Summary:

- Verizon stock boasts a forward dividend yield of 6.6%.

- Income investors are likely underpinning its robust consolidation zone above the $40 level.

- Verizon is focusing on convergence and GenAI opportunities to drive growth in its consumer business.

- Verizon might not attract growth investors. However, it’s still a fundamentally strong company.

- I explain why income investors shouldn’t be too concerned, supporting VZ’s valuation.

RiverNorthPhotography

Verizon Stock: Strong Support Above $40

In my previous Verizon Communications (NYSE:VZ) article, I highlighted that VZ appeared to have consolidated well above the $40 support level. I indicated that VZ’s recovery has remained intact, suggesting that the worst is likely over.

Since my previous article, VZ has underperformed the S&P 500 (SP500). However, it’s increasingly clear that buyers have been keen to defend VZ’s $40 zone. Despite that, Verizon’s losses in postpaid phone customers could dampen a more substantial valuation re-rating. Verizon’s Q1 earnings release in late April underscored these challenges as VZ reported a “net loss of 68,000 postpaid phone connections in the quarter.” However, it was better than Wall Street’s estimates. Despite that, the gains of T-Mobile (TMUS) and AT&T (T) suggest Verizon must navigate intense challenges in its consumer segment. Moreover, the ongoing decline in Verizon’s business revenue could worsen the obstacles in its consumer business, lowering Verizon’s medium-term growth prospects.

Verizon: Convergence And GenAI Opportunities

Notwithstanding the challenges faced by Verizon in its consumer business, VZ posted an ARPU increase of 4.4% in its postpaid consumer segment. In addition, the company is also working on its “convergence” strategy, integrating Verizon’s leadership in FWA and fiber. Verizon management is confident there is significant potential to lift its convergence opportunities. VZ highlighted that only “about 15% of Verizon’s customers are converged.” Given the scale of Verizon’s network infrastructure, Verizon could offer attractive packages to improve Verizon’s value proposition to customers.

Verizon also anticipates revenue growth opportunities from GenAI at the edge. With GenAI expected to broaden from cloud-based to edge-AI inferencing, Verizon is expected to be a key beneficiary. Verizon is confident its massive infrastructure investments would pay off in mobile edge compute. VZ believes the impetus to lower latency is expected to drive new growth drivers, benefiting Verizon. While these developments are assessed to be nascent, they could provide a much-needed valuation boost to VZ investors.

VZ Stock: Not Attractive When Adjusted For Growth

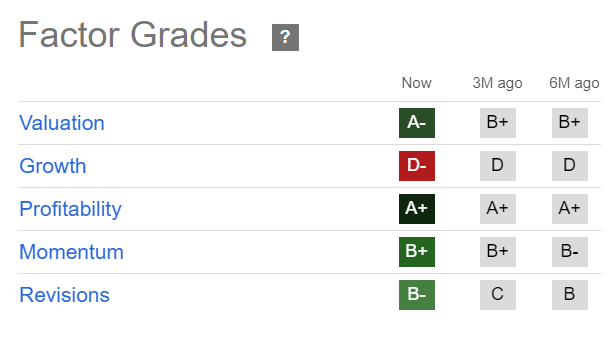

VZ Quant Grades (Seeking Alpha)

VZ’s forward adjusted P/E of 8.8x is well below its sector median of 12.5x. However, arch-rival TMUS’s surge to new highs in June underscores the criticality of assessing VZ’s growth-adjusted valuation. VZ’s tepid “D” growth grade seems much less attractive than TMUS’s “A+” growth grade.

VZ’s forward adjusted PEG ratio of 6.37 should have alerted me to why VZ seems to have trouble getting a more substantial valuation re-rating. TMUS’s forward adjusted PEG ratio of 0.75 suggests TMUS is a much more attractive prospect when adjusted for growth. T-Mobile’s recent acquisition of U.S. Cellular is also expected to expand its growth opportunities in rural areas, intensifying its competitive edge against Verizon.

Notwithstanding these challenges, VZ’s attractive forward dividend yield of 6.6% should keep income investors onside. With the Fed expected to have reached peak rates, it should attract income investors looking to reallocate to fundamentally strong companies. VZ’s “A+” profitability grade underscores the robustness of its business model, helping to sustain the clarity over its dividend payouts. While growth investors could prefer TMUS’s highly attractive PEG ratio, income investors are still expected to support VZ’s valuation.

VZ Stock: Price Action Suggests Resilience

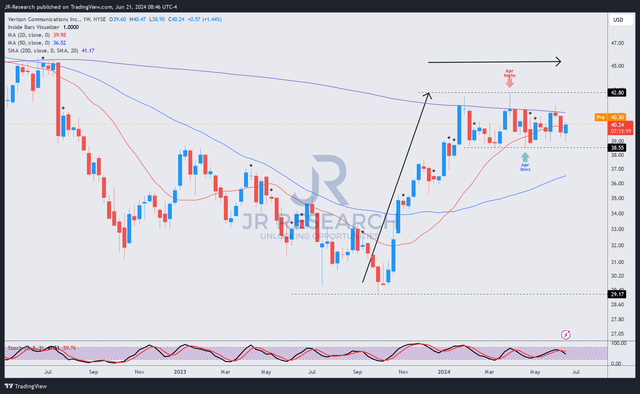

VZ price chart (weekly, medium-term, adjusted for dividends) (TradingView)

VZ’s price action (adjusted for dividends) demonstrates the resilience of buying support above the $40 level.

As seen above, VZ has been consolidating above that level since early 2024, although selling resistance has been observed below the $43 level. Bullish investors have likely assessed a pretty tight consolidation zone between those levels. After a significant re-rating from VZ’s October 2023 lows, taking a break to consolidate shouldn’t be a surprise.

Moreover, VZ’s “B+” momentum grade supports my thesis that buying sentiments have remained robust.

Takeaway

If you are an income investor, VZ offers an attractive bet as the Fed potentially lowers its interest rates by the end of 2024. VZ has a fundamentally strong business model that underpins the soundness of its capital allocation strategies. In a highly regulated environment, Verizon also benefits from incumbency and massive scale, helping to mitigate significant competitive risks from new challengers in its wireless business.

Despite that, Verizon has faced market share losses against T-Mobile and AT&T in its consumer business, which must be addressed to improve investor confidence. Moreover, Wall Street’s estimates suggest Verizon needs to deliver more robust performance before growth investors might consider returning.

From a risk/reward basis, I view VZ’s bullish thesis as still reasonable. The recent consolidation has also been constructive, as the selling intensity observed in 2023 has dissipated.

Rating: Maintain Buy.

Important note: Investors are reminded to do their due diligence and not rely on the information provided as financial advice. Consider this article as supplementing your required research. Please always apply independent thinking. Note that the rating is not intended to time a specific entry/exit at the point of writing unless otherwise specified.

I Want To Hear From You

Have constructive commentary to improve our thesis? Spotted a critical gap in our view? Saw something important that we didn’t? Agree or disagree? Comment below with the aim of helping everyone in the community to learn better!

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

A Unique Price Action-based Growth Investing Service

- We believe price action is a leading indicator.

- We called the TSLA top in late 2021.

- We then picked TSLA’s bottom in December 2022.

- We updated members that the NASDAQ had long-term bearish price action signals in November 2021.

- We told members that the S&P 500 likely bottomed in October 2022.

- Members navigated the turning points of the market confidently in our service.

- Members tuned out the noise in the financial media and focused on what really matters: Price Action.

Sign up now for a Risk-Free 14-Day free trial!