Summary:

- Vale S.A. faced a 25% stock price drop in 2024 due to governance issues and fluctuating iron ore prices but remains promising for long-term growth.

- Q2 2024 saw record iron ore output and a 35% year-over-year increase in operating income, highlighting Vale’s operational efficiency and production scalability.

- Vale’s strategic projects, including the Sohar iron ore concentration plant and capacity growth initiatives, position it well for future market opportunities.

- Despite risks, Vale’s low P/E ratio, strong free cash flow margin, and expansion into energy transition metals make it an attractive investment.

temizyurek

Investment Thesis

Vale S.A. (NYSE:VALE) had some problems in 2024 as its stock price was reduced by 25%, resulting from governance issues as well as fluctuations in iron ore prices. Therefore, for the long run investment, Vale’s low cost of production in iron ore and visible efforts to diversify in energy transition metals like copper and nickel hold promising growth. The decline in share price may mostly be ascribed to outside variables, including political concerns in important markets and economic difficulties in China, the biggest iron ore user. Vale has been faced with financial loss since China’s economy has slowed down, and hence, there is a low demand for iron ore. However, Vale appears to have persisted in addressing these challenges. Nevertheless, it has held optimal production standards to ensure that the corporation remains globally competitive even where the pricing has been lowered.

Q2 Highlights

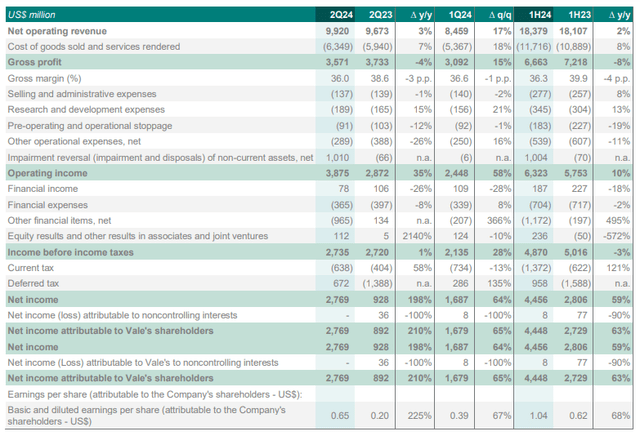

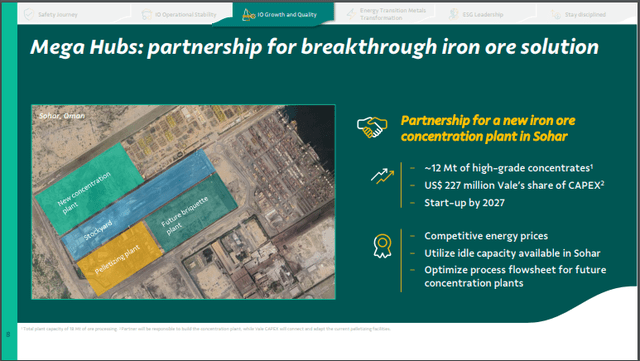

Driven by record iron ore output at the S11D complex, the greatest for a Q2 since 2018, Vale S.A.’s performance in the second quarter of 2024 remained strong, with a 3% year-over-year growth in net operating revenue to $9.92 billion. Constant production efficiency helped gross profit jump 15% quarter-over-quarter. Strong operational improvements are shown by the company’s operating income, which grew significantly by 35% year over year to $3.88 billion.

Vale SA Q2 Report

There is sustained iron ore sales expansion and a record S11D production. While production at the S11D mine grew by 2%, illustrating the efficiency and scalability of Vale’s operations, iron ore output climbed by 3% year over year, hitting 81 Mt in Q2 2024. Sales also increased by 7%, or 80 Mt. Given iron ore’s significant contribution to Vale’s income, this performance exposes its capacity to grow output while preserving operational stability. Since Vale shows that it can satisfy growing demand despite price instability, the higher production also helps the firm to be positioned favorably in the worldwide iron ore market.

Vale SA Investor Presentation

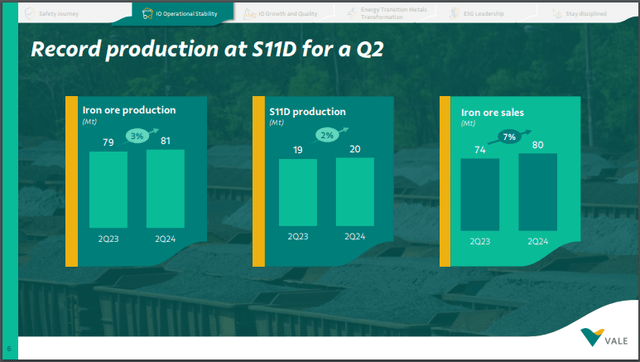

Several vital initiatives aiming at increasing production by 50 Mt by 2026 help to highlight Vale’s concentration on capacity growth. With the Vargem Grande project set to contribute 15 Mt to production and nearing 96% completion by June 2024, the projects look good. Finally, with a target of 20 Mt, the S11D expansion and crusher project is making good development. They show that Vale is heavily future-proofing its activities to not only satisfy present demand but also take advantage of prospects in the market.

Vale SA Investor Presentation

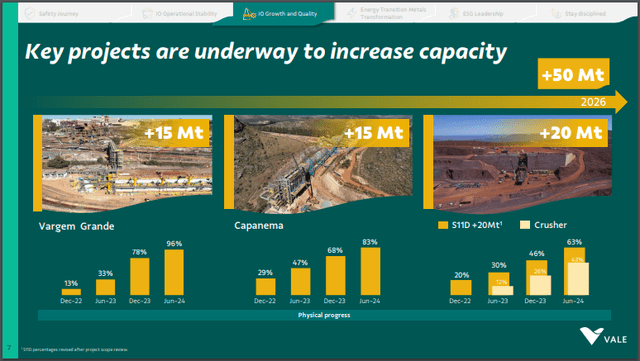

For Vale, the strategic step is the cooperation in Sohar, Oman, to build a new iron ore concentration plant. Starting by 2027, this project—with a 12 Mt capacity for high-grade iron ore concentrates and a CAPEX investment of $227 million for Vale—is planned to be Vale is maximizing its manufacturing process in a reasonably affordable area by using current idle capacity and accessing competitive energy prices. This action will help Vale support its long-term development goals and improve its capacity to service worldwide markets, especially in areas with rising demand for premium iron ore.

Vale SA Investor Presentation

For Vale, the calculated move is working with Sohar, Oman, to develop a new iron ore concentration plant. Beginning by 2027, this initiative—with a CAPEX expenditure of $227 million for Vale and a 12 Mt capacity for high-grade iron ore concentrates—is expected to be by leveraging present idle capacity and obtaining competitive energy rates, Vale is optimizing its manufacturing process in a somewhat reasonable cost range.

Vale SA Investor Presentation

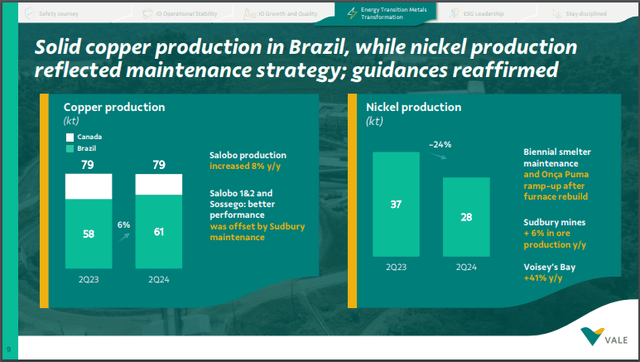

Reflecting Vale’s constant performance in non-iron-ore sectors, the last slide shows consistent copper production in Brazil, which witnessed a 6% year-over-year growth. With copper output in Q2 2024 at 79 kt, operations performed successfully. However, operational disturbances and maintenance at important smelters caused a 24% drop in nickel output.

Peer Comparison

With the return on equity (ROE) and levered free cash flow margin, Vale S.A. stands out in the worldwide mining and metals sector with an attractive valuation and excellent operational efficiency. For those looking at long-term prospects, Vale’s financial foundations in comparison to its peers show great worth even with temporary income problems.

With forward P/E ratios ranging between 8.42 and 16.95, Vale’s P/E GAAP (FWD) of 5.71 is somewhat lower than that of rivals, including Nucor (NUE), POSCO (PKX) and Steel Dynamics (STLD). This suggests that Vale is underpriced now compared to its rivals, which offers value investors a good starting point. Further implying the market has yet to value Vale’s earning potential fully, primarily as it focuses on improving operational performance and cost efficiencies.

|

VALE |

NUE |

PKX |

MT |

STLD |

RS |

|

|

P/E GAAP (FWD) |

5.71 |

16.51 |

16.95 |

8.42 |

12.25 |

16.5 |

|

P/E GAAP (TTM) |

5.8 |

10.81 |

25.83 |

NM |

10.09 |

14.78 |

|

PEG Non-GAAP (FWD) |

NM |

NM |

0.58 |

0.67 |

2.45 |

– |

|

PEG GAAP (TTM) |

NM |

NM |

NM |

– |

NM |

NM |

|

Price/Sales (TTM) |

1.34 |

1.12 |

0.42 |

0.34 |

1.11 |

1.17 |

|

Revenue 3 Year (CAGR) |

-10.21% |

7.94% |

5.11% |

0.38% |

11.93% |

10.79% |

|

Revenue 5 Year (CAGR) |

8.11% |

5.49% |

2.56% |

-3.30% |

9.15% |

4.15% |

|

Levered FCF Margin |

17.87% |

6.94% |

-1.28% |

1.35% |

3.69% |

4.65% |

|

Return on Equity |

24.05% |

17.63% |

2.29% |

-0.96% |

22.78% |

14.96% |

With a levered free cash flow margin of 17.87%, Vale’s financial performance is among the best among its rivals, much above others. With this excellent cash-generating capacity, Vale can keep flexibility in spending on strategic development projects while returning capital to shareholders via dividends and share buybacks. It is still possible that Vale’s diversification pushes into copper and nickel, critical metals for what is expected to be the global energy transition, has hidden future growth drivers that need to be better captured by today’s stock price.

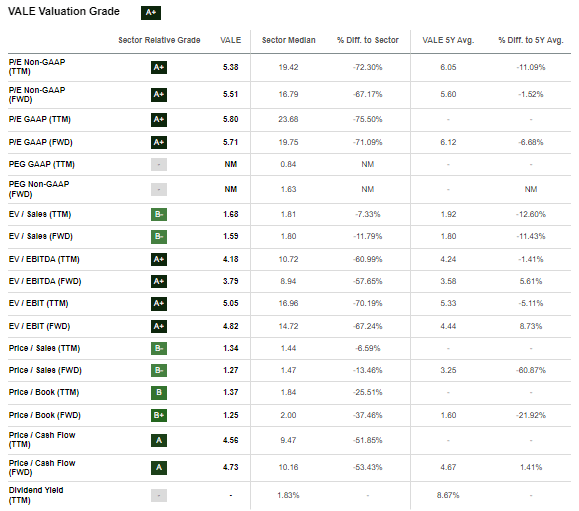

Valuation

Vale S.A. is offering investors in the mining and metals sectors an appealing value, particularly about its industry rivals. With the forward P/E ratio being 67% lower than the sector median of 16.79, the company’s P/E ratios—ahead (5.51) and trailing (5.80) show a notable sector discount. Both trailing (4.18) and forward (3.79) Vale’s Enterprise Value (EV) to EBITDA ratios are 57% lower than the sector medians of 10.72 and 8.94, respectively. This significant discount emphasizes how much less Vale is selling at a multiple of its cash earnings than its competitors. Vale presents a strong argument for investors seeking low-cost producers with significant revenue-generating potential. Given its solid operational basis and capacity to effectively generate iron ore, Vale stands to gain as world demand for essential goods stays excellent.

Seeking Alpha

The company’s P/E ratios—ahead (5.51) and trailing (5.80)—show a clear sector discount because the forward P/E ratio is 67% lower than the industry median of 16.79. Given its operational solid basis and ability to efficiently produce iron ore, Vale stands to benefit as world demand for primary products stays outstanding.

Because it undervalues sector peers, strong cash-generating, free cash flow margin, and solid capital management, Vale presents an exciting investment opportunity overall. Since Vale focuses on acquiring energy transition metals while maintaining leadership in iron ore output, it is positioned to weather fluctuations in commodity prices and give long-term value to its owners.

Overall, Vale is an appealing investment prospect because it undervalues its industry peers, robust cash-generating, free cash flow margin, and sound capital management. Vale is positioned to withstand changes in commodity prices and provide long-term value to its owners since the company is concentrating on acquiring energy transition metals while keeping leadership in iron ore output.

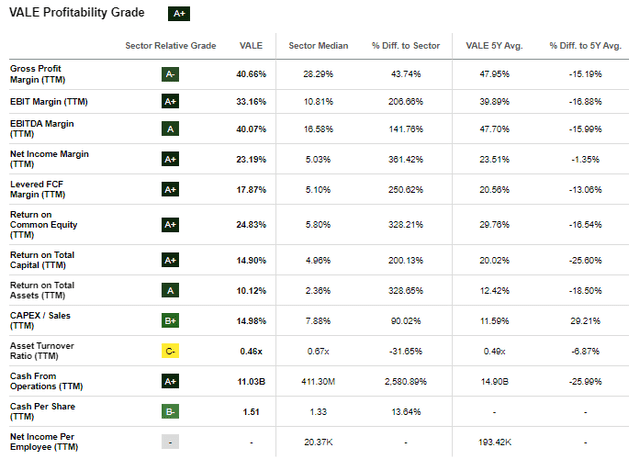

Why Am I Bullish on Vale?

The profitability numbers of Vale S.A. make a compelling case for an optimistic attitude. The company shows excellent operational efficiency and high cash flow creation by performing exceptionally well on many necessary financial measures. For example, Vale’s gross profit margin (40.66%) dramatically exceeds the sector median by 43.74%, highlighting its capacity to keep strong sales while controlling manufacturing costs. This substantial margin is essential in the capital-intensive mining sector to guarantee that the company stays profitable even in declining markets. At last, Vale’s return on equity (ROE) of 24.83% is an unambiguous measure of effective capital allocation, much above the sector median by nearly 328%. With this high ROE, Vale reinvests its earnings to create additional profits, increasing shareholder value. Such high profitability indicators make Vale an exciting investment, confirming the premise for a positive future.

Seeking Alpha

Risks

Vale (VALE) faces different risks that might challenge the organization’s long-term view and financial health. Its heavy reliance on iron ore, which continues to be the primary source of revenue for the business, brings about the main risk. Fluctuations in the price of iron ores due to demand by other essential markets, such as China, may significantly reduce Vale’s revenue. For instance, a change in demand from China or a shift in the supply chain affects the price of iron ore, for vale. While Vale is so passionately transforming from being a miner of iron ore, these markets are still growing. Environmental events have had legal and financial impacts on the corporation; the deadliest was the Brumadinho dam failure in 2019. Any other events in the future may cause more legal responsibilities and fines, as well as loss of operating licenses, which may limit the company’s operations and profit-making abilities.

Conclusion

Given Vale S.A.’s operational solid efficiency, low production costs, and expansion into energy transition metals, the company presents a promising long-term investment opportunity. Despite recent challenges, including stock price declines due to external factors and fluctuations in iron ore demand, Vale’s record production and strategic projects position it well for future growth. Its valuation is attractive compared to competitors, with a solid free cash flow margin and low P/E ratio. Investors seeking exposure to a diversified mining company with growth potential in critical metals should consider Vale a solid investment choice.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.