Summary:

- Verizon Communications Inc. is well positioned to break a multi-year downward trend, supported by fundamental and technical analyses.

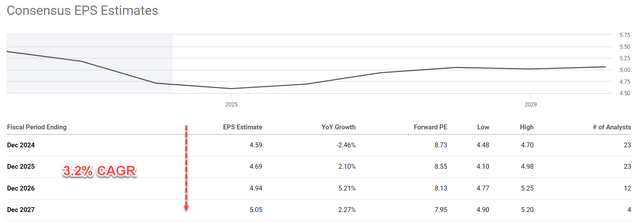

- Consensus estimates show gradual EPS growth over the next four years and I see good reasons for such projection.

- With its current low P/E ratio and generous yield, any growth could trigger a sizable valuation expansion.

- The generous dividends (~6.5%) add another layer of protection, especially for investors who need current income.

Mihaela Rosu

Thesis

The thesis of this article is very simple. I will argue that Verizon Communications Inc. (NYSE:VZ) is now well poised to break a multi-year downward trend. The argument will be supported by both fundamental and technical analyses.

Fundamentally, the stock presents a compelling investment opportunity under current conditions combining excellent value (with an attractive FWD P/E ratio of only 8.7x), growth potential, and a generous dividend yield that adds extra protection to the investment (more on these later).

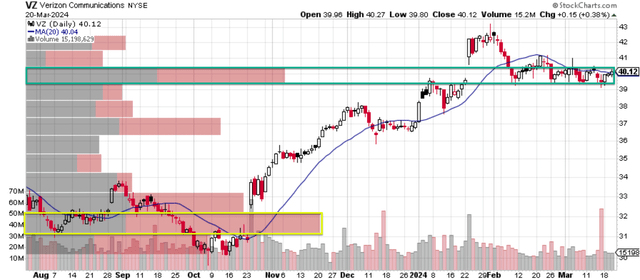

Furthermore, technical indicators suggest a potential breakout. VZ’s stock prices have been in a miserable downward trend in recent years. It has declined from a peak of around $60 in 2021 to a bottom close to $30 in 2023. I will show the technical signs of recent trading patterns and argue why the downward trend is finally over.

Now let me start with the fundamentals. The chart next shows consensus estimates for VZ’s future EPS over the next few fiscal years. As seen, analysts now predict gradual EPS growth for VZ over the next four years after several years of decline. More specifically, their projections translate into a compound annual growth rate (“CAGR”) of 3.2% between FY 2025 and 2027. Do not overlook such growth. An 8.7x P/E is only reserved for terminally stagnant business in my mind, and any growth could trigger a re-evaluation and large upside potential.

Next, I will argue that such growth is very likely to materialize.

Fundamental catalysts

The telecommunication space gives us the impression that they mostly compete on price – which of course has a lot of truth to it. However, looking deeper, I can see that VZ differentiates itself from other telecommunication companies in a few crucial ways.

VZ has consistently invested heavily in building and maintaining a robust and reliable network infrastructure. This includes a focus on fiber optics for high-speed data transmission and a significant investment in 5G technology rollout. This focus on network quality attracts customers who prioritize consistent and fast connections (like this author himself). VZ also focuses on premium services: While VZ offers competitive basic plans, it also emphasizes premium services like bundled plans with high data allowances, unlimited calling and texting, and access to exclusive content or entertainment packages. This strategy targets customers willing to pay a premium for a comprehensive and seamless mobile experience.

This strategy has been working effectively, in my view. As an example, VZ reported 449,000 total wireless postpaid phone additions during the fourth quarter of 2023, compared to 217,000 such additions a year ago. It also reported as many as 413,000 broadband net additions.

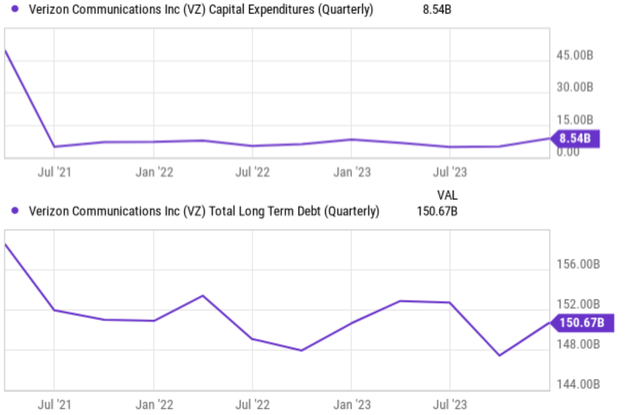

In the meantime, I also anticipate that its capital expenditures have already peaked and are likely to stabilize/fall in years ahead (see the top panel of the chart below). As just mentioned, VZ has invested heavily in the past to build a robust infrastructure. I expect this phase to be over now and those investments to pay dividends – pun intended – in the many years to come.

To add to the good news, the company has also been reducing its debt position at the same time. As seen in the bottom panel, its total long-term debt has been gradually declining in recent years. With a lower CAPEX intensity and lower debts, I expect the company to have more free cash to pursue new growth initiatives and reward its shareholders, e.g., by raising its dividends as to be elaborated later.

Technical signs

To supplement the above fundamental catalysts, let’s take a quick look at the trading patterns in recent months. The chart below shows the price-volume information for VZ in the past 6 months. As seen, VZ has been in an uptrend for the past few months since reaching a bottom of around ~$30 between Oct and Nov 2023. Its prices have been steadily increasing since then to the current level of ~$40.

In particular, during the downtrend (Aug to Nov), the most trading volume occurred in a price range of $30 to $32 as highlighted by the yellow box. The stock has definitely overcome this range by now in my mind. Since then, the trading volume has been the heaviest in a price range of $39 to $41 as highlighted by the green box. The stock can only keep moving up till buyers and sellers in this range are replaced. I am optimistic that the stock can overcome this range given the fundamental catalysts mentioned above.

Other risks and final thoughts

Here I won’t repeat the risks generic to telecommunication stocks, which have been thoroughly discussed in my other articles. I will just focus on a few risks that are particular to VZ.

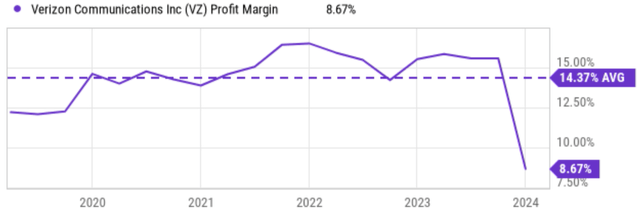

As said earlier, there is a good amount of truth that this space competes on price. And the next chart shows how VZ’s recent customer acquisitions came at a cost. As seen, its net profit margin dropped substantially in recent quarters. The current level of margin (around 8.6%) is far below its recent peak of ~16% and also its long-term average of ~14.3%. However, my outlook is that the margin can recover given its differentiating services and products as mentioned earlier.

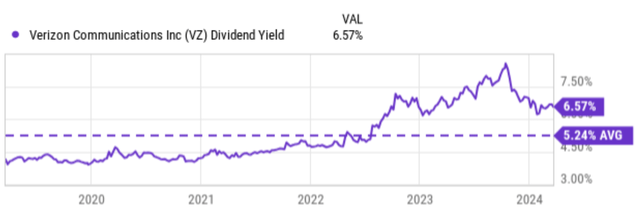

In terms of other upside risks, its generous dividend yield is at the top of my list. The next chart shows that VZ’s current dividend yield is 6.57%, which is not far above its historical average but also close to the peak levels from at least 2019. The average dividend yield for VZ over the past five years is 5.24%, and the current level is a whopping 25% higher. Such a high yield (both in absolute and relative terms) can add extra safety to the investment.

First, it provides another indication of its compressed valuation in addition to the single-digit P/E.

Second, it also provides a regular cash flow, which is especially beneficial for investors who need current income.

Finally, such a high yield can also provide an effective hedge against potential downturns, especially given how expensive the overall equity market currently is. And as argued earlier, I am optimistic that the company can maintain its dividend even during a downturn given the debt reduction and lower CAPEX intensity.

All told, my conclusion is that Verizon Communications Inc. stock presents a strong bullish case, with the positives outweighing the negatives by a large margin. The stock provides a good combination of value, income, and growth potential. I see several fundamental catalysts that could drive healthy growth in the 3~4% range. But in the end, with its current low P/E ratio and generous yield, any growth is a plus.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of VZ either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

Join Envision Early Retirement to navigate such a turbulent market.

- Receive our best ideas, actionable and unambiguous, across multiple assets.

- Access our real-money portfolios, trade alerts, and transparent performance reporting.

- Use our proprietary allocation strategies to isolate and control risks.

We have helped our members beat S&P 500 with LOWER drawdowns despite the extreme volatilities in both the equity AND bond market.

Join for a 100% Risk-Free trial and see if our proven method can help you too. You do not need to pay for the costly lessons from the market itself.