Summary:

- VZ’s FQ2’24 results have been misunderstood indeed, with the decrease in wireless equipment revenues well-balanced by growth in service revenues and robust net adds.

- This may be further aided by the robust net additions for both mobility and fixed wireless in the Business segment, further underscoring why the management has reiterated their FY2024 guidance.

- The consensus have also upgraded their forward estimates, with VZ expected to report increasingly rich adj EBITDA margins and Free Cash Flow margins through FY2026.

- Lastly, long-term investors may look forward the upcoming hike typically announced in August/ September, building upon the previous raise by +1.9% and the 5Y Dividend Growth rate of +1.99%.

Jitalia17

We previously covered Verizon Communications Inc. (NYSE:VZ) in April 2024, discussing its robust growth across the mobile and fixed wireless segments, with 2024 likely to bring forth promising net adds.

Combined with the excellent FY2024 Free Cash Flow guidance, the peak 5G capex well behind us, and the rich dividend investment thesis, we had reiterated our Buy rating then.

Since then, VZ has traded sideways before the market over-reacted to the supposed FQ2’24 earning miss, leading to a painful -6.5% correction at its worst.

While the pullback has been unwarranted, we believe that it presents a great opportunity for dividend oriented investors to dollar cost average, attributed to the expanded dividend yields. Combined with the reiterated FY2024 guidance, we are maintaining our Buy rating here.

VZ’s Telecom/ Broadband Investment Thesis Remains Robust

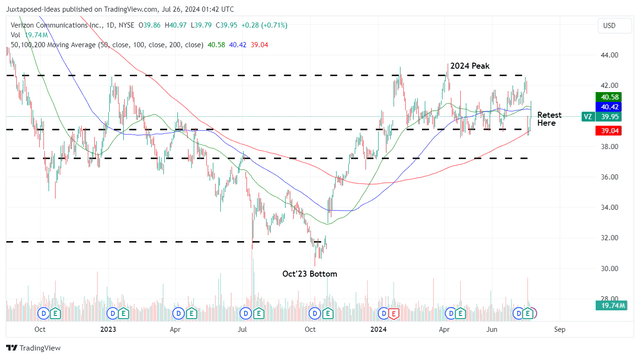

VZ 2Y Stock Price

Trading View

For now, VZ has already returned its recent gains, while appearing to be well supported at its 2024 bottom of $39s and trading below its 50/ 100 day moving averages.

The recent correction is mostly attributed to the perceived miss in its FQ2’24 top-line at $32.8B (-0.5% QoQ/ +0.6% YoY) compared to the consensus estimates of $33.05B (+0.2% QoQ/ +1.3% YoY), attributed to “a decrease in wireless equipment revenue due to lower upgrade volumes.”

We believe that the market has over-reacted indeed, since the same has been reported by AT&T (T) in the recent earnings call, with the headwind attributed to Comcast’s (CMCSA) aggressive pricing plans launched in April 2024 and the latter’s resultant growth in revenues/ net adds.

For reference, VZ reported wireless equipment revenue of $5B (-6.7% QoQ/ -5.3% YoY), with this headwind well balanced by the growing Consumer wireless services revenue to $16.3B (+1.2% QoQ/ +3.7% YoY), attributed to the growing ARPA.

Most importantly, the net effect remains somewhat stable, with the total Consumer revenue still increasing to $24.9B (-0.7% QoQ/ +1.5% YoY) and the management still reporting 218K fixed Consumer wireless net additions (+7.3% QoQ/ -13.4% YoY) in the quarter.

This is proof that VZ’s launch of myPlan in May 2023 has worked as intended in growing its subscriber base, with “over 30% of our subscribers using it” and explaining why the management has expanded this strategy to Home Internet with myHome in June 2024.

Combined with the expanding Consumer segment adj EBITDA margins of 44.1% (+1.5 points QoQ/ +1 YoY), it is unsurprising that the bulls have quickly defended the recent correction with the stock likely to moderately recover moving forward.

This may be further aided by VZ’s robust net additions for both mobility and fixed wireless in the Business segment, with the 156K postpaid phone net additions (+73.3% QoQ/ +8.3% YoY) being the highest result since fourth-quarter 2022 and 160K fixed wireless net additions being the best quarterly result to date (+5.9% QoQ/ +20.3% YoY).

These incremental improvements in its performance metrics across Consumer and Business on a QoQ/ YoY basis also underscore why the management has reiterated their FY2024 guidance, implying that readers should buy the dip.

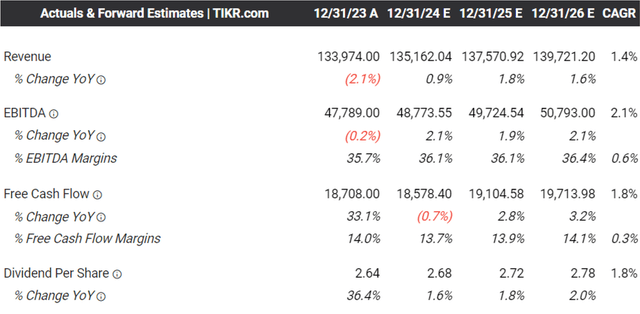

The Consensus Forward Estimates

Tikr Terminal

Readers must also note that the consensus have upgraded their forward estimates, with VZ expected to report increasingly rich adj EBITDA margins and Free Cash Flow margins through FY2026, compared to the average of ~35.8% and ~13% reported over the past five years, respectively.

This development is unsurprising indeed, since it builds upon on the expanding YTD adj EBITDA generation of $24.36B (+2.4% YoY) and Free Cash Flow generation of $8.5B (+6.2% YoY).

Despite the higher effective interest rate on its long-term debts at 5.1% (+0.3 points YoY), VZ has also delivered on its promise to consistently deleverage its balance sheet.

By FQ2’24, the telecom reported $125.3B of long-term debts (-2.4% QoQ/ -4.6% YoY) and a lower net-debt-to-EBITDA ratio of 2.5x, down from 2.6x in FQ1’24/ FQ2’23 and nearer to the management’s target of 2.25x.

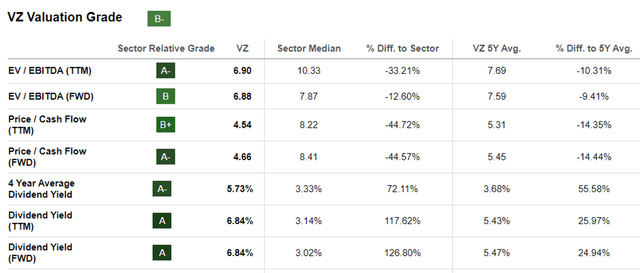

VZ Valuations

Seeking Alpha

This is also why we believe that VZ remains overly discounted at FWD EV/ EBITDA valuations of 6.88x and FWD Price/ Cash Flow valuations of 4.66x, compared to their 5Y mean of 7.59x/ 5.45x and the sector median of 7.87x/ 8.41x, respectively.

While VZ may appear to trade at a premium compared to its direct peer, AT&T (T) at FWD EV/ EBITDA valuation of 6.66x and FWD Price/ Cash Flow valuation of 3.76x, this is attributed to the former’s projected growth in adj EBITDA at a CAGR of +2.1% and FCF at +1.8% through FY2026, compared to the latter at +2.3%/ -7.2%, respectively.

As a result of VZ’s accelerated profitable growth prospects compared to the historical levels at +0.2%/ +1.1% between FY2018 and FY2023, respectively, we believe that its current valuations appear to be reasonable, offering interested investors with an excellent margin of safety.

So, Is VZ Stock A Buy, Sell, or Hold?

VZ 20Y Stock Price

Trading View

Thanks to the recent pullback, VZ now offers a richer dividend yield of 6.71%, improved than our previous article levels of 6.62% and 2020 bottom of ~4%, though moderated from the October 2023 peak of 8.55%.

These yields are particularly attractive, especially since the European Central Bank [ECB] has already announced a rate cut from 4% to 3.75% by June 2024, while joining other countries such as Canada, Sweden, and Switzerland.

With inflation already cooling on a QoQ/ YoY basis, we believe that the US Fed pivot is unlikely to be far behind, with the macroeconomic outlook eventually normalizing over the next few years.

Combined with VZ’s robust YTD profit margins and the reiterated FY2024 guidance, we also concur with the Seeking Alpha Quant’s upgraded rating in Dividend Safety Grade from the previous C grade to C+ grade.

Lastly, long-term investors may look forward the upcoming hike typically announced in August/ September, building upon the previous raise by +1.9% and the 5Y Dividend Growth rate of +1.99%.

As a result of its robust dividend investment thesis, we are maintaining our Buy rating for the VZ stock here. Do not miss this dip.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

The analysis is provided exclusively for informational purposes and should not be considered professional investment advice. Before investing, please conduct personal in-depth research and utmost due diligence, as there are many risks associated with the trade, including capital loss.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.