Summary:

- Verizon Communications’ acquisition of Frontier Communications Parent will expand its fiber network and potentially generate significant synergies, including $500 million in annual cost savings.

- Frontier Communications Parent has struggled with declining revenues and profits but shows growth in fiber broadband customers and ARPU, making it an attractive target.

- The success of the acquisition hinges on Verizon’s ability to capture synergies, reduce interest expenses, and leverage cross-selling opportunities to enhance cash flows.

- Despite risks, the deal is likely beneficial for Verizon, warranting a ‘buy’ rating, while Frontier’s current trading price suggests a soft ‘buy’ due to the buyout premium.

photobyphm

Late last week, news broke that telecommunications giant Verizon Communications (NYSE:VZ) had struck a deal to acquire Frontier Communications Parent (NASDAQ:FYBR) in an all-cash transaction that will make it one of the largest acquisitions of 2024. This purchase will significantly expand the reach of Verizon Communications from a fiber perspective. It also opens up the door for additional significant cash flows. The extent to which the deal makes sense though is a bit more complex. A lot of the attractiveness of this transaction hinges on the ability of Verizon Communications to capture the synergies that they anticipate. Even without this, I would hesitate to say that the transaction is bad. But there is a difference between good and great.

A look at Frontier Communications Parent

Those who follow my work closely know that I have written in the past about Verizon Communications. My last article on the company was published in July of this year. At that time, I said that the picture for the business was improving enough to warrant an upgrade from a ‘hold’ to a ‘buy’. This was based on certain improvements the company had made and it was based on how shares of the company were priced. Since then, things have gone nicely. Shares are up 6.4% at a time when the S&P 500 is down 1.6%.

Frontier Communications Parent is a different story entirely. Back in May of 2019, I rated its predecessor company, Frontier Communications, a ‘sell’. Because of operational difficulties and a major asset sale that the company completed that came at a rather high cost but that was necessary in order to reduce debt, I felt as though prospects for shareholders weren’t looking all that great. But a lot has transpired since then. Less than a year later, in April of 2020, the company entered into bankruptcy under Chapter 11. One year after that, in April of 2021, the company exited bankruptcy as a new publicly traded firm. Since then, management has been working hard to improve operations. And recent performance figures have been encouraging to an extent.

At first glance, data provided by the company looks disappointing. Consider the 2022 to 2023 period of time. In 2022, the company generated $5.79 billion worth of revenue. Sales dropped slightly to $5.75 billion in 2023. A lot of the company’s problems stemmed from the fact that the number of copper broadband consumer customers that it had dropped from 1.04 million to 822,000. Over the same window of time, the number of copper broadband business and wholesale customers dropped from 136,000 to 114,000. But even at that point in time, there were some signs of life. In particular, the company was doing well when it came to its fiber broadband operations. The total number of consumer customers rose from 1.58 million to 1.88 million.

Fiber is all the rage these days. Telecommunications companies are investing heavily in it. The fact of the matter is that these kinds of investments are necessary in order for the continued growth of all things digital. Their greater capacity for high-speed data transfer is integral to the success of more advanced applications, such as those regarding AI and cloud computing. So it’s not shocking to me to see such a nice increase in these users. It also helps that, in 2023, the average fiber broadband consumer customer was responsible for monthly ARPU (average revenue per user) that was about 20.9%, or $10.96, greater than their copper broadband counterparts.

Even though revenue dipped only slightly, Frontier Communications Parent saw a big decline in its net profits from $441 million to only $29 million. A rise in operating costs, mostly involving depreciation and amortization, combined with lower investment and other income, as well as higher reorganization expenses, pushed net profits down accordingly. Other profitability metrics fared better, but they still suffered. Operating cash flow fell from $1.40 billion to $1.34 billion. If we adjust for changes in working capital, we get a decline from $1.97 billion to $1.65 billion. And finally, EBITDA for the company fell from $2.40 billion to $2.19 billion.

Moving into the 2024 fiscal year, there have been some more impressive signs of life for the business. Revenue for the first half of the year actually increased year over year, climbing from $2.89 billion to $2.94 billion. Even though the number of copper broadband consumer customers continued its descent, falling from 928,000 to 721,000, the number of consumer customers involving fiber broadband jumped from 1.72 million to 2.05 million. During this time, ARPU for the fiber broadband customers at the consumer level increased from $63.12 per month to $65.32 per month.

During this time, Frontier Communications Parent did see a decline in net profits from $1 million to negative $122 million. In addition to seeing depreciation and amortization costs rise, the company also suffered from a surge in interest expense from $290 million to $398 million. Other profitability metrics were far more stable. Operating cash flow grew from $665 million to $709 million. On an adjusted basis, the decline was modest from $739 million to $718 million. Meanwhile, EBITDA for the company grew from $978 million to $1.05 billion.

A major move

When set beside the behemoth known as Verizon Communications, it may seem peculiar that management would be interested in a business that isn’t doing all that great. However, there are two very specific reasons why Verizon Communications seems to be interested in the company. The first and easiest to explain relates to operational synergies. Within the first three years of the deal closing, the management team at Verizon Communications expects to capture about $500 million in annual run rate operating cost savings. These savings should come from a variety of things such as cross-selling benefits, savings from getting rid of duplicative functions, certain go to market savings under the marketing, advertising, and other parts of the company, and certain third-party contract synergies and customer experience improvements.

Even a cursory glance suggests to me that there could be some easy pickings for the company. For starters, while monthly ARPU for fiber broadband for Frontier Communications Parent start at $65.32 during the first half of this year, that number for Verizon Communications was $101.29. In addition to this, as part of its acquisition, Verizon Communications is taking on $11.24 billion worth of gross debt that is currently on the books of Frontier Communications Parent. The weighted average interest rate of this debt was 7.1% in the most recent quarter. By comparison, for Verizon Communications, its weighted average interest rate is currently 5.1%. Eventually, transferring all of this over could reduce annual interest expense by $224.8 million.

Another reason for this move is that it will significantly expand Verizon Communications’ fiber network. As you can see from the image above, while Frontier Communications Parent is rather spread out, a lot of its network connects with or overlaps with Verizon Communications’ fiber network. This makes it easy for Verizon Communications to expand westward and to further densify its network in parts of the northeastern United States. It also gives the company a presence in key markets, including many parts of California and key parts of Texas.

Altogether, the combined firm will have 25 million fiber passings spread across 31 States and Washington DC. And that number should only grow. Today, Frontier Communications Parent has just over 7 million fiber passings. But by 2026, it’s expected to grow this number to 10 million. All combined, the company will have around 10 million fiber subscribers once the deal is closed. They will also have about 3.8 million FWA. For those not familiar with it, it refers to ‘fixed wireless access’. This is essentially 5G or 4G LTE that uses wireless technology in order to achieve broadband access as opposed to fiber optic cables. It does this by means of radio waves that send high-speed signals where needed. But I digress.

These investments are incredibly important for a company like Verizon Communications. I say that because over 100% of all industry net additions when it comes to broadband have involved fiber and FWA over at least the last five quarters. Cable and DSL are on the way out. So making this transition is incredibly important for the long haul. This expanded reach will help Verizon Communications significantly grow its mobile+home offering. This is because it will open it up to 22 new states. Management pegs this as being a joint subscriber opportunity of around 1 million. In all likelihood, there will be other types of cross-selling opportunities as well.

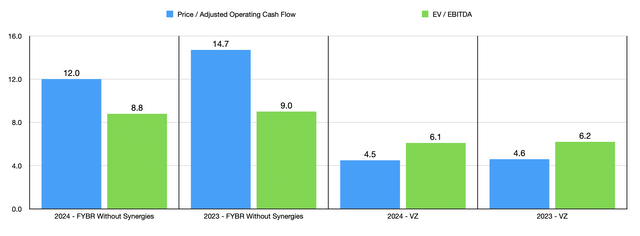

Naturally, buying up a company like Frontier Communications Parent is not cheap. Management pegs the purchase price, inclusive of net debt, at about $20 billion. Based on my own math, it’s a bit closer to $19.63 billion. As I stated at the outset of this article, the extent to which this transaction makes sense will center around the aforementioned synergies. In the first chart above, you can see how Frontier Communications Parent is being priced without synergies. For the price to adjusted operating cash flow multiple, this assumes that Verizon Communications will be able to borrow a full $19.63 billion at its current weighted average cost of debt of 5.1%.

The chart also shows how Verizon Communications is currently valued. Especially when it comes to operating cash flow, this purchase is considerably more expensive than what Verizon Communications is going for. But considering the benefits coming from the deal, I would hesitate to say that the company is drastically overvalued. This is especially true since it will prove incremental to cash flows while trading at an EV to EBITDA multiple that is only a bit higher than what Verizon Communications is currently trading for.

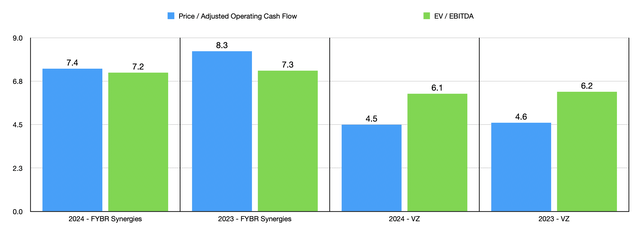

In the next chart above, you can see the same calculations. The only difference is that this assumes $500 million in annual run rate synergies. It also factors in a 21% tax rate on those synergies. In this case, the picture looks quite a bit better. While Verizon Communications is paying a higher multiple than what it is currently trading for, the multiples would still place the company in the undervalued category as far as I am concerned. This is particularly the case when using the EV to EBITDA approach.

Takeaway

Fundamentally speaking, I find this transaction made by Verizon Communications to be interesting. The company doesn’t seem to be making a bad move. But the extent to which it is really attractive will depend on management’s ability to extract cost savings from these new assets. All in all, I feel as though this warrants a ‘buy’ rating for Verizon Communications. I am not as optimistic when it comes to Frontier Communications Parent from a fundamental perspective. Having said that, shares of it are currently trading at $35.51. By comparison, the buyout price is $38.50. This implies a gap of 8.4% that should carry with it relatively little risk. There are certainly risks out there, such as the deal falling through because of regulatory concerns. But for those who think that’s unlikely, I would say that it warrants a soft ‘buy’ at this time.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

Crude Value Insights offers you an investing service and community focused on oil and natural gas. We focus on cash flow and the companies that generate it, leading to value and growth prospects with real potential.

Subscribers get to use a 50+ stock model account, in-depth cash flow analyses of E&P firms, and live chat discussion of the sector.

Sign up today for your two-week free trial and get a new lease on oil & gas!