Summary:

- Frontier Communications is being acquired by Verizon for $38.50 per share in cash, expected to close in 18 months.

- Frontier’s financials show marginal revenue growth but significant cash burn and debt, which Verizon will likely refinance at lower rates.

- The merger offers long-term value by accelerating Frontier’s shift to fiber, but regulatory risks could impact the effort to combine the companies.

- Frontier shareholders should consider selling near the deal price due to regulatory hurdles, while Verizon investors should be cautious of the 18-month timeline and risks.

JHVEPhoto/iStock Editorial via Getty Images

Introduction

Frontier Communications (NASDAQ:FYBR) is a telecommunications company reinventing itself after restructuring during the pandemic. While I have not written about the company since its emergence from bankruptcy, I revisited Frontier’s situation earlier this week. Before I could finish my analysis, Verizon (NYSE:VZ) announced that they were acquiring Frontier for an all-cash transaction valued at $20 billion. The deal would give Frontier shareholders $38.50 per share in cash and is expected to close in 18 months. While I expect the deal will add long term value to Verizon shares, the timeline for closing and the regulatory risks have me waiting to invest.

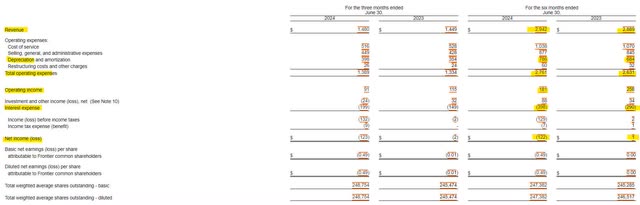

Frontier Communications Financial Results

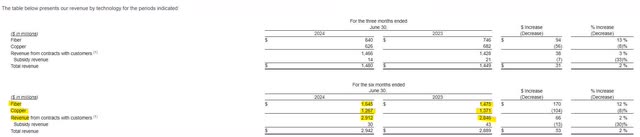

Frontier Communications has seen its sales grow marginally in 2024. During the first six months of the year, revenue came in at $2.9 billion, an increase of $53 million or less than 2% compared to a year ago. Unfortunately, operating expenses rose by more than revenue with expenses rising by $130 million compared to a year ago. Most of the expense growth was tied into depreciation expenses, which are noncash related. Operating income declined to $181 million and interest expenses grew by more than $100 million, which led to the company generating a net loss of $122 million for the first half of 2024.

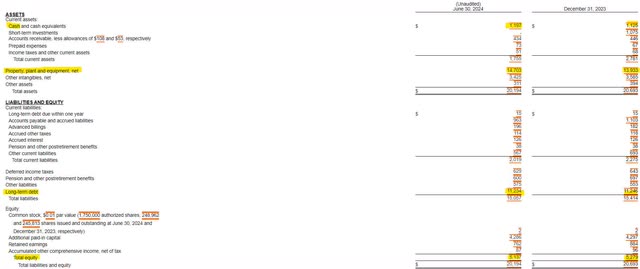

The bulk of Frontier’s balance sheet is property on the asset side and long-term debt on the liability side. The company is carrying a healthy cash balance of $1.1 billion, which it has sustained through the first half of the year. Long term debt has remained steady at $11.2 billion, but the company had to burn $1 billion in short term investments to make it capital commitments in 2024. Shareholder equity stood at $5.1 billion, a drop of more than $140 million.

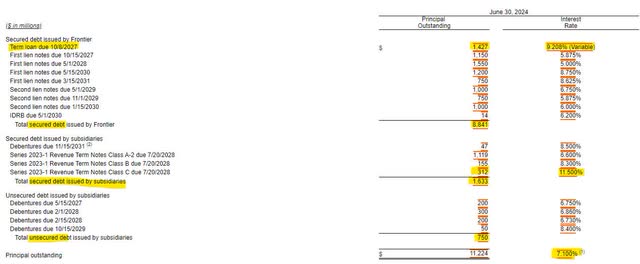

Frontier’s Debt Likely to Be Retired/Replaced with New Verizon Debt

The reason a $20 billion deal is being announced on a $7 billion market cap company is because Frontier has more than $11 billion in debt. This debt will likely be paid off at closing as part of the acquisition package. Frontier debt carries an average interest rate of over 7%, which is higher than the current debt rates for Verizon. I’m expecting Verizon to finance the bulk of this deal through the issuance of long-term debt, which will grow that balance closer to $170 billion, but for every 100 basis points Verizon obtains financing under Frontier’s average debt rate, Verizon will be adding over $110 million to future annual earnings.

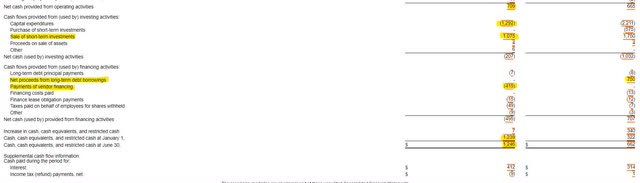

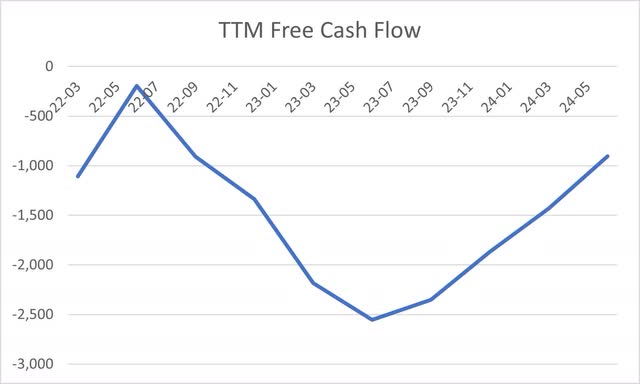

The Cash Burn Problem at Frontier

Despite having a $1.1 billion cash balance, Frontier Communications has a cash burn problem. Cash flow from operations did edge up during the first half of the year from $665 to $709 million. Unfortunately, the company spent $1.3 billion on capital expenditures, which led to a free cash flow burn of nearly $600 million. On a trailing twelve-month basis, Frontier’s free cash flow burn is just under $1 billion. At this pace, the company will consume its cash balance and need additional financing later in the second half of 2025.

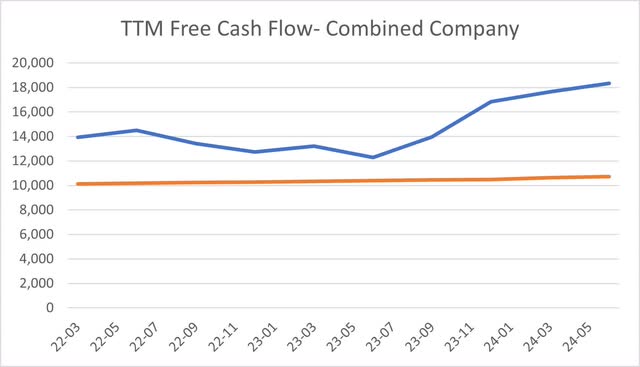

Verizon shareholders should continue to watch the cash flow situation at Frontier over the next 18 months to see how it will affect the combined company. Verizon has generated strong free cash flow which has recently grown from $15 billion to $19 billion over a trailing twelve-month period. The company can clearly absorb Frontier’s cash flow burn, but investors should be mindful of that combination in relation to the dividend obligations. As both companies currently stand, there is sufficient free cash flow to cover dividends by nearly $8 billion, but this number could be impacted by negative changes in earnings or share dilution (if Verizon opts to issue shares to fund the deal).

TIKR- Frontier and Verizon Cash Flow Combined

There is Long Term Value

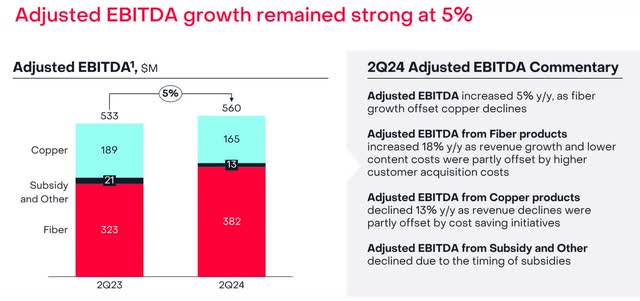

Frontier is transforming its business away from copper and into fiber as fast as possible. The company is seeing some notable results. Frontier grew its fiber sales by 12% during the first half of 2024 while simultaneously dropping copper sales by 8%. Fiber now accounts for more than 55% of total revenues. In addition to becoming most of the revenue, fiber now accounts for nearly 70% of adjusted EBITDA. Fiber provides higher returns and is in more demand than copper, which will go a long way to achieving profitability if Frontier were to remain a standalone business. Frontier’s combination Verizon’s existing fiber and capital structure provide the ability for that transformation to accelerate further, which will generate more earnings growth.

SEC 10-Q Earnings Presentation

Regulatory Risk

While a good portion of this deal makes sense for both companies, there is a regulatory cloud that will likely hang over it for months. It’s important to note that in the last decade, Verizon eventually negotiated a sale of its landline business to Frontier, which in itself faced many regulatory hurdles, before clearing and eventually blowing up on Frontier.

Now, bringing the two companies together is going to be an even bigger sell to regulators in states like Illinois, not to mention the federal government, which has not made M&A easy on companies the size of Verizon. It is hard to say whether the deal will get approval, but I believe that there will be speed bumps along the way that create volatility in the shares of both companies, like what we are seeing with US Steel. Investors should look at these speed bumps as possible opportunities to buy Frontier stock.

Conclusion

The pending merger between Verizon and Frontier Communications is a great opportunity for the shareholders of both companies, but regulatory risks remain. Frontier shareholders should consider selling with the value of their shares near the deal price as there will be likely hurdles ahead in getting the government’s approval. For Verizon shareholders, the deal does provide value, but 18 months out with regulatory risk is not enough certainty to justify an investment.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.