Summary:

- Verizon and AT&T both had struggling share prices, but the latest hit came with exposure to lead cables and the potential liabilities that could come from that.

- Higher interest rates have impacted both of these telecom giants in more ways than one, but significant debt is one of the primary ways as debt costs could rise.

- That being said, both are attractively valued at deep discounts relative to their historical ranges.

- Both are also covering their dividends with FCF in the trailing twelve months and are expected to have strong coverage going forward.

peshkov/iStock via Getty Images

Written by Nick Ackerman.

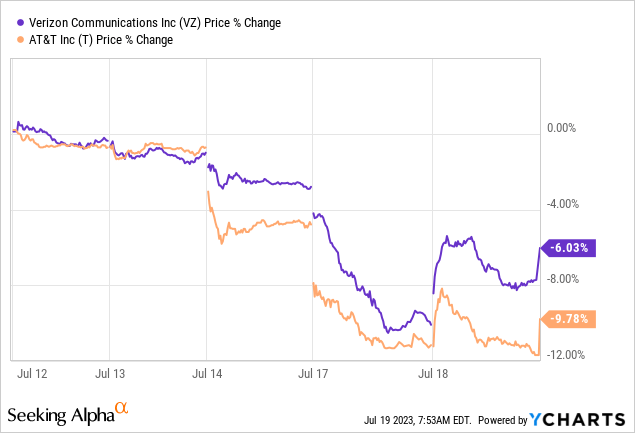

Recently, a new report has come out that both telecommunication companies could be on the hook for liabilities due to lead in their old cables. That sent several names down, but the largest of these two and the one’s that I’m most concerned with, would be Verizon (NYSE:VZ) and AT&T (NYSE:T). These are income plays as they offer some significant dividend yields to investors. When these reports broke, the decline in both of these was substantial.

Ycharts

To be fair, as of writing this, we are seeing some sizeable rebounds.

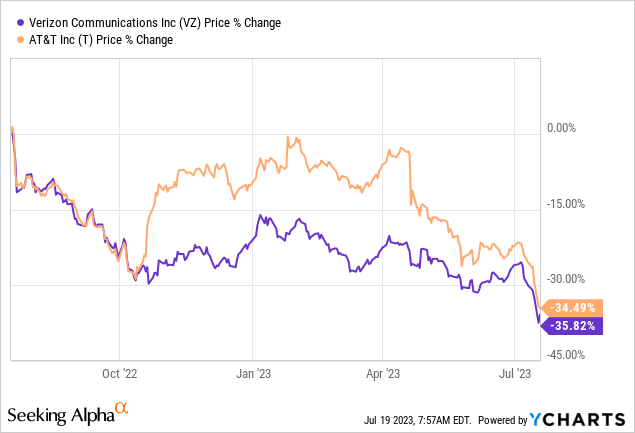

That said, this was as both of these names have been under considerable pressure already with rising rates that can hurt these investments in more ways than one. In particular, rising rates means higher costs for their debts are likely coming in the next few years. They have some cash flows to pay off some of the debt, but ultimately there will be refinancing that takes place as well.

Besides just higher interest rates hurting their outlook on their massive debt piles, higher interest rates make risk-free yields tempting. That means income-oriented investments such as these telecom giants could be seen as less attractive now that there are alternatives worth considering to get some yield.

Given that is the case with both of these headwinds, the share prices of these two have come under significant pressure for the last year. Not to mention that T has just been declining for years now due to massive acquisitions that failed and have now been spun-out.

Ycharts

Still, both of these are presenting fairly attractive valuations despite the headwinds they face and the seemingly endless bad news that keeps hitting them. They don’t come without risks, though, clearly.

T is also in a position where it is estimated if the lead wire issue gets pushed, they are on the hook for a larger liability relative to VZ. One report suggests T could be paying an estimated cost of $34.4 billion, while VZ is looking at a more modest $8 billion. On the other hand, Morningstar noted that “we don’t expect major liability tied to lead in telecom cable sheathing.”

They then go on to note that they believe the fair value for T shares is at $25, and VZ is looking at a fair value estimate of $57. Of course, that’s something I’m rooting for, but I’m biased. I’m sitting on some VZ shares where I took an assignment of puts I sold for $51 and T at $19. The ultimate idea was to utilize the options wheel writing strategy, but no doubt I’ll be sitting on these positions for a while before covered calls seem like they’ll make sense. That is okay, too, because they are still likely to pay some dividends going forward – even if worst-case scenario, they cut.

Naturally, T has also come out to “strongly disagree” with the WSJ findings and is looking at more testing.

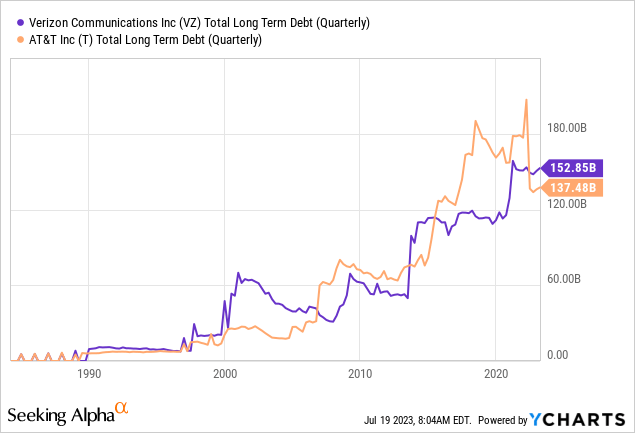

VZ carries the larger absolute debt pile over T, but T also had a helping hand with its Warner spin-off. In that transaction, they pushed off debt onto the new Warner Bros. Discovery (WBD) that was created.

Ycharts

While both companies should work on paying down this debt now that money isn’t free, it’s not likely to happen anytime soon with these behemoth debt piles.

Debt to adjusted EBITDA for VZ came to 2.7x. Debt to adjusted EBITDA for T comes in at 3.22x, down from the 3.75x level in the year prior. On that basis, that puts VZ in a better financial position.

It should also be noted that neither company is in immediate danger of massive interest rate costs on their debt. They both have maturity schedules staggered well out into the future, which are primarily at fixed-rate financing. VZ has more debt due within the next year relative to T.

Valuation

Besides Morningstar having some rosy outlook price targets, their fair value estimates based on historical trading P/E levels also show that these are bargain stocks. For VZ, the range is around $51 to $65 based on its historical P/E range and its current sub-7x P/E that it’s at.

VZ Fair Value Range Based on Historical P/E Levels (Portfolio Insight)

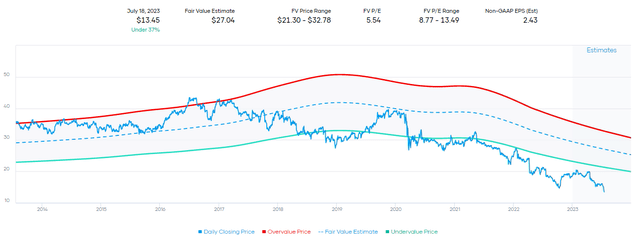

T is showing a similar significant undervaluation. However, its P/E historical range is lower than VZ’s, which puts it at a relatively lower valuation multiple range. In this case, between $21 and $33 is what the fair value estimate range is projecting.

T Fair Value Range Based on Historical P/E Levels (Portfolio Insight)

Even if these stocks hit the low end of these ranges, there could be a significant upside. Of course, the debate is that T has been in the bargain bin for years at this point.

Dividend Coverage

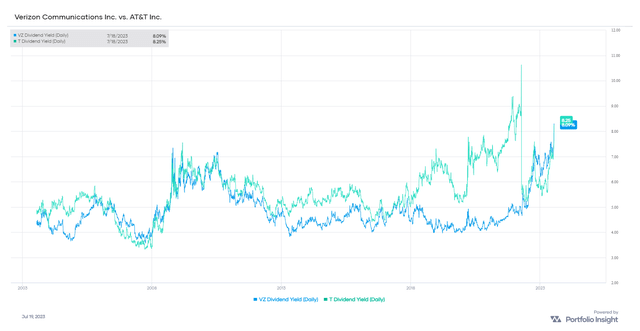

Dividend coverage can be an important factor to consider here, as any cash flow going to the dividend is not being retained for debt repayment or paying off liabilities. Both companies pay out substantial dividends and are currently at pretty lofty yields, given the share price struggles.

VZ And T Dividend Yields (Portfolio Insight)

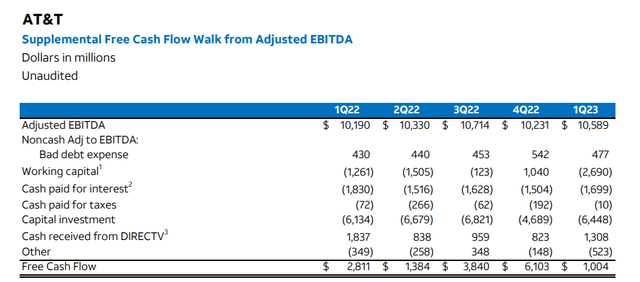

Both companies have been covering their dividend through free cash flow in the trailing four quarters. That’s even if the first quarter of the year showed a pretty dismal coverage and reasons for raising some red flags. They had reported $1 billion in FCF in the first quarter against paying out around $2 billion quarterly. However, FCF came to $12.33 billion in the last four quarters. That would put the trailing FCF payout ratio at around 65%.

They are projecting $16 billion in FCF this year, which is what they projected last year and then reduced their target to around $14 billion. That would put the FCF payout ratio to 50%, leaving them with a lot of flexibility if they are able to hit that target. However, besides wanting to pay off more debt, if the lead cable liabilities lead to something substantial, they could be put in a position to cut their dividend anyway to free up more cash.

With VZ, their lead cable liability is fairly minimal, and their coverage is looking just as strong in terms of its dividend and then having some FCF for debt reduction. In the first quarter, they also came to light with free cash flow at $2.3 billion against the dividends paid of $2.7 billion.

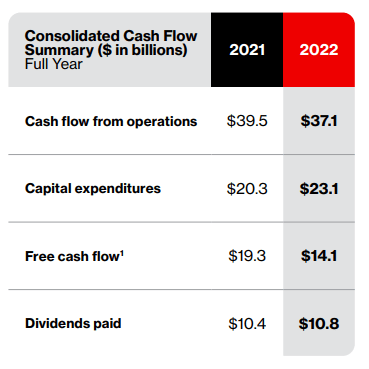

VZ 2022/21 FCF/Dividends (Verizon)

FCF for 2022 came in at $14.1 billion against the $10.8 billion paid in dividends. The first quarter of 2022 had FCF of $1 billion. That would put the trailing four-quarter FCF at $15.4 billion against the $10.8 billion. That actually puts the FCF payout ratio at a higher 70% compared to T’s ~65%.

VZ expects Capex to come down through this year, as noted in their most recent earnings call. They anticipate that to produce a better dividend payout ratio.

As we look to build on the free cash flow growth generated in the first quarter, we expect to see significant improvement in our dividend payout ratio this year, putting the board in a strong position to increase the dividend once again and bring us closer to our debt targets over the following years.

They then remarked later in the call, more specifically on Capex.

CapEx for the quarter came in at $6.0 billion, which includes most of the remaining $1.75 billion of C-band-related spending in our guidance. With the conclusion of the program, we would expect a step down in the pacing of overall CapEx throughout the remainder of the year and continue to expect 2023 capital spending to be within our guidance of $18.25 billion to $19.25 billion. The net result of cash flow from operations and capital spending is free cash flow for the quarter of $2.3 billion, up $1.3 billion versus last year.

Last year Capex came in at $23.1 billion; if they only spent the high guidance of $19.25 billion, that would see an improvement of $3.85 billion. All else being equal, FCF could come up to $17.95 billion, given last year’s numbers.

Admittedly, that’s a huge assumption to be made that everything else will be equal. It most likely won’t, but it gives us some estimates and numbers to work with. I would also assume they will increase their dividend in the fourth quarter as they historically have done. However, given the $10.8 billion paid in dividends against that estimated FCF potential, we’d see the dividend payout drop to around 60%.

So overall, T’s FCF payout ratio could potentially be healthier this year compared to VZ’s. Still, if liabilities are higher for T than VZ with lead cables, it could put T in a tighter financial position. We already know T is not in a position where they feel comfortable raising the dividend as they have paid out the same $0.2775 for the last six quarters.

Conclusion

VZ and T have been hurting for a while now regarding their share prices. Higher interest rates are making their debt piles unattractive now that money isn’t free. While both expect FCF to improve this year, they are still paying massive dividends. Coverage of the dividend has been fine, and a higher FCF would see this coverage improve. That improvement would mean more cash to pay down debt instead of having to refinance it all at higher rates. However, with new potential liabilities, that could certainly cause some headwinds. This is already being reflected, and that’s why we’ve seen the latest drop in share prices. A recent report suggests that T is in a worse position potentially compared to VZ.

Overall, I believe both are trading at attractive valuations, but I’d have to continue to believe that VZ is in a better financial position. With both having earnings coming up next week, we should get much more clarity on the latest financial data and be looking for any new guidance.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of VZ, T, SHORT VZ PUTS either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

Interested in more income ideas?

Check out Cash Builder Opportunities where we provide ideas about high-quality and reliable dividend growth ideas. These investments are designed to build growing income for investors. A special focus on investments that are leaders within their industry to provide stability and long-term wealth creation. Along with this, the service provides ideas for writing options to build investor’s income even further.

Join us today to have access to our portfolio, watchlist and live chat. Members get the first look at all publications and even exclusive articles not posted elsewhere.