Summary:

- Iron ore prices have been weak in 2024, but a rebound since mid-August aligns with Brazil’s stock market recovery, though Vale S.A. hasn’t fully participated.

- Vale’s Q2 results were mixed, with strong iron ore production but a revenue miss; ongoing risks include China steel production and environmental liabilities.

- Despite technical risks, Vale’s valuation is compelling with a P/E ratio below 10 and an EV/EBITDA multiple under 4, suggesting undervaluation.

- I maintain a hold rating on Vale, noting potential upside if the stock breaks above $11-$12, but caution due to recent technical breakdowns.

Monty Rakusen

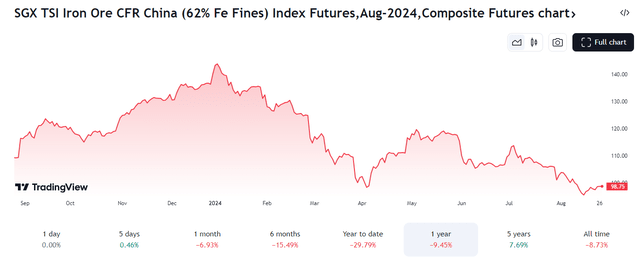

Iron ore prices have been weak throughout much of 2024. Like copper, the industrial commodity was performing well at times in Q2, but ongoing economic weakness in China and sluggish demand elsewhere have generally hurt this cyclical resource. But prices have been trending ever-so modestly upward since the middle of August. The rebound comes as the Brazil stock market has been on the mend too.

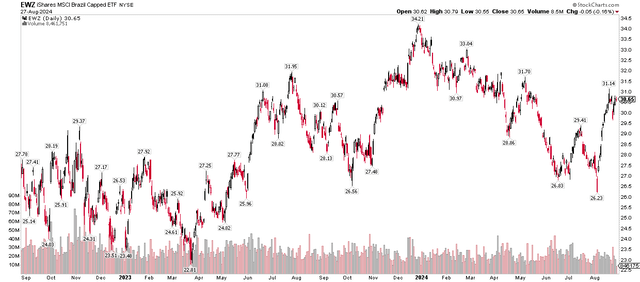

The iShares MSCI Brazil ETF (EWZ) has surged from near $26 at the intraday August 5 nadir to above $30 as we approach the final month of the third quarter. There are clearly some bullish inklings, but Vale S.A. (NYSE:VALE) hasn’t participated much in the equity recovery.

I reiterate a hold rating on the Materials-sector stock. The valuation case is undoubtedly compelling, but share-price momentum is a risk. I will, however, outline a potentially bullish chart formation that could take share into year-end.

Iron Ore Prices Steady Near 1-Year Lows

Brazil ETF Soars Off the Early-August Low

For background, Vale is one of the largest producers of iron ore and pellets, and one of the largest nickel producers in the world. Vale also produces copper, coal, manganese, and ferroalloys and holds equity stakes in some steel producers/projects.

Back in July, the company reported a mixed set of quarterly results. Q2 GAAP EPS of $0.65 topped the Wall Street consensus estimate of $0.57 while revenue of $9.9 billion, up 2.6% from the same period a year earlier, was a material $560 million miss. But Vale confirmed that it has shipped 5.4 Mt of iron ore during the period, a 7% jump from Q2 of 2023, along with a 25% sequential increase from 16 Mt in Q1. Strong iron ore production coupled with inventory sales drove the solid operational results.

Capex was close to in line with expectations at $1.3 billion in Q2, while gross debt and leases of $15.1 billion rose by $500 million from the end of March to the end of June. In terms of guidance, the management team now sees 2024 copper production of 320-355 kt, confirming a target previously given, despite a generally strong first half of the year, primarily due to production constraints (not lack of demand). Shares traded higher by 0.3% in the session after the Q2 report posted, and analysts expect $0.53 of GAAP EPS to be reported for Q3.

VALE then rose by 2.5% last Tuesday when it was announced that CFO Pimenta would take the helm as CEO, but it’s too early to say if that will have long-lasting positive impacts.

Ongoing risks around China steel production and a modest rise in costs should be monitored in the quarters to come. Moreover, liabilities from previous environmental events could weigh if there are further adverse charges against the firm. Overall, though, its net debt appears decent, and liquidity metrics are solid relative to some of its peers.

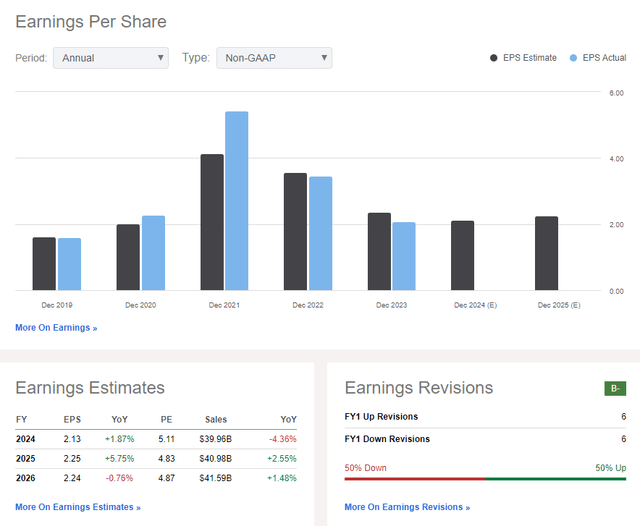

On the earnings outlook, analysts expect $2.13 of non-GAAP EPS this year, with mid-single-digit growth through the out year. Per-share profits may then stall in the low $2s, while revenue ranges between $39 billion and $42 billion through 2026. The result is a price-to-earnings ratio well below 10 and an EV/EBITDA multiple under 4 – a sharp discount to its Materials-sector peers and slightly cheaper compared to the stock’s historical average.

Vale: Earnings and Sales Forecasts

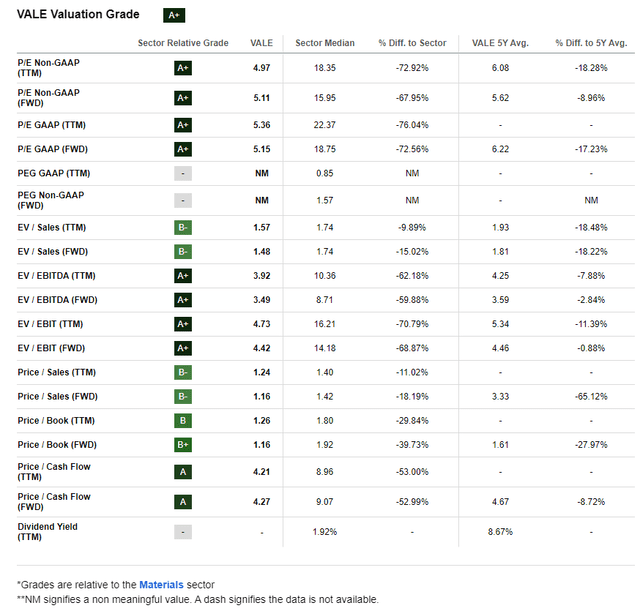

On valuation, if we assume $2.20 of normalized operating EPS over the next 12 months and apply a 5.6 multiple, Vale’s 5-year average, then shares should trade near $12.30. That is a slight decrease from my previous valuation. The sector median P/E has fallen more than two figures, so that suggests overall pricing is now softer.

Still, with a decent first half of 2024, there’s reason for some optimism, and I still see the stock as undervalued, particularly on a price-to-sales basis.

VALE: Compelling Valuation Metrics, Very Cheap on Sales

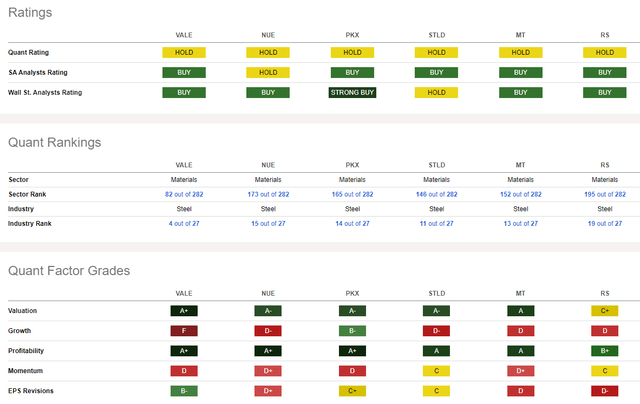

Compared to its peers, Vale sports a very strong valuation quant factor grade by Seeking Alpha’s system, while its growth trajectory is quite weak. But profitability trends are robust, while EPS revisions have actually been to the good side in the past 90 days.

What’s notably soft is VALE’s share-price momentum, and I will highlight key risks and some opportunities on the chart later in the article.

Competitor Analysis

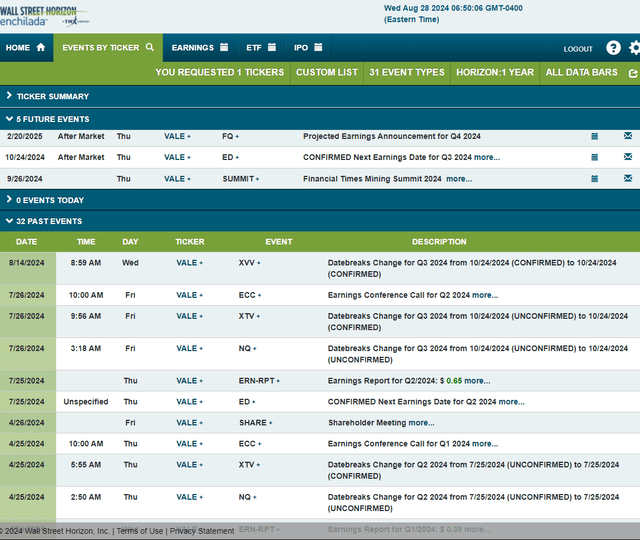

Looking ahead, corporate event risk data provided by Wall Street Horizon shows a confirmed Q3 2024 earnings date of Thursday, October 24 AMC.

The company’s management team is expected to present at the Financial Times Summit 2024 in London from September 26 through 27 which could provide key industry and company insights.

Corporate Event Risk Calendar

The Technical Take

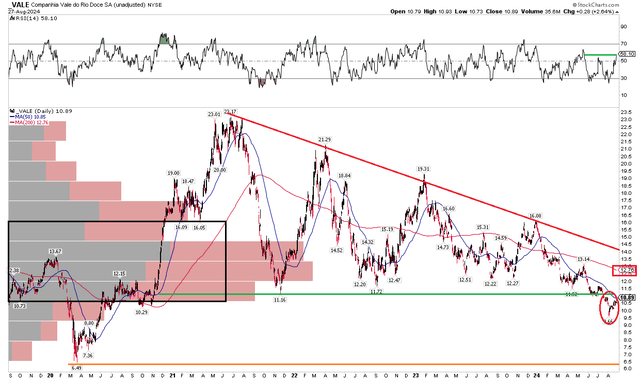

While there have not been major fundamental changes with Vale in the past handful of months, a key technical move was made recently. Notice in the chart below that VALE dropped below key support I noted in my springtime analysis. $11 was a crucial level for the bulls to defend, and with the stock dropping below $10 earlier this month, the bears have clearly asserted themselves. That’s also seen in the long-term 200-day moving average, which is negatively sloped and close to $2 above the latest stock price.

But we should be on the watch for a potential false breakdown. If VALE rises back above the $11 to $12 zone, then we could see a fast move higher to $16 – the year-to-date peak. On the downside – if the stock fails to rise through the previous support line – then the March 2020 nadir of $6.49 is the obvious level to monitor. I am encouraged by a multi-month high in the RSI momentum oscillator at the top of the graph – that could portend a move up in price.

Overall, while a breakdown under important support is not a good sign, the RSI rise could set the stage for a bullish false breakdown.

VALE: False Breakdown Watch, Falling 200dma, But RSI Rebounds

The Bottom Line

I have a hold rating on Vale. I see the Brazil-based $46 billion market cap company as undervalued with mixed technical risks.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.