Summary:

- Verizon reports another weak quarter with meager growth, missing revenue targets, and facing challenges in generating revenue despite increased data usage.

- The company’s lack of focus on AI and reduced capex spending has boosted free cash flows, but the lack of investment in growth opportunities raises concerns about future revenue growth.

- With a high dividend yield of 6.6% and potential rate cuts by the Fed, Verizon’s stock may become more attractive to yield investors, but long-term growth prospects remain uncertain.

JHVEPhoto

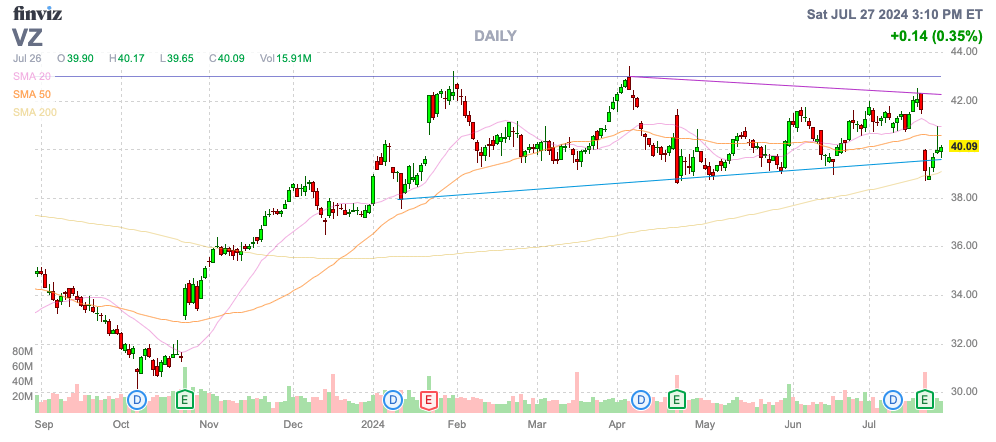

Despite surging data usage, the wireless giants have not managed to figure out how to grab higher revenues from additional demand for their networks. Verizon Communications, Inc. (NYSE:VZ) (NEOE:VZ:CA) reported another quarter with meager growth last week, making the dividend the only reason to own the stock. My investment thesis remains Neutral on the stock trading at $40.

Source: Finviz

Another Weak Quarter

Verizon hasn’t been a growth story for years, with the wireless giant reporting meager growth back prior to Covid and never really seeing much of a boost from surging work-from-home demand. Wireless customers use far more data every year, yet even the addition of 5G hasn’t led to a revenue boost.

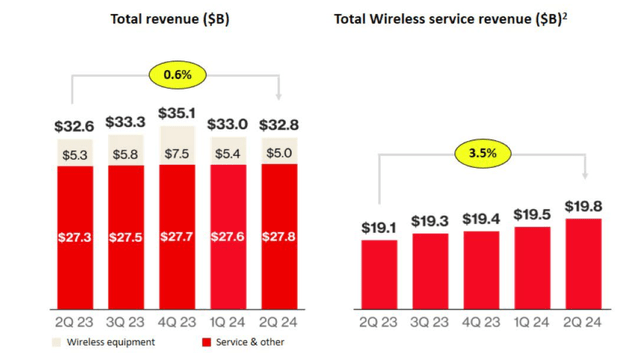

The company just reported revenues grew only 0.6% in Q2’24 to $32.8 billion, as follows:

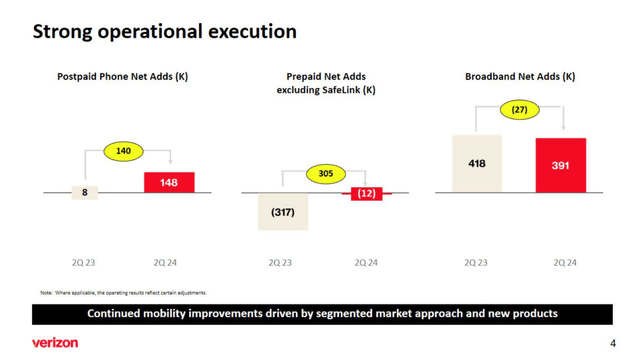

Verizon missed revenue targets by over $250 million for the 2nd consecutive quarter. The wireless company continues to add a bunch of customers with little to no financial benefit.

Source: Verizon Q2’24 presentation

The company added 378,000 FWA subscribers in the quarter and has grown the total to 3.8 million for 69% growth YoY, while total broadband net additions were 391,000. The business is set to reach $2 billion in annual revenue, yet Verizon still isn’t generating much in the way of growth.

The company saw both wireless equipment revenue dip and prepaid wireless customers fall. The crucial wireless service revenue is growing at a 3.5% annual clip to reach $19.8 billion in the quarter, but this growth rate isn’t fast enough to offset other weaknesses.

Source: Verizon Q2’24 presentation

Verizon even reported an EPS of $1.15 in Q2, down from the prior year. The company is forecast to report a 2024 EPS of $4.56, down 3.1% from last year.

The biggest problem is higher interest expenses after Verizon ramped up capital spending the last couple of years from boosting 5G services without attracting higher revenues. The company will benefit from the Fed cutting interest rates.

For Q2’24, interest expenses jumped to $1.7 billion from less than $1.3 billion in the prior year. The company continues to face the problem with 5G services and AI driving network demand without boosting revenues.

On the Q2’24 earnings call, CEO Hans Vestberg discussed AI as follows:

Our portfolio of high performance spectrum, the capacity of our fiber and our ability to deploy and support mobile edge compute, make us as the backbone of the AI economy and the partner of choice for players in the space. We will power the best AI services for our customers. What set us apart with AI is our network’s mobile edge computing capabilities and deep fiber footprint. By processing data closer to the source, we enable real-time AI application that requires security, ultra-low latency, and high bandwidth.

What the CEO didn’t discuss was a path to turning the backbone of the AI economy into a growing revenue stream to support the capex spend. Most companies spending billions in capex aren’t planning for it all to turn into maintenance spending.

Verizon has at least cut back dramatically on capex spending, with the 5G network mostly built out. The wireless giant is now forecasting only spending $17.0 to $17.5 billion on capex this year.

The benefit is a huge boost to free cash flows. Verizon produced $8.5 billion in free cash flow during the 1H alone, in part due to spending $2.0 billion less on capex during the period.

Verizon is in one of those good and bad situations. The good news is that Verizon is generating the cash flows to repay massive debt levels. The bad news is that the wireless company not only doesn’t have any path to invest in AI to generate faster growth but also all the investments in 5G failed to produce growth.

Yield Attraction

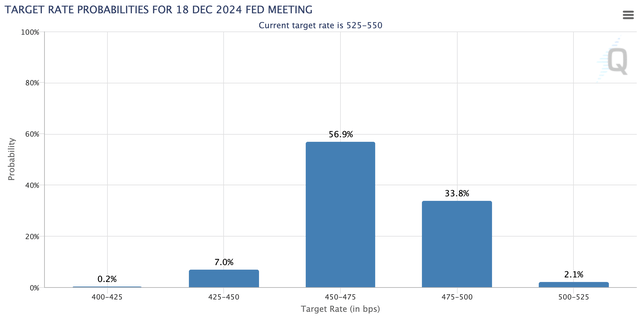

With the Fed expected to start cutting interest rates in the next few meetings, Verizon’s large dividend becomes more attractive to yield investors. The stock currently offers a strong 6.6% yield, while the CME FedWatch tool forecasts a nearly 64% chance of at least 3 rate cuts by year-end.

Verizon slumped all the way into the low $30s as the dividend yield has limited benefit compared to high-yielding savings accounts and Treasuries offering 5% yields. With a few rate cuts, Verizon will start offering a sizable yield advantage over risk-free investments.

The annual dividend payout now tops $11 billion, following 17 years of rate cuts. With the free cash flow forecast, Verizon will produce a roughly 55% payout rate, providing the company with somewhere around $8+ billion in cash to repay debt.

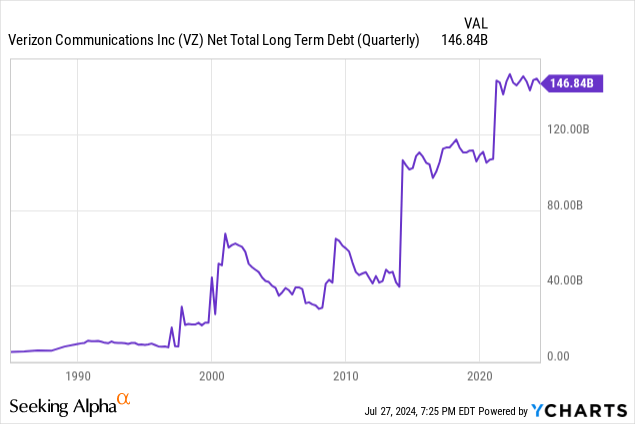

Again, this is where the investment story in Verizon always hits a wall. The company has no history of wisely using this cash to invest in growth, such as data centers, cloud services, and AI, yet Verizon also has no history of repaying debt. The company doesn’t have the financial flexibility to really invest aggressively in any AI opportunities due to still having a net debt balance of $147 billion now despite the audacity of hiking dividends for 17 years in a row.

The stock has a total return over the last 5 years of -8%. The returns will likely be better going forward due to debt repayments and the lower stock price, but investors shouldn’t be surprised if the S&P 500 doesn’t continue outperforming the highly indebted Verizon.

The benchmark index is up nearly 100% over this period. The big problem for Verizon is that the largest tech companies responsible for the strong S&P performance are loaded with cash and produce billions upon billions in free cash flow without the need to repay debt or large dividend payouts.

Takeaway

The key investor takeaway is that Verizon has reduced capex and boosted free cash flows to help the company take a stab at reducing large debt levels. The company should be good for the large dividend yield and not much else, as cutting capex provides no avenue to growth in the future.

Dividend-obsessed investors can own Verizon for the large yield, but the large wireless player has to start cutting net debt levels to ensure long-term stability.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

The information contained herein is for informational purposes only. Nothing in this article should be taken as a solicitation to purchase or sell securities. Before buying or selling any stock, you should do your own research and reach your own conclusion or consult a financial advisor. Investing includes risks, including loss of principal.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

If you’d like to learn more about how to best position yourself in under valued stocks mispriced by the market to start Q3, consider joining Out Fox The Street.

The service offers a model portfolio, daily updates, trade alerts and real-time chat. Sign up now for a risk-free 2-week trial.