Summary:

- Peak 5G buildout and peak interest rates are in the rearview mirror, which means that Verizon’s 6.6% dividend yield safety and dividend growth prospects are improving.

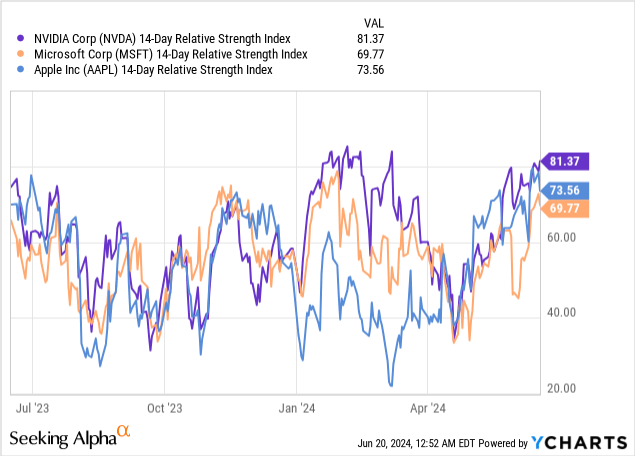

- The RSI indicator suggests that the three largest growth stocks are overbought, significantly increasing the probability of a correction in growth stocks.

- With its strong financial position, rock-solid revenue and profitability stability, and decreasing CAPEX, Verizon’s stock looks like a no-brainer safe haven for the likely correction in growth stocks.

- My dividend discount model suggests that the stock is 50% undervalued.

M. Suhail/iStock Editorial via Getty Images

Investment Thesis

My previous bullish thesis about Verizon (NYSE:VZ) aged decently as the stock returned around 3% to investors since March. This was behind the broader U.S. stock market. On the other hand, VZ’s solid and safe above 6% dividend yield was one of the major reasons for my bullishness. From the perspective of dividend yield safety, my thesis keeps up well as the company recently declared a quarterly dividend in line with the previous. I see several positive developments for VZ and today want to share my insights and explain why I am still bullish. Additionally, my updated valuation calculations suggest that VZ is still very attractively valued. All in all, I reiterate my “Strong Buy” rating for Verizon’s stock.

Recent Developments

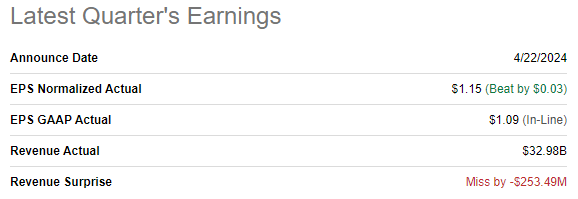

The company released its latest quarterly earnings on April 22, missing revenue consensus estimates but delivering a positive EPS surprise. Revenue was flat YoY, but the adjusted EPS shrunk from $1.20 to $1.15. Interest expense once again was the adverse factor for the bottom line, while operating performance was quite stable, with the operating margin expanding by five basis points.

Seeking Alpha

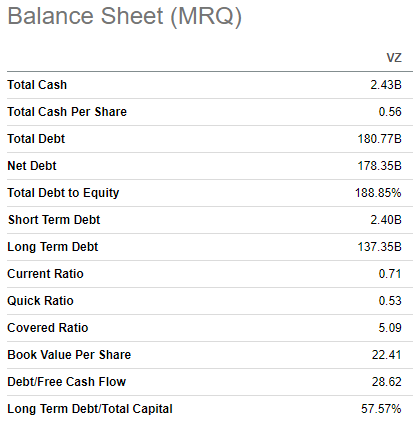

While Verizon’s high indebtedness is an apparent elephant in the room, conditions look much better now as the peak 5G buildout is in the rearview mirror. During Q1 2024 Verizon spent around $1.5 billion less on CAPEX than the company did during the same quarter last year. The good information is that, during the earnings call, the management reiterated its CAPEX guidance for the full year, with the midpoint of the provided range at $17.25 billion. This is around 9% lower compared to FY 2023, increasing confidence in dividend sustainability. On June 5, VZ declared a $0.665 dividend, in line with previous. This is a strong bullish sign for me because dividend safety is the primary strength of the stock, in my opinion.

Seeking Alpha

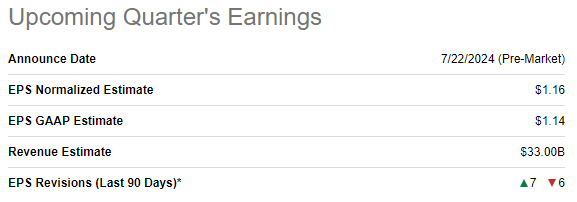

The upcoming earnings release is scheduled for July 22. Wall Street analysts expect Q2 revenue to be $33 billion, about 1.2% higher on a YoY basis. The adjusted EPS is expected to shrink on a YoY basis once again, from $1.21 to $1.16. While the bottom-line decline is never good, I also have to emphasize that despite revenue moving approximately flat, it will be the third consecutive quarter with sequential adjusted EPS expansion. With the management’s commitment to cost efficiency, I think that we can expect EPS stability in the foreseeable future.

Seeking Alpha

From the Fed’s monetary policy perspective, developments also look quite positive for Verizon. One rate cut is expected in 2024, meaning that we are currently at the peak of the tightening cycle and monetary policy is poised to continue easing in 2025. This is extremely positive for a highly leveraged company like VZ as less tight credit conditions will likely give more financial flexibility and will be apparently beneficial from the interest expense perspective.

Apart from favorable external factors, I also like that the management is continuously working on innovation and improving customers’ experience. Verizon adapts to the evolving technological landscape and recently unveiled AI-powered tools to improve the experience for customers. New GenAI tools will help in streamlining the process of frontline employees helping Verizon’s customers, which will likely drive customer satisfaction and loyalty.

Another recent initiative in cementing topline prospects was the introduction of the company’s proprietary Equipment Asset Tracker (EAT) to the European market. The offering helps in managing equipment data, such as status, location, productivity, and health, while reducing theft and downtime for high-value and critical machinery. Expanding its set of offerings across a wealthy European market is a positive catalyst for the company’s revenue.

Another potential positive catalyst for the stock is the increasing probability of a rotation from growth to value. The three largest growth stocks including Nvidia (NVDA), Microsoft (MSFT), and Apple (AAPL) look overbought as their current RSI indicators are close to peak levels. This significantly increases the probability of a correction in all growth stocks as these three set the tone for all growth stocks with their massive market capitalizations. In this case, investors will be likely seeking for a high-yielding safe harbor and Verizon apparently is a safe haven with its low volatility and high 6.6% forward dividend yield.

Valuation Update

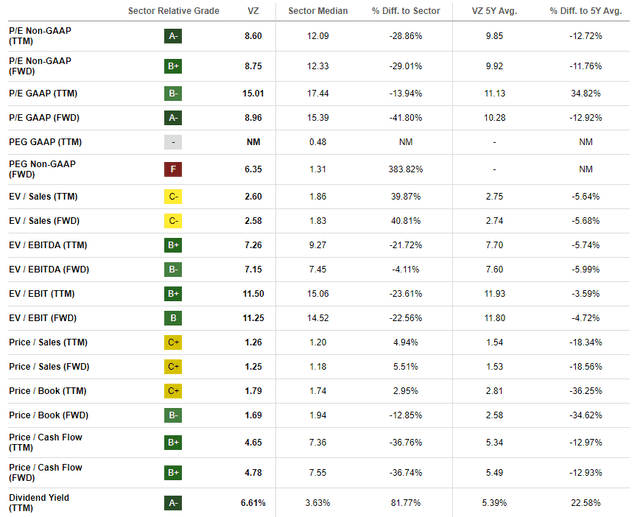

The stock price increased by 11.9% over the last twelve months, notably lagging behind the broader market. YTD performance was also behind the S&P 500 with a 6.3% rally. Verizon’s current valuation ratios are mostly lower than historical averages, meaning that the stock is attractively undervalued from the multiples perspective.

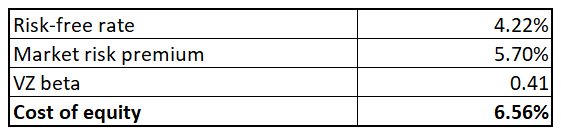

The dividend discount model (DDM) is a sound approach to proceed with in Verizon’s case. The stock has a vibrant dividend history, making the DDM a reliable way to figure out the stock’s target price for the next twelve months. Cost of equity is the discount rate for the DDM approach, which I figure out below using the CAPM formula and all variables are publicly available.

Author’s calculations

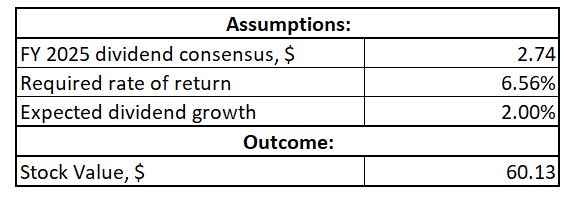

Cost of equity is 6.56%, and now I need to outline two more assumptions necessary to complete the DDM analysis. Verizon’s FY 2025 dividend projected by consensus is $2.74, which is a reliable assumption given historical stability in payouts. A 2% dividend growth is in line with long-term inflation levels and Verizon’s last five years’ growth rate.

Author’s calculations

Verizon’s target price according to my DDM is $60. This is 50% higher than the last close, meaning that Verizon is currently very attractively valued.

Risks Update

My readers should keep in mind that Verizon’s stock is not a good long-term investment. While I believe that it is a good safe harbor with a safe and high dividend yield at the moment, from the long-term perspective it is difficult to expect solid share price growth. For a high-quality business like Verizon, a 50% discount on its fair value is unfair, but it prices in inherent industry risks. The telecom industry in the U.S. is close to a 100% penetration, which we see from almost no revenue growth over several last quarters. The industry is capital intensive with long payback periods for CAPEX, meaning that telecom companies have little financial flexibility to expand into new businesses, which makes unlocking new revenue growth drivers quite unlikely.

With a very limited space to drive revenue growth, the only way to drive profitability is to cut costs. While VZ’s current stability in profitability suggests that the management is efficient in controlling costs, over the long term, the compounding effect of the inflation will highly likely undermine profitability. Moreover, it is impossible to exercise cost-cutting measures infinitely, especially for an established company like Verizon where internal processes are highly likely already lean.

Bottom Line

To conclude, VZ is still a “Strong Buy”. It is highly likely that most headwinds are behind us, as the peak CAPEX and peak interest rates are highly likely in the rearview window. Revenue is rock-solid and the management is committed to sustaining strong operating margins with a firm commitment to cost discipline. Therefore, I think that a high 6.6% dividend yield is rock-solid. Moreover, the valuation is compelling, indicating very limited downside potential.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of VZ either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.