Summary:

- AT&T has outperformed Verizon Communications this year, but Verizon’s current valuation makes it an attractive investment opportunity, earning it a solid ‘buy’ rating.

- Verizon’s third-quarter revenue was flat year-over-year, with growth in consumer services offsetting declines in wireless equipment sales and business segment revenue.

- Despite a drop in profitability due to restructuring costs, Verizon’s EBITDA showed a marginal increase, and its lower leverage compared to AT&T is a positive.

- Verizon’s future looks promising, but AT&T’s consistent growth projections and unique assets like the FirstNet network make it a slightly better investment.

RiverNorthPhotography

Those who follow my work closely know that I am a big fan of certain companies in the telecommunications space. One of my favorite businesses on the planet has got to be AT&T (T). Year to date, its shares are up 40.6%. It happens to be one of my best performers and I regret not buying more of it. However, one other player in the market that I have been bullish on, even if not as much as AT&T, is Verizon Communications (NYSE:VZ). So far this year, Verizon Communications has seen upside of only 13.2%. This disparity compared to its competitor likely stems from the fact that AT&T has been a turnaround play in action and that the results of that turnaround, when combined with how cheap shares were even relative to Verizon Communications, helped to fuel significant upside.

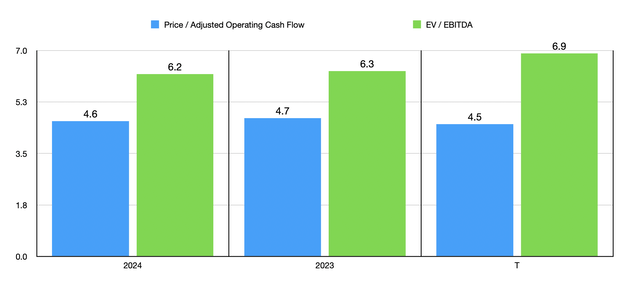

Fast forward to today, and this pricing disparity has essentially evaporated. In fact, on an EV to EBITDA basis, Verizon Communications is actually cheaper than its competitor. Fundamentally speaking, I believe that Verizon Communications makes for an attractive opportunity for investors. However, because of some of the volatility in its financial results, I believe that the discount it’s trading at relative to AT&T is warranted. At the end of the day though, this doesn’t change my previous assessment that the company deserves a ‘buy’ rating.

Still appealing

Over the past several months, I have written a couple of articles about Verizon Communications. In my most recent article, I discussed the firm’s decision to acquire Frontier Communications Parent (FYBR) for approximately $20 billion. The purpose of this article is not to go through those details again. In fact, since the transaction has not yet closed, I believe that it’s best to focus on Verizon Communications as a standalone enterprise. While Frontier’s investors did recently approve of the deal, it likely will face meaningful regulatory scrutiny, plus management doesn’t expect the transaction to close until the first quarter of 2026. So none of my figures will be factoring in that transaction. If you do want my insight on that, I would refer you to the aforementioned article.

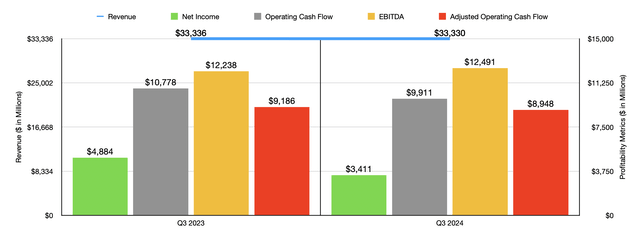

With that in mind, it’s time to dig in. The most recent data that we have regarding Verizon Communications involves the third quarter of the company’s 2024 fiscal year. Revenue for the company came in at $33.33 billion. This is essentially flat compared to what the company achieved during the third quarter of 2023. To best understand why revenue remained flat, it probably is best to look at the firm’s operating segments.

The first of these is its Verizon Consumer Group, which in the latest quarter accounted for 75.9% of the firm’s overall revenue. This part of the company focuses on consumer focused wireless and wireline communications services and products provided by the enterprise. This includes things like fixed wireless access broadband, wireless phone services, Internet using its fiber optic network, and more. Just like with AT&T, Verizon Communications provides wireless services on both a postpaid and a prepaid basis. As is typical these days, the postpaid side of the business is considerably larger than the prepaid side is. The rest of the company’s revenue comes from its Verizon Business Group. This includes wireless and wireline communications services and products such as the aforementioned ones, but dedicated instead to businesses. The company also made clear that this part of its operations include its IoT (Internet of Things) products and services.

The consumer side of the company has been the growth part of it for some time. In the most recent quarter, $25.36 billion of revenue was generated from these operations. That represents an increase of 0.4% compared to the $25.26 billion generated by that part of the firm the same time last year. This growth occurred even though wireless equipment revenue contracted by 8.6% from $4.90 billion to $4.48 billion. Management attributed that decline mostly to lower volumes associated with wireless devices being sold. At the same time, service revenue for the company propped up by 2.2% from $18.85 billion to $19.26 billion.

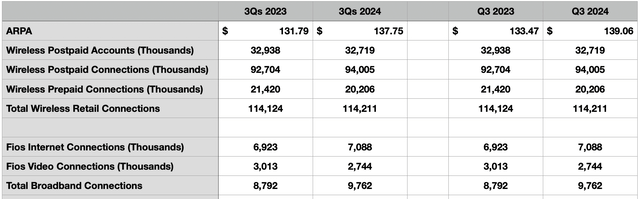

Year over year, Verizon Communications benefited from a rise in the number of wireless retail postpaid connections from 92.70 million to 94.01 million. This came at a time when wireless retail prepaid connections contracted from 21.42 million to 20.21 million. Even though this almost entirely offset the increase in postpaid accounts, the firm did see growth in some interesting areas. This included its Fios Internet platform, which saw growth from 6.92 million connections to 7.09 million connections. Total broadband connections grew from 8.79 million to 9.76 million over the same window of time.

Year over year, the company has seen an increase in revenue that is generating from its postpaid accounts. For the 32.72 million wireless retail postpaid accounts that the company ended the most recent quarter with, it generated $139.06 in ARPA (average revenue per account) each month. That’s up from $133.47 reported the same time last year. And for the first nine months of this year, the company achieved $137.75 compared to the $131.79 reported for the same five month window of 2023.

When it comes to the Verizon Business Group, we are dealing with a part of the firm that has been struggling. Overall revenue dropped 2.3% year over year in the most recent quarter, falling from $7.53 billion to $7.35 billion. This was in spite of the fact that wireless retail postpaid connections grew from 29.46 million to 30.53 million. Fios Internet connections jumped nicely from the 383,000 to 397,000, while total broadband growth was from 1.50 million to 2.16 million. Most of the weakness for the company when it comes to this segment involved its Enterprise and Public Sector operations that provides wireless products and services to large businesses and government agencies. Management attributed this to market pressure and a change in technology that is altering the landscape of this market. A reduction in customer premise equipment sales volumes also negatively impacted operations. Fortunately, some of the company’s other operations in this segment improved, thanks to higher pricing and a rise in the company’s fixed wireless access subscriber base.

Even though revenue was virtually flat year over year, profitability for the business took a hit. Net income dropped from $4.88 billion to $3.41 billion. Management chalked this up mostly to ‘special items’ that consisted mostly of $1.73 billion of additional selling, general, and administrative expenses. This was due to higher severance charges as the company works to restructure its operations for the long haul. But there were other expenses as well, such as a $374 million pre-tax asset and business rationalization charge that was mostly because of the firm’s decision to cease using certain real estate assets, and its decision to exit certain lines of business.

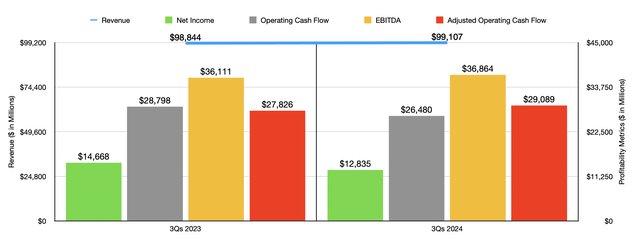

Other profitability metrics for the company also suffered during this time. Operating cash flow fell from $10.78 billion to $9.91 billion. If we adjust for changes in working capital, we get a drop from $9.19 billion to $8.95 billion. And finally, when it comes to EBITDA, we did get an increase, but only a marginal one from $12.24 billion to $12.49 billion. In the chart above, you can also see results for the first nine months of 2024 compared to the same time of 2023. In this case, revenue did increase year over year. However, with the exception of EBITDA and adjusted operating cash flow, the firm’s profit and cash flow results were all lower compared to the same time of 2023.

When it comes to the rest of this year, we don’t have a lot to work with. Management did say that EBITDA in 2024 should be between 1% and 3% above what it was in 2023. If we take the midpoint of guidance here, that would give us a reading of $48.75 billion. If we assume that the other profitability metrics will rise at the same rate, that would translate to adjusted operating cash flow of $38.50 billion. And hitting the midpoint of guidance when it comes to adjusted earnings per share would give us adjusted net profits of $19.44 billion compared to $19.85 billion achieved during the 2023 fiscal year.

Using these estimates, as well as the historical results for the 2023 fiscal year, we can see in the chart above how the stock is currently priced. When it comes to these types of firms, I really don’t like to value based on earnings. So I did leave the price to earnings multiple out of the picture. But when it comes to the price to adjusted operating cash flow multiple and the EV to EBITDA multiple, it’s clear that Verizon Communications is attractively priced. In the same chart, you can also see how the stock is valued relative to my favorite player in the space, AT&T. No longer are shares of Verizon Communications trading at a meaningful premium to its competitor. And on an EV to EBITDA basis, it’s actually cheaper.

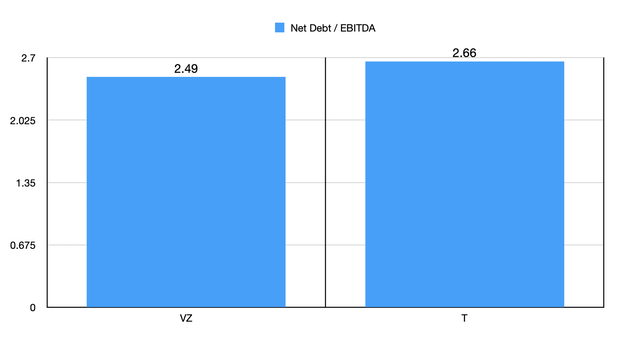

Another thing that Verizon Communications has compared to AT&T is lower leverage. In the chart below, you can see the net leverage ratio of each of the firms. When it comes to Verizon Communications, this is after stripping out the $24.3 billion in asset back to debt that the company has. I have long maintained that neither company has leverage that is too high. But all things being equal, you would want leverage to be lower.

With data points like this, you might think that I am crazy for still favoring AT&T over Verizon Communications. However, it’s not just about where things stand today. It’s also about where they are moving. This year, for instance, Verizon Communications has said that EBITDA will be between 1% and 3% higher than it was last year. For AT&T, the company has projected a growth rate of 3%. And for the next couple of years, as I detailed in my prior article about the firm, it’s expecting growth to be 3% or greater on an annualized basis. Add on top of this other unique assets like AT&T’s FirstNet network that I have written about before, and I believe there are plenty of reasons to like it over Verizon Communications.

Takeaway

Based on all the data provided, I think that Verizon Communications is a solid enterprise. The firm is doing well and I suspect that the future for it will be positive. There are some weak spots that need to be addressed. And in my view, it’s not as good a play as AT&T happens to be. But it does justify a very solid ‘buy’ rating at this time.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of T either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

Crude Value Insights offers you an investing service and community focused on oil and natural gas. We focus on cash flow and the companies that generate it, leading to value and growth prospects with real potential.

Subscribers get to use a 50+ stock model account, in-depth cash flow analyses of E&P firms, and live chat discussion of the sector.

Sign up today for your two-week free trial and get a new lease on oil & gas!