Summary:

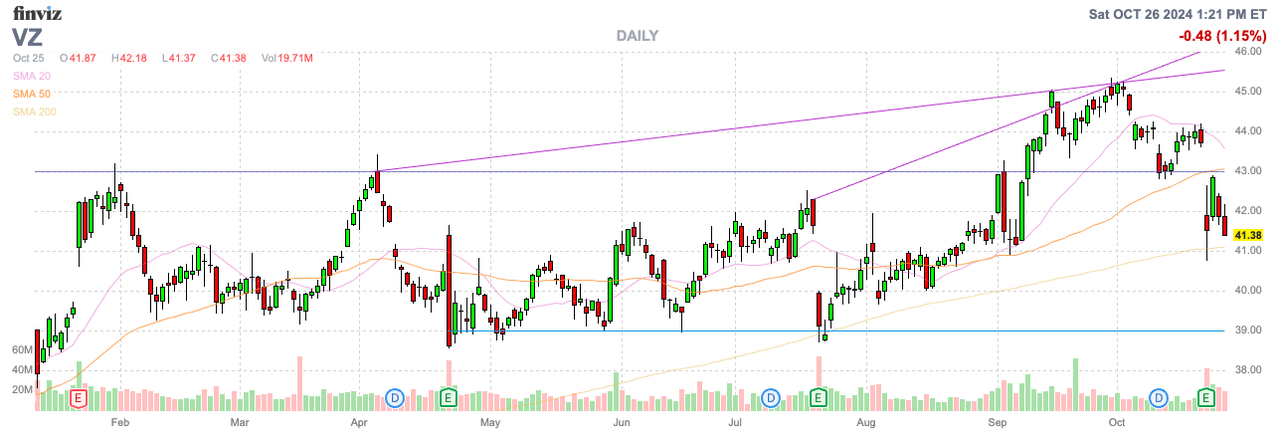

- Verizon’s financial performance remains weak despite a recent dividend hike, with Q3’24 revenues down 0.1% and EPS declining to $1.19.

- The wireless company has spent heavily on capex, 5G spectrum and acquisitions, yet the spending hasn’t translated into revenue growth.

- The stock has a large dividend yield of 6.55%, but ongoing high debt levels and limited growth potential pose significant risks for investors.

JHVEPhoto

In no surprise here, Verizon Communications, Inc. (NYSE:VZ) shareholders are getting increasingly frustrated with the performance of the wireless giant. The company recently hiked the quarterly dividend again, yet lots of questions exist in why payouts are rising with weak quarterly numbers and heavy spending on acquisitions. My investment thesis remains slightly Neutral on the stock due to the large yield, but total returns could be limited.

Still Struggling

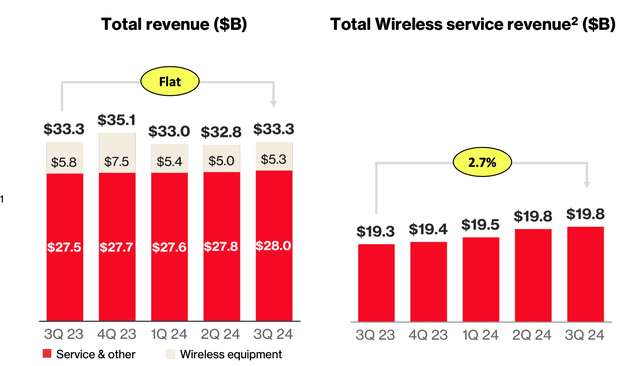

As much as Verizon talks about a promising future in wireless and fixed wireless broadband, the company continues to report weak quarterly results as follows:

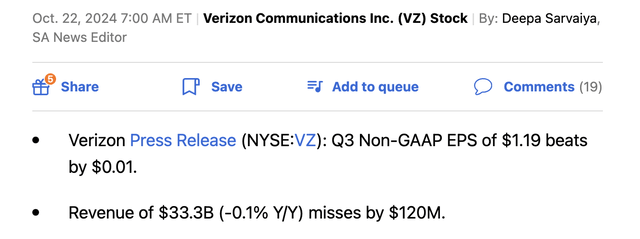

Despite a 2.7% boost in wireless services revenue for Q3’24, Verizon still reported total revenues were down 0.1% to $33.3 billion. The company even missed consensus analyst targets by $120 million.

Source: Verizon Q3’24 presentation

The earnings metrics were even worse. Verizon reported a Q3’24 EPS of $1.19, down from $1.22 last year.

At the end of the day, Verizon is reporting weaker revenues while AI computing demand is surging. The wireless giant has pulled back on capex after building out the 5G network, but the company has seen absolutely no overall benefits from the faster network despite the surge in AI spending and the likely necessary higher bandwidth needs of enterprises and consumers.

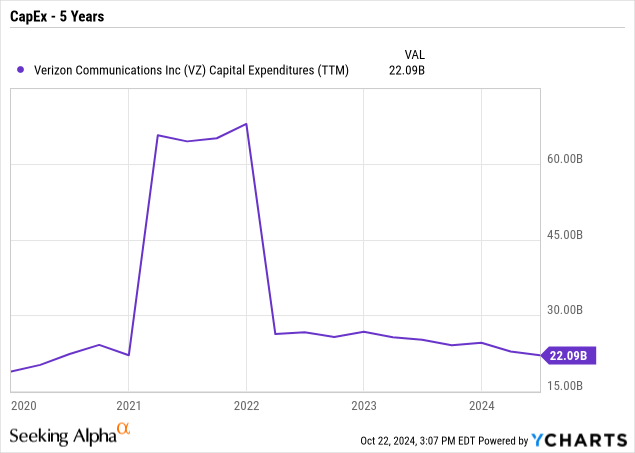

Verizon has spent $14.2 billion on capex so far this year with the goal of spending $17.0 to $17.5 billion. The wireless giant spent $18.8 billion on capex in 2023, down from $23.1 billion in 2022, and when including spectrum costs has spent substantial amounts on capex this decade, yet the company still can’t grow revenues.

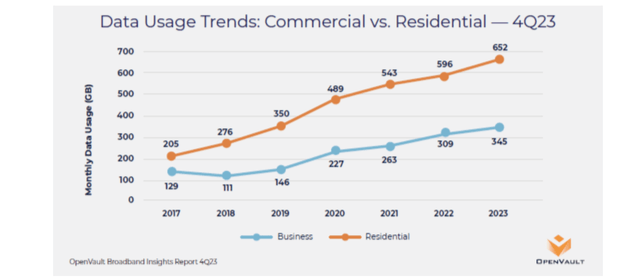

As reports highlight, bandwidth usage continues going through the roof. AI usage should only grow data usage the rest of the decade with monthly consumer data usage already reaching 652 GB a month in 2023, nearly double the pre-Covid amount of 350 GB per month in 2019.

The problem is that Verizon has spent some $20+ billion per year on capex during this period until the recent cut to the $17 billion level, yet the company has seen limited to no financial benefits. An investor has to now see this capex spending as more necessary maintenance spending in order to keep the wireless network competitive with peers.

Fixed wireless might be the one promising segment leading to a boost to 2025 capex plans of $17.5 to $18.5 billion, but investors shouldn’t expect the spending to move the needle. Verizon has 4+ million fixed wireless subscribers with a goal of reaching 8 to 9 million by 2028 with coverage topping 90 million households leading to only a 10% penetration rate.

Dividend Problems

Verizon now has the conundrum of spending so much on dividend payouts, the company can’t invest to grow the business. The potential Frontier Communications (FYBR) deal might even pressure dividends further.

Verizon is spending $20 billion on acquiring the telecom leading to further pressure on the massive debt balance already at $126 billion. The all-cash deal could face regulatory hurdles leading to management fighting with the DoJ versus building out a network to meet the demands of AI.

Verizon offers a 6.55% dividend yield now and the company just hiked the quarterly dividend payment to $0.6775 for a 1.9% boost. As the numbers highlighted above, the wireless giant should probably have lowered the dividend payout to match the weak financial results.

The company will now spend $2.9 billion each quarter on payouts amounting to $11.5 billion annually. Year to date, Verizon has only produced $14.6 in FCFs while payout out $8.2 billion in dividends, but the company has just agreed to pay $20 billion for Frontier while spending most of the FCF on dividend payouts.

As with the aggressive spectrum spending (company just agreed to another $1 billion purchase), these cash deals continue to weigh on the company. Verizon constantly spends a vast amount of money without actually leading to financial benefits.

At the end of the day, investors are frustrated CEO Hans Vestberg continues to make these statements on the earnings calls:

That means it’s a good a good result.

Shareholders are getting tired of Verizon claiming the results are good when the numbers dip below the prior year levels. The company can’t continue to propose $21 billion worth of acquisitions when cash flows hardly cover the dividend leading to the end result being a further boost in the debt levels.

Takeaway

The key investor takeaway is that Verizon currently has the cash flows to easily pay the large dividends, but the company isn’t positioned to grow from booming demand for wireless traffic and AI. Investors will be lucky to collect the 7% dividend yield, especially with the debt levels set to soar beyond $145 billion on the Frontier deal. The risk is an upside providing a 7% dividend yield with limited capital appreciation offset by the potential for the stock to sink on the massive debt load.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

The information contained herein is for informational purposes only. Nothing in this article should be taken as a solicitation to purchase or sell securities. Before buying or selling any stock, you should do your own research and reach your own conclusion or consult a financial advisor. Investing includes risks, including loss of principal.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

If you’d like to learn more about how to best position yourself in under valued stocks mispriced by the market to end October, consider joining Out Fox The Street.

The service offers a model portfolio, daily updates, trade alerts and real-time chat. Sign up now for a risk-free 2-week trial to started finding the best stocks with potential to double and triple in the next few years.