Summary:

- VALE has plunged nearly 30% YTD due to falling iron ore prices, but its solid operational performance positions it well in the face of market fluctuations.

- Increased iron ore production suggests producers expect a rebound in prices and demand, hinting that Vale’s stock may have found a bottom and could rebound with signs of recovery.

- Vale’s investments in nickel and copper for the EV market, coupled with early signs of Chinese economic recovery, support its performance against iron ore price fluctuations.

- Vale’s commitment to ESG initiatives enhances its market position, attracting socially responsible investors and reinforcing its long-term growth potential.

sdlgzps/E+ via Getty Images

Investment Thesis

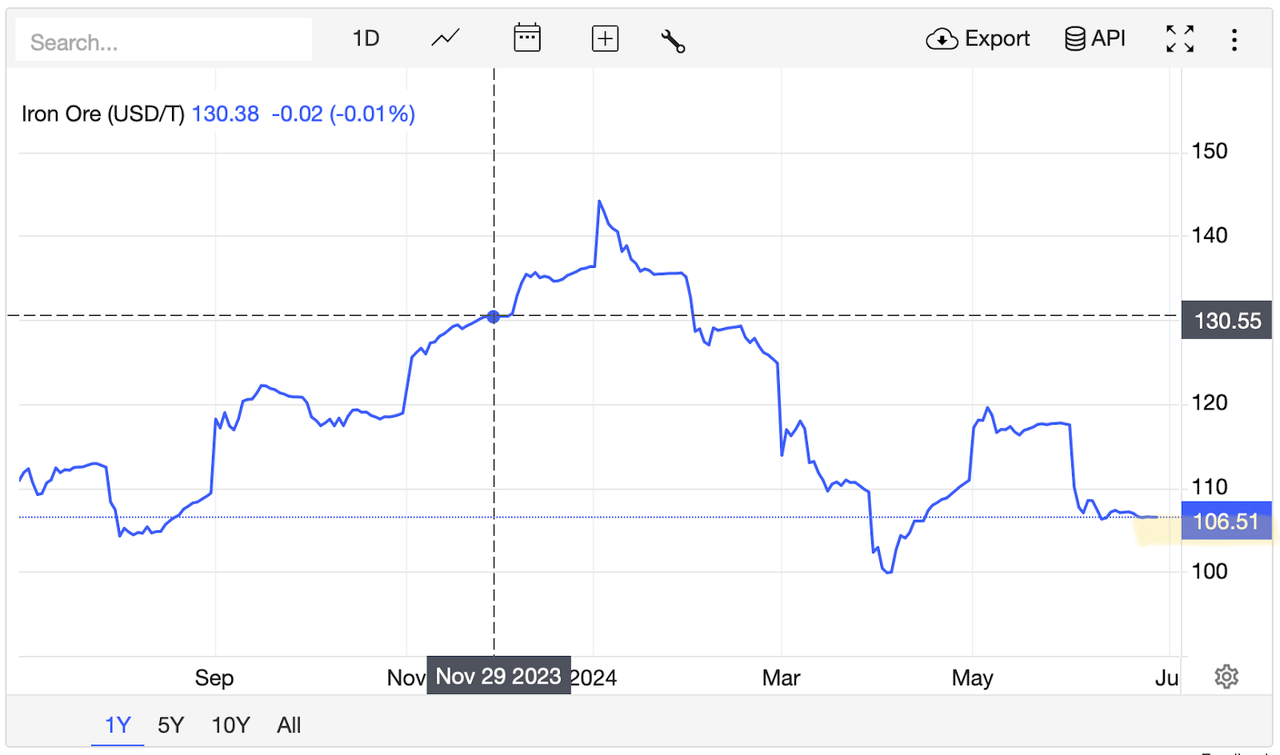

We expressed our optimistic view on Vale (NYSE:VALE) eight months ago. Since then, despite a short-lived upward movement, VALE has plunged nearly 30% YTD, tracking the decline in iron ore prices amid a seasonal break in Chinese demand. As a commodity-driven stock, Vale’s earnings and stock performance remain highly correlated with iron ore prices, reflecting the market’s volatility. Nevertheless, Vale has maintained solid operational and cost performance, effectively positioning itself to weather these fluctuations.

Despite the dropping demand in China, the increased iron ore production indicates that producers anticipate a rebound in iron ore prices and recovering demand in the foreseeable future. This optimism suggests that the stock might have found a bottom and priced in the pessimistic sentiment, setting the stage for a potential rebound with the first signs of recovery, particularly from China.

Lastly, Vale’s nickel and copper investments will play an essential role in the growing EV market, enabling it to protect performance from fluctuations in iron ore prices. Meanwhile, the first signs of recovery in Chinese economic growth, fueled by government stimulus toward infrastructure-focused projects, may drive steel demand and, thus, iron ore prices.

Vale Reports Q1 2024 Growth in Iron Ore Production and Revenue Despite Profit Dip

For the first quarter of 2024, Vale reported a positive movement in iron ore production and revenue but decreased net profit. Iron ore manufacturing increased by 6% year-on-year (YoY) to 71 million tons, and the main drivers of this increase were enhanced operation at the S11D arm, better asset dependency programs, and more third-party purchases.

Pellet manufacturing also increased by 2% YoY up to 8.5 million tonnes. Even with a reduction in the average realized price of iron ore by 7.3%, the sales increased by 15%, reaching 63.8 million tonnes, though the prices of pellets increased by 5.8% YoY. However, compared to the Q4 2023, Q1 2024 saw decreased production and sales. Iron ore manufacturing fell by 20.8%, while pellet manufacturing dropped by 14%. Sales of iron ore and pellets reduced by 32.5% and 10.3%, respectively.

Copper production increased 22% YoY to 81.9 kt in Q1 2024, while nickel decreased 4% to 39.5 kt. For 2024, Vale estimates output of 38–42 million tons of pellets and iron ore production of 310–320 million tons. In the case of iron ore, Vale’s output grew by 4.3% YoY in 2023 to reach 36.5 million tons of pellets—reflecting growth of 13.5% and 4.3%, respectively.

In contrast, iron ore sales decreased 1.5% year–over–year to 256.79 million tons, while pellet exports increased 8.1% to 35.8 million tons. In summary, Vale recorded strong growth in iron ore production and myriad revenues in the first quarter of 2024 despite a drop in net profit due to improved operations and strategic purchases.

Vale Reports 9% Dip in Q1 2024 Net Income Amid Strong Iron Ore Production and Strategic Advancements

Vale reports 9% Drop in Q1 2024 Net Income Against Strong Iron Ore Production and Strategic Advancements Incorporated; on the financial front, Vale witnessed an ebb of 9% in net income attributable to shareholders, at $1.67 billion, against $1.83 billion registered in Q1 2023. Vale posted net operating revenues of $8.45 billion in the same quarter, charting well against its FY-before figure of $8.43 billion.

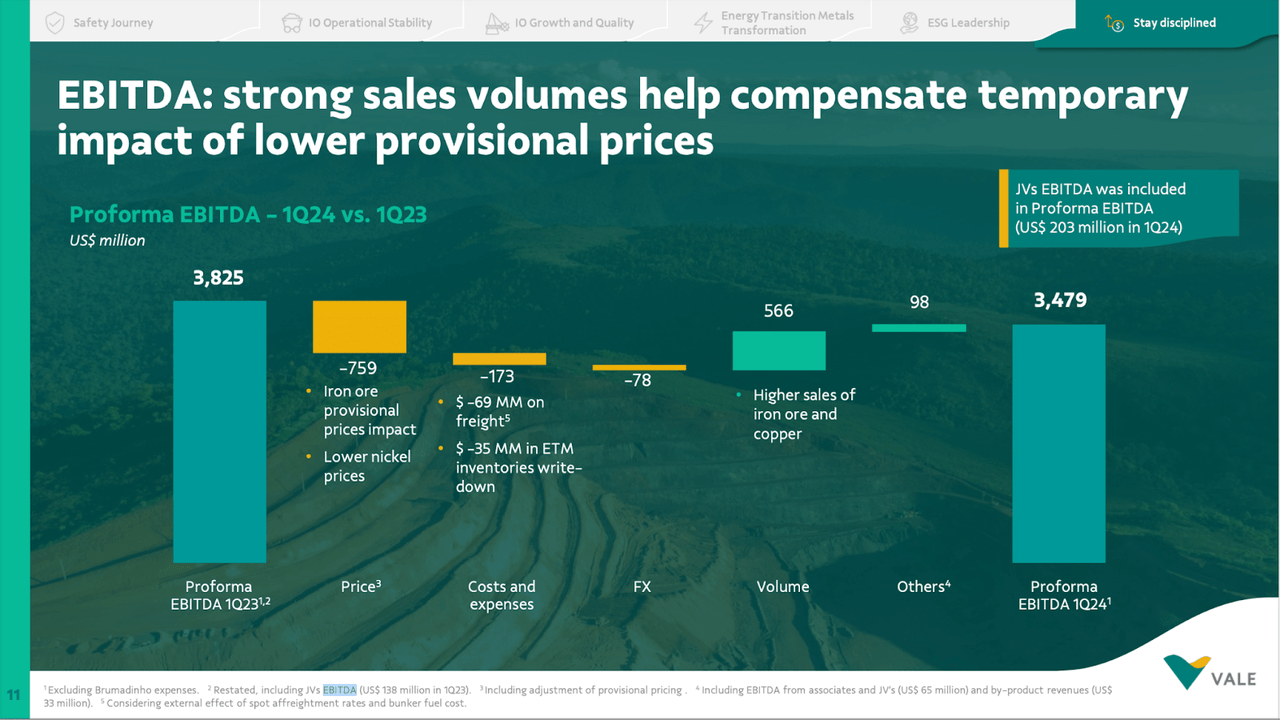

Q1 2024 EBITDA came in at $3.48 billion versus $3.82 billion in Q1 2023, while the adjusted EBITDA margin fell to 32% from 44% YoY. Capital expenditure increased 23% to US$1.39 billion in Q1 2024 from US$1.13 billion in Q1 2023. The average prices received for its essential commodities fell: nickel declined by 33%, copper dropped by 18%, and the sales volumes for both metals increased. According to Vale CEO Eduardo Bartolomeo, the company is off to an excellent start in 2024, driven by solid iron ore sales and production during the quarter; Q1 output is the strongest since 2019.

Progress in growth projects, improved performance at the Salobo complex, and ramping up of the Salobo 3 plant contributed to higher copper production and sales volumes. Bartolomeo also praised the Canadian nickel operations and highlighted Vale’s success in Brazil, which uses all green power two years in advance.

Finally, despite a fall in net profit and mixed fortunes across various business segments, strong iron ore production at Vale, growth in sales, and progress in strategic projects will probably boost investor confidence. Therefore, if CapEx increases, signaling possible future growth, it may positively affect the share price in the short run.

China’s Steel Slump: Implications for Vale

China’s steel consumption is projected to decline by 1.7% in 2024, following a 3.3% decrease in 2023. This reduction is attributed to the ongoing real estate crisis and slowing infrastructure demand. Twelve debtor regions have been ordered to halt certain projects, further impacting steel demand. The Metallurgical Industry Planning and Research Institute (MPI) highlights these factors as key drivers of the downturn.

Chinese steel exports surged more than a third last year to their highest since 2016, at 90.26 million tons, despite falling domestic demand. Exports to the US dropped by 8.2%, but this did not impact exports that much; the major export destinations include Japan, South Korea, and the Middle East. Chinese steelmakers are targeting exports equal to last year’s shipments, and estimates for 2024 are above 100 million tons.

Producers can increase production even when China demands to maintain or increase market share, since higher production makes companies remain competitive globally. Greater output also brings in economies of scale, which reduce the cost of production per unit and improve profitability. Besides, producers diversify markets to reduce dependence on any particular economy, like China, by entering other growing regions to spread the risk.

The other reason might be strategic stocking; businesses may stockpile the ore given future demand rebounds or commodity prices. This would undoubtedly give them leverage to benefit when the market turns around. There would probably be continued bearish pressure on iron ore prices amid weakened steel demand and growing port inventories in China.

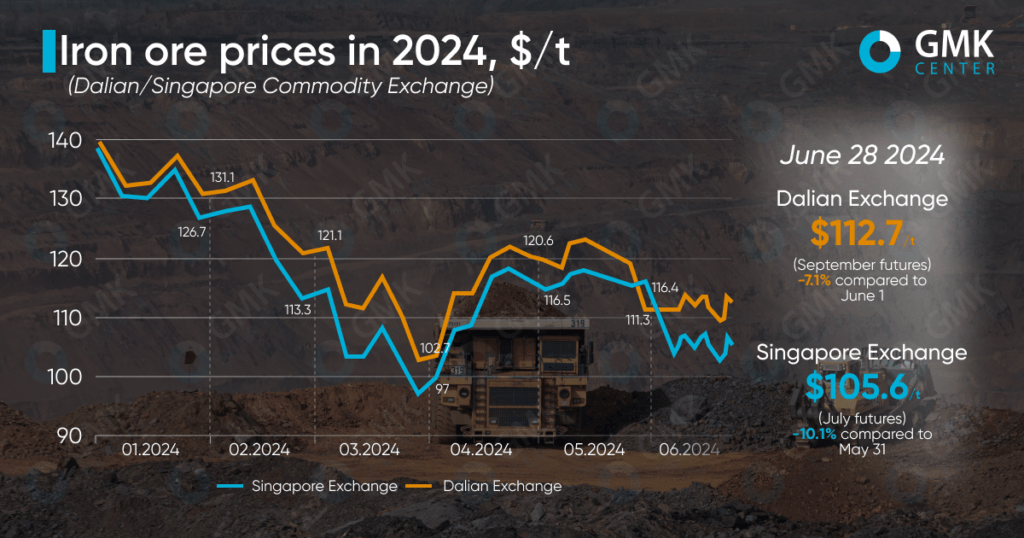

Iron ore futures suffered a massive decline in June, with Dalian falling 7.1% and Singapore falling 10.1%. Although the Chinese government’s stimulus to the real estate market temporarily boosted prices, this failed to hold up prices. Seasonal drops in steel demand, poor construction weather, and probable controls on steel production in China are putting more stress on the market.

Finally, long-term forecasts remain gloomy despite some economic improvements and slight price increases at the end of June. HSBC says that, together with Capital Economics, it is projecting around $100/t in 2024—possibly further declines to $85/t at the end of the year—based on an oversupply and weak global steel demand environment.

gmk.center

Additionally, trade disputes are escalating, with 112 applications for anti-dumping and anti-subsidy measures against Chinese steel products in 2023. Further, Beijing may impose production restrictions, adding uncertainty to export prospects. The China Iron and Steel Association (“CISA”) emphasizes the need for leading producers to align production with market demand to address the contradiction of strong supply potential and declining demand.

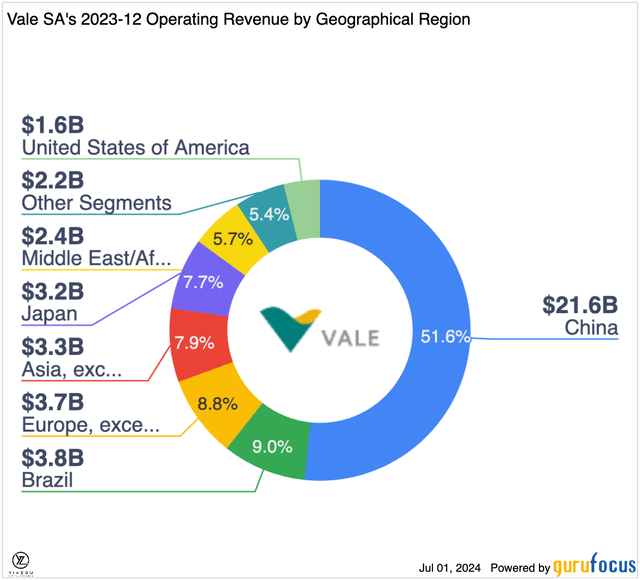

China, accounting for over half of Vale’s revenue, significantly impacts the company’s financial health through its steel demand. With China’s steel consumption expected to drop, Vale faces reduced iron ore demand and lower prices, affecting its revenue and profitability. Despite increased iron ore and pellet production in Q1 2024, the decline in average realized prices and quarterly production poses challenges.

Takeaway

Despite recent stock volatility due to fluctuating iron ore prices and reduced Chinese demand, Vale maintains strong operational performance and strategic investments in nickel and copper. These investments are crucial for the growing EV market and help buffer the company against iron ore price shifts.

Further, Vale’s commitment to ESG initiatives enhances its market position and appeals to socially responsible investors. With a promising start to 2024, Vale’s increased iron ore and pellet production and revenue growth indicate robust fundamentals.

Lastly, the strategic partnerships, like the one with Caterpillar for decarbonization efforts, further bolster Vale’s long-term growth potential. Given the lower valuation, Vale presents an attractive entry point for investors seeking to capture future upside potential amidst a recovering Chinese economy and ongoing global demand for cleaner energy solutions.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.