Summary:

- The VZ stock Q2 earnings report provides another example of growth challenges.

- Combined with the selling pressure afterward, I see large odds for VZ prices to fall below a key support level of $38.5 in the next 6–12 months.

- Investors with a short timeframe should thus consider selling.

- There are other alternative ideas (such as MO and EPD) that offer similar value-yield combinations but far higher growth potential and positive market momentum.

Adam Gault

VZ stock Q2 earnings: another quarter of slow growth

I last covered Verizon stock (NYSE:VZ) earlier this month. The article is titled “Why And How I Sold My Shares” as you can see from the screenshot below. As the title suggests, the article detailed my thought process for selling my Verizon shares. More specifically, I sold my shares due to the following concerns:

There is nothing wrong with holding a sector leader trading at a reasonable P/E and yielding significantly above its historical average. However, I sold my Verizon shares recently due to consideration of compressed dividend yield and tepid growth outlook. I expect the annual growth rate to be only around 1.5% and see other income options that provide both higher yield and higher growth potential. In particular, I used covered-call options to sell my shares at an effective price of around $41, a proven strategy to help boost effective yield.

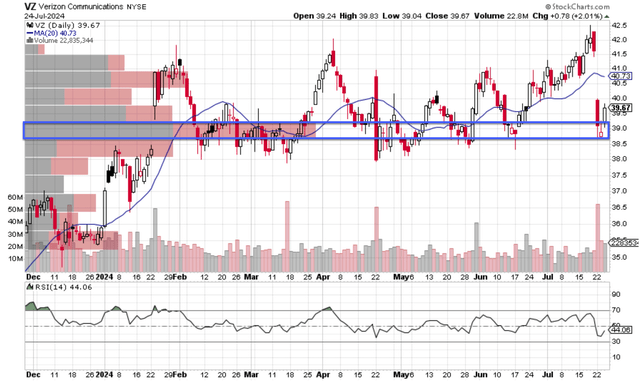

That article approached the stock from a long-term perspective. Since then, the company released its 2024 Q2 earnings report (ER) earlier this week, which was met with a sharp price correction as you tell from the chart above. Its stock prices fell by almost 7% during intraday trading after the ER, a huge setback considering the stock’s relatively low historical beta. I will elaborate on the Q2 numbers a bit in the next section and explain why they do not change my concern – they actually add to it – over their slow growth. Given the new development in Q2 and the sizable price correction, I want to provide this updated assessment. This assessment is more oriented toward the near term. I see a very unfavorable return potential in the near term, and thus urge existing investors to consider selling.

VZ stock: Q2 recap

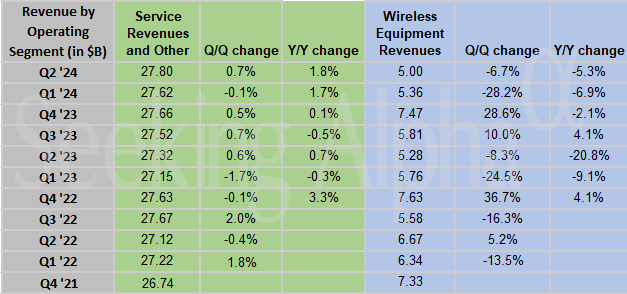

Overall, my impression of its second-quarter results and full-year 2024 outlook is another year of stagnating business. To wit, VZ’s total revenue dialed in at $32.8B, missing the consensus estimate of $33.04B slightly. Diving into the numbers more, you can see that revenues from its services grew by 1.8% YOY, but wireless equipment revenues fell by 5.3% YOY. For the growth in service revenues, my estimate is that it is largely driven by higher pricing, not by strong shipping volume. Pricing can be quite volatile given the uncertainties of inflationary pressure and consumer confidence, which compound my concern about its growth pressure.

In terms of the bottom line, net income dialed in at $4.7B for the quarter, compared with $4.8B a year ago, translating into an annual growth rate of 2%. On a per-share basis, Q2 EPS came in at $1.09 per share, a slight decrease compared to $1.10 per share a year earlier due to share dilution. For the full year 2024, VZ provided an EPS guidance in the range of $4.50 to $4.70, essentially on par with its 2023 EPS of $4.71. Note that this guidance range assumes that wireless service revenue growth of 2% to 3.5%.

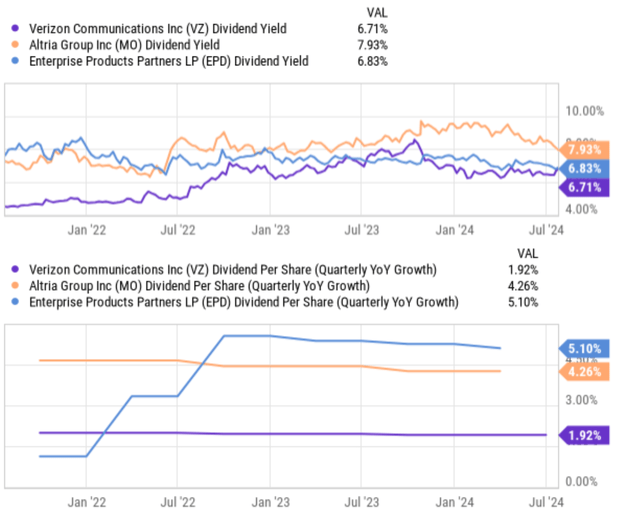

Most VZ bulls emphasize the deep value and high yield here. And I totally see the draw with a yield of 6.7% and an FWD P/E of 8.7x. However, bear in mind that there are quite a few other options with similar yields and P/E ratios, but feature far higher growth rates. Tobacco stocks (such as Altria) and midstream stocks (such as Enterprise Products) come to mind easily.

VZ stock: trading pattern points to continue selling pressure near term

In addition to my above growth concern at a fundamental level, I am also seeing signs of persisting selling pressure in the near term that can push VZ prices even lower. VZ prices have been trading sideways mostly for the past 6 months in a consolidation window between $38.5 and $41.5 as you can see from the chart below (which echoes my earlier comments about the low beta of its historical stock prices). The sell-off after its Q2 ER has sent the prices to the lower end of this range. Currently, its prices are well below the 20-day moving average, a classical technical indicator for bearish momentum (the so-called bearish crossover). The Relative Strength Index (RSI) currently hovers around 44, again another classical indicator of selling pressure. Finally, pay attention to the price-volume bar highlighted by the blue box in the chart below. This price-volume bar shows that the heaviest trading volumes happened in this price range of $38.5 to $39 in the past 6 months. Due to the heavy trading volume in this range, it is a key support level in my mind, the current price is too close to this key support level. Given the prevailing selling pressure as argued above, I see good odds for the prices to break this support level in the near future.

Other risks and final thoughts

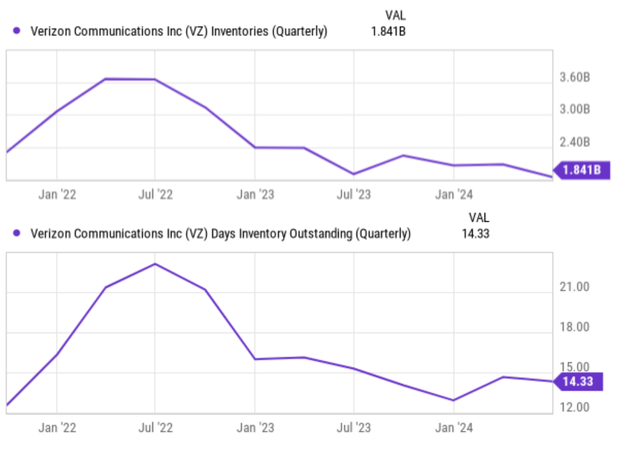

On the positive side, the company has made good progress in clearing its inventory buildup in recent quarters. I was concerned about the buildup in 2022 in the aftermath of the COVID-19 pandemic (due to factors like global logistic congestion, normalization of consumer upgrades, etc.). More specifically, the chart below shows the inventory (top panel) and days of inventory outstanding (bottom panel) for VZ stock in the past 3 years. As seen from the top panel, its inventory levels reached a peak in mid-2022 at around 3.6 billion dollars and currently sit near the lowest levels in this period at around 1.8 billion dollars. In terms of days inventory outstanding, the bottom panel shows a similar pattern. VZ’s days’ inventory outstanding has also trended down substantially over the past two years. It again peaked in 2022 at around 22 days and now sits at 14.33 days only.

All told, to reiterate, this article is oriented toward the near term (say the next 6 to 12 months). For investors with a longer horizon, I don’t see anything wrong with owning shares of a leader in a stable sector with a single-digit P/E (the topic of my last article). However, in the near term, given the developments (or the lack of) reported in its Q2 results and the selling pressure after the report, I see a very unfavorable return/risk profile. I see large odds for the stock to fall below a key support level of around $38.5 in the near future.

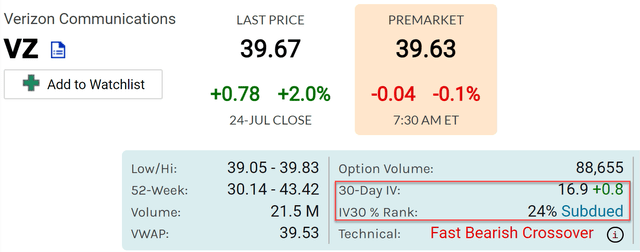

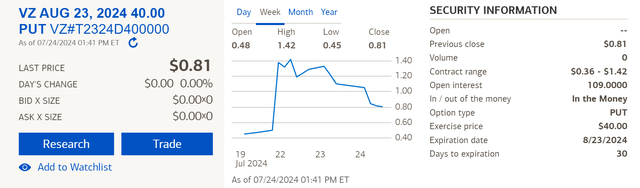

Thus, I recommend existing investors with shorter timeframes consider selling. Despite the price correction after Q2 ER, the current share prices provide a reasonable exit point over a grander scheme of things. Moreover, I see other options with equally attractive P/E and yield combinations such as MO and EPD, but far better growth potential (that is, relative to VZ) and far more positive market momentum in the near term. For potential investors who really want VZ shares, you could consider the use of the put option. Currently, these options have an implied volatility of about 16.9 (see the first chart below). Do not be under-impressed – this is already among the top 24% percentile of its historical IV, thus indicating a high option premium. Indeed, as you can see from the second chart below, even short-term VZ options do provide a sizable premium under these conditions. As an example, out-of-the-money put options with a $40 strike and an expiry date of August 23 now offer a premium of $0.81. Thus, sellers for this option get paid $0.81 upfront, or about 2% return based on the strike price in a month. As a VERY simple yet crude estimate, the annualized return (often interpreted as a “yield” from funds using similar strategies) is hence around 24%. Thus, the option writers, in this case, would earn ~24% (again, annualized) already if the option is not exercised, and would get the shares at an effective price of about $39.2 if the options are not exercised. Finally, if you are new to options, let me emphasize that trading options is much more complicated than trading shares. The risk calculus is vastly different. Even with the covered-put strategy just described, the option seller’s potential loss could be unlimited when the loss is interpreted as missed opportunities.

Source: marketchameleon.com Merrill Edge

Analyst’s Disclosure: I/we have a beneficial long position in the shares of EPD either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

Join Envision Early Retirement to navigate such a turbulent market.

- Receive our best ideas, actionable and unambiguous, across multiple assets.

- Access our real-money portfolios, trade alerts, and transparent performance reporting.

- Use our proprietary allocation strategies to isolate and control risks.

We have helped our members beat S&P 500 with LOWER drawdowns despite the extreme volatilities in both the equity AND bond market.

Join for a 100% Risk-Free trial and see if our proven method can help you too. You do not need to pay for the costly lessons from the market itself.