Summary:

- Verizon’s strategic acquisition of Frontier Communications for $20 billion aims to expand its fiber broadband footprint, potentially enhancing its competitive edge in rural markets.

- The Q2 2024 results highlighted a 0.6% revenue increase to $32.8 billion, driven by a 3.5% rise in wireless service revenue, despite a 13% drop in wireless equipment sales.

- Despite the recent decline in adjusted EPS, Verizon’s strong cash flow and improved balance sheet, with net unsecured debt reduced to $122.8 billion, support its growth strategy.

- My updated dividend discount estimate suggests a $50.75 price target for Verizon with an 18% upside, resulting in a cumulative yield of over 24% by 2025.

- I reiterate my “Buy” rating again, retaining my belief that Verizon can adapt to the changing telecommunications landscape and take advantage of future opportunities, especially AI and mobile edge computing.

JHVEPhoto

My Thesis Update

I started covering Verizon Communications Inc. (NYSE:VZ) stock in January 2024 and updated it in April stating that VZ stock had a 20% nominal upside potential, not including the very high 6% dividend yield. In July, I confirmed my rating and updated my DDM model, which pointed to a new target – 22% higher than the stock’s price at the time. Since that call, Verizon has managed to outperform the S&P 500 index (SP500) (SPX) slightly but lagged far behind my appreciation expectations:

Seeking Alpha, Oakoff’s previous article on VZ

I think the ongoing gradual growth of VZ stock is just the beginning, and investors should expect the upside potential I have described in my previous articles to continue to be realized.

My Reasoning

First off, let’s assess the latest financial and operational updates. Verizon Communications’ second quarter in fiscal year 2024 showed consolidated revenue of $32.8 billion, up 0.6% YoY. This was driven mainly by a 1.8% increase in service and other revenue, partially offset by a 13% decrease in wireless equipment revenue as a result of a 13% decline in total upgrades. One significant driver was wireless service revenue, which hit $19.8 billion in a sequential growth of more than $250 million and a 3.5% year-over-year growth of $660 million – this was largely driven by consumer wireless service revenue, which rose 3.7% to $16.3 billion due to price adjustments and the growth of fixed wireless access (FWA).

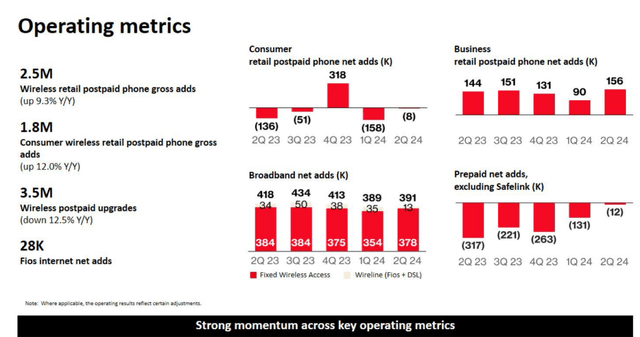

From my understanding, Verizon performed strongly both in the mobility, broadband, and network sectors from an operational perspective. The company posted a 12% year-over-year growth in consumer postpaid phone gross additions to close out the quarter at about 1.8 million – it was the 6th consecutive quarter of YoY growth in this segment. Verizon is still projecting full-year churn to be unchanged or slightly better than last year, despite consumer postpaid phone churn increasing a little bit to 0.79%. The firm also achieved big gains in consumer postpaid phone net losses, which were down to 8,000 in the quarter. At the same time, Verizon’s broadband business continued to expand strongly with broadband net additions totaling 391,000 – the 8th consecutive quarter over 375,000 net additions. Mobile Fixed Wireless Access accounted for 378,000 net additions to increase the total subscriber base to more than 3.8 million (a 69% increase over Q1 of last year). It also received strong demand for its Fios Internet product, which generated 28,000 net adds in the quarter despite ACP’s shutdown and weaker move activity.

VZ’s Q2 results, IR materials

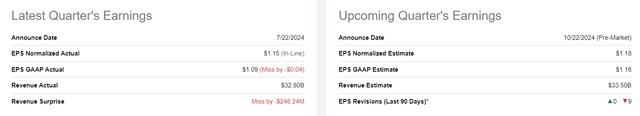

As a result of all that, VZ’s adjusted EBITDA for the quarter was $12.3 billion, a 2.8% year-on-year increase due to improved operating leverage. But adjusted EPS declined 5% to $1.15, driven by “increased interest expenses from lower capitalized interest as additional C-band spectrum was deployed.” So VZ couldn’t beat the consensus expectation significantly – in fact, they missed on the GAAP basis and on the top line, which led to a 100% rate in EPS/sales revisions for Q3:

Seeking Alpha, VZ

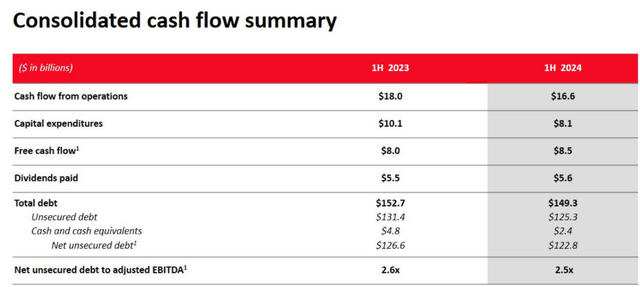

On the other hand, Verizon’s cash flows remained strong with operating cash flow coming in at $16.6 billion in the first six months of the year, compared with $18 billion the previous year due to higher cash taxes and interest costs. Also, I see that Verizon’s balance sheet improved with net unsecured debt reduced to $122.8 billion, down $3.2 billion from Q1 and $3.7 billion from a year ago. The net unsecured debt-to-consolidated adjusted EBITDA ratio increased to 2.5 times from 2.6 times during the prior quarter. Free cash flow in the first half of 2024 reached $8.5 billion, up 7% from the same time last year (despite higher cash taxes and interest expense).

VZ’s Q2 results, IR materials

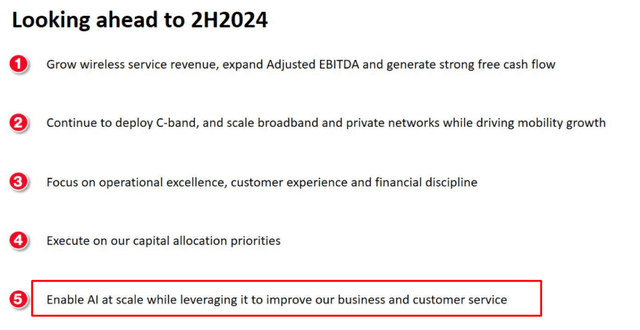

Verizon’s management is looking forward to continuing to pursue growth in wireless service revenue, trying to increase adjusted EBITDA, and keeping the free cash flow at robust levels. They’re adapting their broadband approach with an eye on 4–5 million fixed wireless access customers and will continue growing with private networks while expanding through mobility. The continuous C-band growth should support increased network speeds and new markets.

What is relatively fresh news for me, as I haven’t covered the stock since it saw the light, is Verizon’s acquisition of Frontier Communications for $20 billion in an all-cash transaction – a significant strategic move, that shows VZ’s ambition to expand its fiber broadband footprint across rural America. The offer of $38.50/share represents a 37% premium over Frontier’s pre-announcement stock price, which could be enticing enough to secure shareholder approval. I find this acquisition aligning with Verizon’s strategy to enhance its broadband and fixed wireless access services, extending its “reach to 25 million locations across 31 states and the District of Columbia.”

Verizon’s management anticipates the deal will be accretive to revenue and adjusted EBITDA upon closing, with expected cost synergies of $500 million annually. However, the path to regulatory approval may be challenging, given the need for both federal and state-level clearances, and the current administration’s cautious stance on mergers and acquisitions. From a financial perspective, Verizon’s decision to finance the acquisition with cash rather than undervalued shares looks prudent, in my view. The transaction valued Frontier at approximately 9x EBITDA, which is relatively high for the telecom sector, but taking into account Verizon’s plans to extract significant cost savings and further capitalize on Frontier’s growth potential as it expands its fiber network, I think that was a fair price. While Frontier’s current broadband penetration is around 30%, Verizon’s more efficient operations could drive this figure higher, potentially enhancing its competitive position in rural markets.

On the other hand, the acquisition will definitely add to Verizon’s debt load, increasing its leverage ratio, though the company plans to manage this through continued debt reduction efforts. While the strategic upside might be high, some analysts remain cautious about the impact that the transaction would have on Verizon’s market share. The deal increases Verizon’s fiber availability, but the expansion impacts only 5% of Americans: The penetration of Verizon’s existing broadband is already greater than Frontier’s, so this might increase, but its long-term effects on market share are unclear. The purchase will also delay Verizon’s plan to reduce debt in the long run, but Verizon believes it will be able to maintain enough cash flows to keep up.

Personally, I look at this deal positively. It shows that Verizon has the vision to scale up broadband, especially in rural areas, as they move through integration and regulatory approval processes. I don’t believe there is any other way to significantly increase the volume of products and services offered, except through such strategic moves.

From what I see, Verizon is executing its capital allocation strategies well, including investing in growth and sustaining its dividend while repaying debt. As AI transforms the industry further, I think Verizon can facilitate and capitalize on these developments, by harnessing the power of its secure and fast network to power AI and mobile edge compute services.

VZ’s IR materials, notes added

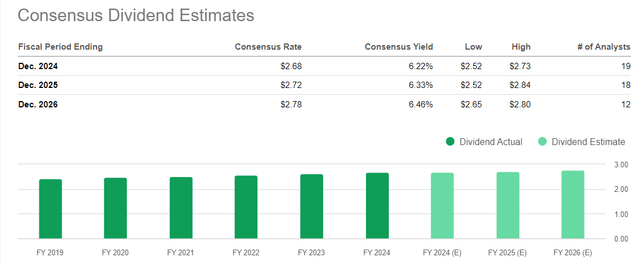

The day before the Frontier deal announcement, Verizon increased its quarterly dividend by 1.9%, raising the payout to $0.6775 per share. This means the current dividend yield for the full year 2024 is approximately 6.22% and is expected to reach nearly 6.5% by the end of 2026, according to Seeking Alpha data.

Seeking Alpha, VZ

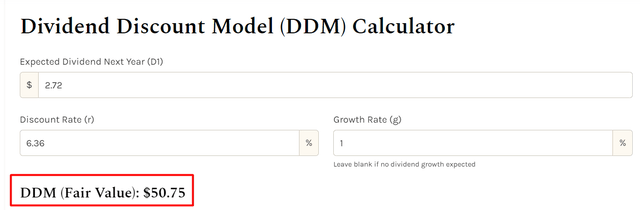

In my last article, I updated my calculations on the dividend discount model I used to value the company – StableBread’s DDM template. At the time, my calculations included a WACC of 6.50%. However, I’m now lowering this rate back to where I saw it at my coverage initiation (6.36%) because the share of debt in the company’s capital structure should now increase as they don’t deleverage as actively as before. I’m inserting the FY2025 expected dividend payout amount ($2.72/share), the targeted dividend growth rate of 1% (my basic assumption), and the WACC I mentioned above. This results in a price target of $50.75, which is 18% higher than the stock price at the close of trading on October 11, 2024.

StableBread’s DDM, notes added

It’s important to mention here – this model indicates the nominal value of the stock, showing how much it should be trading at, but it doesn’t account for the dividend yield investors will earn while holding the stock. We know that the consensus expects common stock investors to receive over 6% annually for the next few years (at least) if the stock price remains unchanged. Therefore, considering the forecasted dividend yield and adding the results from the model above, we arrive at a comfortable total return yield of >24% by the end of 2025 from current values. My “Buy” rating should be logically confirmed.

Risks To My Thesis

Verizon’s key risk factors haven’t changed significantly in the last three months – they only got even larger as the firm acquired Frontier.

The proposed Frontier acquisition adds new risks for Verizon. The large $20 billion price tag increases the risks for Verizon if the expected returns fail to materialize or the as yet unknown costs to reap the merger synergies come in higher than expected. Further, the regulatory clearance for mergers of this size could well be fraught. We remember, AT&T’s failed bid for T-Mobile and T-Mobile’s ultimately successful but highly contested acquisition of Sprint. Federal regulators have not taken kindly to large telecom incumbents taking out smaller competitors. State regulators could take a similar dim view.

Source: Argus Research, proprietary source (September 2024)

Also, despite its 4G dominance and advances in 5G, Verizon still faces disruptive technological changes that pose a risk to its business. I also should note that the presence of severe competition could hinder management’s plans to re-accelerate business growth in an already oversaturated telecom market, as I warned my readers in my previous VZ article. Should this be the case, my entire thesis would be wrong.

It’s also worth remembering the dangers associated with legacy infrastructure, as the Wall Street Journal’s report on obsolete copper cables shows. Although they haven’t been used since the mid-20th century, there are still questions about their presence in the system that can lead to liability claims, especially those originating from previous acquisitions.

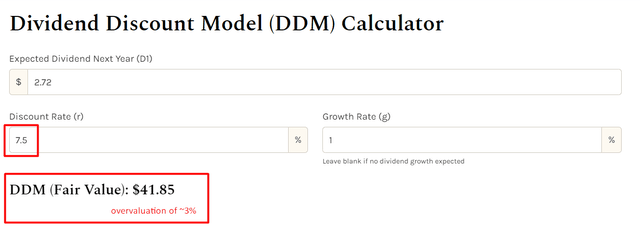

In addition, there is a risk that I have made some mistakes while calculating the fair value of VZ share prices. For example, if we use a discount rate of 7-8%, all the conclusions from my DDM will change meaningfully:

StableBread’s DDM, notes added

Your Takeaway

Despite these clear risks, my updated research suggests that the stock is still a good thing to own (and buy). Yes, Frontier’s ambitious $20 billion takeover will be a rocky road ahead, but Verizon has the potential to grow fiber broadband access, particularly in rural markets – it is part of Verizon’s larger effort to ramp broadband and fixed wireless access offerings and should accelerate top-line growth again. Meanwhile, Verizon’s cash-flow strength and prudent capital planning (including a recent 1.9% dividend hike) are a good start to future growth.

My updated dividend discount estimate (now using a WACC of 6.36%) implies a price target of $50.75 and an 18% upside from the current stock price. Take that with a dividend yield forecast at above 6% per year, and you get a cumulative yield of over 24% by the end of 2025.

Based on all that, I reiterate my “Buy” rating again, retaining my belief that Verizon can adapt to the changing telecommunications landscape and take advantage of future opportunities, especially AI and mobile edge computing.

Good luck with your investments!

Analyst’s Disclosure: I/we have a beneficial long position in the shares of VZ either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

Struggle to access the latest reports from banks and hedge funds?

With just one subscription to Beyond the Wall Investing, you can save thousands of dollars a year on equity research reports from banks. You’ll keep your finger on the pulse and have access to the latest and highest-quality analysis of this type of information.