Summary:

- Vale’s Q3 results, characterized by a 7.8% sequential increase in EBITDA and 11.2% annual growth, reflect a robust recovery driven by favorable seasonality and rising iron ore prices.

- The company’s disciplined capital allocation strategy, positive valuation metrics (trading below historical averages), and a 6% dividend yield for 2023 make it an attractive investment opportunity.

- Despite market challenges and dependency on Chinese demand, Vale’s resilience in generating cash, repurchasing shares, and delivering dividends underpins the bullish thesis.

andreswd/E+ via Getty Images

As I have expressed in my recent article on the Brazilian mining giant Vale (NYSE:VALE), my investment thesis for the company is primarily centered on its capacity to consistently provide robust dividends to shareholders while trading at an exceptionally appealing valuation. The most recent results reported by the company further support my thesis.

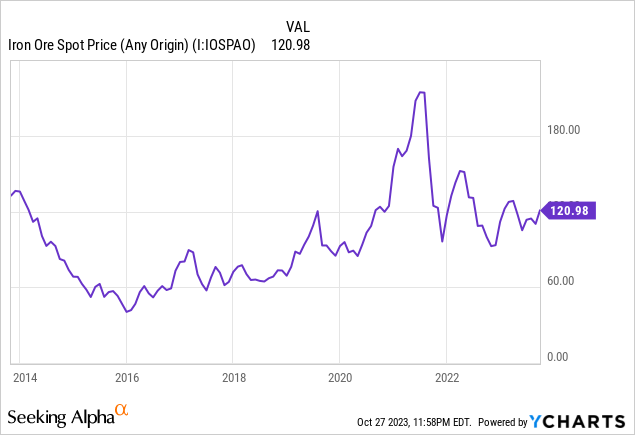

During the third quarter, despite the challenges faced in the Chinese commercial real estate market, Vale reaped the benefits of an average iron ore price of $114 per ton, marking a 62% increase and reaching a 2.7% peak over the previous quarter. The price of this commodity continued to climb, ultimately reaching approximately $120 per ton, a level roughly 30% above the historical average of the past decade.

These factors significantly contributed to Vale’s third-quarter performance, where the average realized price for fine iron ore reached $105 per ton. This marked a 6.7% increase compared to the previous quarter and a substantial 13.5% increase compared to last year. The price surge was fueled by strong demand in construction, infrastructure, and social housing projects financed by the Chinese government, record-breaking activity in the Asian automotive industry, and increased Chinese crude steel exports to global markets, including Brazil.

Despite the company’s significant dependence on the Chinese economy, Vale has consistently proven to be a resilient cash generator, continuously delivering value to shareholders through dependable dividend distributions and share buyback programs. Furthermore, Vale is currently trading at very attractive valuation multiples, remaining below its historical average, which bolsters my optimistic outlook for the company.

Vale Q3 Results

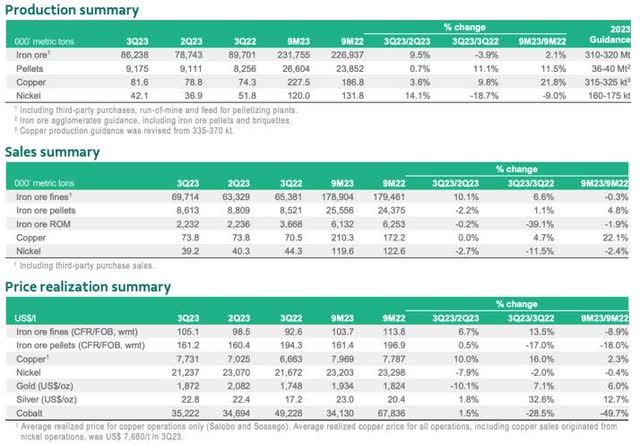

The company’s released operating results on October 17 showed a 4% decline in iron ore production, Vale’s primary business, when comparing the third quarter of 2023 to the same period in 2022. This drop can be attributed to operational issues at the mines, leading to reduced production. On the sales front, iron ore sales volume in the third quarter of 2023 was 6.0% higher than in the third quarter of 2022, indicating the company’s effort to reduce inventories following several quarters of overproduction. This is a positive development in my view.

Regarding prices, iron ore prices showed a positive trend in the third quarter of this year, reaching approximately $105 per ton, compared to $98 in the second quarter of 2023 and $92 in the third quarter of 2022. Additionally, there was an appreciation in the value of the U.S. dollar against the Brazilian real, which benefited Vale since it’s an exporting company.

These factors indicated that Vale was poised to report substantial revenue and excellent cash generation if costs remained stable. This expectation materialized when Vale released its quarterly results on October 27.

In the third quarter of 2023, Vale reported a 7% increase in net sales revenue compared to the same period in the previous year, reaching the US$10.6 billion mark. In terms of operating profit (EBIT), there was a 16% increase compared to the third quarter of 2022, totaling $3.3 billion, with an EBIT margin around 3 percentage points higher, reaching 31%. However, net income from continuing operations experienced a 35.7% decline compared to the same period in 2022, primarily due to the absence of a positive impact from financial items in this quarter.

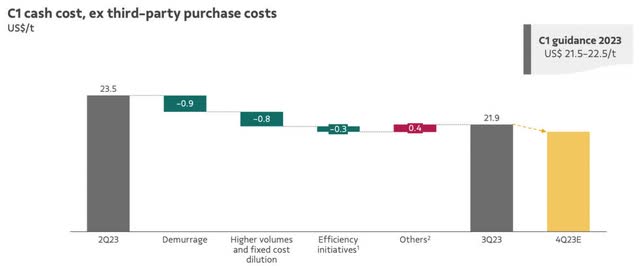

Among vital operational factors, one of the main highlights was the 13.5% increase in the average selling price of iron ore fines compared to the same period in 2022. This contributed to higher net sales revenue despite a slight drop in production. The C1 cash cost of iron ore, excluding purchases from third parties, reached $21.9 per ton, consistent with the guidance provided, which ranges from $21.5 to $22.5 per ton for the year.

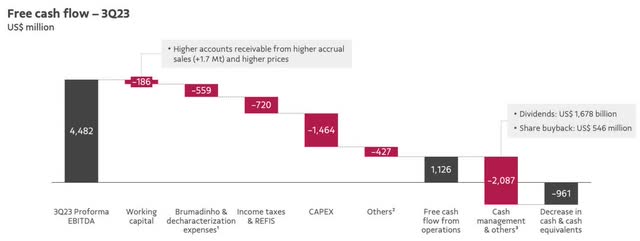

The company has also been executing a disciplined capital allocation strategy. In the third quarter, free cash flow from operations amounted to approximately $1.1 billion, marking an increase of roughly $350 million compared to the second quarter. This increased working capital was primarily due to higher accounts receivable, resulting from increased iron ore sales and prices. Additionally, income taxes saw an uptick due to improved performance.

The free cash flow from operations was employed to provide value to our shareholders by paying $1.7 billion in dividends and $0.5 billion in share buybacks. In line with this approach, Vale has approved a new buyback program to repurchase up to 150 million shares within 18 months. Since initiating the company’s first buyback program, 830 million shares, equivalent to 60% of the share count, have already been repurchased.

As a result, shareholders who invested in Vale during this period have increased their earnings per share participation by 19%, as the company’s management highlighted.

Vale’s Outlook

The primary factors directly impacting Vale’s results are the price of minerals and the quantity produced. In this context, the company has been pursuing two interconnected strategies to optimize its operational performance: increasing production and reducing costs.

The first strategy involves cost reduction because Vale lacks control over the price of its product. Hence, its focus must be on maintaining profitability even in challenging scenarios. Vale’s cash cost for iron ore is approximately $19.6 per ton (as of 2022 data).

This cost increases to around $37.4 per ton when accounting for expenses related to royalties, distribution, maintenance investments, and freight to reach Asian ports, which are the primary consumers of the company’s ore. Therefore, after considering current investments in Vale’s operations, the breakeven point is approximately $60. Despite having lower extraction costs than its competitors (Rio Tinto (RIO) and BHP (BHP)), Vale faces significantly higher freight costs due to Brazil’s greater distance from China than Australia.

For this reason, the company continuously seeks ways to enhance its production and freight costs. In 2022, the all-in cost per ton of iron ore, before accounting for maintenance investments, reached $49.3. The company anticipates this figure to be $52-54 per ton in 2023 and to decrease to approximately US$42 per ton by 2026, achieved through cost dilution and reduced fixed expenses from higher production volumes.

Iron Ore’s Outlook

The primary risks associated with this thesis stem from the highly volatile and unpredictable nature of the sector in which the company operates. The iron ore industry relies heavily on demand, particularly infrastructure and construction. China, currently experiencing economic challenges, plays a crucial role as it is responsible for 50% of the world’s steel production, a significant consumer of iron ore. Last year, China accounted for 62.9% of Vale’s iron ore shipments, while Asia represented 77%.

Therefore, Vale’s results are closely linked to the Chinese economy. In the years ahead, there is an expectation that China’s demand for iron ore will become more stable, not reaching the high growth rates of past decades but still maintaining a reasonable level. Positive trends also emerge from developed regions, emphasizing sustainable steel production and renewable energy infrastructure development. Furthermore, the ongoing migration of people from rural to urban areas in China will contribute to increased steel demand. Additionally, there is an expectation that steel production capacity in Southeast Asia will double by 2030, further benefiting the sector.

Valuation and Dividends

Vale trades with an Enterprise Value (EV), the market value plus net debt, of R$340 billion. This suggests the company trades at an EV/EBITDA multiple of 4x, below its historical average. It’s important to highlight that the company is expected to generate an EBITDA range of R$80 to R$98 billion for the year.

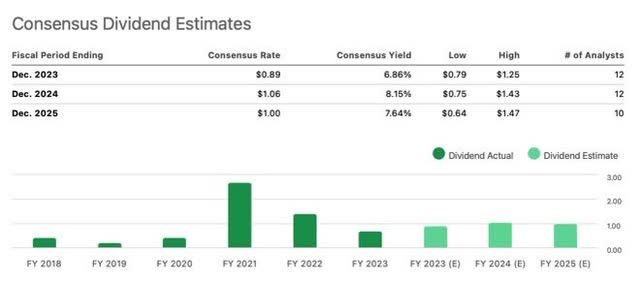

Additionally, Vale has recently declared a dividend of R$2.33 per share (approximately $0.47 per share), with R$1.56 as dividends and R$0.76 via JCP (Shareholder’s Equity Interest). This is roughly $2 billion, equivalent to 3.6% of Vale’s market value.

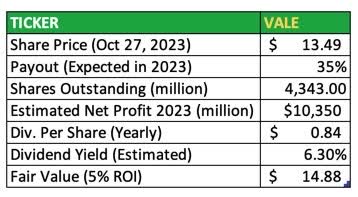

In my assessment, considering the average consensus of analysts predicting a 44% decrease in EPS for Vale by the end of 2023, the company is expected to generate $10.35 billion in net income. A payout ratio of 33.5% translates to an annual dividend per share (Vale pays semi-annual dividends) of $0.84, indicating a yield of 6.3%.

Applying a 5% return on investment [ROI] suggests a fair price of $14.88 per share for Vale. This supports an upside potential of 10% from the current price, which I consider a safe point for purchasing Vale shares to generate value through dividends.

Company’s data, table compiled by the author

The outlook for the next few years appears more optimistic, particularly considering a possible payout ratio more in line with the company’s historical average of 68% over the last five years. While it’s uncertain whether this program will utilize the $2.4 billion, there’s a good chance, in my view, that Vale won’t keep the funds idle and may use them to generate shareholder value, either through dividends or share buybacks.

Conclusion

My bullish outlook on Vale remains unaltered following the release of its Q3 earnings report.

Vale displayed a remarkable recovery, marked by a 7.8% sequential increase in EBITDA in the third quarter and an 11.2% annual growth. This can be attributed, in part, to the favorable seasonality in the third quarter, which boosted sales and reduced fixed costs, consequently leading to a sequential decrease in the C1 cost. Furthermore, the rise in iron ore prices encouraged Vale to expedite the disposal of inventories accumulated in the first quarter and improve its balance sheet.

I continue to perceive an excellent opportunity to invest in Vale at its present valuation. The company trades at an EV/EBITDA multiple of 4x, below its historical average. Additionally, it offers an appealing dividend yield of approximately 6% for 2023.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of VALE either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.