Summary:

- Verizon investors got spooked after a recent earnings revenue miss of $257 million caused a big sell-off in the stock.

- Despite the strong attributes of Verizon listed by bullish analysts, Wall Street has punished the stock for a very small top-line miss.

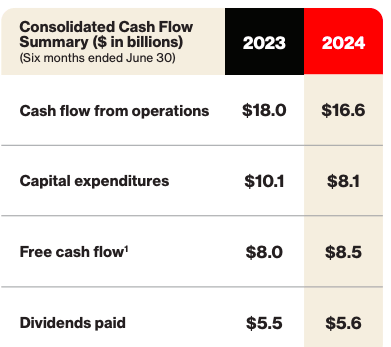

- The drop in capital expenditure has improved the free cash flow of the Company, but this will not create a big dent in the debt pile of close to $150 billion.

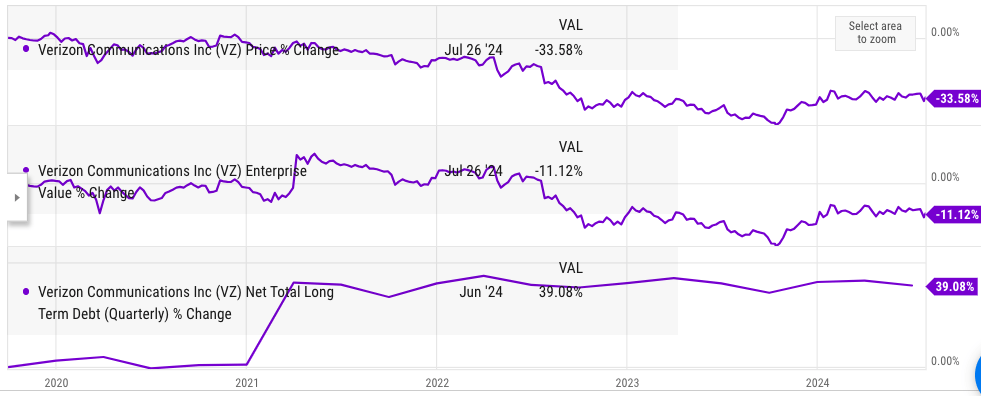

- The enterprise value of VZ stock has been stable for the last few years, despite a big decline in market cap because of the increase in long-term debt.

- Rate cuts will unlikely change the sentiment towards the stock as other headwinds continue to pull the stock down.

hapabapa

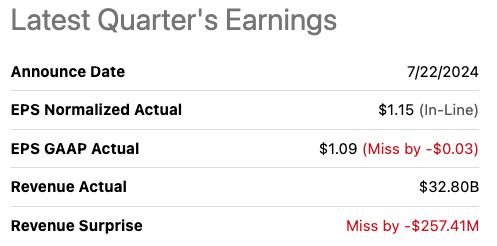

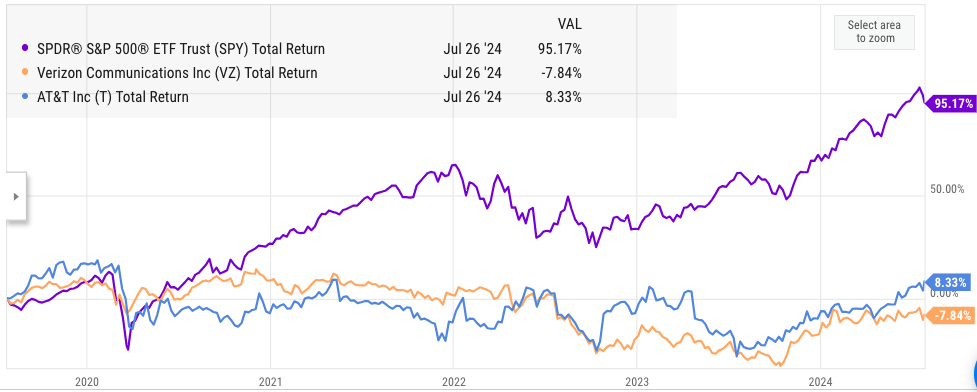

Verizon (NYSE:VZ) stock saw a strong correction after earnings, as the company announced a revenue miss of $257 million on actual revenue of $32.8 billion. The EPS was in line with the expectations and this did not stop the stock from showing a big dip. If a minor miss can cause the stock to correct, it can be a sign that Wall Street does not see other bullish factors working for the company. Since the previous article on Verizon published in December 2023, the stock has given total returns of 12% compared to 16% by S&P500.

There has been an increase in free cash flow as the 5G capex needs have been reduced. However, the management needs to balance the need to raise dividends and try to pay down the massive debt load. Prior to the pandemic, Verizon’s stock price was close to $60. Since then, the stock price has declined to $40, which might seem like an overreaction by Wall Street considering the stable fundamentals of the company. However, the long-term debt has increased from $105 billion in 2020 to close to $150 billion currently. This has caused the enterprise value, which includes market cap and long-term debt, to remain relatively stable. Looking at the enterprise value, the stock does not seem like a deep value as is shown by some bullish analysts.

A fed rate cut might finally be within view, but this is unlikely to change the dynamics for Verizon stock due to other headwinds faced by the company. There is barely any revenue growth, and Wall Street is ready to punish the stock for even a small top-line miss. The yield of more than 6.5% seems attractive to income investors, but the company has a long history of underperforming S&P500 in terms of total returns, by a wide margin. Despite the recent correction, Verizon stock continues to be a Sell and is likely to underperform S&P500 in the near to medium term.

Punished for minor revenue miss

Bullish analysts have called out the recent correction in Verizon stock as the company missed the revenue estimates by $257 million, which is equal to 0.7% of the total revenue base of $32.8 billion. However, Wall Street’s correction can be seen as a warning for Verizon, which shows that the market is not going to give the company any leeway. It will need to deliver results that meet expectations, and any small miss will cause a big correction in the stock.

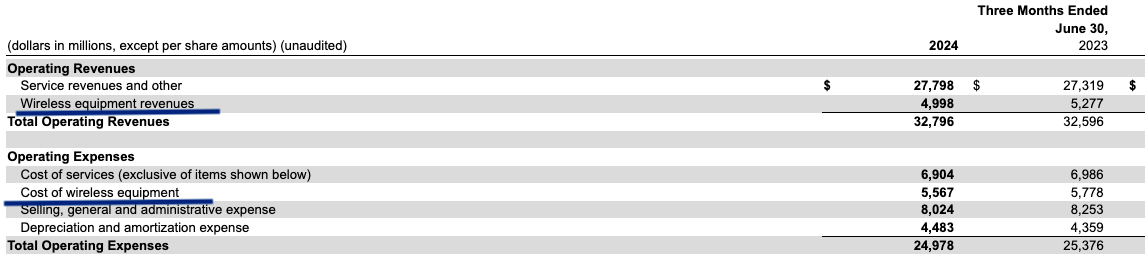

Seeking Alpha

Most of the decline has been due to a dip in Wireless equipment revenues, which fell from $5.277 billion in the year-ago quarter to $4.998 billion in the recent quarter. Customers have not been upgrading their phones as frequently, which has reduced this revenue stream. Almost all the revenue miss in the recent earnings can be attributed to the $270 million decline in equipment sales. However, this segment does not contribute any profits for the company. The operating expenses of wireless equipment was $5.567 billion in the recent quarter. This shows that the company operates this segment at a loss.

Verizon Filings

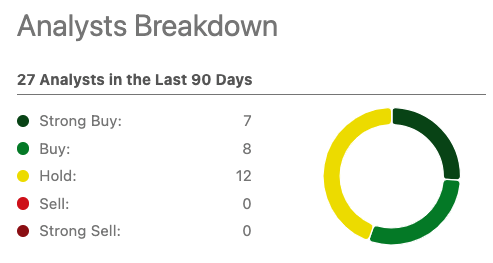

Wall Street has overlooked this aspect and has focused on the top-line miss. It is unlikely that the market will get more bullish on Verizon, despite a better Buy rating by analysts.

Wall Street analysts, Seeking Alpha

Enterprise value vs. Market cap

Despite the bullish rating for Verizon at the current price, it is unlikely that the stock will move close to the pre-pandemic level of $60. Prior to the pandemic, the enterprise value of Verizon was close to $350 billion. This has declined to $320 billion after the recent correction. The correction in enterprise value is minor compared to the 33% decline in stock price. The main reason is the massive debt taken by the company to expand its 5G network. Over the last 5 years, the net long-term debt of Verizon increased by a whopping 40% from $105 billion to $145 billion. Unless the company is able to make a big enough dent in this debt load, we are unlikely to see a strong bullish sentiment towards the stock.

YCharts

Looking at the enterprise value, the stock does not appear extremely cheap. The additional debt has increased the risk for the company, and any miss in performance would be punished by Wall Street.

Risk to the bearish thesis

The dividend yield for Verizon is 6.64% which looks very attractive. The company has also given close to 2% CAGR improvement in dividends over the last five years. The free cash flow easily covers the dividend payment, and the capex requirement for the next few years is also quite low. These are some of the positive factors for Verizon.

Verizon Filings

If the management is able to rapidly pay down the debt, we could see a more bullish sentiment towards the stock. However, Verizon also has to pay huge dividends and continues to increase these dividends. This is a tight rope for management, which reduces the possibility of a strong bullish rally in the stock.

A fed rate cut is also seen as a possible tailwind for Verizon. Investors looking for stable income could put more resources in mature companies like Verizon, who have a track record of increasing dividends.

Future trajectory of the stock

The company is a long way off from reducing the debt load to reasonable levels. A buy-and-hold strategy is also not a good option for mature companies like Verizon and AT&T (T). Both of them have massive underperformed S&P500 over the longer period, which reduces the attractiveness of their massive dividend yield.

YCharts

Investors looking to buy the recent dip should carefully look at the long-term debt reduction possibility of Verizon. Unless the debt pile is reduced substantially, we could continue to see the stock getting punished for even small earnings misses. Verizon remains a Sell at the current price.

Investor Takeaway

Verizon has seen a big dip in stock price post-earnings, as the revenue missed estimates by $257 million. This is a small miss compared to $32.8 billion in quarterly revenue. Most of the revenue decline was in the non-profitable wireless equipment segment. However, Wall Street has still been very bearish towards the stock.

Over the long term, the enterprise value of the company appears to be quite stable compared to the big decline in stock price in the last five years. This is because of the additional debt. The dividend payments appear to be safe in the near term as capex requirements have reduced. But this is unlikely to help the stock build a bullish run. I maintain the Sell rating for the stock.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.