Summary:

- Vale demonstrates a strong presence in the iron ore market, with increased sales despite a slight drop in production.

- Vale’s strategic initiatives, such as the development of Mega Hubs and diversification into Energy Transition Metals, contribute to its positive outlook.

- China’s regulatory measures soften iron ore prices, yet the market stays bullish.

- Citigroup predicts an iron ore price hike to $140/ton amid Chinese solid demand, implying a 7% additional upside from current levels.

- Any decline in iron ore prices leading up to the Chinese New Year could present an attractive entry point.

maki_shmaki/iStock via Getty Images

Investment Thesis

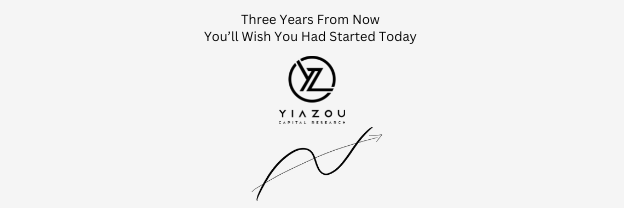

Vale S.A. (NYSE:VALE) demonstrates a strong presence in the iron ore market, marked by a strategic balance between sales and production. Despite a slight drop in production from 89.7 million tons in Q3 2022 to 86.2 million tons in Q3 2023, Vale has increased iron ore fines and pellet sales by 6% year-over-year.

Undoubtedly, Vale’s financial health is closely tied to iron ore prices, a critical factor in steel production, making its revenues and profitability highly sensitive to market fluctuations. Any change in iron ore prices directly impacts Vale’s earnings and stock price, with increases leading to higher revenues and profitability and decreases having the opposite effect.

The market upswing is expected to continue, fueled by China’s substantial investment in urban renovation and housing. However, the Chinese government’s active measures to regulate market prices and prevent speculation introduce some uncertainty into this otherwise bullish trend. Any decline in iron ore prices leading up to the Chinese New Year could present an attractive entry point.

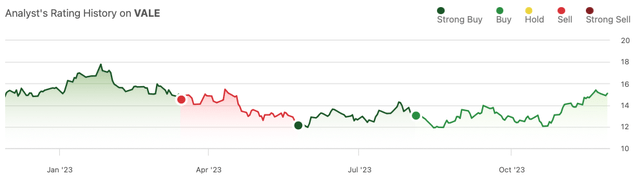

Analyst’s Coverage (seekingalpha.com)

Ironclad Strategy: Balancing Sales Amidst Production Tweaks

Vale’s performance in iron ore fines and pellet sales witnessed a commendable 6% year-over-year increase, showcasing the company’s ability to meet market demand. Despite a marginal 4% year-over-year reduction in iron ore production from Q3 2022 (89.7 million tons) to Q3 2023 (86.2 million tons), Vale successfully narrowed the production-to-sales gap as anticipated, aligning with the company’s strategic goal to synchronize production (reduced by 3.5 million tons year-on-year) with sales (increased by 4.4 million tons year-on-year).

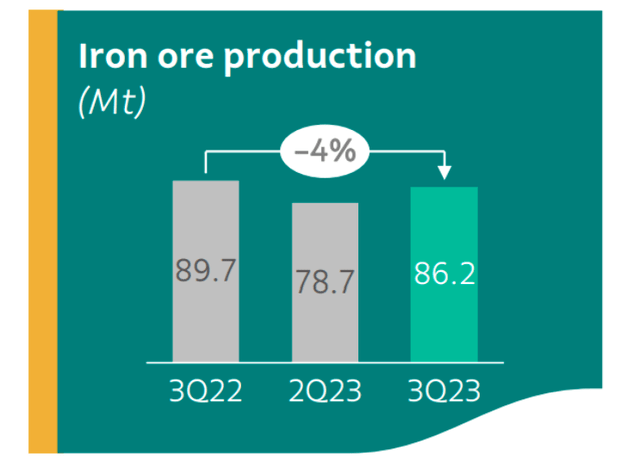

To boost the iron ore production at Tubarão Unit, Vale commenced commissioning its first iron ore plant (Briquetting Plant I). The upcoming start-ups of Briquetting Plants (I & II) will add value to its iron ore portfolio. The initiation of operations at this unit will ensure future revenue streams and market positioning.

Looking forward (to Briquetting Plants I and II), Vale’s timeline for commissioning Plant I by August 2023 and initiating operations by December 2023, followed by the commissioning of Plant II in 1Q 2024 (operations by H1 2023) with an added six metric ton per year capacity, reflects the company’s strategic intent to expand its production capabilities.

Also, the agreements formed with Porto do Açu and H2 Green Steel for developing Mega Hubs in Brazil, and North America indicate Vale’s proactive approach toward infrastructure development. These partnerships underscore the company’s strategic vision to create logistical hubs for enhanced operational efficiency and cost optimization.

With agreements and Memorandums of Understanding (MoUs) in place, Vale is slated to commence construction for the first unit of Mega Hubs in 2024, emphasizing the company’s focus on establishing robust infrastructure. It is replacing natural gas with hydrogen to address a demand for 100 million tons for the next 15-20 years with CO2-free production.

Despite facing one-off engineering issues at S11D and Viga, coupled with a power outage in Brazil, Vale maintained a robust output from S11D, witnessed a lower production-to-sales gap in Q3, and achieved higher pellet feed from Brucutu post-Torto dam commissioning. Additionally, the continued ramp-up of Salobo III to 80% of its capacity suggests operational resilience and an inclination towards scaling production.

On the downside, Vale faces challenges in managing all-in costs impacted by various external factors. The company experiences increased all-in costs due to amplified bunker costs (+$0.9 per ton quarter-over-quarter) and larger spot affreightments (+$0.6 per ton quarter-over-quarter). Fluctuations in Brent oil prices directly influence freight costs, with a $10/bbl change correlating to a $0.9 per ton change in freight costs.

Finally, Vale navigates cost fluctuations resulting from variations in Fe content within its production and sales mix. Additionally, a lower 65% Fe index spread (-$1.9 per ton quarter-over-quarter) and the absence of seasonal pellet JV dividends (-$1.2 per ton quarter-over-quarter) impacted the company’s cost dynamics.

Transition Metals in Flux: Odyssey Through Copper Growth and Nickel Decline

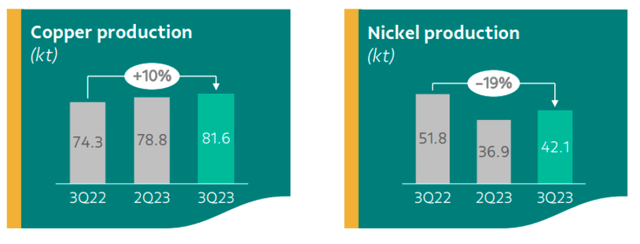

Notably, this reduction was partially offset by lower gold prices (+$133 per ton quarter-over-quarter) and the absence of one-off tax credits (+$550 per ton quarter-over-quarter). Despite a three-kiloton year-over-year sales increase, the company faced challenges in maintaining profitability. The sustained ramp-up of Salobo III presents a crucial growth opportunity for Vale in the copper segment.

On the other hand, nickel production for Vale witnessed a notable 19% year-over-year decrease from 51.8 kilotons in 3Q22 to 42.1 kilotons in 3Q23. This decline was primarily attributed to the ongoing transition of Voisey’s Bay to underground mining and additional maintenance activities in the North Atlantic.

The maintenance of the Onça Puma furnace also impacted production in Q3. The all-in costs for nickel production escalated mainly due to higher maintenance costs in Sudbury (+$1,250 per ton quarter-over-quarter) and reduced copper sales (+$2,425 per ton quarter-over-quarter).

However, a one-off settlement of royalties (-$1,096 per ton quarter-over-quarter) mitigated some of these cost burdens. The projected all-in guidance 2023 is estimated between $15,500 and $16,000 per ton. Thus, Vale’s growth potential in nickel production lies in the successful transition of Voisey’s Bay to underground mining.

Iron Ore Surge Fuels Vale’s Financial Upswing Amid China’s Real Estate Revival

Vale’s revenue and profitability are highly correlated with iron ore prices. The company’s financial performance directly hinges on the market dynamics surrounding this commodity. Iron ore is a critical component in steel production, and any fluctuations in its price significantly impact Vale’s earnings and stock price.

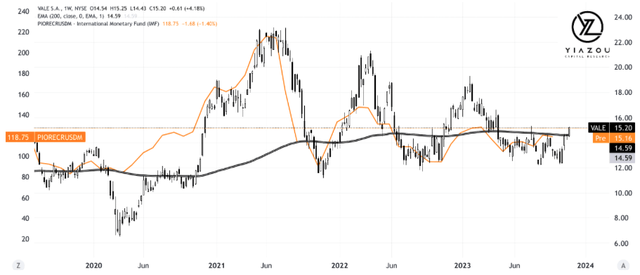

For example, due to their high correlation, Vale’s revenue (top line) significantly increases when iron ore prices rise. This increase and efficient production results in greater profitability (wider bottom line) and vice versa. This relationship is similarly reflected in the fluctuations of both Vale’s stock prices and global iron ore prices (orange line).

For the first time since March, iron ore futures in Singapore reached $130 per ton at the Singapore Exchange due to an improving steel demand outlook in China. Following the peak, iron ore prices have recently touched the March point of $130 after experiencing their longest weekly gains since January.

The iron ore market is experiencing a significant rally, with prices reaching their highest since June 2022. This surge is partly due to China’s economic measures to support its struggling real estate sector, which has increased demand for iron ore, a vital component in steelmaking.

Specifically, China plans to inject 1 trillion yuan ($137 billion) into urban renovation and affordable housing programs to counter the property downturn. This initiative can boost steel and iron ore demand as the property sector represents 40% of Chinese demand, bolstering prices.

However, the Chinese government is actively trying to control this price surge by increasing market supervision and warning against market manipulation and hoarding. These efforts have slightly softened the prices, but the market remains bullish, with futures still showing solid gains.

Market analysts predict a continued upward trend in iron ore prices, with Citigroup (C) forecasting prices soon reaching $140 per ton. This optimism is rooted in the expectation of sustained demand, mainly due to China’s property market stimulus. Despite current weak demand fundamentals, analysts expect an increase in demand for iron ore in 2024, supported by stable construction steel demand. However, government interventions remain a risk factor that could influence short-term price movements.

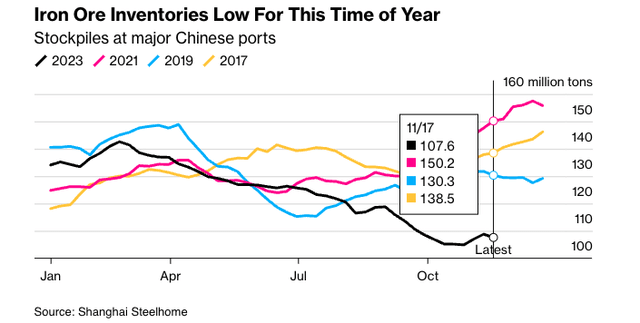

Any decline in iron ore prices leading up to the Chinese New Year could present a buying opportunity. This optimism is underpinned by the current tightness in the supply chain, with iron ore stockpiles at major Chinese ports being at their lowest since 2015 and steel inventories also experiencing a rapid decline.

Additionally, Chinese steel production remains strong, defying expectations of the government imposing traditional caps on output levels. The first ten months of the year saw a 1.4% increase in production compared to last year’s period, indicating that the industry is on track to maintain high production volumes into 2023.

Finally, positive operating margins among steelmakers further support this robust production, suggesting that production levels will likely remain stable for the remainder of the year and well into the first half of 2024. This scenario points towards sustained demand for iron ore, bolstering the market’s outlook.

Takeaway

Given these projections, Vale’s stock price is expected to follow the upward trend in iron ore prices, albeit with potential fluctuations due to market dynamics. Investors should remain aware of global economic factors and industry-specific developments that could influence iron ore demand and prices. Overall, if iron ore prices maintain their projected growth trajectory, Vale’s stock price should reflect this positive trend, offering a potentially attractive opportunity for investors.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

Author of Yiazou Capital Research

Unlock your investment potential through deep business analysis.

I am the founder of Yiazou Capital Research, a stock-market research platform designed to elevate your due diligence process through in-depth analysis of businesses.

I have previously worked for Deloitte and KPMG in external auditing, internal auditing, and consulting.

I am a Chartered Certified Accountant and an ACCA Global member, and I hold BSc and MSc degrees from leading UK business schools.

In addition to my research platform, I am also the founder of a private business.