Summary:

- Vale’s iron ore investment thesis remains robust, attributed to the tighter supply and the growing Chinese imports/moderating port-side inventory levels.

- The producer has also made great efforts to improve its iron ore quality to capture the premium gap, naturally contributing to its expanded realized prices and bottom lines.

- Market watchers expect the higher quality iron ore/pellets to command an increasing price premium by over +20% through the next decade.

- Combined with its excellent TTM dividend yield of 7.3%, well exceeding the US Treasury Yields of between 4.47% and 5.46%, we maintain our buy rating for VALE stock.

mmuenzl

We previously covered Vale S.A. (NYSE:VALE) in July 2023, discussing its mixed prospects attributed to the lower-than-expected contracted iron ore rates from China and impacted valuation for its Energy Transition Metal segment.

However, we had chosen to opportunistically rerated the stock as a Buy then, attributed to the improved risk/reward ratio after the much-needed pullback, expanded forward dividend yield, and strategic electrification plans.

In this article, we maintain our buy rating for VALE, attributed to the recovering iron ore spot prices as China increases its imports and produce more steel on a YoY basis.

Most importantly, its ongoing premiumization efforts have been working well, with the higher quality iron ores contributing to its expanded realized prices and bottom lines.

The Iron Ore Investment Thesis Remains Robust For The Largest Global Producer

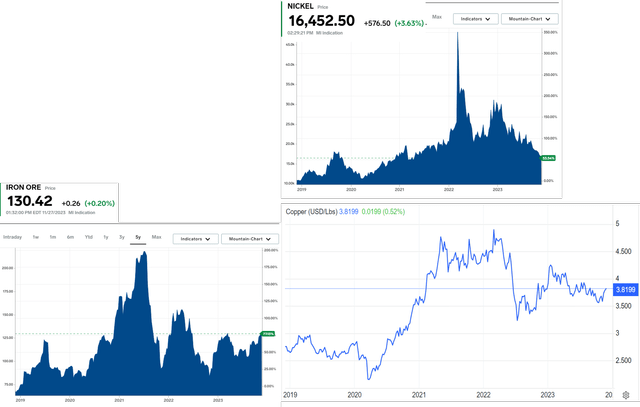

Iron Ore/ Copper/ Nickel Spot Prices

Market Insider/ Trading Economics

For now, iron ores comprise the bulk of VALE’s FQ3’23 adj EBITDA at $4.45B (+12.9% QoQ/ +18% YoY) and copper/ nickel to a much smaller extent at $269M (+13.9% QoQ/ +73.5% YoY)/ $100M (-57.4% QoQ/ -52.9% YoY), or the equivalent of 92%, 5.5%, and 2%, respectively.

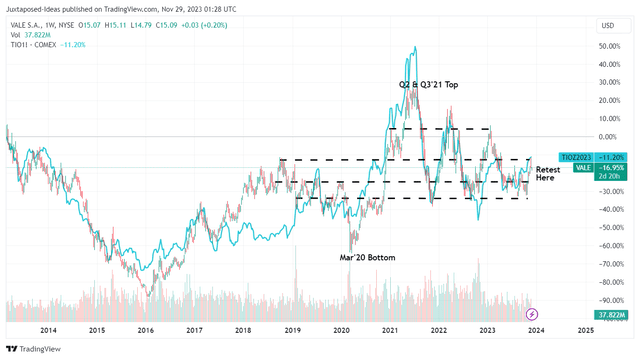

The Correlation Of Iron Ores To VALE’s Stock Prices

With iron ores being the clear bottom line driver for VALE, it is unsurprising that its stock price is inherently linked to the commodity over the past few years. For now, iron ore spot prices have recovered optimistically to $130.16 per tonne (+9.9% MoM/ +40.3% YoY), especially when compared to 2019 averages of $90s per tonne.

As previously discussed in our Rio Tinto (RIO) article here, the Chinese government has planned to build multiple social housings in 35 cities while introducing a 1T yuan government support, or the equivalent of $138B. With the ultimate end goal of “ending a multi-year property slump,” we may see the country’s demand for iron ores remain elevated ahead.

Multiple dry bulker shipping companies have also highlighted promising developments, with growing Chinese dry bulk imports over the past nine months and recovering Capesize TCE rates (up to 77% of the global Capesize fleets commonly used for iron ore transports).

For example, the world’s second largest dry bulk shipping company, Golden Ocean Group Limited (GOGL), guides excellent FQ4’23 TCE rates for Capesize at $23.04K (+26.8% QoQ/ +7.7% QoQ) and FQ1’24 TCE rates at $21.7K (-5.8% QoQ/ +59.3% YoY), compared to the FY2019 averages of $18.02K and FY2021 peak of $33.33K.

The same has been commented by the largest dry bulk shipping company, Star Bulk Carriers (SBLK) in their recent earnings call, highlighting the Chinese government’s increased imports and steel production on a YoY basis:

Despite weak macro sentiment and a struggling property sector, China dry bulk imports have increased by +13.7% during the first nine months. China steel production increased by +2.4% year-over-year during the first three quarters, supported by infrastructure projects, manufacturing and strong exports. At the same time, domestic iron ore output contracted by -5.5%, while stockpiles decreased to a three-year low.

These promising developments may also be aided by the tighter iron ore supply, with Goldman Sachs estimating a reduced 2023 global supply of 1.536B tonnes (-4% YoY), compared to the previous estimate of 1.557B tonnes (-2.6% YoY).

This is partly attributed to the largest global iron ore producer, VALE’s reduced FQ3’23 iron ore production by -4% YoY from a system failure in the Northern System complex and one-time maintenance work in the Southern System complex.

We believe the temporal tightening in supply may drive up the commodities’ spot pricing over the next few months, especially since most restocking usually occurs before the Chinese Lunar New Year Holiday in January/ February.

VALE’s 2030 Growth Plan

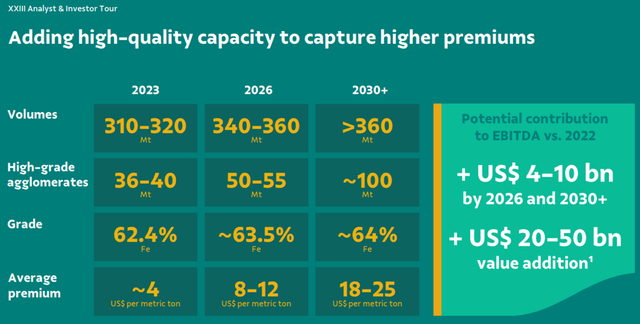

Moving forward, VALE has also attempted to differentiate its offerings by producing greater iron ore volumes at higher qualities, as observed in its 2023 Analyst & Investor Slides.

We are already seeing notable improvements in its iron ore grades to 62.9% (+0.6 points QoQ/ +0.8 YoY) and a growing share of premium products of 81% (+2 points QoQ/ +3 YoY) by the latest quarter. This strategy allows the management to command a notable premium of $3.8 per tonne, nearly in-line with its previous projections of ~$4 per tonne.

We believe that this approach may be highly accretive to VALE’s bottom lines indeed, well-balancing the headwinds from the Chinese government’s plans of expanding its use of scrap-to-steel usage to 380M metric ton by 2030, at a CAGR of +7.69% from 210M MT in 2022.

This is especially since recycled scrap metal usually underperforms “virgin steel from freshly mined materials,” further demonstrating why its 2030 growth strategy may play out as guided, with the higher quality iron ore/ pellets likely to command an increasing price premium by over +20% to regular 62% iron ores through the next few decades.

This further underscores the importance of innovation for VALE, especially with the ongoing industrialization trend for India and developing economies in Asia continue to signal the robust global appetite for high quality iron ore and steel products through 2050.

This is further aided by the global net zero commitment by 2050, with Wood Mackenzie already projecting prices for low-grade high-emission iron ores to fall by nearly -30% by 2030.

VALE Valuations

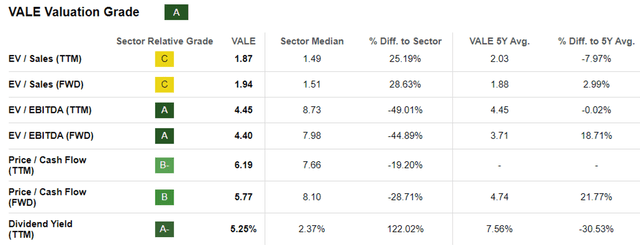

As a result of these promising developments, we believe that VALE’s FWD EV/ EBITDA valuation of 4.40x has been overly compressed here, compared to its 3Y pre-pandemic mean of 5.19x and the sector median of 7.98x.

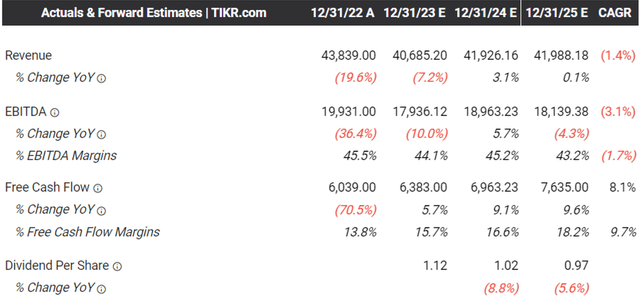

The Consensus Forward Estimates

This is especially since the consensus still estimate that VALE may remain highly profitable moving forward, attributed to its robust adj EBITDA margins of 43.2% and Free Cash Flow margins of 18.2% by FY2025.

This implies that the miner may still be able to pay out its variable dividends, while also sustainably funding its growth ambitions through 2030.

So, Is VALE Stock A Buy, Sell, or Hold?

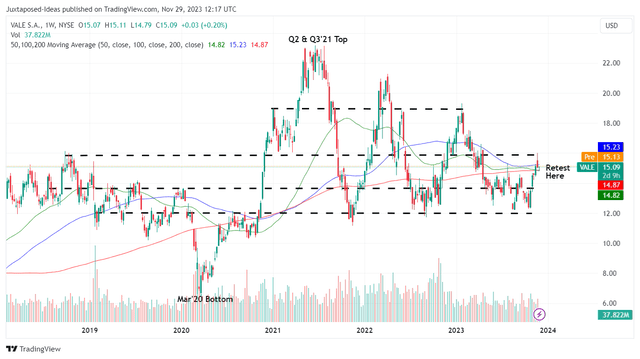

VALE 5Y Stock Price

For now, VALE has also rallied optimistically by +25%, after bouncing off its critical support levels of $12s, thanks to the recovering iron ore spot prices.

Based on the $1.11 paid out in 2023, we are looking at a very decent TTM dividend yield of 7.3%, well exceeding the US Treasury Yields of between 4.47% and 5.46%.

As a result of its robust dividend investment thesis, we maintain our buy rating on the VALE stock, with it being suitable for investors with higher cyclical risk tolerance and a taste for variable dividend payouts.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

The analysis is provided exclusively for informational purposes and should not be considered professional investment advice. Before investing, please conduct personal in-depth research and utmost due diligence, as there are many risks associated with the trade, including capital loss.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.