to trading at the 5-year average of its peers of 5.1x. This seems to price in the worst-case scenario of weak demand and increasing supply, which provides a good margin of safety and supports my buy recommendation.

Potential Threats To The Bullish Thesis

I see two major risks to the thesis. There are more pessimistic projections regarding the global supply of iron ore. While Vale projects that global supply will fall by 2030, other sources indicate that supply should grow 3.1% y/y by 2028, which would put further pressure on prices.

Another major risk is that Vale operates mainly in Brazil, and the country is facing a serious crisis of distrust regarding its president. Today, Brazil spends 30% of its revenues on debt costs, and the president’s recent criticism of the Central Bank justifies investors’ fears.

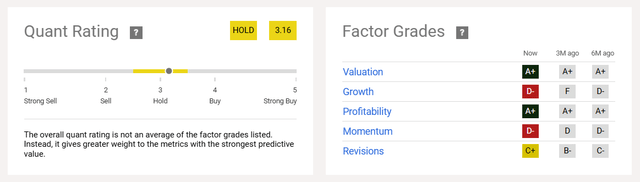

Last but not least, the buy recommendation is not a consensus, and Seeking Alpha’s Quant tools recommend that investors hold on to their shares. The thesis is complex, and investors should be cautious in their analysis.

Quant Rating and Factor Grades (IR Company)

The Bottom Line

Vale indicates that the next 5 years will see lower demand for iron ore in China, which will be partially replaced by higher demand from Southeast Asian countries, India, and North African and Middle Eastern countries.

The above scenario, combined with a similar supply, will lead to prices falling. In this scenario, Vale is banking on its extremely competitive cost to outperform its competitors and become the preferred choice for investors.

Based on this analysis, I recommend buying Vale shares. The company’s EV/EBITDA seems to suggest a very bad scenario, and positive surprises could be the trigger for the 30% upside to materialize.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.