Value Investors Take Note! Why Chevron May Be A Must-Own Stock

Summary:

- Value investments have significantly underperformed, with the relative valuation of value to growth stocks at a 20-year low.

- Growth stocks have been driven by the belief that the Fed has won the fight against inflation, but inflation remains a concern.

- Energy stocks, including Chevron Corporation, are the cheapest sector in an overvalued market and could benefit from a potential rotation to value stocks.

Mario Tama

A Lengthy Introduction About Value & Energy

If there’s one thing I’ve discussed repeatedly with my friends and colleagues in the investment world, it’s that the past few months have started to feel like 2020/2021 again.

Don’t get me wrong, I’m not complaining about this market (I have no shorts).

We’re just witnessing some remarkable developments, including the significant underperformance of “value” investments.

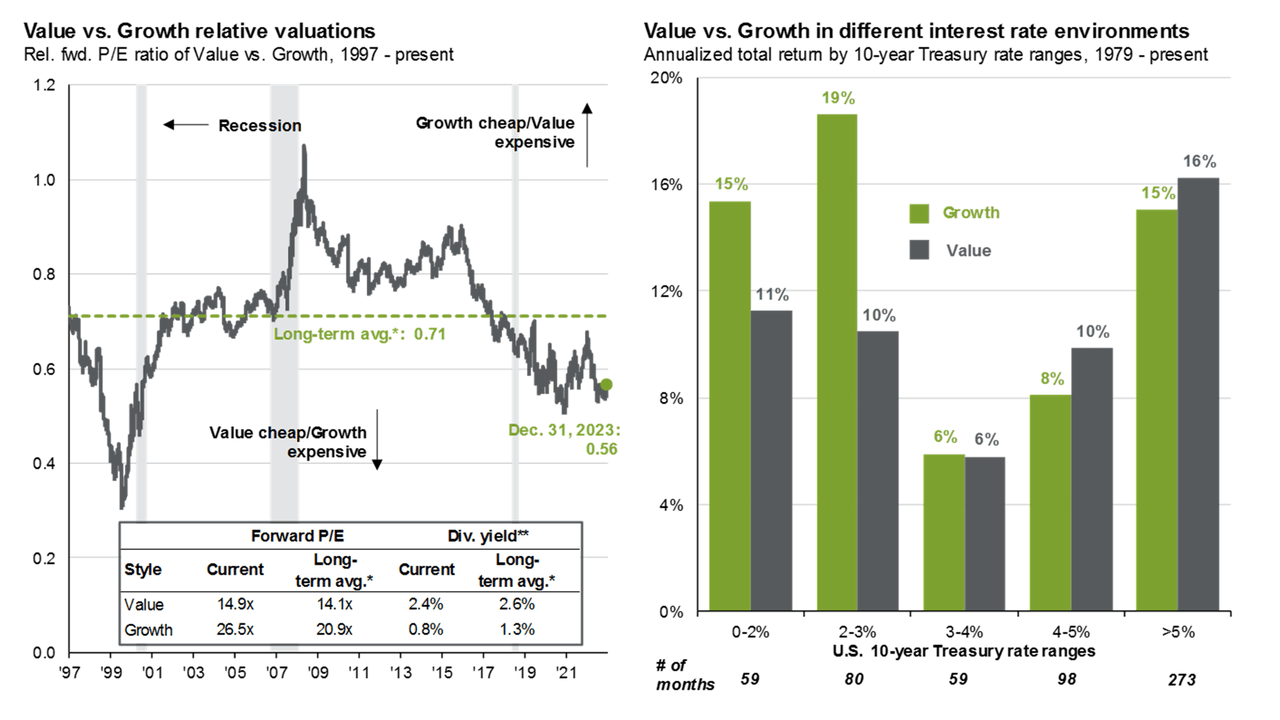

As we can see below, the relative valuation of value to growth stocks ended 2023 close to a 20-year low.

The last time value investments performed this poorly was during the quarters after the first wave of lockdowns ended in 2020, when cheap money flooded the market.

This is unusual. Not only is value very cheap compared to growth, but it is also unusual given the state of rates.

While I am writing this, the U.S. 10-year yield (US10Y) is at 4.1%. As the chart above shows, once rates cross the 3% mark, it becomes increasingly likely that value investments outperform.

This makes sense, as growth stocks prefer low rates and low inflation, which makes discounting future growth much more attractive.

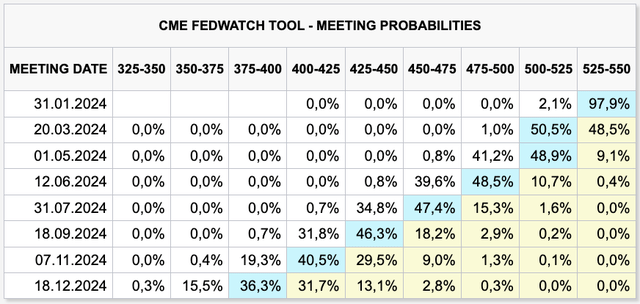

What has driven growth stocks is the belief that the Fed has won the fight against inflation. It has resulted in expectations of six rate cuts this year!

Sure, inflation has come down a lot, and I am not going to make the case that the Fed has no room to somewhat ease rates.

My point is that the risk/reward for the market, in general, has become unfavorable.

Among other reasons:

- Core inflation is still close to 4.0%.

- WTI crude oil is close to $80 (despite economic pressure).

- Tech stocks have been flying lately.

- Home prices are close to record highs.

This is NOT an environment that will allow the Fed to easily reduce rates by 150 basis points this year, at least not without potentially igniting a second wave of inflation.

Bear in mind that one of the biggest fears the Fed has is not preventing a second wave of inflation.

This is what NPR wrote in 2022 (emphasis added).

But the Fed is doing it in the hopes of dousing high inflation, before it ignites a long-smoldering dumpster fire. “The longer the current bout of high inflation continues, the greater the chance that expectations of higher inflation will become entrenched,” Fed chairman Jerome Powell said last week.

It’s a lesson born of the country’s painful experience with runaway prices in the 1970s, when Americans sported “Whip Inflation Now” buttons on their wide lapels.

“I came of age and studied economics in the 1970s and I remember what that terrible period was like,” Treasury Secretary Janet Yellen told a House subcommittee last year. “No one wants to see that happen again.”

As a result, I believe that growth stocks have gotten a bit ahead of themselves.

Sure, the AI trend has added tremendous growth potential on top of ongoing secular demand drivers like cloud computing, connectivity, and whatnot.

However, the valuation has gotten lofty.

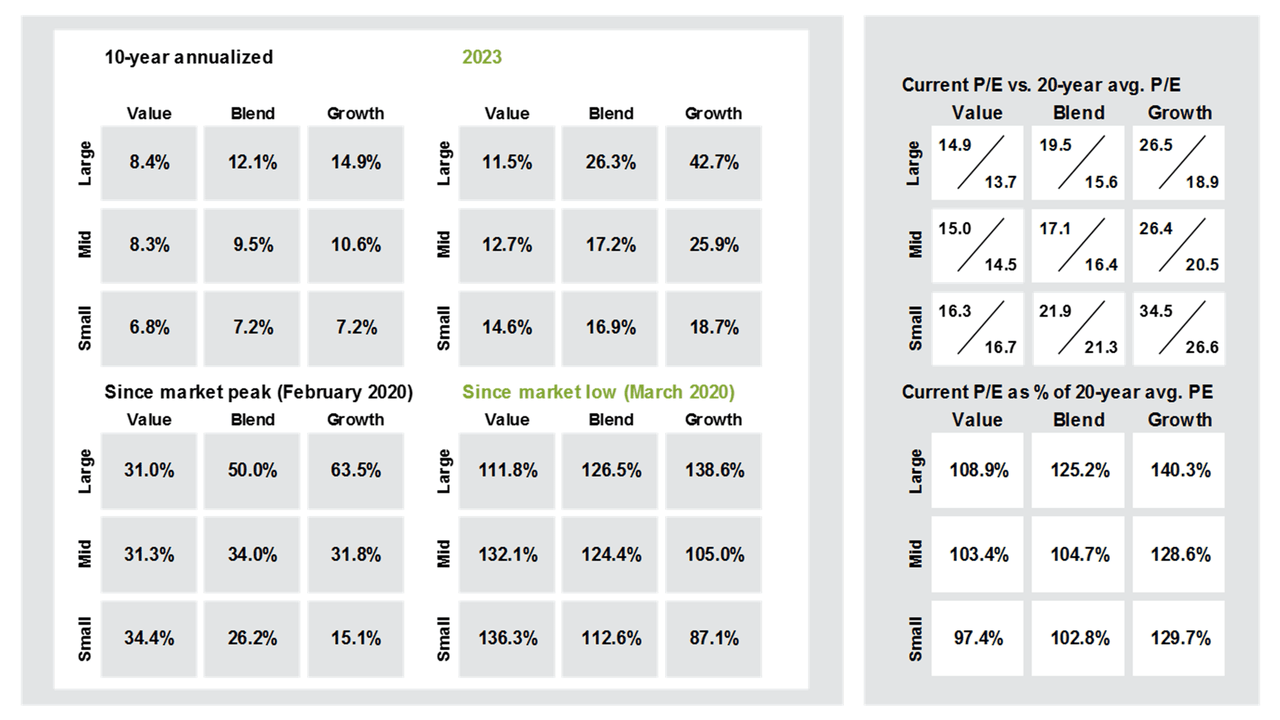

Looking at the data below, we see that:

- Large-cap value stocks are trading at 14.9x earnings, which is slightly above the long-term average of 13.7x earnings.

- Large-cap growth stocks are trading at 26.5x earnings, way above the long-term average of 18.9x earnings.

On top of the current unfavorable risk/reward, I believe that there are some drivers that make it likely that overall inflation will remain at above-average levels on a prolonged basis.

One of these factors is energy, which is also the cheapest sector on the market.

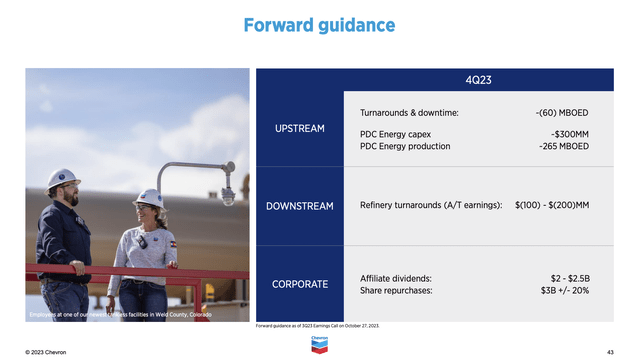

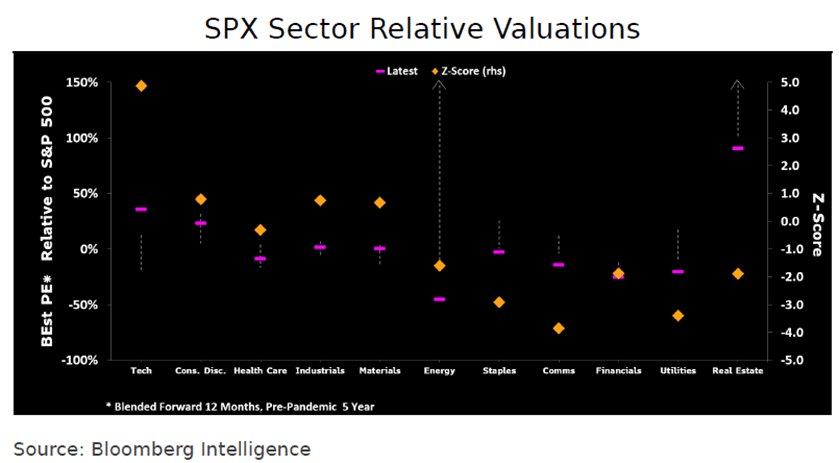

As we can see below, energy stocks are trading at the lowest relative valuation of all sectors. Other cheap sectors are staples, communication stocks, and utilities, all of which have been victims of the environment of elevated inflation and rates.

Bloomberg Intelligence (Via X/@LLequeu)

As almost all of my frequent readers know, I have written countless articles on the energy sector.

I believe that unlike in the 2009-2021 period when cheap energy paved the way for subdued inflation, new developments will likely do the positive, especially once global economic growth expectations rebound.

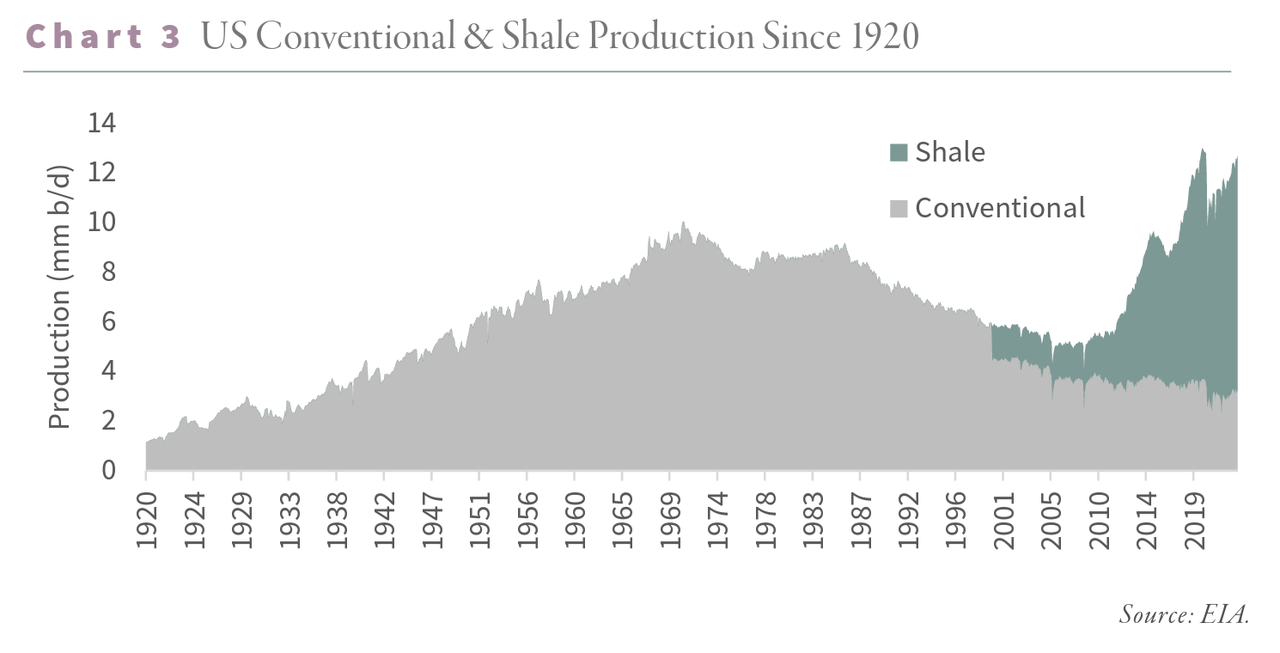

Last year, Goehring & Rozencwajg wrote a research paper making the case that, for the first time in history, crude oil has entered a structural deficit.

Despite the recent correction in oil prices, the report argues that this is a temporary setback in an otherwise robust bull market.

Notably, the mineral and royalty market in the United States has transformed from uninvestable to a must-own asset, with prime acreage prices soaring.

In a market where supply growth engines like the U.S. shale industry are running out of their best drilling spots, massive deals like Exxon Mobil’s (XOM) purchase of Pioneer Natural Resources (PXD) and Chevron Corporation’s (NYSE:CVX) acquisition of Hess (HES), totaling $120 billion, signal a pivotal shift in the oil industry.

These transactions, driven by the scarcity of prime undrilled acreage, emphasize the changing dynamics of the market.

Even the mighty Permian Basin is expected to see peak production this year.

We now calculate the Permian has also produced half of its reserves and expect sequential growth to turn negative within the next few months. With a growing degree of confidence, we expect 2024 will be the peak in Permian production. Over the last fifteen years, the US shales have represented all non-OPEC growth. In the previous five years, the Permian has dominated US shales. If correct, we are entering an unprecedented period of tightness in global oil markets. – Goehring & Rozencwajg.

Given that shale was the sole reason why the U.S. made a crude oil production comeback after decades of lower output, it is highly likely that global oil prices will benefit from subdued supply in the years ahead.

Goehring & Rozencwajg

I believe that only economic weakness and new drilling technologies can keep oil prices subdued (below $70).

Once economic growth improves, I expect oil prices to reach triple-digit dollar territory.

This is highly beneficial for oil stocks.

- Energy is currently the cheapest sector in a somewhat overvalued market.

- Value stocks, in general, are very cheap compared to growth stocks.

- If the market starts to price in a less dovish Fed, it could trigger a rotation to value stocks, (likely) benefitting energy more than its sector peers.

That’s where Chevron comes in, a company that is a part of a number of investing accounts in my family.

In the remainder of this article, I’ll explain what makes CVX such an important long-term play in light of the developments discussed in this > 1,000-word introduction.

So, let’s get to it!

A Fantastic Conservative Way To Potentially Beat The Market

As I mentioned in the first part of this article, Chevron is one of the giants preparing for a future where players will compete for the best oil reserves in the market.

As reported in October of last year, Chevron is buying Hess in a deal worth $53 billion, one of the biggest oil M&A deals ever.

According to the Bloomberg article:

The acquisition will give Chevron a significant foothold in Guyana, the South American country that is one of the world’s newest oil producers. It will enable faster production growth and more generous returns to investors, according to the statement.

“The prize here is Guyana,” said Peter McNally, an analyst at Third Bridge Group. “And it’s only gotten bigger” since oil was first discovered in the country less than a decade ago, he said.

As we can see in the chart below, both Hess and Chevron are major players in Guyana’s offshore oil fields.

By buying Hess, Chevron gets a 30% ownership of more than 11 billion barrels of oil equivalent (“BOE”) of recoverable resources in the region!

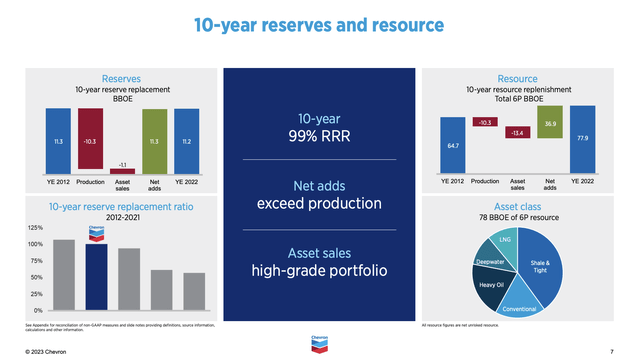

Even without this deal, the company has taken good care of its reserves, as it has replaced almost every drop of oil it produced over the past ten years with new reserves.

In general, Chevron remains in a good spot to generate value for its shareholders.

As some readers may recall, my favorite oil play is Canadian Natural Resources (CNQ), which has a focus on special dividends.

However, there are reasons to opt for Chevron:

- Chevron is a U.S.-based producer, which means investors are not subject to foreign withholding taxes.

- Chevron is a diversified energy producer, covering both upstream and refining on top of investments in alternative energy sources.

- The company stands for safety and reliability, making it the cornerstone of the Energy Select Sector SPDR® Fund ETF (XLE) and countless investment portfolios, including the portfolio of some of my family members.

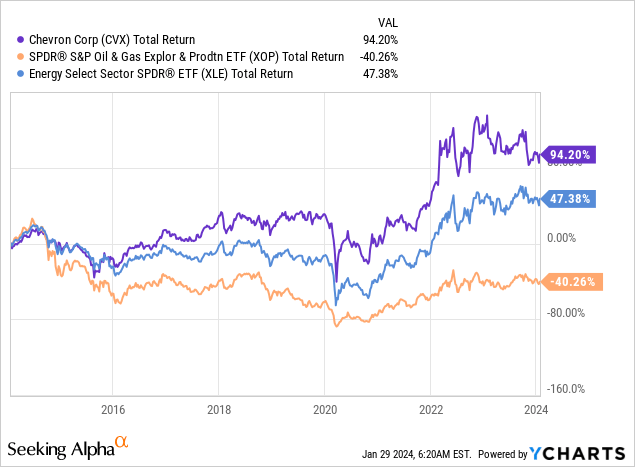

Over the past ten years, CVX has returned 94%, beating the XLE ETF by a wide margin. Meanwhile, the SPDR® S&P Oil & Gas Exploration & Production ETF (XOP) has returned negative 40%, as many of its holdings suffered due to poor balance sheets and low oil prices before 2021.

Chevron may not be exciting (that’s a good thing), yet it is all about consistency and reliability.

Despite a tougher operating environment, the company continues to do well.

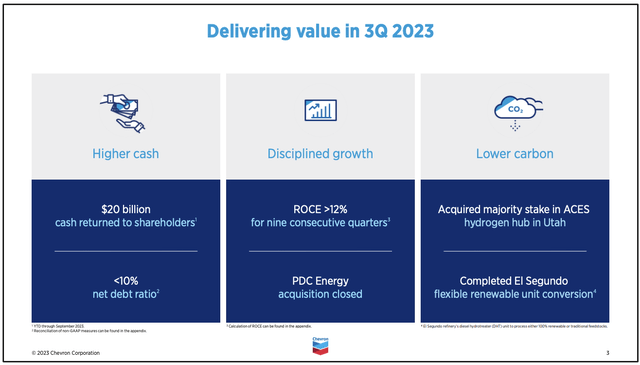

In the third quarter, the company achieved robust earnings, cash flow, and return on capital employed (“ROCE”).

- The company delivered an ROCE greater than 12% for the ninth straight quarter in Q3 2023, which allowed the company to maintain a sub-10% net debt ratio and return roughly $20 billion to shareholders in the first three quarters of the year.

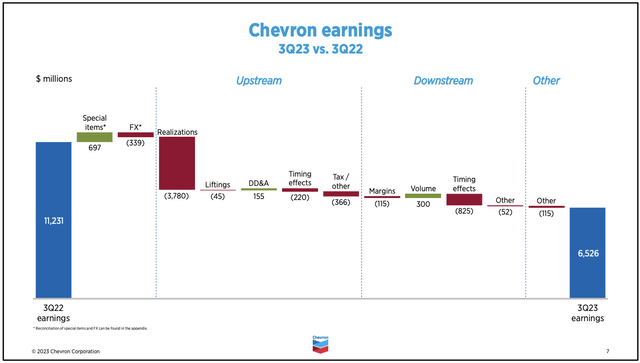

Adjusted earnings for the quarter were down $5.1 billion compared to the same period last year. The decline in upstream earnings was mainly attributed to realizations and negative timing effects, while downstream earnings were impacted by a negative swing in timing effects and lower marketing margins.

With regard to the aforementioned distributions, in the third quarter, the company spent $2.9 billion on dividends and $3.4 billion on buybacks.

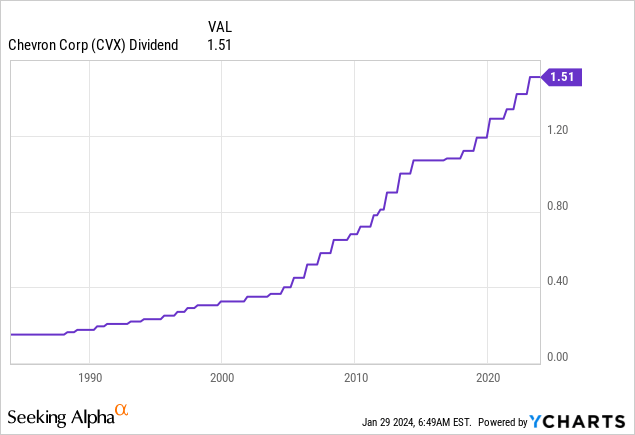

Currently, CVX pays $1.51 per share per quarter in dividends. This translates to a yield of 4.0%.

The company has hiked its dividend for 36 consecutive years, which obviously includes the Great Financial Crisis, the 2014/2015 oil price crash, and the pandemic.

The five-year dividend CAGR is 6.2%.

While this may be underwhelming, given the post-pandemic surge in oil prices and pricing benefits in its refining segment, the company is playing it safe to prevent being forced to cut its dividend once prices crash again.

Currently, the dividend is protected by a low 40% payout ratio.

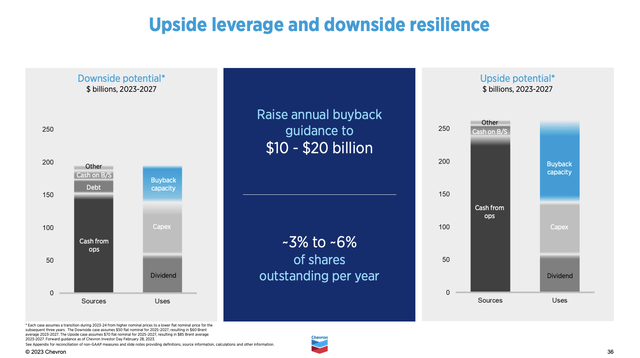

The company’s upside case, which is built on $85 Brent, foresees a lot of room for prolonged dividend growth, as it could generate close to $100 billion in cumulative cash earmarked just for buybacks – that’s more than a third of its current $282 billion market cap!

It is also in a great place to grow output in an environment of elevated pricing.

Ignoring the pending Hess deal, Chevron’s worldwide net oil and gas production experienced a 6% increase over the third quarter, driven primarily by the inclusion of legacy PDC Energy production for two months.

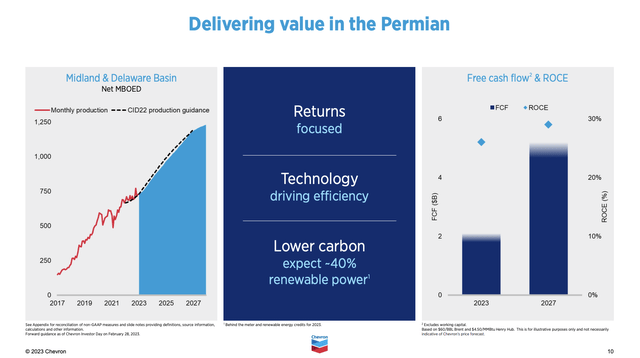

In the Midland & Delaware Basins (part of the Permian), the company aims to grow production to roughly 1.3 million barrels per day after 2027, which, when adding potential pricing benefits, could play a major role in free cash flow (“FCF”) generation – especially because the company expects to grow free cash flow in this area to roughly $5 billion with a ROCE close to 30%.

Looking ahead to the fourth quarter, the estimate for turnarounds and downtime included approximately 30 thousand barrels of oil equivalent per day for the Israelian Tamar oil field, which was halted due to the terror attacks in October.

Furthermore, the company anticipates affiliate dividends in the fourth quarter, primarily from TCO, which is a 50% Joint Venture investment in Tengizchevroil, a Kazakhstan oil company.

Meanwhile, share repurchases are expected to be restricted due to ongoing transactions, with an estimated repurchase amount of around $3 billion, plus or minus 20%, contingent on the timing of definitive proxy statement mailings related to specific transactions.

Needless to say, during the upcoming earnings call, I expect the company to explain how it will balance shareholder distributions and investments in growth – like the Hess transaction.

In this environment, I have little doubt that the company can use pricing to protect its balance sheet and stick to mid-single-digit long-term dividend growth.

With that said, the company is scheduled to release its earnings on Friday February 2 before the market opens. Analysts expect $3.29 in earnings per share, which is based on eight estimates.

Over the past four weeks, the company has received one upgrade and six earnings downgrades, which makes it somewhat likely that it can beat expectations.

Personally, I do not care too much whether CVX beats or misses its estimates. As long as it comes close to estimates, it will be fine.

The focus will be on the Hess deal and how CVX is capital spending on investments in growth and shareholder distributions. This also means that I expect no major stock price volatility on the earnings day.

Chevron Stock Valuation

Even without the incorporation of higher potential oil prices, CVX is cheap, which reflects what I wrote in the first part of this article.

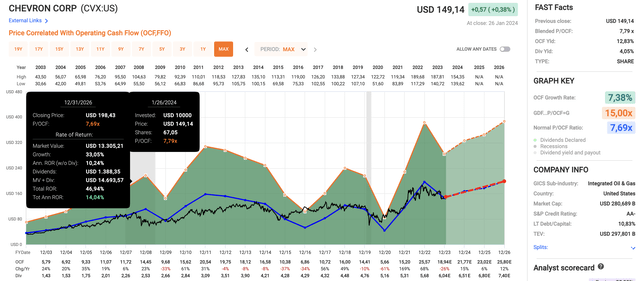

Using the data in the chart below:

- CVX trades at a blended P/OCF (operating cash flow) ratio of 7.8x, which is in line with its long-term normalized valuation of 7.7x.

- This year (2024), OCF is expected to grow by 15%, potentially followed by a 6% rise in 2025 and 12% growth in 2026.

- The incorporation of its dividend, a 7.7x OCF multiple, and expected OCF growth pave the road for roughly 15% annual returns through 2026.

It also gives the stock a fair price target of $198, which is 32% above the current price.

The consensus price target is $177, 18% above the current price.

Personally, I believe potential returns will likely be much higher if oil prices get the benefit of bottoming global economic growth this year.

Although economic challenges could keep a lid on the price of oil or even pressure CVX in the short term, I am very bullish on the future of CVX, and I am currently buying the stock for various family accounts.

The only reason why I won’t disclose a long position in CVX is because I do not have a financial benefit from the CVX investments of family members.

I believe the mix of undervalued energy stocks, a looming rotation from growth to value, and oil supply issues make it a must-own stock for investors looking for income, capital gains, and inflation protection.

I also look forward to its earnings to learn more about the Hess deal and how the company aims to balance growth and shareholder distributions in the future.

Takeaway

In a market reminiscent of 2020/2021, the underperformance of “value” investments and soaring tech stocks create a favorable risk/reward scenario.

With inflation concerns persisting and a less dovish Fed on the horizon, a potential rotation to value stocks, especially in the energy sector, becomes likely.

Chevron, a cornerstone of stability, stands out. Positioned for sustained value, dividend growth, and impressive returns, Chevron Corporation’s strategic moves, including the $53 billion Hess deal, make it a conservative yet compelling choice amidst market uncertainties.

As economic conditions improve, Chevron Corporation stock emerges as a fantastic long-term play.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of CNQ either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

Test Drive iREIT© on Alpha For FREE (for 2 Weeks)

Join iREIT on Alpha today to get the most in-depth research that includes REITs, mREITs, Preferreds, BDCs, MLPs, ETFs, and other income alternatives. 438 testimonials and most are 5 stars. Nothing to lose with our FREE 2-week trial.

And this offer includes a 2-Week FREE TRIAL plus Brad Thomas’ FREE book.