Summary:

- Vale showed better-than-expected earnings and significant cost reductions, despite lower revenues.

- Vale mitigated a major risk by resolving the Samarco accident legal provisions, enhancing its investment appeal.

- The company’s valuation is highly attractive, trading at just 3.7x EBITDA, with a potential upside of 35% if it returns to 5x EBITDA.

- Positive news flow from China and potential new stimulus could further boost Vale’s momentum, making the risk/return ratio favorable.

Abstract Aerial Art

Investment Thesis

I recommend buying Vale (NYSE:VALE) shares after the release of its 3Q24 results. It is worth noting that this report is a continuation of my thesis for starting coverage, which was published on April 17, 2024.

Vale is the largest mining company in Brazil and one of the largest in the world. The company had already released its production and sales report for 3Q24, but its results were better than I expected.

The company also resolved one of the major risks to the thesis, the legal provisions for the Samarco accident. Finally, a positive flow of news from China is expected for next week and may improve the company’s momentum.

Vale’s 3Q24 Results Review

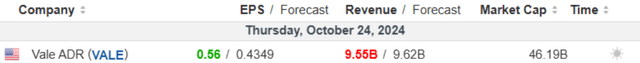

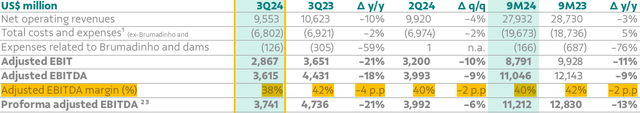

Vale released its 3Q24 results on October 24, and as we can see below, they came in below market expectations in revenues, but above expectations in earnings per share. From now on, I will provide a complete description of each segment of the result. Enjoy reading.

Net Revenues – Falling Due to Iron Ore

Vale reported a -10% y/y and -4% q/q variation in net revenue to $9.5 billion, a little below my forecast of $9.7 billion. The reason for this is the drop in iron ore prices, which varied -7.7% q/q and -13.8% y/y.

Vale’s revenue outlook remains closely tied to the Chinese government’s ability to stimulate its economy. Additionally, investors are awaiting new stimulus packages ($1.4 trillion), which could be new triggers for Vale.

Costs and Margins – Very Competitive C1 Cost

The C1 cost, which excludes third-party purchases, fell sharply to $20.6/t (in 2Q24 it was $24.9/t), resulting in greater fixed cost dilution and efficiency. The value came in better than my estimate between $21/t and $22/t. However, this was not enough to offset the drop in margins.

Adjusted EBITDA Margin (IR Company)

This was due to the 9% annual increase in freight prices. Vale indicates that it will be able to maintain the guidance for C1 costs (between $21.5/t and $23/t), which seems quite feasible to me given the company’s excellent track record of cost management.

Judicial Provisions – One Less Risk

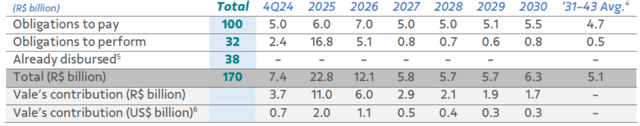

Vale’s biggest highlight during the period was the definitive agreement to repair damages related to the Samarco accident. The financial value is BRL 170 billion (approximately $30 billion) and the payment schedule is below.

Expected Cash Disbursement Schedule (IR Company)

In my view, Vale mitigated one of the major risks of its thesis, given that the extent of the loss was unknown. Now, the only thing left to do is resolve the Brumadinho incident, which was not reported during the period.

Net Income – Expected Drop

Due to the drop in iron ore prices, pressure on margins and the final agreement, Vale’s profit varied by -15% y/y and -13% q/q to $2.4 billion. We can see the variation below.

Overall, I thought the results came in better than expected when I looked at the company’s production and sales report. Cost reductions, the resolution of legal settlements, and the positive news flow from China do not seem to be priced in, as we will see below.

Valuation – Very Cheap

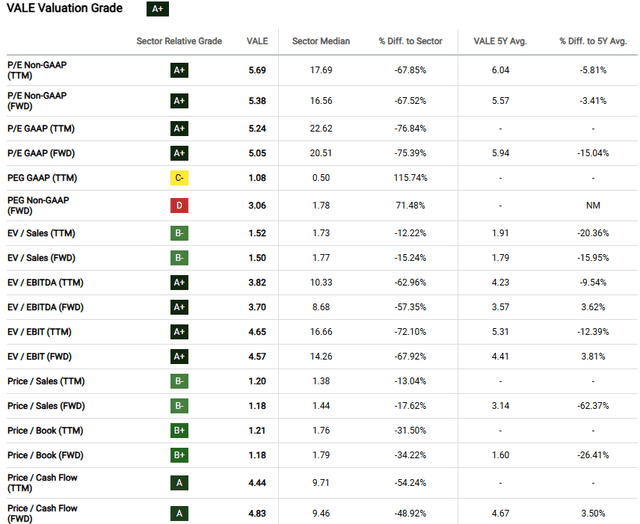

As we can see below in Seeking Alpha’s valuation tools, Vale is cheap by any metric, whether versus the sector average or versus its own trading history.

Valuation Grade (Seeking Alpha)

Trading at just 3.7x EBITDA, the company has an upside of 35% if it returns to trading at just 5x EBITDA, well below the sector as we can see, and this corroborates my buy recommendation.

Potential Threats To The Bullish Thesis

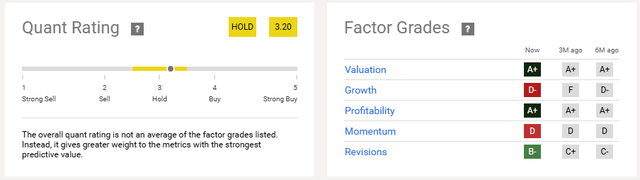

As for risks to my bullish thesis, it is important to note that it is not a consensus. Despite the A+ valuation grade, Seeking Alpha’s Quant tools recommend that investors hold on to their shares, as we can see below.

Quant Rating and Factor Grades (Seeking Alpha)

Additionally, recent Chinese stimulus has not had the desired effect on the economy, and market participants are beginning to believe that it will not be enough for a strong recovery of the Chinese economy.

If this were to occur, it would contribute to Vale’s share price remaining stagnant. The thesis is complex and investors should be cautious in conducting their investment analysis, given the dependence on the Chinese economy.

The Bottom Line

Vale released results slightly above expectations for those who also analyzed its 3Q24 production and sales report. Cost reductions and the final agreement for Mariana do not seem to be priced in.

In addition, the flow of positive news from China continues strong, with promises of new stimulus next week. The company’s valuation also remains very cheap, with Vale trading at 3.7x EBITDA.

Based on this analysis, I recommend buying Vale shares. In my view, investors should focus on the quality of the company, the positive flow of news from China, and the discounted valuation. The risk/return ratio seems attractive.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.