Summary:

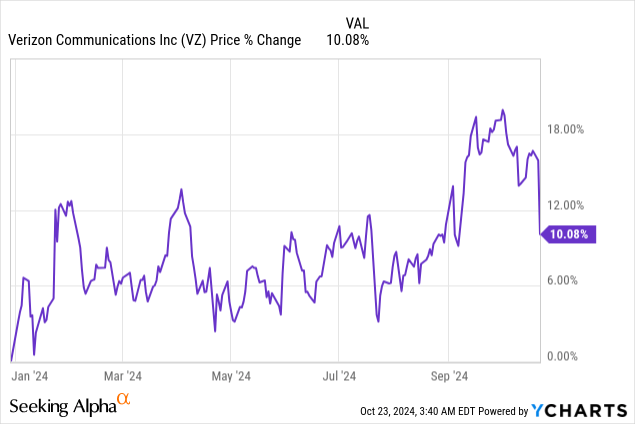

- Verizon’s Q3 results exceeded EPS expectations but fell short on revenues. Shares undeservedly dropped 5% on Tuesday.

- VZ saw strong broadband subscriber growth and confirmed its wireless service revenue growth outlook for FY 2024.

- Despite high debt, the Company’s solid dividend coverage ratio of 214% (based off of free cash flow) ensures a secure payout for dividend investors.

- Shares are attractively valued with an 11% earnings yield, making Verizon a top choice for income investors.

- VZ’s consistent broadband customer acquisition and dividend growth are two reasons to buy the telecom’s shares.

peshkov

Verizon (NYSE:VZ) reported mixed results for its third fiscal quarter on Tuesday, which included a slight earnings beat and weaker-than-expected revenue. However, the telecommunications company benefited from strong subscriber momentum in its core broadband business and Verizon earned a ton of free cash flow in the third quarter as well… leading to a dividend coverage ratio well in excess of 200%. Since shares of the telecom are still very reasonably valued, trade at an earnings yield of 19% and the payout is growing, I believe Verizon represents top value for income investors on the drop.

Previous rating

Strong momentum in the broadband business, and the potential for accelerating down payments of the company’s net debt were two reasons why I recommended shares of the telecom to dividend investors in July: Ignore The Noise, Buy The Dip. Verizon continued to see a healthy amount of new net additions in the broadband segment and although the telecom missed revenue targets for the third-quarter, Verizon delivered very strong free cash flow. The very comfortable dividend coverage ratio and the fact that the dividend is growing are two main reasons why investors may want to buy the drop here.

Strong subscriber momentum, easy Q3’24 beat

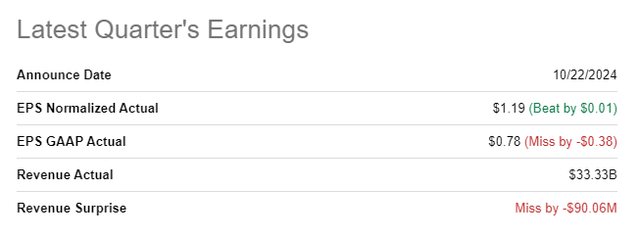

Verizon reported mixed results for its third-quarter: the telecom had adjusted earnings of $1.19 per share, which beat the consensus estimate of $0.01 per-share. While earnings beat, the telecom missed Q3’24 top-line estimates by $90M, chiefly due to weakness in its phone segment. The company’s core broadband business, however, continued to do very well.

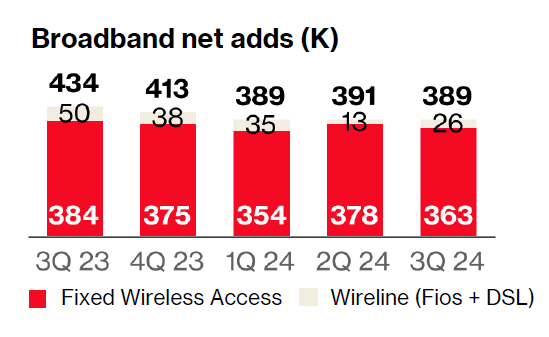

Verizon continued to make gains in the broadband business in the September quarter: in Q3’24 the telecom added a total of 389,000 subscribers in the broadband business which included fixed wireless net additions of 363,000 subscribers. While broadband net adds fell 10% year-over-year, the telecom extended a previous streak lasting eight quarters of net additions exceeding 375k.

Verizon

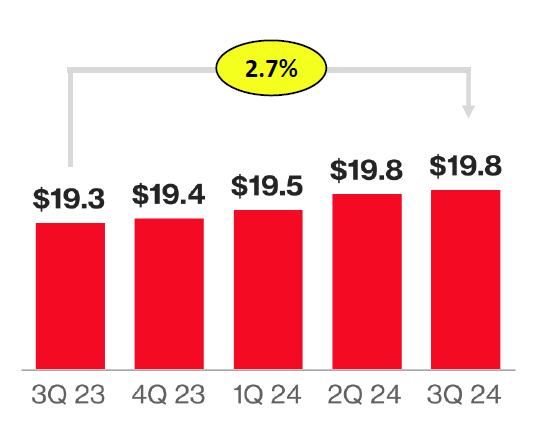

Verizon’s top line remained flat year-over-year, in part because of a slow phone upgrade cycle, but wireless service revenues kept growing: they went up 2.7% year-over-year and Verizon confirmed its full-year outlook of 2.0-3.5% wireless service revenue growth.

Verizon

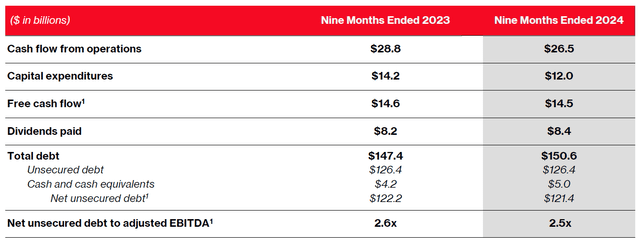

The most important takeaway from Verizon’s Q3’24 earnings sheet, besides an unchanged outlook for wireless service revenue growth and strong subscriber net additions, was its strong free cash flow. Verizon generated $6.0B in free cash flow in the third fiscal quarter and paid a total of $2.8B in dividends. This calculates to a dividend coverage ratio of 214% and renders the dividend very secure for investors, in my opinion. On a 9-month basis, the dividend coverage was 173%, lower than in Q3’24, but still more than sufficient to pay shareholders a growing dividend.

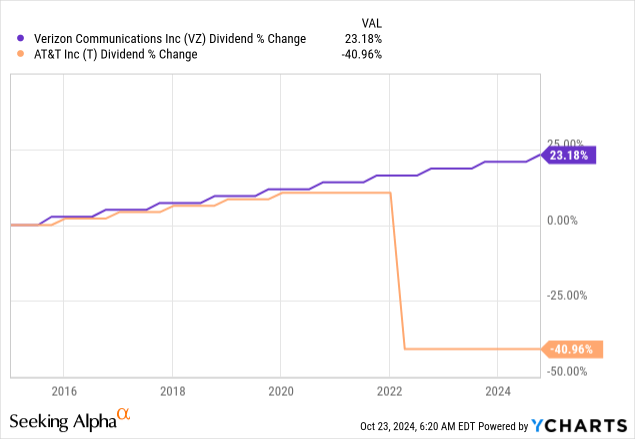

While AT&T also pays a dividend, Verizon is the one telecom that is growing its dividend payout. Verizon last raised its dividend by 2% to $0.6775 per-share. AT&T’s dividend record is blemished, in part because the telecom dumped its WarnerMedia business unit two years ago… which led to a dividend reset. From a dividend growth perspective, Verizon is clearly the better choice for dividend investors.

Leverage needs to be addressed

Verizon owes a considerable amount of debt, but the telecom did not yet make much progress in terms of lowering its financial obligations. At the end of the September quarter, Verizon had long-term debt of $128.9B, meaning its debt actually went up $2.9B quarter-over-quarter. As I said in my last work on AT&T (T) — AT&T: Moment Of Truth — debt repayments are a potential catalyst for telecoms to see higher valuations in the future. This is because telecoms have a lot of financial debt that costs them a ton of interest each quarter — Verizon has recurring quarterly interest expenses of about $1.7B — so reducing this debt could be a lever for free cash flow growth going forward.

Verizon’s valuation

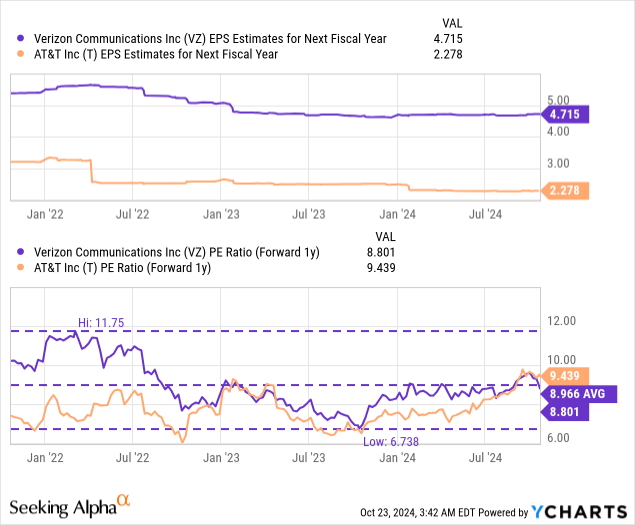

Shares of Verizon dropped 5% after Q3’24 earnings, which I believe creates a new engagement opportunity for dividend investors. Verizon is currently valued at a price-to-earnings ratio of 8.8X, which implies an earnings yield of 11.4%. AT&T, Verizon’s fiercest rival in the U.S. telecom market, is trading at a forward (FY 2025) price-to-earnings ratio of 9.4X… implying an earnings yield of 10.6%.

I believe both telecoms could trade at 10-11X P/E ratios under the condition that they make progress repaying more debt and reducing their leverage profiles. A 10-11X P/E results in a fair value range of $47 to $52 per share, implying up to 25% upside revaluation potential. AT&T, as I indicated in my last work, has made more considerable progress here lately and reduced its net debt by billions of dollars. On the other hand, Verizon saw its long-term debt tick up in Q3’24, but the telecom is growing its dividend… leading to a better dividend growth and value proposition.

Risks with Verizon

Verizon is a slow-growth telecom investment and investors, given the maturity of the U.S. telecom market, shouldn’t expect much in terms of revenue or EPS growth. Most likely, Verizon is going to see low single-digit growth in its top-line going forward and slightly stronger growth in its wireless services business. What would change my mind about Verizon is if the telecom were to see no significant achievements (that is, reductions) in its net financial debt going forward or if the company saw a decline in its subscriber growth rates in its broadband business.

Closing thoughts

Verizon submitted a fairly decent earnings sheet for the third quarter that showed both better-than-expected earnings and weaker revenues, leading to an exaggerated 5% share price drop. Verizon added a solid 389k new subscribers, net, to its broadband business in the September quarter, and the telecom easily supported its dividend with free cash flow. Shares of Verizon are trading at a very attractive earnings yield of 11% which is the second-most important reason why I recommend the telecom (the first being its consistent customer acquisition momentum in broadband). Further, Verizon is growing its dividend, which is something that makes the telecom stand out from AT&T. I believe investors are dealing with a new engagement opportunity after the 5% drop on Tuesday, and I see no major reason why I would want to deviate from a buy recommendation.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of VZ, T either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.