Summary:

- Valneva SE has filed to raise $100 million U.S. public market investment.

- The firm commercializes and develops vaccines for various diseases.

- The IPO appears reasonably priced and the firm has extensive expertise in vaccine development, so the IPO is worth consideration.

Quick Take

Valneva SE (NASDAQ:VALN) has filed to raise $100 million in an IPO of American Depositary Shares representing underlying ordinary shares, according to an F-1 registration statement.

The firm is a commercialization stage biopharma that is advancing additional vaccine candidates for various diseases, including for COVID-19.

The IPO appears reasonably priced, so for patient life science investors, the IPO is worth a close look.

Company & Technology

Saint Herblain, France-based Valneva was founded to develop and commercialize prophylactic vaccine candidates for diseases such as Lyme disease and chikungunya.

Management is headed by president, Chairman and CEO Thomas Lingelbach, who has been with the firm since 2013 and was previously president and CEO of Intercell AG.

Below is a brief overview video of a recent trade visit to the firm:

Source: UK in Austria

Below is the current status of the firm’s pipeline and commercialization stage products: Source: Company prospectus filing

Source: Company prospectus filing

Valneva has received at least $300 million in equity investment from investors including Groupe Grimaud La Corbiere SAS, Fonds MVM, and Bpifrance.

The firm has two vaccines in commercialization stage, IXIARO for the prevention of encephalitis and DUKORAL for the prevention of diarrhea caused by Vibrio cholera.

VALN is collaborating with Pfizer (PFE) on the development of its lead program, VLA15 for the prevention of Lyme disease.

Marketing and Distribution expenses as a percentage of total revenue have dropped as revenues have fluctuated, as the figures below indicate:

|

Marketing & Distribution |

Expenses vs. Revenue |

|

Period |

Percentage |

|

2020 |

16.6% |

|

2019 |

19.1% |

Source: Company registration statement

The Marketing and Distribution efficiency rate, defined as how many dollars of additional new revenue are generated by each dollar of Marketing and Distribution spend, was negative (0.9x) in the most recent reporting period.

Market & Competition

According to a 2020 market research report by Mordor Intelligence, the number of tick-borne diseases in 2018 was over 47,000 in the U.S., according to the Centers for Disease Control.

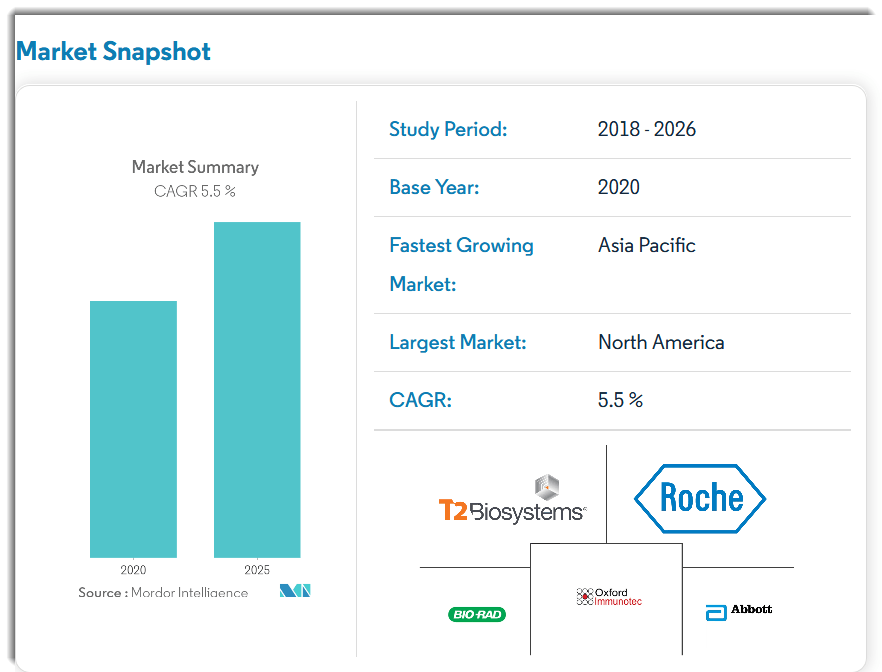

The demand for treatment is expected to grow at a CAGR of 5.5% from 2018 to 2025, as the chart shows below: The largest market by region is North America, but the Asia Pacific market is expected to grow at the fastest rate during the forecast period.

The largest market by region is North America, but the Asia Pacific market is expected to grow at the fastest rate during the forecast period.

The main drivers for this expected growth are a rise in the incidence of Lyme disease and increased diagnostic testing options and availability.

Also, the serological test segment is forecast to be ‘the largest growing segment in the Lyme disease diagnostic market.’

Major competitive or other industry participants include:

-

Biken

-

Kaketsuken

-

Sanofi Pasteur

-

PaxVax

-

Takeda Pharmaceuticals (TAK)

-

Inovio Pharmaceuticals (INO)

-

Euroimmun

-

Moderna Therapeutics (MRNA)

-

Others

Financial Performance

Valneva’s recent financial results can be summarized as follows:

-

Contracting topline revenue

-

Reduced gross profit and gross margin

-

Increased operating and net losses

-

Sharply increased cash flow from operations

Below are relevant financial results derived from the firm’s registration statement:

|

Total Revenue |

||

|

Period |

Total Revenue |

% Variance vs. Prior |

|

2020 |

$ 133,488,410 |

-12.6% |

|

2019 |

$ 152,697,160 |

|

|

Gross Profit (Loss) |

||

|

Period |

Gross Profit (Loss) |

% Variance vs. Prior |

|

2020 |

$ 67,782,990 |

-23.7% |

|

2019 |

$ 88,832,150 |

|

|

Gross Margin |

||

|

Period |

Gross Margin |

|

|

2020 |

50.78% |

|

|

2019 |

58.18% |

|

|

Operating Profit (Loss) |

||

|

Period |

Operating Profit (Loss) |

Operating Margin |

|

2020 |

$ (66,695,200) |

-50.0% |

|

2019 |

$ (981,310) |

-0.6% |

|

Net Income (Loss) |

||

|

Period |

Net Income (Loss) |

|

|

2020 |

$ (77,915,530) |

|

|

2019 |

$ (2,110,240) |

|

|

Cash Flow From Operations |

||

|

Period |

Cash Flow From Operations |

|

|

2020 |

$ 166,662,980 |

|

|

2019 |

$ 6,690,090 |

|

Source: Company registration statement

As of December 31, 2020, Valneva had $247 million in cash and $449.8 million in total liabilities.

Free cash flow during the twelve months ended December 31, 2020, was $143.8 million.

IPO Details

Valneva intends to raise $100 million in gross proceeds from an IPO of American Depositary Shares representing underlying ordinary shares, offering 3.5 million ADSs at an expected price of around $28.24.

No existing shareholders have indicated an interest to purchase shares at the IPO price.

There is a concurrent offering outside the U.S. The firm’s shares are currently listed on the Euronext Paris under the symbol “VLA”.

Assuming a successful IPO, the company’s enterprise value at IPO would approximate $1.05 billion, excluding the effects of underwriter over-allotment options.

Excluding effects of underwriter options and private placement shares or restricted stock, if any, the float to outstanding shares ratio will be approximately 7.24%.

Management says it will use the net proceeds from the IPO as follows:

to fund further development of our Lyme VLA15 vaccine candidate

to fund further development of our chikungunya VLA1553 vaccine candidate

to fund further development of our COVID-19 VLA2001 vaccine candidate

to advance our pre-clinical vaccine candidate programs; and

any remaining amounts to fund working capital and general corporate purposes.

Management’s presentation of the company roadshow is not available.

Listed bookrunners of the IPO are Goldman Sachs, Jefferies, Guggenheim Securities and Bryan, Garnier & Co.

Valuation Metrics

Below is a table of relevant capitalization and valuation figures for the company:

|

Measure [TTM] |

Amount |

|

Market Capitalization at IPO |

$1,382,157,211 |

|

Enterprise Value |

$1,047,178,391 |

|

Price / Sales |

10.35 |

|

EV / Revenue |

7.84 |

|

EV / EBITDA |

-15.70 |

|

Earnings Per Share |

-$1.57 |

|

Float To Outstanding Shares Ratio |

7.24% |

|

Proposed IPO Midpoint Price per Share |

$28.24 |

|

Net Free Cash Flow |

$143,750,420 |

|

Free Cash Flow Yield Per Share |

10.40% |

|

Revenue Growth Rate |

-12.58% |

Source: Company Prospectus

Commentary

Valneva is seeking additional public investment from both U.S. and international investors to further fund its vaccine research and commercialization efforts.

The company’s financials indicate contracting topline revenue for its first two vaccines, which may have been negatively affected in 2020 as a result of the COVID-19 pandemic crowding out other vaccine distributions.

Marketing and Distribution expenses as a percentage of total revenue grew as revenue contracted; its Marketing and Distribution efficiency rate swung into negative territory due to the revenue contraction.

The market opportunities for the firm’s vaccines are substantial and the tick-borne disease market is expected to grow moderately in the years ahead.

Goldman Sachs is the lead left underwriter and IPOs led by the firm over the last 12-month period have generated an average return of 48.4% since their IPO. This is a top-tier performance for all major underwriters during the period.

The primary risk to the company’s outlook is whether or not their next vaccines under development will be approved by regulators.

As for valuation, it is difficult to develop a valuation comparison, as the firm is an unusual combination of commercial-stage vaccines plus vaccine candidates under development.

A basket of publicly held Biotech drug makers compiled by Dr. Aswath Damodaran at NYU Stern School as of January 2021 indicated an EV/Sales multiple of 8.73x.

Management is asking IPO investors to pay an EV/Revenue multiple of 7.84x, which by comparison to the public basket referenced above appears reasonable.

For life science investors with a patient hold time frame, the IPO is worth a close look.

Expected IPO Pricing Date: May 5, 2021

Analyst’s Disclosure: I/we have no positions in any stocks mentioned, and no plans to initiate any positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

Gain Insight and actionable information on U.S. IPOs with IPO Edge research.

Members of IPO Edge get the latest IPO research, news, and industry analysis.

Get started with a free trial!