Summary:

- Verizon recently announced a $20B acquisition of Frontier Communications.

- Despite potential synergies, I believe the market’s prevailing bullish rating overestimated the upside impacts of the deal.

- Furthermore, the acquisition price represents a 44% premium.

- To me, this suggests potential overpayment and could offset some of the anticipated accreditive benefits for shareholders.

PeopleImages

VZ stock: previous thesis and new development

I last analyzed Verizon stock (NYSE:VZ) more than a month ago. As you can see from the screenshot below, that article was published on July 26, 2024, and was titled “Verizon Q2: Still Not Too Late To Sell (Technical Analysis)”. As the title suggests, the article recommended selling at that time. The recommendation is mainly based on the near-term prospects and technical trading patterns of the stock prices surrounding its Q2 earnings report. Quote:

VZ stock’s Q2 earnings report provides another example of growth challenges. Combined with the selling pressure afterward, I see large odds for VZ prices to fall below a key support level of $38.5 in the next 6–12 months. Investors with a short timeframe should thus consider selling. There are other alternative ideas (such as MO and EPD) that offer similar value-yield combinations but far higher growth potential and positive market momentum.

The goal of this follow-up article is to upgrade my rating to HOLD. The upgrade is based on two considerations: volatility and new developments in its business fundamentals. The stock has indeed suffered sizable volatilities as you can see from the next chart below shortly after its Q2 ER in late July. With the earnings season over, I expect quieter volatility ahead.

On the business front, a key development since my last writing was the announcement the company has made to acquire Frontier Communications (NASDAQ:FYBR). On Sept 5, VZ announced a $20B cash deal to acquire FYBR and stated that:

This strategic acquisition of the largest pure-play fiber internet provider in the U.S. will significantly expand Verizon’s fiber footprint across the nation, accelerating the company’s delivery of premium mobility and broadband services to current and new customers.

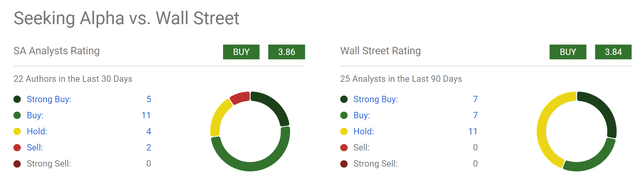

The company is optimistic about the synergist opportunities. And both Seeking Alpha and Wall Street analysts are bullish on the stock, as you can see from their recent ratings below. However, my view is that such a bullish rating very likely reflects an overestimation of the potential impacts from this acquisition, as detailed next.

VZ stock: Frontier’s potential impact

Before moving on, let me first clarify that I am not denying the accretive nature of the acquisition. I certainly see many synergistic opportunities as the bulls see. It is just that I think the potential impacts are that substantial. As an example,

VZ expects to realize at least $500M in run-rate cost synergies by year three from the benefits of increased scale and distribution and network integration. The deal integrates Frontier’s advanced fiber network, which encompasses 2.2M subscribers across 25 states, into Verizon’s portfolio of fiber and wireless assets, including its best-in-class Fios offering.

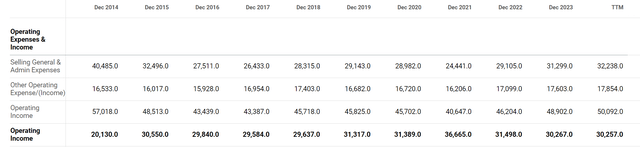

To contextualize the above cost synergies, the chart below provides a breakdown of Verizon’s operating expenses over the recent few years. Specifically, it shows the company’s SG&A (selling, general, and administrative expenses) together with other operating expenses. As shown in the chart, VZ’s operating expenses have generally increased over the years. On a TTM basis, its SG&A expenses reached $32.2B and other expenses $17.8B in the latest quarter.

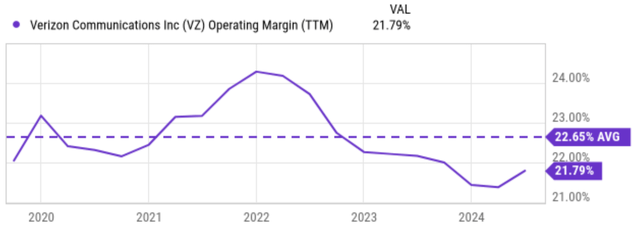

With these expenses and its current revenue (of around $134.2B on a TTM basis), its operating margin worked out to be slightly below 22% as you can see from the next chart below. Achieving a synergistic benefit of $500M (that is, if the benefits actually materialize as management predicts) would help to reduce its operating expenses by about 1% in my estimate. VZ has been facing margin pressure since 2022 as seen due to a variety of headwinds (including changes in borrowing rates, cost management strategies, competitive pressures, heavy CAPEX requirements, etc.). And its current margin has fallen below the 5-year average of 22.65% by a noticeable gap as seen. Even with the synergist benefits fully factored in, its margin would be still lower than the long-term average, according to my estimate.

Other risks and final thoughts

Besides the limited impact, there are a few other downside risks surrounding the deal. The deal translates into an acquisition price of $38.5 a share in cash, representing a premium of close to 44% to FYBR’s average share price before the deal’s announcement. To me, such a sizable premium very likely means that VZ is overpaying, and the overpayment could offset some of the anticipated accretive benefits. It is also uncertain if the deal can be approved, as there are antitrust and other risks associated with a sizable acquisition like this.

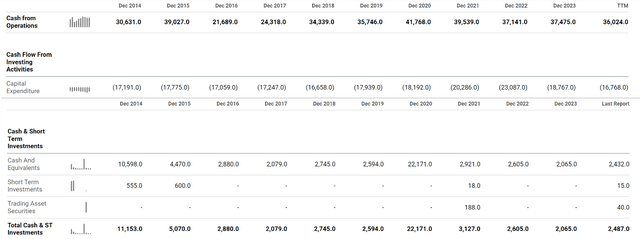

On the positive side, VZ generates a significant amount of cash flow from its core business activities and maintains a healthy balance sheet to finance the deal. To wit, as of TTM, VZ generated $36,420 million in cash from operations as seen from the next chart below. However, there have been fluctuations in this metric, with some years showing higher levels of cash generation than others. As noted earlier, VZ has invested heavily in capital expenditure over the years. However, I expect its CAPEX to have peaked already. As of TTM, its CAPEX sits at $16,768 million as seen, compared to over $20B in 2021 and 2022. As a result, VZ generated about $20B of free cash flow as of TTM, almost the exact amount needed for its Frontier deal. In addition to the robust cash flow, VZ also maintains a healthy cash position. As seen in the chart, as of the latest reported period, VZ has over $2.4 billion in cash and short-term investments on its ledger.

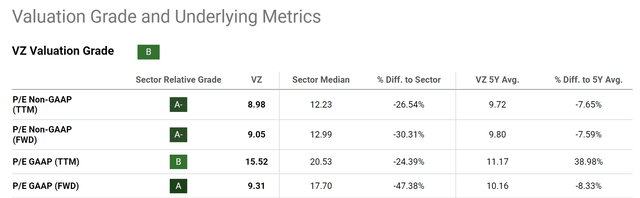

At the same time, the company is trading at a very reasonable valuation, both in absolute and relative terms. More specifically, the chart below summarizes VZ stock’s valuation grade. As seen, VZ’s P/E ratios, both in TTM and FWD terms, are lower than the sector median and its own 5-year average. As an example, VZ’s TTM non-GAAP P/E ratio is 8.98 only. Compared to the sector median of 12.23, this represents a 26.54% discount. Compared to its 5-year average of 9.72, this represents a milder discount of about 7%. Its FWD non-GAAP P/E ratio is 9.05 and shows a similar trend when compared to the sector median of 12.99 and its 5-year average of 9.80.

All told, in the mid to long term, I don’t see anything obviously against holding on to a leader in a stable sector at a ~9x P/E multiple. Its 6.4% dividend yield adds further draw and downside protection. However, I don’t expect an alpha from VZ when compared to other dividend stocks (such as Altria and/or Enterprise Products, as mentioned in my last article). I expect the total return potential to be uninspiring under current conditions with a fair valuation multiple, limited margin expansion potential, and limited EPS growth potential. I don’t expect the Frontier acquisition to fundamentally change these limitations.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

Join Envision Early Retirement to navigate such a turbulent market.

- Receive our best ideas, actionable and unambiguous, across multiple assets.

- Access our real-money portfolios, trade alerts, and transparent performance reporting.

- Use our proprietary allocation strategies to isolate and control risks.

We have helped our members beat S&P 500 with LOWER drawdowns despite the extreme volatilities in both the equity AND bond market.

Join for a 100% Risk-Free trial and see if our proven method can help you too. You do not need to pay for the costly lessons from the market itself.