Summary:

- Vale S.A. is poised to benefit from global economic stimulus measures, especially in infrastructure, making a 25% YTD stock price decline a buying opportunity.

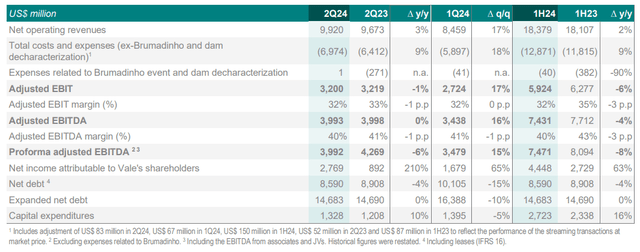

- Strong financial results, including a 63% increase in net earnings and a 4% reduction in net debt, support Vale’s generous 11.8% dividend.

- Iron ore demand may rise due to developing nations’ industrialization and potential fiscal stimulus in major economies, despite current global economic sluggishness.

- Risks include a potential global slowdown driven by geopolitical tensions or an oil price spike, which could negatively impact iron ore demand and Vale’s profitability.

Monty Rakusen

Investment thesis: With signs of the global economy slowing down. We have to turn our attention to prospects for economic stimulus and what shape it is likely to take. Traditionally, governments tend to lean toward infrastructure projects as a means to stimulate the economy all along the supply chain. Vale S.A. (NYSE:VALE) could be one of the main beneficiaries given that most of the World’s major economies are looking at stimulus measures. This comes as an addition too much of the developing world looking to build out infrastructure and industrialize. Its stock price is down significantly for the year, making this a decent entry point, just as we saw a turnaround in September in its stock price. I am adding to my existing position, with an eye on a generous dividend that is supported by solid financial results, with the long-term added benefit of potential for further stock price appreciation.

Vale continues to see solid financial results, which supports its dividend.

Given Vale’s stock performance for this year, one would expect a significant deterioration in financial results.

Vale stock price and other metrics (Seeking Alpha)

As we can see, even with the recent improvement in its stock price, it is still down about 25% YTD. As for the financial results that one might point to as a justification for the market performance of this stock, the numbers do not suggest a deterioration.

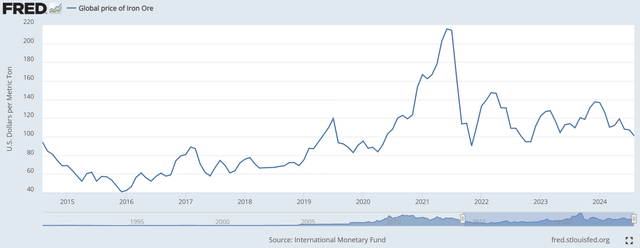

Revenues increased just slightly by 2% for the first half of the year compared with H1, 2023. Iron ore prices were more or less steady for the period, so there was no significant impact on its revenues from the iron ore price factor.

Federal Reserve Bank of St. Louis

There was a slight increase in iron ore production and sales, which is the most relevant factor in the increase in revenues.

Net earnings increased by 63% in H1, as the chart shows. A decline in the costs associated with the Brumadinho mine disaster is one of the factors that led to the improvement in earnings. There was also an impairment reversal event that made a positive impact on net earnings of just over $1 billion in H1.

Other results of note include a decline in net debt by 4%, to $8.59 billion. Maintaining a healthy debt situation is important for most companies, but it is even more so for mining companies since market volatility can create prolonged periods of hardship, with depressed commodities prices.

Understanding the outlook for iron ore is key to appreciating Vale’s prospects.

As is most often the case, when it comes to commodities producers, the outlook for the commodities that the companies in question produce is far more important to the financial performance of a mining company than the internal specifics. There are of course some exceptions, including situations where the internal financial situation is so deteriorated that even a significant improvement in commodities prices will fail to lift a stock. There are also situations where companies simply run out of viable reserves to exploit. Neither one of these situations is relevant to Vale’s particular internal situation. I already covered the financial aspect of it. When it comes to reserves, Vale’s competitive advantage over its peers consists of sitting on the highest quality ore on the planet at its Carajas plant.

Vale has what it takes to be a successful iron ore miner. At the same time, the market seems to be leaning toward being negative on the outlook for global iron ore demand. There are some positives as well as negative factors to consider when evaluating the longer-term outlook for the iron ore market.

- Negative demand factors include a sluggish global economy, with the abrupt deceleration of the Chinese driver of the world’s economy driving headlines.

Much of the negativity around the commodities market tends to center around the ongoing deceleration of China’s economy, after being the main driver of commodities demands growth for decades. Given the deindustrializing trend in the EU, and a less than impressive pace of economic growth in the US as well, we have the world’s three largest economies, which together account for about 60% of the World’s nominal economic output, where iron ore demand is set to be sluggish due to a lack of construction and industrial growth demand. Other major economies, including Japan, also lack economic growth prospects. Infrastructural and industrial overcapacity seems to plague much of the Developed World and China’s economy. Within this context, it is hard to see how global demand for iron ore will be robust in the long term.

- Positive demand factors include the desire for much of the rest of the world to industrialize.

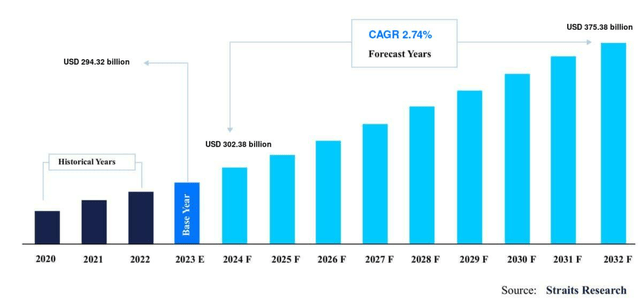

The developing world, not including China, may amount to a small percentage of the global economy, but it is home to the majority of the World’s population, and it is also the part of the world that continues to see demographic growth. Countries like India & Indonesia that are seeing robust economic growth and are in need of physical infrastructure are the countries to watch as commodities demand drivers.

The Asia-pacific region is forecast to drive almost 90% of iron demand going forward. I personally think that there may be positive surprises coming out of Africa as well.

The one factor that is not taken into account is the likelihood that the three major economies, namely China, the EU and the US, may all introduce fiscal stimulus measures as a means to deal with the economic slowdown they are experiencing. China moved first introducing an economic stimulus package which recently boosted Vale’s stock price in expectation of a boost in Chinese building activities, since many of the measures are meant to prop up the real estate sector of its economy.

The EU, or at least individual members within the EU may be next, as the recent report by Mario Draghi, calls for the EU to find ways to increase investments by 800 billion/year in order to avoid deindustrialization and to regain competitiveness is being digested by the political class. I believe the US will be the one holdout, given that the economy is doing slightly better than the Europeans, while deficits are already in the $2 Trillion/year range. Leaving limited room for stimulus measures.

The combined effect of demand for iron from developing nations in Asia & Africa where there is still a great need for infrastructure, housing and a desire to industrialize and struggling major economies such as the EU & China that are looking to revitalize their growth prospects should in my view translate into higher than forecast demand. If the US government will also get in on at least some stimulus measures meant to provide a boost to the economy, it is possible that we may even see a spike in iron ore prices this decade.

Investment implications:

- Vale stock price outperformed S&P by a wide margin in September, which could be a sign of things to come.

For the past month, Vale’s stock price increased by about 17% as I write this.

Vale stock price and other metrics (Seeking Alpha)

The news of China’s stimulus plans has been the main catalyst that led to a significant market outperformance of Vale’s stock. It shows that the market recognizes the positive impact that it will likely have on global iron ore demand.

S&P index chart and related metrics (Seeking Alpha)

It remains to be seen whether or not the trend of Vale’s market outperformance continues for the longer term. The news of China’s stimulus plan can propel Vale further, but in the absence of news of other stimulative measures in China or elsewhere, the positive momentum can easily stall out. Actual data showing more robust demand than anticipated can take over eventually, but it will take a while for it to have an impact, especially when faced with a collective skeptical market mindset.

- Risks to my positive thesis.

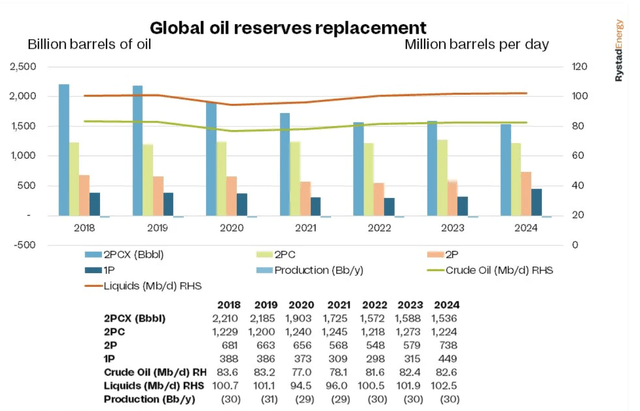

Several factors could derail iron ore prices going forward. On top of my list, is the potential for a further slowdown in global economic growth. A sustained slowdown could be triggered by a deteriorating global geopolitical environment, which has the potential to collapse global trade or a sustained oil price spike that can have a cooling effect on all economic activities. My worries concerning either risk factor coming to fruition are not unfounded. In regard to the geopolitical factor, we see regular news reports on frictions and economic confrontations between major economies. On the issue of an oil supply growth crisis, it should be noted that Rystad has gradually reduced its estimates for global oil reserves which can eventually be produced, by about 700 billion barrels since 2018.

Rystad’s data tells us of problems ahead with oil supplies, but it does not provide for a timeline. I recently wrote an article concerning growing discrepancies when it comes to organizations such as OPEC, EIA and the IEA and their supply/demand outlook for this year and next. Their forecasts for this year are increasingly out of step with each other and at times with their own data. To maintain credibility, they will have to correct their numbers, which in turn will likely lead to oil market turmoil within a few months. This is perhaps the most important factor to watch for Vale investors, because if we do get an oil price-induced global recession, the negative impact on iron demand is likely to be significant.

- A generous dividend, supported by strong financial results, combined with potential positive iron market factors outweigh the potential risks.

A sustained oil price spike induced global economic downturn might be the worst nightmare scenario for Vale investors. This particular risk factor is potent when it comes to certain industries, including iron ore miners, because high oil prices are inflationary, meaning that stimulus measures will be put on the backburner and efforts to contain inflation will dominate policy instead. Iron ore prices could potentially collapse in such a scenario, at least in real inflation-adjusted terms. Vale’s profitability would plunge as well, and it might then have to cut its dividend.

I believe that the risk of an oil price spike within a few months is very real, and I have been investing accordingly in the past year. Having said that, there is also a chance that I am wrong, and Vale is a good investment opportunity that can help me to hedge against a potential hit to my portfolio if my overall portfolio strategy turns out to be less than ideal for the actual market outcome in coming months and years. The generous dividend that currently yields about 11.8% and at the moment looks safe is itself a great boost to one’s portfolio, whether it is reinvested in Vale, creating a compounding effect, or whether it is a source of a steady cash inflow that one can redeploy in other investment opportunities.

In addition to the dividend, there is a decent chance that we will see Vale’s stock price appreciate on rising production, and potentially higher iron ore prices going forward, even if there are some temporary headwinds along the way. For these reasons, I added incrementally to my Vale shares in the Spring, in the Summer, and now again in the Fall. In the event that we will see further declines in its stock price, while fundamentally the company continues to perform well, I will probably add more.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of VALE either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.