Summary:

- Verizon’s recent earnings were mixed, with in-line numbers for EPS but missing revenue expectations.

- Despite the initial share price drop, investors are bidding VZ shares back up, but they still present an attractive value to long-term investors.

- The Company remains focused on paying down debt and continuing on with a strong dividend yield of ~6.5% that’s set to continue to grow.

- We’ve been utilizing options to generate additional ‘income’ from what is already providing strong quarterly cash flows.

photobyphm

Written by Nick Ackerman

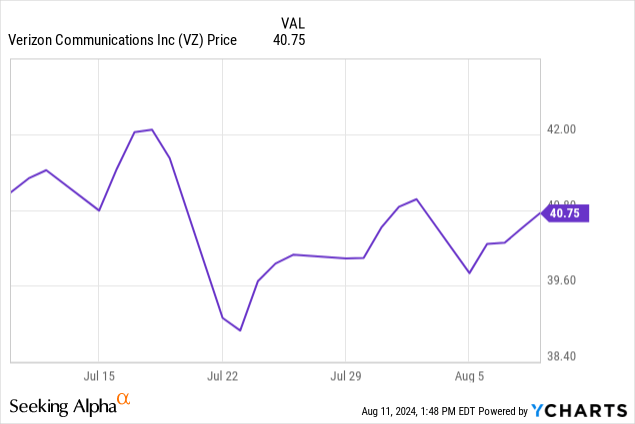

Verizon Communications’ (NYSE:VZ) latest Q2 results were mixed. Earnings came in line with expectations, but revenue expectations were a miss. Service revenue was noted as being one of the areas that were weaker and could signal further weakness in the latter half of the year. While shares initially sold off, it was relatively short-lived as investors started bidding VZ shares back higher – we aren’t back at pre-earning share price levels yet, but that is where an opportunity exists.

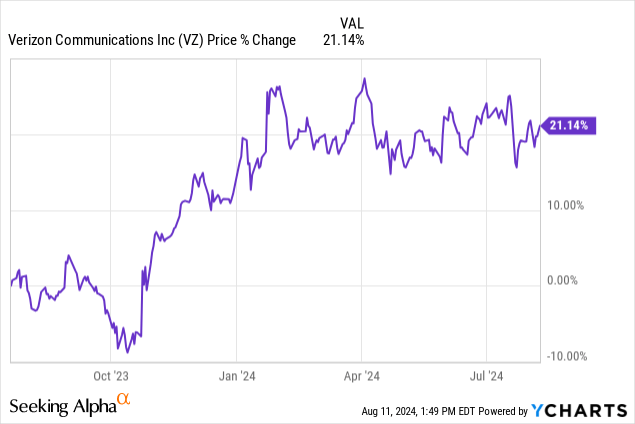

The last time we took a look at Verizon was back on July 20, 2023. At that time, shares were selling down sharply because of new reports of potential liabilities due to lead in their old cables. Since then, shares have performed incredibly well on a total return basis. The latest dip being the mixed earnings they reported. On a YTD basis, shares of VZ are still up just over 6%

Valuation Continues To Look Enticing

Verizon shares remain cheaply valued, in my opinion. Initially, VZ and its competitor AT&T (T) were hit with a higher rate environment, which put pressure on these income-focused investments. A further pressure on these telecom giants is also their massive, giant piles of debt that they carry. With a higher rate environment, interest expenses could start to climb materially when it comes to refinancing.

Fortunately, both have been focused on paying down debt rather than simply refinancing everything. That can ease those pressures of higher interest rates, and with the expectation of the Fed cutting rates on the horizon, that should also bode well. Debt was down $3.2 billion from the prior quarter for VZ but still stands at a monstrous $122.8 billion. Of course, with steady cash flows and earnings, it can be manageable. Despite the absolute size of the debt, on debt-to-adjusted EBITDA ratio, it seems more modest at 2.5x.

As the company pays down debt, it can become a virtuous cycle as well. Lower debt can translate into more free cash flow, which can further be converted over to paying down more debt.

Paying down debt remains a focus of VZ, and that was noted in the latest earnings call, where the CEO mentioned the back half of the year will support paying down debt even further.

Our full year guidance for CapEx spending remains unchanged at a range of $17 billion to $17.5 billion. The net result of cash flow from operations and capital spending is free cash flow of $8.5 billion for the first half of 2024. This represents an increase of nearly 7% or approximately $550 million from the prior year period, despite higher cash taxes and interest expense. We expect to generate strong cash flow in the back half of the year that will support paying down debt.

As this pressure eases, and we are expected to move into a lower-rate environment, shares of VZ can continue to lift higher – which is something that has been happening already from the depths of the last October lows, where shares almost touched the $30 price tag.

VZ Fair Value Estimate Range (Portfolio Insight)

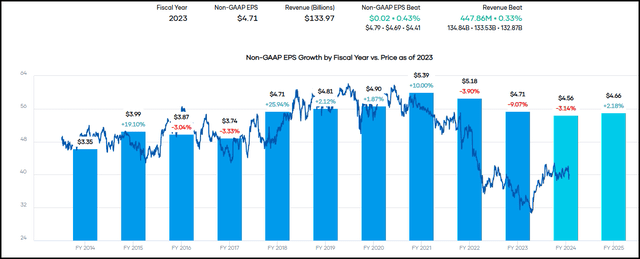

Earnings are expected to be weaker again this year, though moderate from the declines seen in fiscal 2023. Analysts are projecting earnings growth to return once again in fiscal 2025. If they can achieve that, it should only further support the share price fundamentally for the long-term investor. After two years of declines and an expected third year of declines, that would admittedly be refreshing to see.

VZ EPS History and Forward Estimates (Portfolio Insight)

Dividend Remains Solid

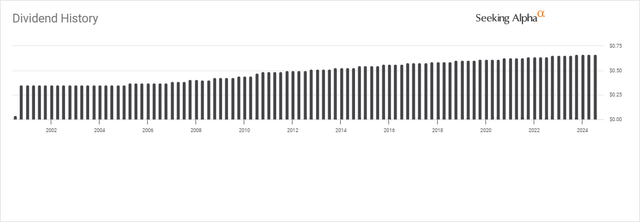

Now, results might have been mixed more recently, and this is definitely not a name for expecting significant growth. That said, a quarter doesn’t define a company, and over the long term, VZ has been able to deliver a solid dividend. With a current yield of ~6.5% and solid coverage of the dividend yield here, it remains an interesting choice for the long-term income investor.

VZ has delivered dividend growth for going on 19 years.

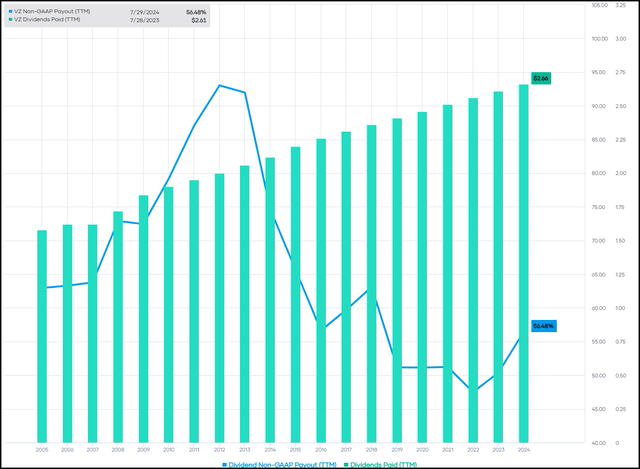

VZ Dividend History (Seeking Alpha)

Though the growth has been quite modest, being at only a 2.3% CAGR over the last decade, it has been consistent. For investors that aren’t using the income to live on for expenses, one can create their own growth as well by reinvesting all or a portion of the dividend received. While shares are at a lower price is actually even more ideal for investors being able to be in that situation.

Along with paying down debt, this is another focus of the company, to keep the dividend growing over time. This was brought up in the latest earnings call when an analyst was questioning achieving the leverage target in 2025 if, from there, they were looking to invest more in fiber or share buybacks.

Secondly, the dividend is very important. I mean we have now been growing our dividend for 17 consecutive quarters. And Tony and my job of — years, not quarters. And Tony and I are committed to continue to put the Board in a position to do that. And you see on our pay ratio, we’re well inside that ratio doing well. And then we’re paying down our debt. We paid down debt this quarter. Second half, we’re going to continue with that. We will not consider any conversation about buybacks until we get to 2025. And after that there is a lot of factors in the market, the priorities but also where is the interest rates, where is share price and all of that. So let us focus on the priority in the order we have said, and that’s how we are going to continue for the next foreseeable future.

On the payout ratio front, VZ is looking quite healthy. The latest EPS came in at $1.15; against the current $0.665 per quarter, we are looking at a payout ratio of around 58%. That’s up modestly from the last few years but down relative to the longer-term payout ratio.

VZ EPS Payout Vs. Dividends Paid (Portfolio Insight)

That said, with the next dividend announcement due in early September, we should be getting that annual raise announcement. For several years now, the raise has been an increase of $0.0125. That is again what I would expect, and again, that means modest growth in the payout, but when you are over a 6.5% yield already, that’s still quite generous.

With that, we could expect the dividend bumped up to $0.6775 per quarter or $2.71 for the next year. With $4.56 in earnings expected this year, that would come to a payout of ~59.5% – upping the payout ratio a touch. Against the $4.66 expected for 2025, we are back around the same 58%.

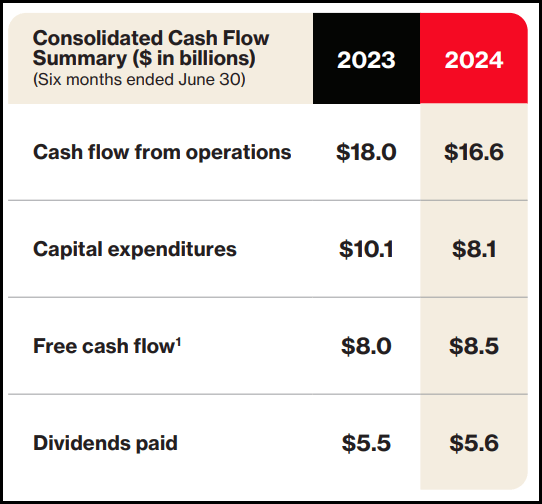

When looking at free cash flow, dividend coverage there has improved year-over-year for the latest six-month period. This was even while cash flow from operations took a meaningful hit, it was capex coming down that helped drive FCF higher anyway. During this six-month period, the FCF payout ratio came to ~66%.

VZ FCF Vs. Dividends Paid (Verizon)

They provided $18.7 billion in FCF for the prior year but didn’t provide any specific guidance for what to expect in 2024. Instead, just stated at the end of last year that “we expect a strong free cash flow profile that will support our capital allocation priorities and position us for meaningful unsecured debt reduction in 2024…”

Boosting ‘Income’ Through Options

While we hold a long core position in VZ, we’ve also been utilizing writing options in an effort to drive further cash flow for ourselves. Here’s a look at our latest move, where we rolled our covered calls both up and out to bring in further premium:

The Trades:

- First: Buy to Close Verizon (VZ) August 16, 2024 expiration, $41 Calls – cost $0.22

- Second: Sell to Open Verizon (VZ) October 18, 2024 expiration, $42 Calls – collected $0.74

The net premium received on this move is $0.52.

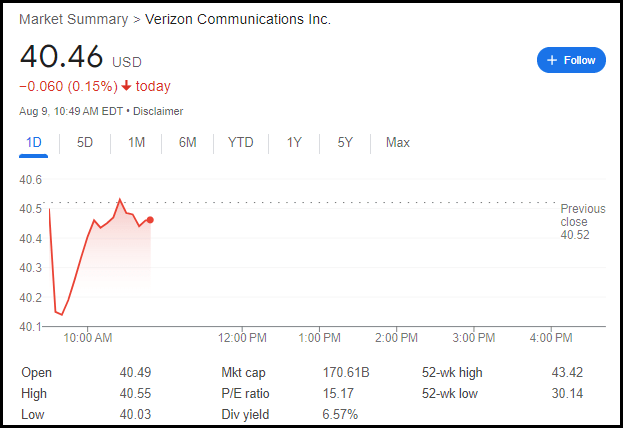

At the time of the move, VZ shares were about flat on the day, with the options expiration coming up next week. I decided to ‘reload’ this trade a bit early at a profit and bring in some more option premium.

VZ Friday Intraday Pricing (Google Finance)

In doing this move, I’ve taken the strike price up from $41 to $42, so we are rolling up and out in this case. That ‘cost’ us some additional option premium during this roll relative to if we had stuck with the same $41, but we still came up net positive.

On its own, the net premium of $0.52 against the $42 works out to a potential annualized return of 6.46%. For those that may not have had to roll to write these covered calls – and therefore don’t have the $0.22 cost to close out the previous covered calls – their PAR would be 9.19%.

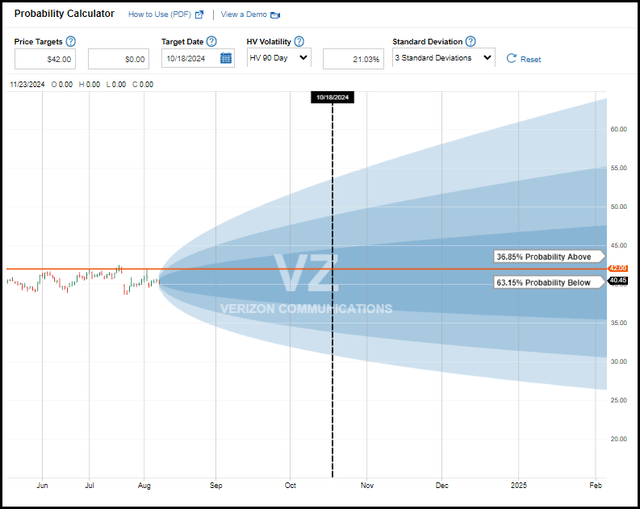

I also rolled out to October 18 because, historically, that would mean we’d be holding the shares on the other side of the Q3 dividend. The dividend ex-date for many years has been in the first half of October, though there is always a risk they could change that. Also, worth noting is that the company’s estimated earnings are also around this time on October 22. So that is something we’ll have to watch for.

According to Fidelity, the probability of shares trading above $42 is in the minority, meaning we could expect to keep these shares to possibly continue to write more covered calls in the future. Though it isn’t overwhelmingly leaning that way.

VZ Probability Chart (Fidelity)

In the covered calls we are closing today, we originally collected $1.12. Though, members that have been around for a while now will know we’ve had quite the history with this batch of VZ shares.

This has been working out incredibly well, as the shares continued to head higher. We’ve been holding on to this batch of shares by rolling several times, resulting in us sitting on some sizeable paper gains at this point.

That said, it hasn’t been a flawless strategy. As the table below shows, it took us a good chunk of change to roll from $36 up to the $41 strike price. That took us to a net loss in terms of total premiums received, though the argument in doing so was to participate more in potential upside capital gains.

| Ticker | Expiration Date | Upper Strike | Lower Strike | Current Price | Style | Date Initiated | Premium Collected | Date Closed | Closing Cost | Gain/Loss |

| VZ | 08/16/2024 | $41.00 | – | Rolled | Calls | 08/09/2024 | $1.12 | 08/09/2024 | $0.22 | $0.90 |

| VZ | 07/19/2024 | $41.00 | – | Rolled | Calls | 03/25/2024 | $1.53 | 07/08/2024 | $0.54 | $0.99 |

| VZ | 04/19/2024 | $36.00 | – | Rolled | Calls | 01/02/2023 | $3.22 | 03/25/2024 | $4.78 | -$1.56 |

| VZ | 01/19/2024 | $36.00 | – | Rolled | Calls | 10/09/2023 | $0.20 | 01/02/2024 | -$2.74 | -$2.54 |

| VZ | 10/20/2023 | $36.00 | – | Assigned | Puts | 07/17/2023 | $3.11 | Assigned | – | $3.11 |

| VZ | 07/21/2023 | $36.00 | Rolled | Puts | 06/20/2023 | $1.11 | 07/17/2023 | $2.51 | -$1.40 | |

| VZ | 06/23/2023 | $36.00 | Rolled | Puts | 05/22/2023 | $0.69 | 06/20/2023 | $0.31 | $0.38 | |

| VZ | 05/26/2023 | $36.00 | Rolled | Puts | 04/25/2023 | $0.37 | 05/22/2023 | $0.29 | $0.08 |

The last trade brought in $1.12, pushing us back into net positive territory in terms of option premiums being received. We’ve now been pushed even further into positive option premium territory with this move, bringing the net premium received of all trades up to $0.70 – resulting in our breakeven cost basis down to $35.30.

With all that said, this highlights one of the risks – with any strategy, there are always going to be pros and cons. VZ could have easily continued heading lower, as it did after we initially wrote this batch of puts.

Or, as it turned out, it ended up recovering swiftly once the assignment occurred. The recovery was a bit too swift. What I originally was hoping would happen was a more modest recovery once we took the assignment at $36 last October. The idea was that these covered calls would expire worthless, and we could gradually write covered calls at higher and higher strike prices.

A final positive consideration: we also took the assignment of these shares back on October 9, 2023, to be exact – meaning we’ve collected $1.995 in dividends so far.

Conclusion

VZ continues to deliver on the yield front while the share price remains a value. The dividend is strongly supported by earnings and free cash flow, with enough room to also pay down debt, as the company has been doing. This is not a hot growth stock, and one shouldn’t probably expect that to change dramatically in the future. Instead, one can take comfort in the ~6.5% dividend yield that gets raised every year. If there is capital appreciation – which I do expect from here, at least at some point – that can be the cherry on top.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of VZ, T either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

Interested in more income ideas?

Check out Cash Builder Opportunities, where we provide ideas about high-quality and reliable dividend growth ideas. These investments are designed to build growing income for investors. A special focus on investments that are leaders within their industry to provide stability and long-term wealth creation. Along with this, the service provides ideas for writing options to build investors’ income even further.

Join us today to have access to our portfolio, watchlist and live chat. Members get the first look at all publications and even exclusive articles not posted elsewhere.