Summary:

- VALE stock trades at a low forward P/E of only 5.3x.

- However, market consensus expects a decline in VALE’s EPS in the years ahead, leading to a higher implied FWD P/E.

- I see such a gloomy projection as quite plausible given China’s struggling economy and VALE’s large exposure to the China market.

PM Images/DigitalVision via Getty Images

VALE stock trades at 5x FWD P/E only

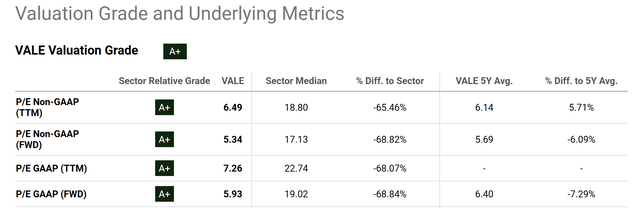

Vale S.A. (NYSE:VALE) probably is on the radar of investors seeking deep-value investment opportunities. Indeed, the stock’s valuation metrics are extremely attractive both in absolute and relative standards. More specifically, the following chart below shows VALE’s valuation metrics in comparison to the sector median and also its historical averages. As you can see, the stock is currently trading at an FWD P/E of 5.3x only (on a non-GAAP basis). In contrast, the forward P/E for the sector has a median value of more than 17x. As such, VALE’s P/E multiple is almost only 1/3 of the sector median. Even when compared to its own historical average, the stock is trading at a noticeable discount of 6%~7% either by FWD GAAP P/E or non-GAAP P/E.

Seeking Alpha

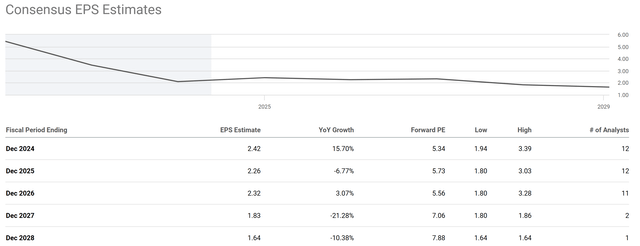

Against this background, the remainder of this article will explain why the stock is so cheap for a good reason (or good reasons). To start, the market has a quite negative view of its EPS growth, as seen in the next chart below. This chart shows the consensus EPS estimates for VALE stock in the next 5 years. As seen, the market consensus expects an overall decrease in VALE’s EPS over this period. Its EPS is projected to grow in FY 2024 to $2.42, representing a 15.7% YOY increase. Then, the EPS is expected to be on an overall declining trajectory after that. All told, the declining trend is expected to continue in FY 2027 and 2028, with its EPS ending up around $1.64 in 5 years. As a result, its implied FWD P/E would jump significantly in the next few years to come from the current level of 5.34x. For instance, by the end of fiscal year 2024, the implied P/E would increase slightly to 5.73 and then to 7.88x in FY 2028.

Next, I will explain why I see such a gloomy outlook is very likely, given its China exposure and also the capital projects.

Seeking Alpha

VALE stock: too exposed to China

The top factor in my mind is China’s struggling economy and VALE’s reliance on the China market. As argued in an earlier article:

The real estate and infrastructure market – both large consumers of iron and steel products – in China kept struggling and its recent stimulus policy seems to have limited effect in my eyes so far in my eyes so far. We are still concerned about China’s trouble in the real-estate sector, a large consumer of raw materials. We are seeing signs that these troubles are far from over, including slumping new home sales, potential default risks for heavy-weight developers, and hidden bad loan problems.

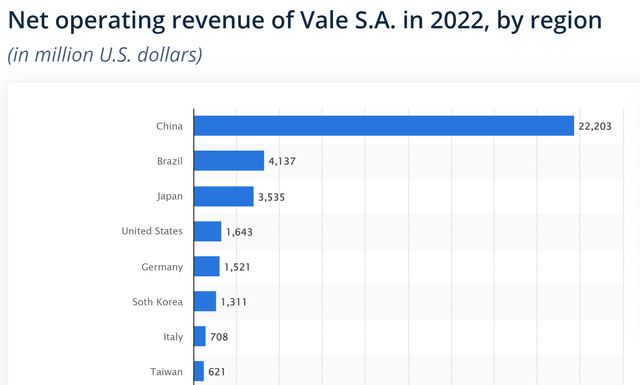

VALE is extremely sensitive to the above concerns because China is the dominant contributor to its operating income, as you can see from the chart below. In 202, the company derived more than $22 billion of operating revenue from its China market. To better contextualize things, its second-largest market (its home market Brazil) only provided about $4B of operating income.

Granted, prices for iron ore (VALE’s main product and a key ingredient in steel making) could fluctuate in a more favorable direction for the company. However, I view the softened demand in China to be a structural issue and would persist in the next few years (say 3~5 years), and the softened demand would more than offset the price movements – IF iron ore prices do move up.

Statistica

VALE stock: balance sheet and CAPEX

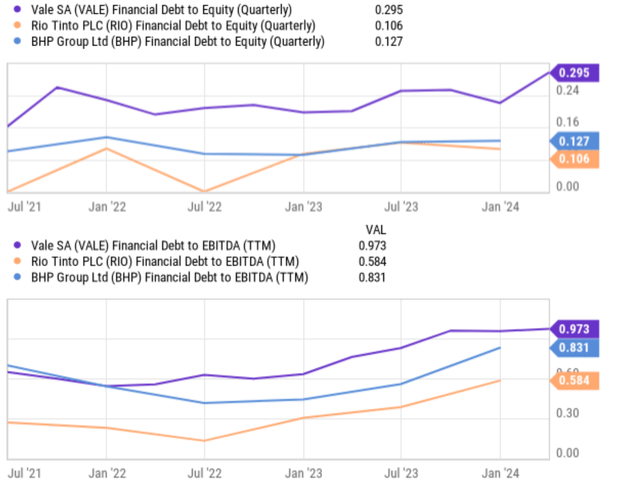

As a stock that is highly sensitive to commodity prices, VALE’s balance sheet is a bit weaker than my liking also. As seen, I consider VALE balance sheet too stretched both in absolute terms and relative terms. For example, VALE’s debt-to-equity ratio is currently at 0.295x (as shown in the top panel of the chart below). This is a bit too high in my view for a company whose profits are highly volatile. In relative terms, this is also significantly higher than other larger miners. For example, RIO and BHP’s debt-to-equity ratios are only 0.106x and 0.127x, respectively, less than half of VALE’s. Other metrics paint the same picture. For example, the bottom panel of the chart shows VALE’s debt-to-EBITDA ratio compared to RIO’s and BHP’s debt-to-EBITDA ratios. As seen, VALE’s to-EBITDA ratio is 0.973x, which again is substantially higher than RIO’s 0.584x and also BHP’s 0.831x.

Seeking Alpha

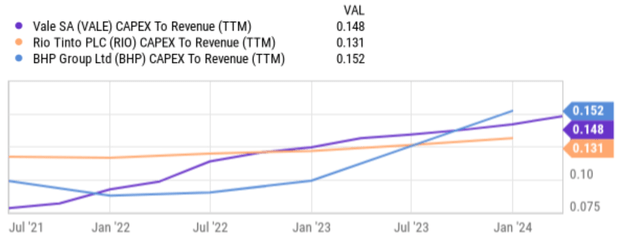

In the meantime, VALE has extensive needs for capital expenditures (see the next chart below) and I expect the capital spending budget to keep increasing in the years to come. For example, its CAPEX expenses for the last year were roughly $5.9 billion, which was about 9% above the ~$5.5 billion budget in 2022. A major portion of the funds was devoted to iron ore expansion projects. This will certainly help the profit IF iron ore demand and price move in a more favorable direction. But as argued above, I am not optimistic about such a favorable scenario in the next few years.

Seeking Alpha

Other risks and final thoughts

In terms of upside risks, the company is also paying much attention to its nickel operations. I expect a portion of the CAPEX budget mentioned above to be spent on this front to diversify its revenue streams. Furthermore, it also has some exposure to the copper businesses, although both copper and nickel combined contributed only about 18% of its 2023 revenues. Other upside risks include the expansionary initiatives in Brazil and Indonesia and acquisition possibilities. For example, it has an agreement with Anglo American plc to buy a 15% equity stake in its Anglo American Brasil unit (which owns the Minas-Rio iron ore complex).

All told, I see several signs of a value trap in VALE stock. While its current low P/E ratio of ~5x might seem very attractive, it is cheap for several good reasons in my mind. Considering the stock’s lackluster growth prospects, the implied FWD P/E is much higher. Analyst estimates project a decline in its EPS in the next few years and I see such a gloomy projection as quite plausible given China’s struggling economy and VALE’s large exposure to the China market. Finally, the combination of leverage and significant capital expenditure further compounds my concerns regarding its future profitability.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

Join Envision Early Retirement to navigate such a turbulent market.

- Receive our best ideas, actionable and unambiguous, across multiple assets.

- Access our real-money portfolios, trade alerts, and transparent performance reporting.

- Use our proprietary allocation strategies to isolate and control risks.

We have helped our members beat S&P 500 with LOWER drawdowns despite the extreme volatilities in both the equity AND bond market.

Join for a 100% Risk-Free trial and see if our proven method can help you too. You do not need to pay for the costly lessons from the market itself.