Summary:

- Verizon Communications raised its dividend by 2% to $0.6775 per share, enhancing its appeal to passive income investors with a 6.2% yield.

- The acquisition of Frontier Communications is expected to accelerate Verizon’s Broadband growth, adding 2.2 million subscribers and enhancing competition against AT&T.

- Verizon’s low free cash flow-based payout ratio of 48% underscores its robust investment proposition, ensuring dividend growth potential for passive income investors.

- Despite higher valuations, Verizon remains a compelling buy due to its strong Broadband momentum and strategic Frontier acquisition, with an intrinsic value of $47 to $52.

hapabapa

Verizon Communications Inc. (NYSE:VZ) just raised its dividend yet again to $0.6775 per share per quarter, handing passive income investors a decent 2% dividend hike. In addition, the U.S. wireless carrier announced the acquisition of Frontier Communications (FYBR), a pure-play Fiber Broadband company, which could turbocharge Verizon Communications’ sales growth and help it compete against AT&T Inc. (T).

I think that Verizon Telecommunications is doing a hell of a job in the Broadband part of its business, growing its subscribers, and now the Frontier deal could accelerate the Telco’s growth prospects.

Last but not least, Verizon Communications has a compelling valuation. Though Verizon’s stock has surged as of late, I am still a buyer here and think that the dividend is worth chasing.

My Rating History

My last stock classification on Verizon Communications was Strong Buy, and I cited the Telco’s growth in Broadband as a good reason to invest. The Frontier Communications deal makes strategic sense for Verizon Communications and should provide the company with a lever to grow its Broadband business quicker.

Verizon Communications also raised its dividend by 2%, this year, making the stock compelling for passive income investors to own.

Broadband Growth And Frontier Acquisition

The number one reason to buy Verizon Communications relates to the Telco’s broadband growth. In the second quarter, the Telco produced a moderate 0.6% sales growth YoY, but it was the Broadband segment that prevented worse.

Verizon Communications’ growth strategy is basically centered on its 5G and Broadband segments, both of which are seeing a decent amount of momentum.

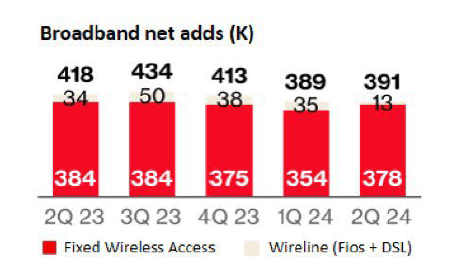

But it is particularly the Fiber segment that stands out due to its persistent growth in subscribers. The Telco is seeing solid sign-up momentum in its Fiber Broadband business, which reported net adds of 391K new customers in the second quarter, up 2K QoQ. Total fixed wireless net adds were 378K, up 24K QoQ.

Broadband Net Adds (Verizon Communications)

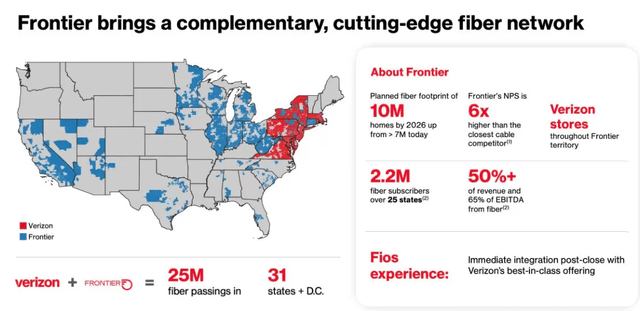

To grow its Broadband business, Verizon Communications is investing billions of dollars in capital spending. In addition, Verizon Communications made an offer in September to acquire Frontier Communications for $20 billion in order to further boost the growth of its Fiber business.

The acquisition will add 2.2 million subscribers to Verizon Communications’ Broadband platform, which already had 11.5 million subscribers at the end of June 2024.

It should also provide a lever for faster sales Broadband sales growth and help the Telco compete more aggressively against AT&T. Frontier Communications’ Fiber network is also complimentary to Verizon’s.

Frontier Fiber Network (Verizon Communications)

Free Cash Flow And Estimated Pay-Out Ratio, Dividend Hike

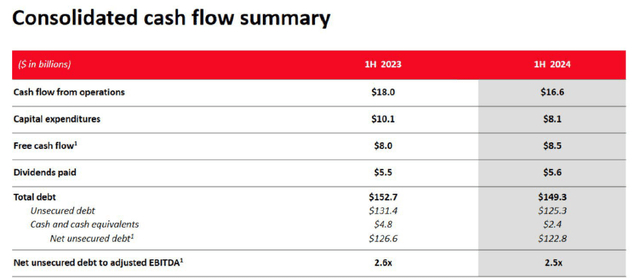

Verizon Communications’ free cash flow in the first half of the year amounted to $8.5 billion, which was half a billion more than the Telco raked in last year. In 2Q24, Verizon Communications earned $5.8 billion, which was 3% more than in the year ago second quarter.

The most important number here is the pay-out ratio, however: Verizon Communications paid out only 48% of its free cash flow in the second quarter. In last year’s 2Q, the Telco paid out 49% of its free cash flow. This low dividend pay-out ratio equates to a very high margin of safety for passive income investors, and I anticipate Verizon Communications to be a dividend-growing stock for a very long time.

Consolidated Cash Flow Summary (Verizon Communications)

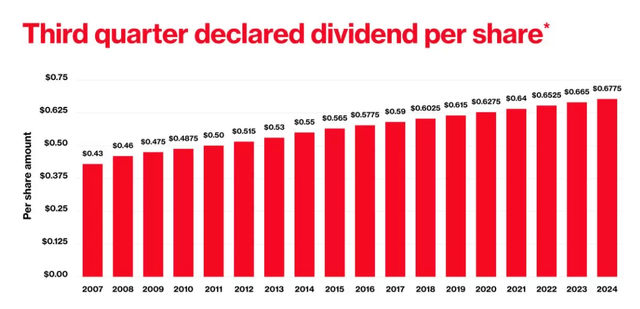

To that effect, on the first of September, Verizon Communications raised its dividend to $0.6775 per share per quarter, up 2% QoQ. For passive income investors, this means that the dividend yield now stands at 6.2%.

Verizon Communications has consistently raised its payout in the past, and the dividend has risen by 58% since 2007.

Pay-Out Ratio Growth (Verizon Communications Inc.)

Verizon Is No Longer A Steal, But Still Good Value

Verizon Communications is selling for a leading (2024) profit multiple of 9.4x, whereas AT&T costs passive income investors 9.6x next year’s profits.

Valuations of Telcos have skyrocketed as of late, which, in my view, is related to the central bank being widely anticipated to cut short-term interest rates.

Lower interest rates in the marketplace make high-yielding stocks like those from Verizon Communications and AT&T more attractive, particularly to those investors who buy stocks mainly for income purposes.

Another reason for the higher valuation is optimism about Verizon Communications’ Frontier deal, which is anticipated to add positively to the Telco’s growth ambitions in Broadband.

I view a profit multiple of 10-11x appropriate for Verizon Communications when taking into account its low FCF-based pay-out ratio as well as its significant growth momentum in Broadband. This leaves us with an intrinsic value of $47 to $52.

Why Passive Income Investors Might Get Disappointed

Verizon Communications is offering passive income investors a well-covered dividend as well as dividend growth potential. Verizon Communications owns a boatload of debt, though, which has held the stock back in the past and led to an absence of real catalysts.

A failed Frontier Communications acquisition might be considered a risk as the deal is set to boost Verizon Communications’ best-performing business unit.

My Conclusion

Verizon Communications is a well-managed Telco with considerable, recurring free cash flow and not insignificant momentum with its Broadband operations.

I think that the setup is positive for Verizon Communications and the stock is enjoying some new momentum following the Frontier acquisition news. In addition, shareholders received a 2% dividend hike and the low free cash flow-based pay-out ratio underscores Verizon Communications’ robust investment proposition for passive income investors.

Though the stock can’t be gobbled up anymore at comparably low profit multiples (as was the case pretty much throughout the entire last year), I think that passive income investors are getting a very strong and growing dividend yield here. Buy.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of VZ either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.