Summary:

- Vale’s 3Q24 report showed increased production but lower prices. Net revenue expected at $9.7 billion, with potential for strong 4Q24 sales.

- The increase in production was the largest since 2018, helped by seasonality. However, freight costs and lower ore prices are expected to squeeze margins.

- Despite this, the company trades at just 3.5x EBITDA, which seems like a great bargain given its robustness.

dt03mbb

Investment Thesis

I recommend buying Vale (NYSE:VALE) shares after the release of its 3Q24 production and sales report on October 15. The company is expected to release its 3Q24 results on October 25.

It is worth noting that this type of report provides many clues about how the company will release its quarterly results. The report came with no surprises, with a sequential increase in volumes offset by lower prices.

However, with the company trading at 3.5x EBITDA against a historical 5x, and with a more positive momentum due to a flow of positive news coming from China, the risk/return ratio of the investment still seems attractive.

Introduction

This report is a continuation of my initial article covering Vale, published on April 17, 2024, with the same recommendation. It is worth noting that Vale is the largest mining company in Brazil and one of the largest in the world.

The company stands out for the quality of its iron ore and for having China as the destination for more than 50% of its sales. Below, I will describe the insights I gained from analyzing Vale’s 3Q24 production and sales report. Enjoy your reading!

Iron Ore Production and Sales

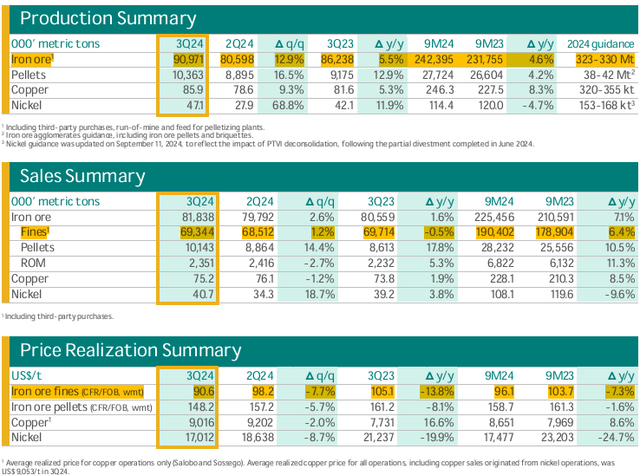

Vale reported an increase in iron ore fines production of 5.5% y/y and 12.9% q/q to 90.9 Mt, a record production since 2018. But as we can see below, there was a gap between volumes and sales, as sales reached 69 Mt.

Production and Sales (IR Company)

On the other hand, realized prices fell 7.7% q/q and 13.8% y/y to $90.6/t due to lower iron ore prices in the quarter. The quality premium was negative (-$1.9/t), but improved from the previous quarter.

In my view, it is interesting to see how resilient demand is, given that Vale is managing to increase production even in a hostile environment. Additionally, I believe that the positive flow of news coming from China (responsible for more than 50% of Vale’s sales) may provide some support for iron ore prices.

Vale’s net revenue is expected to be $9.7 billion in 3Q24. As for prospects, if Chinese stimulus actually increases the price of iron ore, Vale could sell its stocks well in 4Q24, which would be positive and corroborate the buy recommendation.

Copper and Nickel

Copper and nickel production are still underrepresented. In copper, production of 85.9 kt grew +5% y/y, with the annualized figure representing 97% of the mid-range of the 320-355 kt guidance for 2024.

In nickel, production of 47.1 kt grew 12% y/y, with the annualized figures representing around 95% of the average guidance range of 153-168 kt for 2024. Neither of these figures shows any negative signs for the result.

Outlook For Quarterly Results

I believe that cash cost per ton (c1/t) should remain between $21 and $22, positively impacted by higher production with dilution of fixed costs, and negatively offset by the higher freight prices seen recently.

I also believe EBITDA should be close to $3.7 billion, down around 10% y/y. Although cash generation will be boosted by volume, the drop in iron ore prices should more than compensate.

Finally, the recent possibility of an agreement to compensate for natural damages caused in Mariana/MG may contribute to a significant drop in net income for the quarter. However, I continue to have a constructive view when looking at the company’s valuation.

Valuation Is Cheap

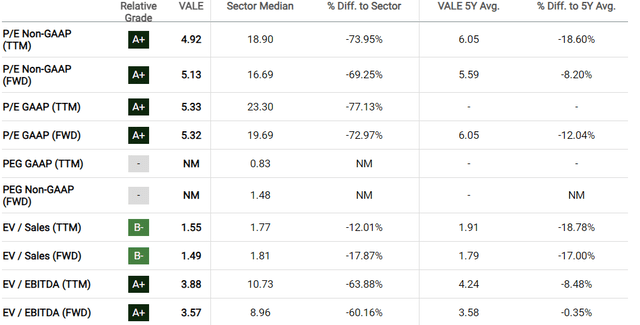

Vale continues with an extremely attractive valuation, as we can see below using Seeking Alpha tools.

Since the company operates in the mining industry, I believe it is appropriate to analyze the valuation using the EV/EBITDA multiple. In this case, Vale trades at only 3.5x EBITDA, which corroborates my investment recommendation.

Potential Threats To The Thesis

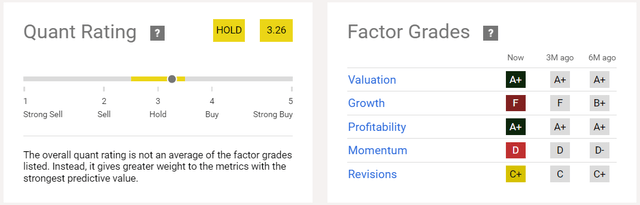

The first threat to my bullish thesis on Vale is that it is not a consensus. Seeking Alpha’s quant tools, for example, indicate a recommendation to hold the company’s shares.

Quant Rating And Factor Grades (Seeking Alpha)

Additionally, one of the reasons for the increase in volume was seasonality. If Chinese economic stimulus measures are not effective, there could be a combination of weak prices and volumes, which will penalize results.

The investment thesis for the company is complex, given Vale’s exposure to the Chinese economy. In my view, investors should be cautious when conducting their investment analysis.

The Bottom Line

Vale released its 3Q24 production and sales report without any major surprises. The company showed a nice increase in production and has inventory to strategically sell as soon as prices recover.

The recent positive news flow from China, combined with the company’s extremely attractive valuation, offset the weak prices and the lower demand for the quality iron ore that Vale offers.

Based on this analysis, I recommend buying Vale shares. In my view, a company like Vale trading at 3.5x EBITDA seems like an opportunity that doesn’t come around every day.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.