Summary:

- Verizon Communications Inc. is a well-managed company with high EBITDA and free cash flow, poised to announce a dividend hike.

- Verizon Communications’ stock is undervalued, with potential for growth due to strong Free Cash Flow and growing dividend.

- The company’s focus on debt repayment could lead to a re-rating to its intrinsic value, providing potential upside for investors.

RiverNorthPhotography

Verizon Communications Inc. (NYSE:VZ) (NEOE:VZ:CA) is a well-managed telecommunications company with a high, recurring level of EBITDA and free cash flow.

The Telco earns its dividend with Free Cash Flow on a full-year basis and is poised to announce a dividend hike for the coming year.

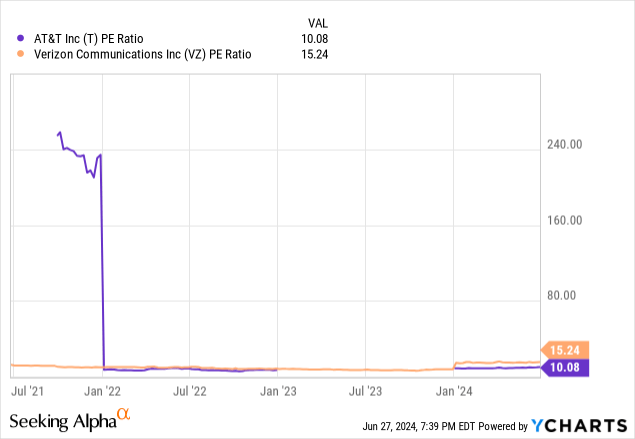

Taking into account that Verizon Communications is selling at a cheap earnings multiple and that the Telco continues to have subscriber tailwinds in its Broadband segment, I think that the risk/reward ratio for VZ remains quite compelling.

A focus on debt repayments could be a catalyst for Verizon Communications to re-rate to its intrinsic value.

My Rating History

In my last piece on Verizon Communications, I highlighted the company’s Broadband momentum as one reason why the stock was appealing to passive income investors.

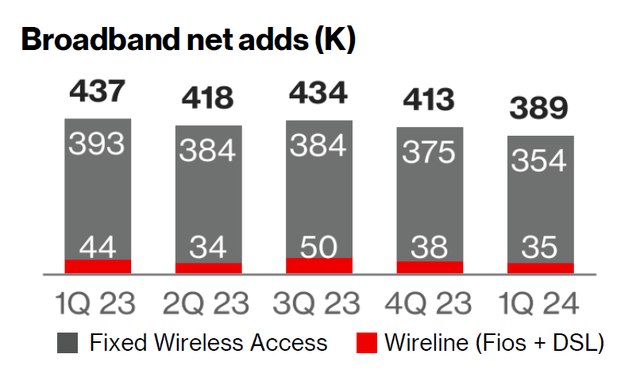

In the first quarter, the Telco continued to make a good impression with its growing subscriber base and total Broadband net additions amounting of 389K. I think that Verizon Communications will choose, as AT&T Inc. (T) did, to repay more of its debt in the coming quarters.

Free Cash Flow, Broadband Upside

Verizon Communications is primarily a ‘Strong Buy’ for its sizable Free Cash Flow. Telcos don’t tend to have a lot upside in sales, EBITDA or Free Cash Flow, but the amount of cash that large telecommunications companies rake in, is at least ensuring a steady flow of dividend income to passive income investors.

Verizon Communications added 389K new subscribers to its Broadband network in the first quarter, which included more than 50K Fios internet net additions. Broadband Business had 151K fixed wireless net additions in 1Q24.

Broadband is doing well for Verizon Communications and the ongoing momentum in net additions, well above 300K per quarter, is the most compelling reason to own a piece of the Telco’s Broadband action.

Broadband Net Adds (Verizon Communications)

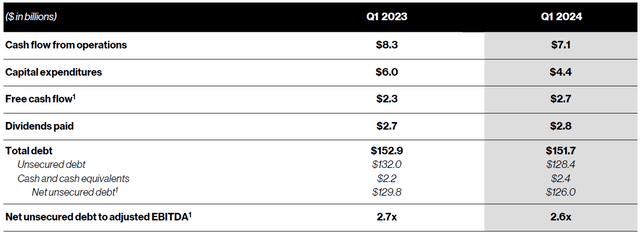

Verizon Communications produced $2.7 billion in Free Cash Flow in the first quarter, which showed an improvement of $400 million compared against 1Q23.

Free Cash Flow was not sufficient, however, to cover the first quarter dividend of $2.8 billion and the Telco fell $100 million short of its payment obligation. The Free Cash Flow dividend pay-out ratio was 103% in 1Q24.

With that said, though, Verizon Communications’ Free Cash Flows tend to even out during the course of the business year and the Telco is widely anticipated to more than earn its dividend pay-out in 2024.

In the prior year, despite also under-earning its dividend with FCF in 1Q23, Verizon Communications ended up earning $18.7 billion in Free Cash Flow and paying out 59% of its Free Cash Flow as dividends.

Free Cash Flow (Verizon Communications)

A New Dividend Will Be Announced In 3Q24

In the case of Verizon Communications, and in a major contrast to A&T, the Telco’s dividend is growing. The dividend is presently anchored at $0.665 per share per quarter, but Verizon Communications is anticipated to soon announce its new dividend for the third quarter, which is when the Telco ordinarily raises its pay-out.

In my view, the dividend could rise to a range of $0.675-0.680 per share in 3Q’24 if the company’s last dividend hike serves as a benchmark. Thus, I am looking forward to getting a 2% raise on my dividend income. The present yield for Verizon Communications is 7%.

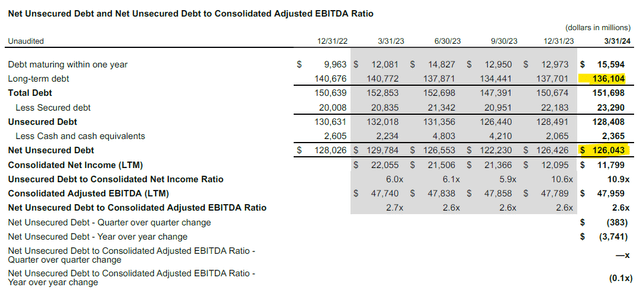

Verizon Communications Under Pressure To Do More About Its Debt

AT&T is moving into the direction of lowering its debt repayments, which I think could put Verizon Communications under pressure to do the same. Both companies have long-term debt way north of $100 billion, and AT&T recently paid $4.7 billion of its long-term debt maturities in 1Q24 and thereby reduced its total net debt by $6.0 billion.

Verizon Communications is not doing as much, the Telco lowered its long-term debt only by $1.6 billion in the last quarter, but there is room for improvement, primarily because of the Telco’s Free Cash Flow pay-out ratio that is likely to clock in somewhere in the 50-percent range in 2024 (as it did in 2023). This excess Free Cash Flow could be applied to the Telco’s enormous outstanding long-term debt and lower the company’s leverage.

Long-Term Debt (Verizon Communications)

Verizon Communications Is Still A Steal

What can’t be argued about, in my view, is that Verizon Communications’ stock is still a steal. Selling for only 8.7x leading earnings, whereas AT&T is selling for 8.1x leading earnings. Both Telcos are a bargain, as far as I am concerned because both Verizon Communications and AT&T cover their dividend pay-outs with Free Cash Flow. In the case of Verizon Communications, passive income investors get the added benefit of actually seeing a growing dividend.

I think that VZ and T are both fundamentally undervalued, as both companies produce a substantial amount of Free Cash Flow. I made the argument lately, in the case of AT&T that the Telco could be valued at 10-11x leading earnings, which is the same argument I am making here (because of its excess FCF). This multiple range leaves us with between 15% and 27% upside, or an intrinsic value interval of $47 to $52.

Why The Investment Thesis Might Disappoint

Passive income investors should not anticipate much in terms of re-rating potential, in my view, unless Verizon Communications moves forward with a concrete debt reduction plan.

What has been holding back Verizon Communications’ stock price is the Telco’s substantial debt burden that is taking a bite out of earnings and weighing on sentiment. If Verizon Communications fails to do something about its substantial debt, I do not see a path for a higher stock valuation.

My Conclusion

Verizon Communications profits from momentum in its Broadband segment, and the company enjoyed a good amount of customer net additions in the first quarter, as it did in the past couple of quarters.

Unless something really out of the ordinary happens, I would think that this momentum has continued in the second quarter and I anticipate that the Telco added a number close to 400K subscribers to its Broadband unit in 2Q24 also.

What makes Verizon Communications a gift is its high Free Cash Flow that is available to passive income investors at a very low price, an 8.7x earnings multiple.

The dividend is poised to grow in 3Q24, and I am looking forward to receiving a 2% hike for my dividend income stream.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of VZ either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.