Summary:

- Verizon is a global telecommunications company offering technology, information, and entertainment products and services.

- The company’s debt load has increased significantly due to the 5G build-out, but the management is committed to moderating capex and deleveraging aggressively in 2024.

- My target price is around $48.

hapabapa/iStock Editorial via Getty Images

Introduction

I am a growth investor and my portfolio looks unbalanced at the moment, with long-duration stocks substantially outweighing less-riskier assets. Therefore, I am looking for a safe dividend name, and my fundamental analysis suggests that Verizon (NYSE:VZ) is a right choice. Stability of profits and free cash flows together with the management’s commitment to keep moderating capex and aggressive balance sheet deleveraging in 2024 give me high conviction that a 6.5% forward dividend yield is sustainable and can continue growing at a modest pace in line with historical dividend growth rates. Furthermore, the stock is around 17% undervalued, which makes it a “Strong Buy”.

Fundamental analysis

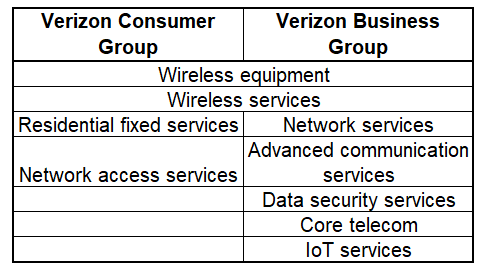

Verizon is one of the world’s largest telecommunication companies, providing also technology, information, and entertainment products and services to consumers, businesses, and government entities. The company’s offerings are outlined in the below table.

Based on VZ’s 10-K report

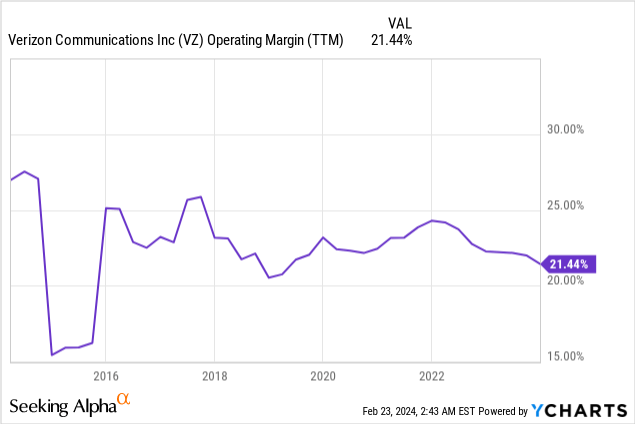

Over the last ten years, Verizon’s stock demonstrated a -14% performance due to several risks the company faced. During the last decade, the company invested heavily in a 5G network buildout, which required substantial investments and increasing leverage. Between December 2014 and December 2023 the company’s net debt skyrocketed from $102 billion to $176 billion. At the same time, profitability did not expand over the same period. These were the reasons why investors were cautious around VZ.

Indeed, it is difficult to expand profitability when revenue growth is naturally decelerating as the number of telecom and internet users are growing toward 100%. But in considering Verizon I am not looking for profitability expansion and rapid revenue growth, there are plenty of other interesting names in the U.S. stock market which demonstrate unbelievable dynamics in financial performance.

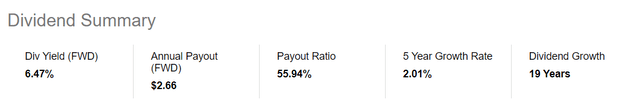

What attracts me to Verizon is a 6.5% forward dividend yield, especially as a growth investor who wants to diversify his portfolio with a value name. Therefore, I will base my investment thesis around assessing whether the dividend is safe and whether further growth is possible. To assess safety of payouts, I need to refer to history. VZ has stellar dividend consistency with increasing payouts for 19 straight years.

However, past success doesn’t always ensure future outcomes, so let’s delve into the forward-looking potential of dividends. Currently, the payout ratio stands at a moderate 56%, indicating the dividend is likely secure. Even in the event of a temporary decline in profits, the payout ratio remains comfortably below 100%, which is reassuring.

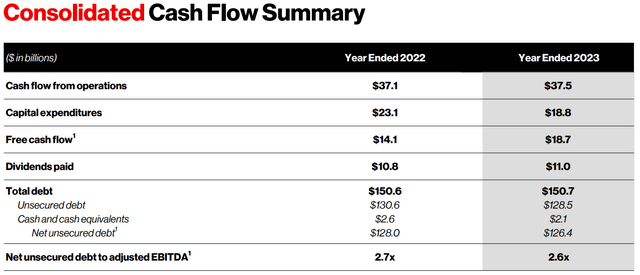

Dividend potential of a company depends on its ongoing earnings and the health of the financial position. No massive revenue growth is expected for VZ, neither for its profits. At the same time, the stability of the operating margin of recent years also gives high probability that decline in profitability is quite unlikely. Debt levels are high, but according to the management, the peak capex levels are in the past and deleveraging of the balance sheet is expected to accelerate in 2024. By the way, capex already significantly decreased in 2023 compared to 2022.

With strong and stable EBITDA, I believe that Verizon will have sufficient resources to balance between sustaining capex levels at required levels, paying out and increasing dividends, and deleveraging the balance sheet. Therefore, I have high conviction that Verizon will be able to sustain its 6.5% forward dividend yield and continue expanding it at a modest pace.

Valuation analysis

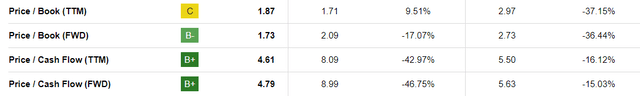

Verizon’s stock had a solid, 2024 start with an 8% YTD rally. The stock experiences solid momentum with a 25% rally over the last six months. Since Verizon is a value stock, I believe that looking at valuation ratios is a sound option. Forward non-GAAP P/E ratio is slightly below 9, which is 12% lower than the past five years’ averages. Other important ratios that I want to highlight are Price/Book and Price/Cash Flow. From both of these ratios’ perspective, VZ looks significantly undervalued compared to historical averages.

Multiplying $4.7 projected by consensus FY 2025 EPS to the historical non-GAAP forward P/E multiple of 10.15 gives the stock’s fair price at $47.7. This means that the stock is around 17% undervalued.

Mitigating factors

Verizon’s debt load has surged notably, particularly as the 5G build-out demanded significant financial backing. While this expansion of indebtedness was necessary to keep pace with the dynamic technological advancements, it also presents a notable risk. In addition to the potential impact of unexpected downturns in Verizon’s financial performance, which could hinder its ability to meet debt obligations, the heavy debt burden constrains the company’s capacity to secure additional financing for lucrative investment opportunities, potentially placing it at a disadvantage compared to competitors.

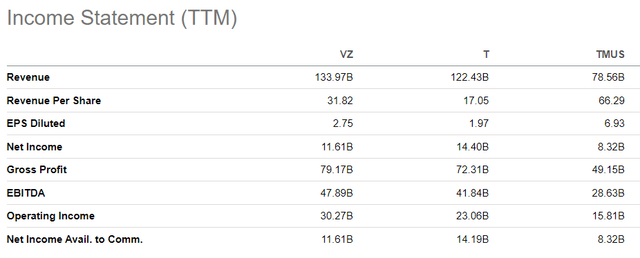

The telecom market in the U.S. is an oligopoly, i.e., it is dominated by a few large players. Verizon’s closest rival is AT&T (T), a large company with millions of users and extensive operations coverage. The third player in the industry, T-Mobile (TMUS), is notably smaller from the revenue perspective but is still a large competitor with almost $80 billion in TTM sales. Hence, Verizon faces formidable competition from rivals with substantial resources. Any incidents causing reputational harm or cybersecurity breaches could trigger significant customer attrition from Verizon to its competitors. These competitors are well-equipped to accommodate the influx of new demand at Verizon’s expense. Consequently, I perceive high competition risks for Verizon.

Verizon may not align with the objectives of investors seeking substantial capital gains. The industry in which it operates is already heavily penetrated, which is the primary factor contributing to the modest projected CAGR of just 3.4% over the next decade. This growth pace is not very far from historical inflation averages, which means that any sharp upswings in the stock price are very unlikely. That said, Verizon is a compelling option for dividend investors and can expect a modest stock price appreciation over time. It may not suit investors seeking aggressive growth, but is well-suited for those prioritizing stability and income generation.

Conclusion

Verizon is a high-quality high-yield name, which I am definitely buying. The company is well-positioned to sustain its stellar dividend history, and I like the management’s capital allocation priorities for 2024. My valuation analysis suggests the stock is 17% undervalued, which makes it a “Strong Buy”.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, but may initiate a beneficial Long position through a purchase of the stock, or the purchase of call options or similar derivatives in VZ over the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.