Summary:

- Valneva’s 1H 2023 revenue declined compared to the previous year, but product sales more than doubled, driven by the recovery in the travel market.

- The phase 3 trial for VLA15, a Lyme disease vaccine candidate, is progressing well, with plans for official submissions to the FDA and EMA in 2026.

- Valneva’s chikungunya vaccine, VLA1553, awaits PDUFA action by the end of November 2023, with the potential for a Priority Review Voucher valued at $100M.

- We maintain a buy rating and see Valneva as an under-appreciated vaccine play.

FatCamera

Reason for the update: earnings and clinical catalysts

This article is a revisit of Valneva (OTCPK:INRLF) (NASDAQ:VALN) with a) updated analysis on Q2 2023 results and b) upcoming catalysts (vaccine PDUFA) that we find material for the stock’s price action as we move into Q4 2023 and Q1 2024 in a few months. We remind readers that in our previous article, we discussed the Chikungunya vaccine pipeline’s prospect and the stock’s recent price action that was detached from the fundamentals.

Phase 3 Lyme Disease Trial is going as planned.

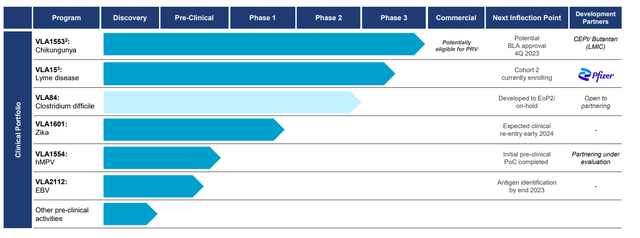

Valneva pipeline overview (Company IR deck)

The phase 3 trial for VLA15, a Lyme disease vaccine candidate co-developed with Pfizer, is progressing positively. We remind readers that VLA15 is a multivalent vaccine that targets Borrelia’s outer surface protein A (OspA), the bacterium responsible for Lyme disease, and phase 3 is ongoing and will be the first Lyme disease vaccine since GSK pulled their vaccine out of the market back in early 2000. The VALOR Phase 3 clinical study, despite facing challenges such as the discontinuation of certain participants due to violations of Good Clinical Practice, continues its patient enrollment in Cohort 2. The VALOR trial is expected to maintain its original design. Those enrolled in Cohort 1 are scheduled for a booster shot in 2Q24, with Cohort 2 commencing primary immunization enrollment in 2Q23. The official submissions to the FDA and EMA are slated for 2026, with a hopeful launch in 2027; we believe the Lyme disease vaccine to be the key driver of the stock moving forward, albeit, due to lack of short/mid-term catalyst for this indication, we believe investors are more focused on the Chikungunya vaccine for the YE 2023. For a more detailed clinical analysis of this candidate, please read our initiation article.

Catalyst: Chikungunya Vaccine and PDUFA Date in Nov

VLA1553, Valneva’s vaccine candidate for chikungunya, awaits the PDUFA action by the end of November 2023. Chikungunya, a disease transmitted by Aedes mosquitoes, has spurred significant interest in a viable vaccine. Of note, the FDA has granted VLA1553 both Fast Track and Breakthrough Therapy Designations in the U.S. This extension for the PDUFA action date provides time to finalize the Phase 4 program. Importantly, upon approval, Valneva stands to receive a Priority Review Voucher (PRV), which could be valued at approximately $100M and can be sold by the company to another sponsor. We believe the approval is likely considering the robust clinical data from multiple phase 2 and phase 3 trials, and also, the PRV should add liquidity for the company if the management decides to sell it. Further, recent safety data from the VLA1553-321 trial, which tested the vaccine in adolescents, has shown promising results with no significant safety concerns.

Positive 1H 2023 Results

During Valneva’s recent 1H 2023 earnings call, the company posted revenue of €73.7M, a decline compared to the €93.2M achieved in 1H 2022. Despite this, the 1H 2023 product sales, which stood at €69.7M, more than doubled from 1H 2022’s €33.3M, highlighting the significant recovery in the travel market and subsequent rise in the demand for travel vaccines (€47.4M of travel vaccine sales). On the commercial front, Valneva’s $32m partnership with the US Department of Defense (DoD) for its Ixiaro supply contract has further cemented its commercial footprint. Moving forward, we see this positive momentum in the earnings ramp, especially in the travel vaccine segment, to continue into 2024.

Risks

The successful development and commercialization of its vaccine candidates, like VLA15 and VLA1553, are subject to regulatory approvals. Any setbacks in clinical trials, regulatory delays, or unfavorable data can significantly impact the company’s stock value. Additionally, the company’s financial health and liquidity, although bolstered by partnerships and agreements, are still dependent on the successful sale and uptake of its products in a competitive market. It’s worth noting the decline in other revenues in 1H 2023 due to the one-time release of an €89.4M refund liability, indicating the importance of diverse revenue streams. However, the company is near cashflow positive and has cash of $223m, which gives us a high degree of comfort as we believe short-term dilution is unlikely.

Conclusion

Net-net, Valneva, with its diversified product portfolio and strategic partnerships, holds significant promise, particularly in the vaccine market with its chikungunya and Lyme disease portfolios. The strong recovery of travel vaccine sales, coupled with the anticipated positive outcomes from ongoing clinical trials for the Lyme disease and Chikungunya vaccines, underpin our buy rating for Valneva. While potential risks exist, the future trajectory and strategic moves of the company, such as the US DoD agreement, position it for potential growth and increased market share. We remain optimistic about Valneva’s prospects and reinforce our buy recommendation.

For a more detailed clinical analysis of Valneva’s pipeline and technology, please read our initiation article (Valneva).

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Biotechvalley Insights (BTVI) is not a registered investment advisor, and articles are not targeted toward retail investors. The content is for informational purposes only; you should not construe any such information or other material as legal, tax, investment, financial, or other advice. Nothing contained in our articles or comments constitutes a solicitation, recommendation, endorsement, or offer by Biotechvalley Insights or any third-party service provider to buy or sell any securities or other financial instruments in this or in any other jurisdiction in which such solicitation or offer would be unlawful under the securities laws of such jurisdiction. The research and reports made available by BTVI reflect and express the opinion of the applicable BTVI entity as of the time of the report only. Reports are based on generally-available information, field research, inferences, and deductions through the applicable due diligence and analytical process. BTVI may use resources from brokerage reports, corporate IR, and KOL/expert interviews that may have a conflict of interest with the company/assets that BTVI covers. To the best of the applicable BTVI's ability and belief, all information contained herein is accurate and reliable, is not material non-public information, and has been obtained from public sources that the applicable BTVI entity believes to be accurate and reliable. However, such information is presented “as is” without warranty of any kind, whether express or implied. With respect to their respective research reports, BTVI makes no representation, express or implied, as to the accuracy, timeliness, or completeness of any such information or with regard to the results to be obtained from its use. Further, any analysis/comment contains a very large measure of analysis and opinion. All expressions of opinion are subject to change without notice, and BTVI does not undertake to update or supplement any reports or any of the information, analysis, and opinion contained in them.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.