Summary:

- Verizon’s dominant position in the U.S. telecom industry and strong market share make it a compelling investment with a 6.3% dividend yield.

- Emerging AI and 5G opportunities, such as edge computing and network slicing, enhance Verizon’s quality and brand strength.

- Verizon’s strategic acquisition will expand its fiber network, driving synergies and maintaining industry leadership.

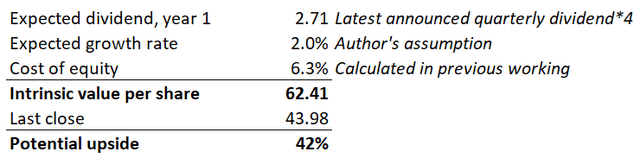

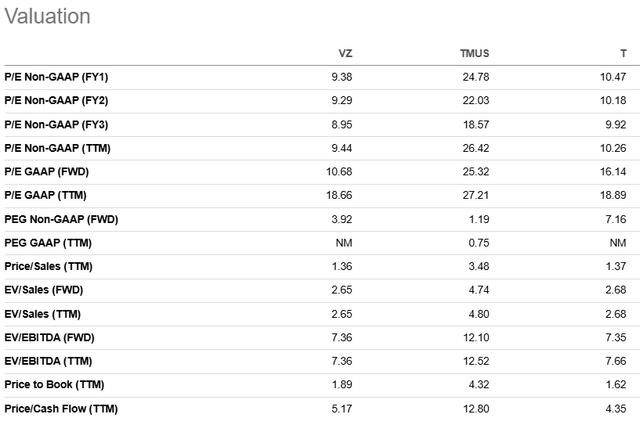

- Intrinsic value calculation shows a 42% potential upside, with VZ’s P/E ratios being the lowest among its rivals.

JHVEPhoto

My Thesis

I believe that Verizon (NYSE:VZ) represents a compelling investment opportunity for a solid bunch of fundamental reasons. As a cornerstone player in the U.S. telecom oligopoly, VZ boasts several key attributes that make it an attractive investment. These attributes include its rock-solid foundation in the industry, emerging AI and 5G opportunities, strong execution, and cost discipline. All these strengths ensure enhanced 6.3% dividend yield safety. The stock is attractively valued, making it a Strong Buy.

VZ Stock Analysis

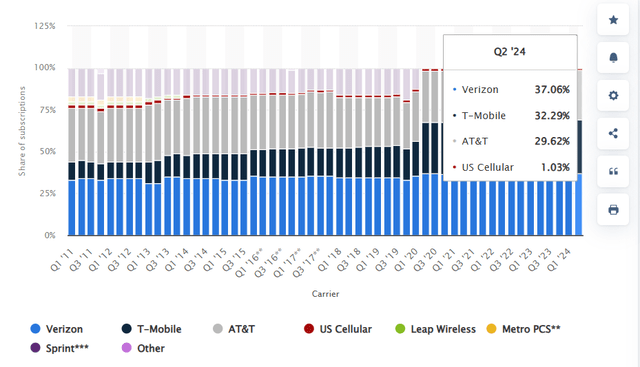

Verizon commands a dominant position in the U.S. telecom industry, where three major players control around 99% of the market. Two other major players are AT&T (T) and T-Mobile (TMUS). According to Statista, Verizon commands a 37% market share in wireless network operator subscriptions. This is the number one spot and the gap with TMUS (32% market share) is notable.

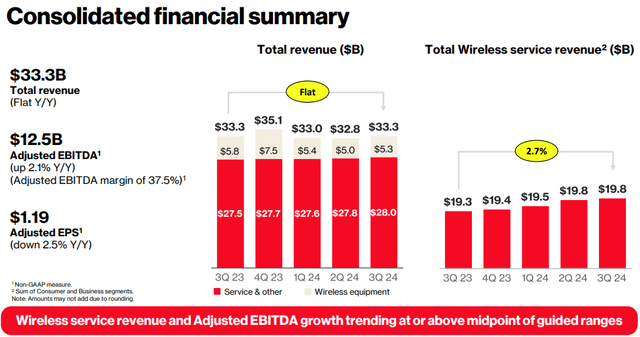

The oligopolistic structure of the industry provides a stable and predictable environment for investors. Verizon’s premium network quality and strong brand resonate with high-value customers. This is evidenced by sustained wireless service YoY revenue growth of 2.7% in FQ3 2024. The management’s commitment to drive profitability is evident from the 2.1% YoY adjusted EBITDA growth. During the FQ3 earnings call the management reiterated its commitment to seek new cost-efficiency sources.

With a strong combination of premium quality and brand power, VZ is well-positioned to keep the ball rolling in the AI revolution through various opportunities. For example, edge computing opportunities leverage the 5G infrastructure. There are also network slicing capabilities, which were emphasized during the earnings call. According to Joe Russo, VZ recently launched its 100% virtualized 5G core network with stand-alone and slicing capabilities. The management promised to indicate how they plan to monetize this network closer to the end of this year, but after I have read various sources I can summarize my understanding below:

- The 5G network can be partitioned into multiple virtual networks (slices)

- Each slice can be tailored to specific use cases or customers

- Different service levels can be assigned for different applications

It looks like such customization is likely to enhance customer value, which will be another contribution to improving VZ’s quality and brand strength. Moreover, providing this level of customization could be offered as additional services or even a subscription-as-a-service.

The announced acquisition of Frontier also looks like a sound strategic move. The acquisition will help VZ in maintaining its leadership in the industry by expanding its fiber network to approximately 48 million homes and businesses. The management expects to drive synergies by cross-selling mobility to Frontier’s base while offering both fiber and fixed wireless access options to customers.

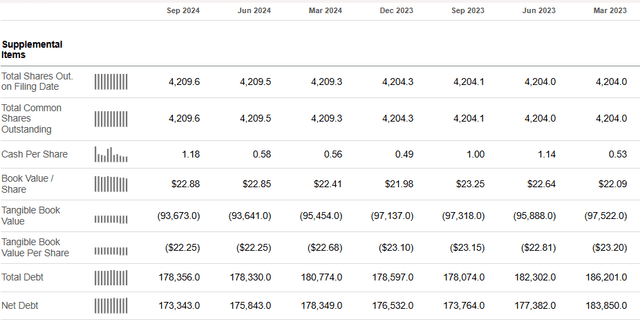

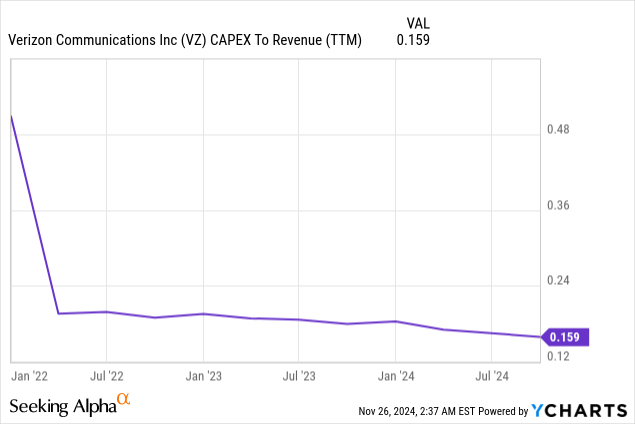

All the aforementioned opportunities and commitments from the management will highly likely positively affect VZ’s bottom line. This is positive for dividend investors because the stock offers a 6.3% forward yield, notably above the risk-free rate. Verizon’s highly leveraged balance sheet shows improvements. The net debt of $173 billion is substantial, but it is $10 billion better compared to Q1 2023 end. I expect this deleveraging trend to continue as Verizon’s CAPEX to revenue ratio has declined significantly since the peak 5G buildout phases.

This trend is positive since it provides more financial opportunities to fuel long-term initiatives. For example, Verizon aims to double its fixed wireless subscribers by 2028. There is also an innovative “myPlan” offering with 7 million subscriptions, expected to double by 2025.

As we see, there are several growth opportunities and strategic initiatives from the management. The company’s leadership not only focuses on driving revenue growth but is also committed to delivering cost efficiencies. Therefore, there is a solid potential to deliver long-term EPS growth and maintain the safety of the generous forward yield.

Intrinsic Value Calculation

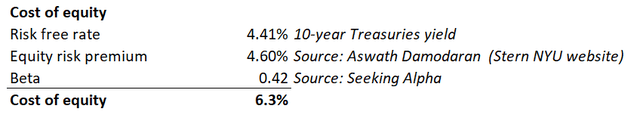

The number one step in completing the dividend discount model valuation is figuring out the discount rate. For calculations that rely on shareholder returns, it is better to use the cost of equity as a discount rate.

Verizon’s cost of equity is 6.3% thanks to a low 0.42 beta suggested by Seeking Alpha. I multiply the latest quarterly dividend by four to get the “year 1” dividend assumption, which will be $2.71. Despite VZ’s potential to capitalize on favorable AI trends, I prefer to be conservative when discussing the dividend growth rate. Selecting a 2% rate to match historical U.S. inflation levels looks like a safe play.

The intrinsic value per share is $62.41. The gap with the last close of around $44 is large, meaning that there is a 42% potential upside.

Comparing VZ’s valuation ratios to its rivals also suggests that VZ is a compelling opportunity at the moment. VZ’s P/E ratios are the lowest among these three stocks.

What Can Go Wrong With My Thesis?

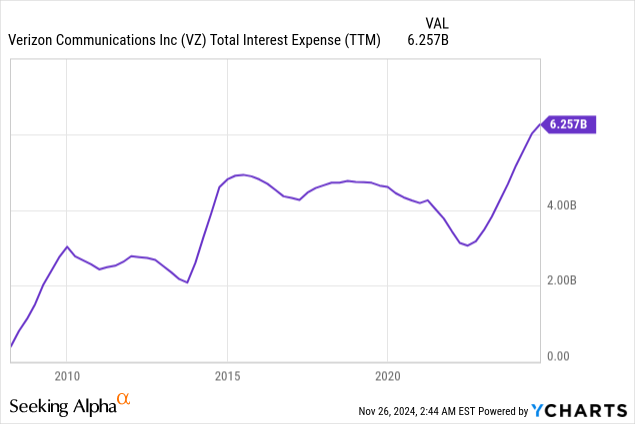

Despite the adjusted EBITDA growth in FQ3 2024, Verizon’s adjusted EPS decreased YoY from $1.22 to $1.11. This is explained by the notable growth in finance costs due to high interest rates. Verizon’s balance sheet is highly leveraged, meaning that the bottom line significantly depends on interest rates. While the Fed started cutting rates in September 2024, the pace of interest rate cuts in 2025 is still quite uncertain. If the U.S. economy demonstrates significant growth deceleration during 2025, the Fed might return to a more hawkish mode. Higher interest rates for longer will mean valuation pressures for VZ.

The Frontier acquisition is a large $20 billion deal, meaning that there are substantial integration risks. Actual synergies might materialize slower than expected by the management.

Due to the oligopolistic nature of the industry and intensive antitrust scrutiny, there is not much room for VZ to exercise pricing powers. Adjusting prices might be risky and potentially lead to higher churn rates. Therefore, VZ’s bottom line might significantly suffer if there is another inflation growth wave like we saw in 2021-2022.

Summary

Verizon is a compelling investment opportunity for various reasons. There is a 42% potential upside for this 6.3% yielding stock. There are revenue growth opportunities, and the management is focused on delivering operating efficiencies. The Frontier acquisition looks interesting and has solid potential to help Verizon expand its footprint and industry dominance even more.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.