Summary:

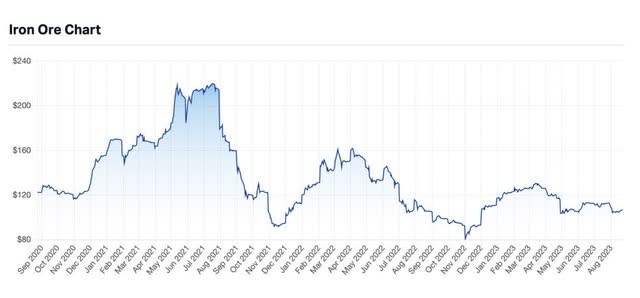

- The second quarter brought lackluster results for Vale due to the declining iron ore price, affecting its financials and balance sheet, coinciding with China’s sluggish economic recovery.

- Vale’s strategic move to spin off its base metals division and partner with Manara Minerals at a substantial valuation showcases the potential for unlocking value.

- Despite challenges, Vale offers an attractive valuation, showing resilience in generating positive cash flow, supported by a generous dividend and substantial share buyback program.

dt03mbb

The second quarter brought disappointing results for mining companies like Vale S.A. (NYSE:VALE), largely due to the declining price of iron ore. This decline had a negative impact on Vale’s balance sheet, which occurred simultaneously with China’s critical economic phase.

Being the world’s largest consumer of iron ore, China has consistently disappointed market expectations throughout the year regarding its economic recovery. After easing Covid-related restrictions, experts anticipated a significant economic upturn in China, which has not materialized. Macroeconomic indicators have consistently shown growth lower than what was expected.

This trend has contributed to declining commodity prices, resulting in reduced profitability margins for companies in the mining sector. The real estate crisis in China further weakens the assumption that the Chinese government will stimulate the construction sector again. With housing prices dropping, it indicates an existing oversupply for the time being. If new stimulus measures are implemented, they are more likely to support construction firms in reducing inventories and increasing their cash reserves rather than driving commodity demand.

Nonetheless, despite the expectedly subdued performance from Vale, with a few shortcomings, the company demonstrated positive cash flow generation. This positive trend will likely translate into reasonable dividends for this year and the next. Furthermore, with the context of the spin-off of the basic minerals division at an elevated valuation, I discern additional indicators suggesting a potential future undervaluation of Vale.

Latest results

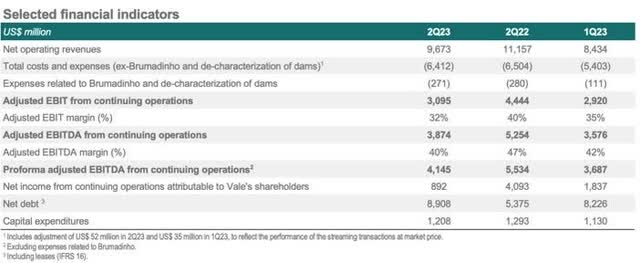

In the second quarter of 2023, the Brazilian mining company released its results, revealing a profit of $892 million (a 78.2% drop year-over-year), equivalent to R$4.573 billion, and an equity interest of R$8.27 billion. The decline in net profit can be attributed to Vale’s assessment, stemming from the impact of falling ore prices, reduced mark-to-market valuation of participating debentures, and the influence of deferred taxes on assets related to provisions for the Renova Foundation, following the judicial reorganization plan.

Additionally, the long-awaited partnership announcement for base metals was received positively. However, the revision of the cost guidance was viewed unfavorably. While the results contained certain negative aspects, they were not entirely surprising.

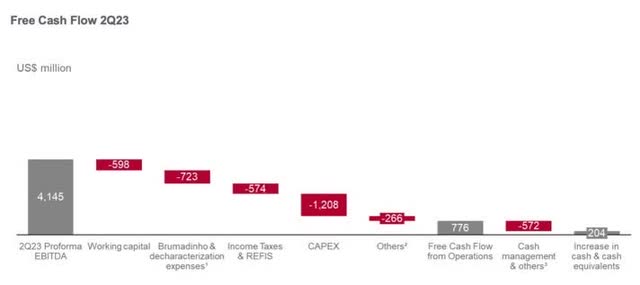

Vale’s performance saw a decline in results compared to the previous year, marked by a weaker performance in the ferrous minerals division. This was due to lower realized prices and increased costs, which offset slight volume improvements. Consequently, Vale’s EBITDA decreased by 25% year-over-year, reaching $4.1 billion. Moreover, weak operating free cash flow generation of $776 million resulted from higher working capital.

Despite generating positive free cash flow, the $1.4 billion spent on buybacks during the quarter increased Vale’s net debt, totaling $14.7 billion (compared to $14.4 billion in Q1 2023). Nevertheless, this remained within the company’s target range of $10 to 20 billion. The lower EBITDA over the last twelve months also caused the Net Debt/EBITDA ratio from 0.8x in Q1 2023 to 0.9x in Q2 2023.

Vale adjusted its cost guidance for 2023 in the iron ore and nickel segments. The C1 cash cost per ton (involving mining, railroad, and port expenses) for ore remained stable at $23.5/t in Q2 2023 compared to Q1 2023. The guidance was revised from $20-21/t to $21.5-22.5/t for the year, primarily due to the appreciation of the Brazilian Real, which came in below expectations for the latter half of 2023 (falling from R$5.20 to R$4.94).

Total net revenue reached $9.6 billion, driven by dynamics in fines and agglomerates. Despite the worsened price scenario from the previous quarter, revenue from fine ores notably recovered, totaling $6.2 billion, representing a 25.2% increase compared to the last quarter and a 12.3% decrease compared to Q2 2022. Factors contributing to these figures included the normalization of shipment volumes from the Northern System and seasonality that brought less rainfall, enabling the staged commencement of production.

Partnership for basic metals

Vale is initiating a spin-off of its basic minerals division, encompassing nickel, copper, and cobalt, in anticipation of future growth. The company has unveiled the sale of a 13% stake in its base metals business for $3.4 billion, valuing it at $26 billion – an appealing proposition. This valuation accounts for 33% of Vale’s enterprise value (EV) and an EV/EBITDA ratio of nearly 9 times.

The anticipated transaction involves the sale to Manara Minerals, a joint venture between Saudi Arabia’s Ma’aden and the country’s sovereign wealth fund PIF, which will hold a 10% stake. Additionally, Engine No. 1 will acquire a 3% stake. While Vale retains its iron ore division, it will become a significant shareholder in the new base metals division.

Despite the predominant revenue source being the iron ore division, the financial outcome will be influenced by participation in the base metals sector, which is projected to experience substantial growth by 2030, according to the company’s estimates. Iron ore will still account for over half of Vale’s results in 2030, which remains a cornerstone of the company’s substantial investment efforts. Consequently, approximately 70% of Vale’s results will likely be attributed to iron ore by 2030.

Although the sale of the basic materials division comprises only 13% of a segment contributing 10-15% of the company’s EBITDA, it’s advisable for investors not to assess the deal’s components solely. As a preliminary step in valuation, Vale’s foremost focus is stabilizing operations before seeking more substantial monetization opportunities.

This partnership potentially marks the initial significant stride towards unlocking even greater value. The terms of this agreement could serve as a foundational point in future negotiations with fresh strategic partners or in potential IPO endeavors.

State risks and political noises

As a state-owned company, investors in Vale should maintain a vigilant stance towards potential political risks associated with it.

While the rumors are not entirely new, they have been gaining momentum in the media: the left-leaning Workers’ Party (PT), led by Brazilian President Luiz Inácio Lula da Silva, is reportedly considering nominating former Finance Minister Guido Mantega as Vale’s CEO. Such a move, if realized, could raise concerns among the mining company’s investors.

This is primarily due to the government’s potential involvement in a private entity. Appointing Mantega as CEO might lead to government attempts to influence policies through direct company control. Furthermore, Mantega’s lack of experience in the mining sector adds to the apprehension surrounding his potential appointment.

However, indications suggest that the likelihood of such an occurrence is low. Banco do Brasil’s state pension fund, which serves as a conduit for potential government pressure on Vale’s board, has diminished its shareholding and influence within the board over recent years. In essence, the government’s sway has significantly reduced.

Moreover, Vale is listed on the Brazilian “New Market,” a shareholding structure designed to provide inherent safeguards against political interference. Notably, any such alteration would necessitate a majority vote, offering additional protection against political meddling.

Valuations

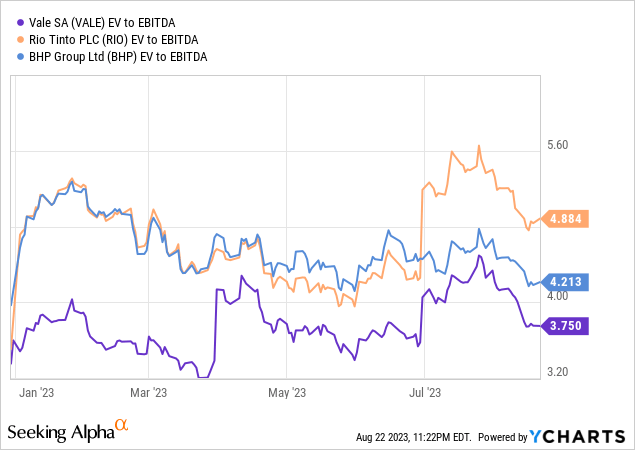

Vale’s current valuation appears to be undervalued. With the recent spin-off of its minerals division, the axed value of the base metals division has become apparent.

However, the question arises: what is the value of Vale’s other business? By excluding the Vale base metals division, the valuation of Vale’s iron ore division would equate to approximately 3.5x EV/EBITDA. Considering peers like Rio Tinto, which trades its business at nearly 5x EV/EBITDA, Vale remains highly competitive. Historically, Vale has exhibited superior margins to Rio Tinto (RIO) and closely competes with BHP (BHP), known for possessing exceptional iron ore assets.

This indicates a potential discount in Vale’s valuation. Moreover, Vale offers an attractive dividend and has embarked on an aggressive share buyback program. The company has already repurchased roughly 20% of its shares and intends to continue this trend, buying back an additional 20% over the next two years. Such substantial buyback programs are rare on a global scale.

The decision to repurchase shares is typically made by the Board of Directors, signifying that the company’s top management perceives the shares as undervalued. While their judgment may be debatable, companies implementing buyback programs in Brazil have often secured advantageous deals.

The bottom line

Despite the weaker results in the second quarter for Vale, my optimism about this mining giant remains unchanged, as it is expected to continue delivering solid dividends and trades at an attractive valuation.

While there were no surprises in the revenue from the iron ores, the dynamics in the base metals division changed. Even though the higher-than-expected C1 cost led Vale to revise its guidance, the EBITDA showed a recovery without any unexpected shocks. However, the net profit was disappointing due to non-recurring factors. Losses were contained in the model by employing more pessimistic assumptions regarding the C1 cost per ton.

The confirmation of Vale’s strategy to bring in a partner for the base metals unit, with Vale selling its stake at an implied Enterprise Value of $26 billion, places Vale’s ex-base metals unit at a forward EV/EBITDA multiple of 3.5x, compared to a historical average of 4.8x. This stretched valuation of the base metals unit further enhances the appeal of the robust cash-generating ferrous minerals unit, making it appear undervalued.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of VALE either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.