Summary:

- Consumer Retail postpaid net adds reverse the negative trend with an expectation for a continued positive net adds in 2024.

- 2024 guidance is strong indicating a strong free cash flow growth.

- Verizon could benefit from a macroeconomic tailwind coming from a potential federal funds rate cut.

Bloomberg/Bloomberg via Getty Images

Introduction

In my previous article, I had a buy rating on Verizon (NYSE:VZ). At the time, I viewed Verizon’s net customer acquisition trend favorably as the company’s multi-quarter losses were improving nearing positive net adds. Further, I also believed that Verizon could expect a meaningful tailwind due to potentially favorable macroeconomic conditions. Federal Reserve hinted at a cut to the federal funds rate, which could entice Verizon’s strong dividend levels creating a tailwind to the company’s stock price. Today, I continue to stand by my previous bullish thesis. In fact, I am updating my views today as the previous reasonings for a bullish case have strengthened in the past few months. Not only has Verizon’s operations strengthened showcased by a growth in consumer retail postpaid customers, but the potential macroeconomic tailwind from a federal funds rate cut continues to be the likely case in 2024. Further, Verizon’s cash flow guidance for 2024 indicates that the company’s financials will strengthen further throughout 2024. Therefore, I continue to believe Verizon is a buy.

Improving Operations

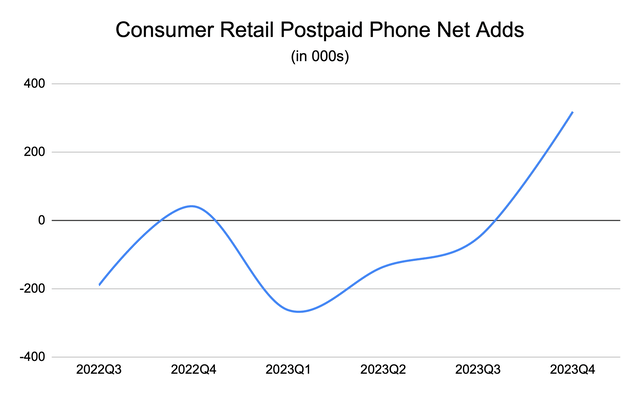

Verizon is a telecommunications company with an inevitable reliance on the telecommunications market. However, during the majority of 2023 and 2022, the company’s consumer postpaid net adds were negative. Other than 2022Q4, for the entirety of 2022 and up until 2023Q3, Verizon’s quarterly consumer retail businesses saw negative net adds. However, in 2023Q4, Verizon finally reported a positive consumer retail postpaid net adds as the chart below indicates.

Verizon

[Source – Downloaded Infographics from Verizon’s 2023Q4 earnings report page]

Beyond reporting strong customer growth, likely, the current positive results are not a one-time phenomenon. As I have mentioned in my previous article, Verizon’s net customer addition trend has been trending upward for the past few quarters, and the 2023Q4 data further supports this reasoning. With no clear signs of a reversal in this trend, it is likely that the current trend to be maintained.

The management team’s commentary further supports the argument that the company’s net positive customer growth in 2023Q4 is not an outlier. During the earnings call, the management team said that the company “anticipate[s] strong wireless service revenue growth of 2% to 3.5% in 2024” hinting at the continued positive momentum expectation. Further, the company “expect[s] to deliver positive Consumer postpaid phone net adds in full-year 2024” even as Verizon balances growth and financial discipline.

Overall, the initial positive trend of improving consumer postpaid phone net adds has reached fruition as Verizon finally reached positive customer net adds in 2023Q4, and as the strong trend along with Verizon’s management team indicates, the current positive trend will likely continue throughout 2024 reflecting Verizon’s strong execution and the attractiveness of the company’s products to consumers.

Strong 2024 Guidance

Beyond improving customer growth, Verizon reported strong guidance for 2024. The Telecommunications industry is mature, which often leads to limited growth in both the top and bottom lines; however, in 2024, Verizon is expecting a strong growth in its bottom-line performance.

In 2023, Verizon reported $18.7 billion of free cash flow, which was up 32.62% from the previous year’s free cash flow of $10.8 billion. The stark growth in free cash flow on a 2.1% year-over-year revenue decline was primarily the result of lower capital expenditure expenses. From 2022 to 2023, the capital expenditures declined from $23.1 billion to $18.8 billion, which is a $4.3 billion difference from the $4.6 billion growth in free cash flow during this period.

The bottom-line expansion is expected to continue in 2024, albeit slower than in 2023. Verizon is expecting adjusted EBITDA growth of about 1% – 3% along with a capital expenditure of about $17 – $17.5 billion, which assumes that the company will save about $1.45 billion on capital expenditure in 2024 relative to 2023 further growing the free cash flow.

As such, I believe the investor sentiment surrounding Verizon will continue to stay positive in 2024 as the company’s bottom line is expected to continue expanding supporting the lucrative dividends.

Risk to Thesis

Macroeconomic tailwind is my base case expectation for Verizon in 2024. Companies like Verizon benefit from a lower federal funds rate as their dividends become more attractive. For example, if the safe treasury bonds offer a 5% yield, then a private company’s dividend of 5% or maybe even 6% or 7% will be relatively less appealing as the treasury bonds, if held until the maturity date, hold no risks, unlike private company’s dividends. Thus, the reduction in federal funds rate is a tailwind for Verizon, and the Federal Reserve during an FOMC meeting in December of 2023 said that there will likely be 3 rate cuts in 2024 creating a likelihood for a tailwind for Verizon.

I continue to believe this is the case as the overall trend of inflation continues to cool. However, risks to this argument have arisen in recent weeks. January 2024 CPI data indicated that the inflation could be far stickier than anticipated as the inflation increased by 0.3% month-over-month and 3.1% year-over-year, which was higher than the 2.9% economists forecasted. As such, the Federal Reserve during their January FOMC meeting indicated that the organization will need to see more positive data before committing to the federal funds rate cut potentially creating a risk of the interest rate cuts becoming less imminent and challenging the magnitude of the rate cuts in 2024 from 3 to a lower number.

While the potential interest rate cuts became slightly more uncertain in recent weeks due to the stronger-than-expected inflation data, I continue to see the potential rate cut as a tailwind for Verizon. Although January’s CPI data was not positive, it was a single month’s data. As such, I believe it is too early to conclude that the disinflation pace has slowed or ended. Until there is more additional data to support the argument of sticky inflation, a single CPI data, in my opinion, is not significant enough to change the trajectory of the Federal Reserve.

Summary

Verizon is expected to have a strong 2024. The company has reversed the trend of negative consumer retail postpaid customers net loss in 2023Q4, the management team has indicated for this to continue through 2024. Further, the company is expecting its bottom line to continue to expand at a strong level in 2024 on top of the strong growth in 2023, and finally, Verizon could have a meaningful tailwind in 2024 from a potential federal funds rate. Therefore, I continue to rate Verizon as a buy.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.