Verizon Q1: The More It Drops, The More I’ll Buy

Summary:

- Verizon beat EPS estimates for Q1 ’24 and is likely to continue growing its dividend this year.

- The broadband business is a strong driver of growth for Verizon, with continual subscriber momentum.

- Verizon’s valuation is attractive, with a competitive P/E ratio and a growing dividend, making it appealing for dividend investors.

photobyphm

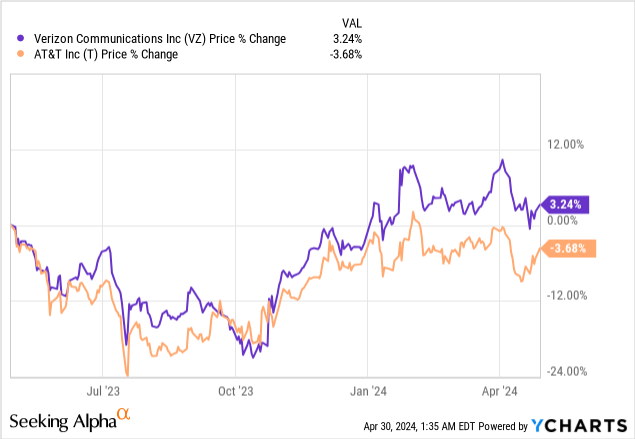

Verizon Telecommunications (NYSE:VZ) submitted a better than expected earnings sheet for the first fiscal quarter last week, which included an EPS beat and strong free cash flow. The broadband business continued to shine in the first-quarter, and Verizon is therefore very likely to continue to grow its dividend this year. Verizon, however, needs to follow in the footsteps of AT&T (T) and repay more debt in order to lower its leverage. Lowering the debt burden could also be a powerful catalyst that allows for a revaluation of the telecom’s shares to take place. With a low valuation based off of earnings, I believe the value proposition for dividend investors especially is a very good one!

Previous rating

I previously rated Verizon a buy after Q4 ’23 earnings due to the company’s considerable momentum in broadband as well as a high implied forward dividend payout ratio: Top Value After A Strong Q4. Verizon’s shares have declined about 5% since my last work, but I believe the investment thesis is intact. I now believe Verizon’s strong free cash flow gives the company a lever to grow both the dividend and reduce its formidable debt, which in turn could pave the way for a higher earnings multiplier. I believe the debt situation especially allows for improvement and, if successfully addressed, could create an upside catalyst for Verizon’s shares. The outlook for FY 2024 is reasonably strong, and I believe the risk profile for dividend investors is favorable.

Verizon beat estimates for Q1 ’24

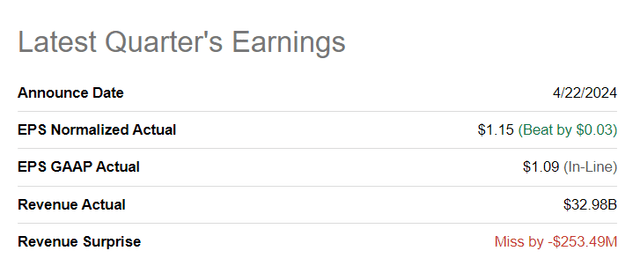

Verizon beat EPS consensus estimates for the first fiscal quarter on April 22, 2024, but missed slightly on the top line. They beat adjusted earnings estimates by $0.03 while revenues fell $253M short of the average Wall Street prediction.

Seeking Alpha

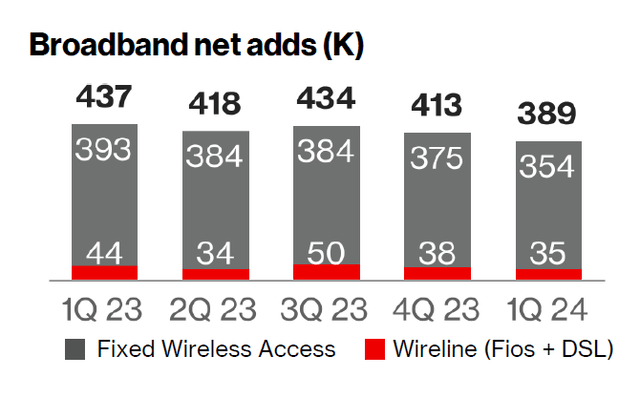

Broadband is still seeing decent growth

Broadband is a growth driver for Verizon, and the telecom saw continual subscriber momentum in this important business in the first fiscal quarter. Verizon had 389k net adds in the broadband segment in Q1 ’24 and a rolling twelve months average quarterly net add of 414k. While Q1 ’24 net adds were below the 1-year quarterly average, Verizon is obviously still signing on a ton of new customers to its fiber broadband offer. While operationally Verizon’s Q1 ’24 results looked quite solid, Verizon needs to do a lot more to lower its debt or risk to trade at a distressed valuation for a much longer period of time.

Verizon

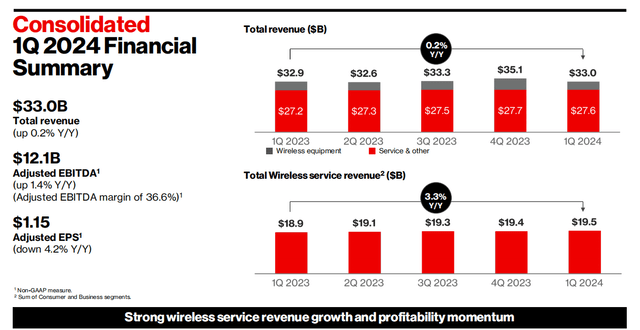

Verizon, however, struggles with its top line, which is not growing very fast. In the first-quarter, the company’s revenues only grew 0.2% and were lifted pretty much only because of Verizon’s positive growth in Wireless. This segment saw $19.5B in revenues, showing 3.3% year-over-year revenue. With broadband growing its subscribers quickly, I believe the outlook is generally favorable, although investors should not expect a massive improvement in the growth picture. Telecoms operate in a saturated market and are likely to continue to see only low single-digit growth rates.

Verizon

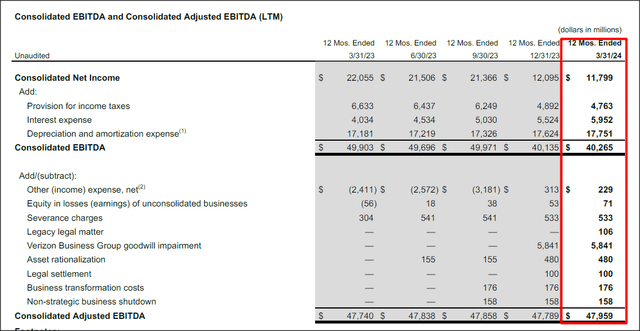

The key benefit of investing in Verizon is that the company’s telecom assets provide highly predictable and stable EBITDA and free cash flow, which ultimately backs the dividend. In the last quarter, Verizon earned $10.7B in EBITDA, showing 3.6% Y/Y growth. On a twelve-months basis, Verizon generated $48.0B in EBITDA, which was about flat Y/Y.

Verizon

Debt repayment provides lever for a revaluation

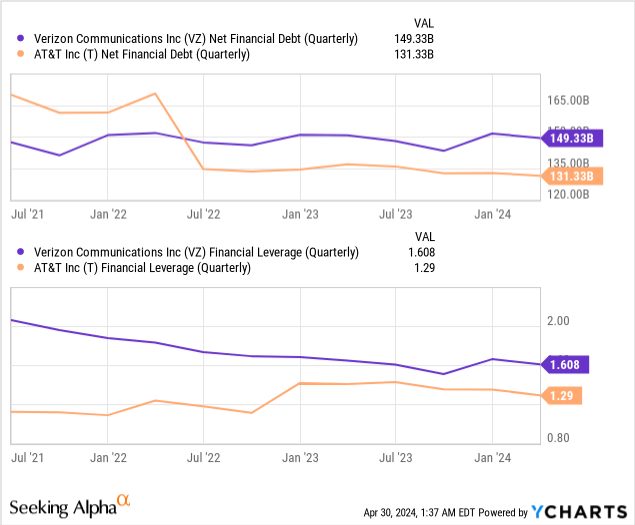

Like AT&T, Verizon simply owns too much debt… which I have said is one of the reasons why the telecom is selling for such a low earnings multiplier factor. At the end of the March quarter, Verizon had net financial debt of $149.3B compared to $131.3B for AT&T. The long-term portion of Verizon’s debt as of Q1’24 was $136.1B and the telecom only paid down $1.6B year over year. The single biggest lever that Verizon has to create a catalyst for itself and boost its free cash flow is to throw as much cash as it can afford at its debt.

I estimate that Verizon could achieve $17-19B in free cash flow annually going forward (which is about equal to last year’s FCF of $18.7B). Since telecoms have stable revenue, EBITDA and free cash flow bases, I believe the assumption for stable Y/Y free cash flow is reasonable. The dividend costs the telecom approximately $10.8B annually, so Verizon could generate between $6.2B and $8.2B in annual excess free cash flow going forward. The company also spends between $4-6B a quarter on CapEx which in part funds the roll-out of its 5G and fiber broadband networks… two growth areas for Verizon. A large portion of this excess free cash flow could be applied to the telecom’s debt balance. I already mentioned Verizon’s strong free cash flow in my last coverage, but dividend concerns about Verizon and AT&T’s dividends have been consistent, so I believe free cash flow and dividend coverage have to be continuously evaluated each quarter.

Both Verizon and AT&T ultimately will likely need to force accelerated debt repayments, as the debt burden seems the single biggest factor that prevents a major revaluation of Verizon’s and AT&T’s shares to the upside. From a financial leverage point of view, Verizon is more leveraged (1.6X) than AT&T which has a 20% lower financial leverage ratio of 1.3X. However, both telecoms need to do more to address their leverage issues to clear the path for a higher valuation.

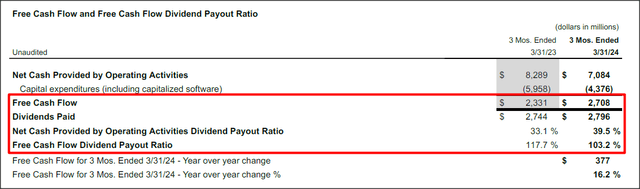

Verizon covered its dividend with free cash flow

First quarter cash flow is typically not very strong for telecoms, but cash flows tend to recover throughout the year. Verizon still covered its dividend with free cash flow in the first-quarter, however, reporting a dividend coverage ratio of 103% based off total Q1 ’24 FCF of $2.7B (+16% Y/Y). For the full year, I expect Verizon to generate, as I said, approximately $17-19B in free cash flow, which implies a forward dividend coverage ratio of 157%-175%. This ratio range also suggests that Verizon will have more than enough free cash flow to pay its dividend and has enough cash left to reduce its outstanding financial obligations.

Verizon

Verizon’s valuation

The good news is that Verizon is still very much a bargain, especially if you are a dividend investor that chiefly looks for investments through an income lens. Verizon is paying a $0.665 per-share monthly dividend to shareholders each quarter, which implies, at a current share price of $40.09, a forward dividend yield of 6.7%. Verizon, as opposed to AT&T, is also growing its dividend, so the dividend proposition here is likely slightly better.

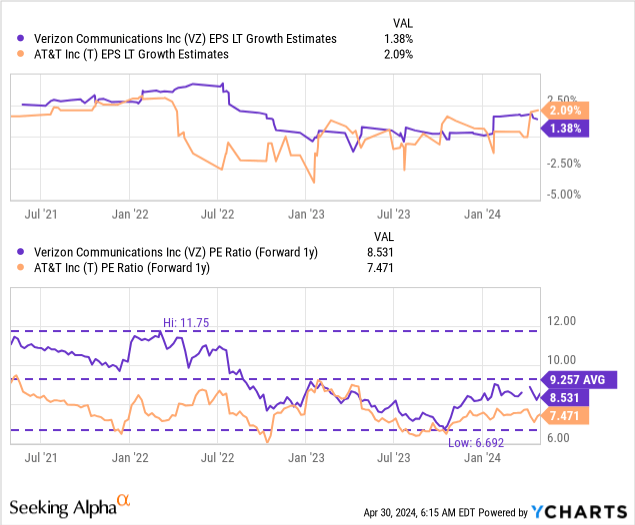

Verizon is currently trading at a P/E ratio of 8.5X compared to a price-to-earnings ratio of 7.5X for AT&T and I consider both valuation multipliers bargains for dividend investors. I believe both AT&T and Verizon could reasonably trade at 10X P/E (the longer term P/E average is about 9.5X) given the stability of their earnings and free cash flows. For Verizon, this implies a fair value of ~$47 and corresponds to approximately 20% upside revaluation potential. In my last article on Verizon, I used a fair value P/E ratio of 9.0X. Given the strength of the company’s free cash flow, consistent subscriber momentum in broadband and the availability of a lever for earnings growth, I believe a 10X P/E ratio could also be justified, under the condition that Verizon makes progress repaying more of its debt going forward.

Verizon is likely more expensive than AT&T because the telecom is actually growing its dividend payout, which obviously makes shares more appealing from a yield-on-cost perspective.

Risks with Verizon

The biggest commercial risk for Verizon, as I see, relates to the overall weakness in top-line growth for mature telecom companies. Verizon is seeing decent broadband subscriber momentum, but the telecom does not see a lot of growth in its core business, which is another reason why shares of both Verizon and AT&T are so cheap. If Verizon failed to earn its dividend with free cash flow, I would likely change my opinion on the telecom as well.

Final thoughts

Verizon submitted a rather strong earnings report for Q1 ’24 that beat EPS estimates, showed continual momentum in broadband and resulted in reasonably strong free cash flow. Based off my free cash flow estimate, Verizon could achieve a forward dividend coverage ratio of at least 157% which makes the dividend very safe for investors. Additionally, Verizon’s valuation implies a high safety margin for dividend investors as well as a double-digit earnings yield. I believe the risk and income proposition for Verizon is exceptionally attractive, and I continue to rate shares of Verizon a buy after Q1’24 earnings!

Analyst’s Disclosure: I/we have a beneficial long position in the shares of VZ, T either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.