Summary:

- I previously rated Verizon stock a hold due to risks from value segment cannibalization, limited cost-cutting potential, and balanced upside/downside risks.

- Verizon has a track record of overpaying and underdelivering on M&A deals, and I fear Frontier will be more of the same.

- Upside potential from Verizon’s premium positioning is offset by risks from the M&A and management distraction, leading to a balanced risk-reward profile.

- I maintain my hold rating on Verizon at a price target of $39.27.

RiverNorthPhotography

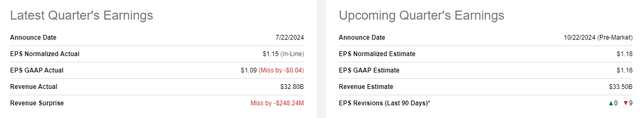

I am updating my analysis on Verizon Communications (NYSE:VZ) in advance of Q3 earnings, which will be released pre-market on October 22nd.

I previously rated Verizon a hold for the following reasons:

- Cannibalization from the value segment risked core business growth

- Costs could only be cut so far, and then margins would start deteriorating again

- DCF generated price target suggested a small downside risk, although this was balanced against a strong dividend

- Upside and downside risks were largely balanced

Since then, Verizon has returned 10%, while the S&P 500 has returned 7%.

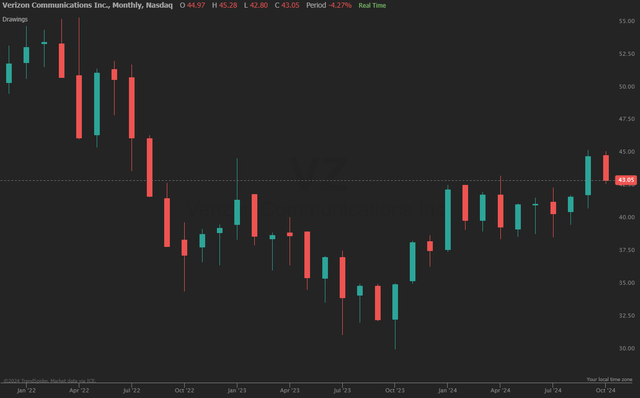

Verizon Price Trend (TrendSpider)

I continue to be conflicted on Verizon, even more so in the light of the Frontier announcement. Earnings are likely to be underwhelming based on recent trends, and Verizon has a history of reducing shareholder value during major M&A deals.

On the flip side, Verizon continues its reign as the “premium” cell carrier and premium pricing along with it. In addition, there is the potential for upside if Verizon can successfully bundle and upsell customers between Fiber and Mobile.

While I lean slightly towards selling Verizon in the wake of the Frontier Deal, the compelling dividend and risk-reward profile must be considered. With that in mind, I maintain my hold rating on Verizon at a price target of $39.27.

Earnings Preview

Verizon is expected to announce EPS of $1.18 and revenue of $33.50 billion, which are each slightly up sequentially.

VZ Earnings Summary (Seeking Alpha)

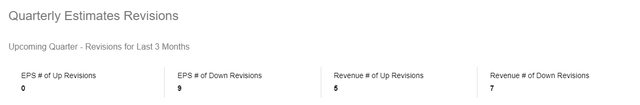

Analysts have been bearish on Q3 results, with 9 EPS down revisions and 0 up revisions over the last 3 months.

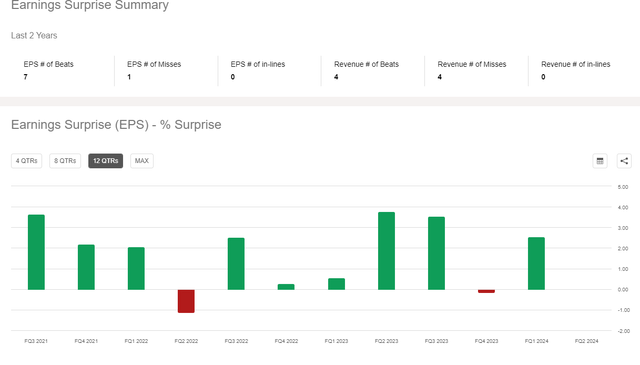

That said, Verizon has a history of guiding softer with 10 beats over the last 12 quarters. We can likely take consensus for what it’s worth, following the down revisions.

VZ Earnings Surprise (Seeking Alpha)

Regardless, performance across the first half of the year, as well as Q3 consensus, keep Verizon solidly on track near the mid-range of 2024 guidance.

2024 Guidance (VZ Investor Relations)

As quarterly results are issued, I will continue to focus on the core business and how the Value segment is impacting Verizon’s ability to drive postpaid rate and volume. In addition, I am looking forward to hearing any more details on cost initiatives and the Frontier deal.

Valuation

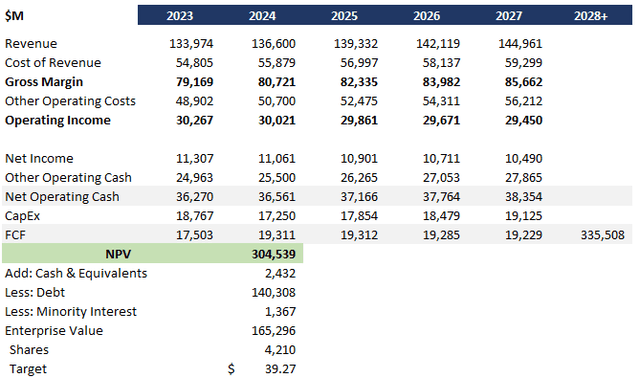

I updated my ongoing DCF analysis on Verizon using the following assumptions:

- Revenue growth of 2% based on management guidance, underlying trends in the business, and overall industry performance

- Cost growth of 3.5% based on cost savings initiatives running out in the near term

- The discount rate of 7% based on WACC of 6.5% adjusted up for deleveraging

- Long-run growth rate of 1% to adjust industry expectations against Verizon’s cost challenges

This DCF analysis yields a price target of $39.27, a slight downside from today’s pricing, although still generating a generous dividend.

VZ DCF Analysis (Data: Seeking Alpha; Analysis: Mike Dion)

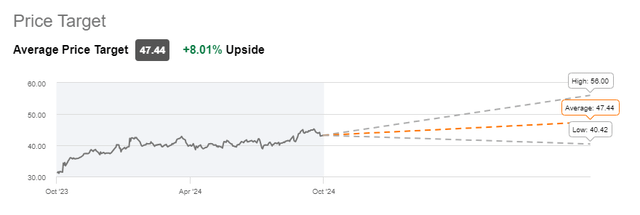

Wall Street is more bullish with a price target of $47.44, and my target is slightly outside the range, which leads me to exercise more caution when considering a final rating.

VZ Wall Street Rating (Seeking Alpha)

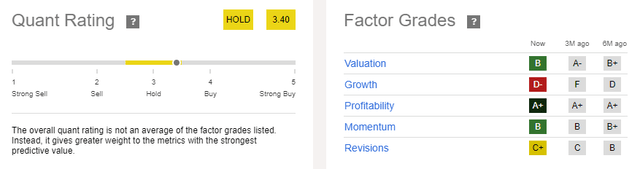

The quant rating is a solid hold, as low growth and poor revisions are offset by strong profitability and solid valuation multiples.

VZ Quant Rating (Seeking Alpha)

Frontier Deal Unlikely To Benefit Shareholders

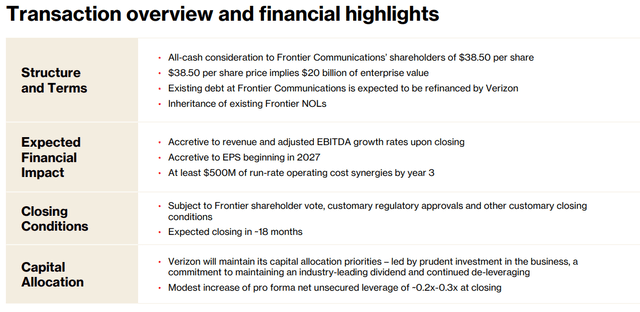

On September 5th, Verizon announced they would acquire Frontier Communications in a deal valued at roughly $20 billion dollars.

Frontier Deal Terms (VZ Investor Relations)

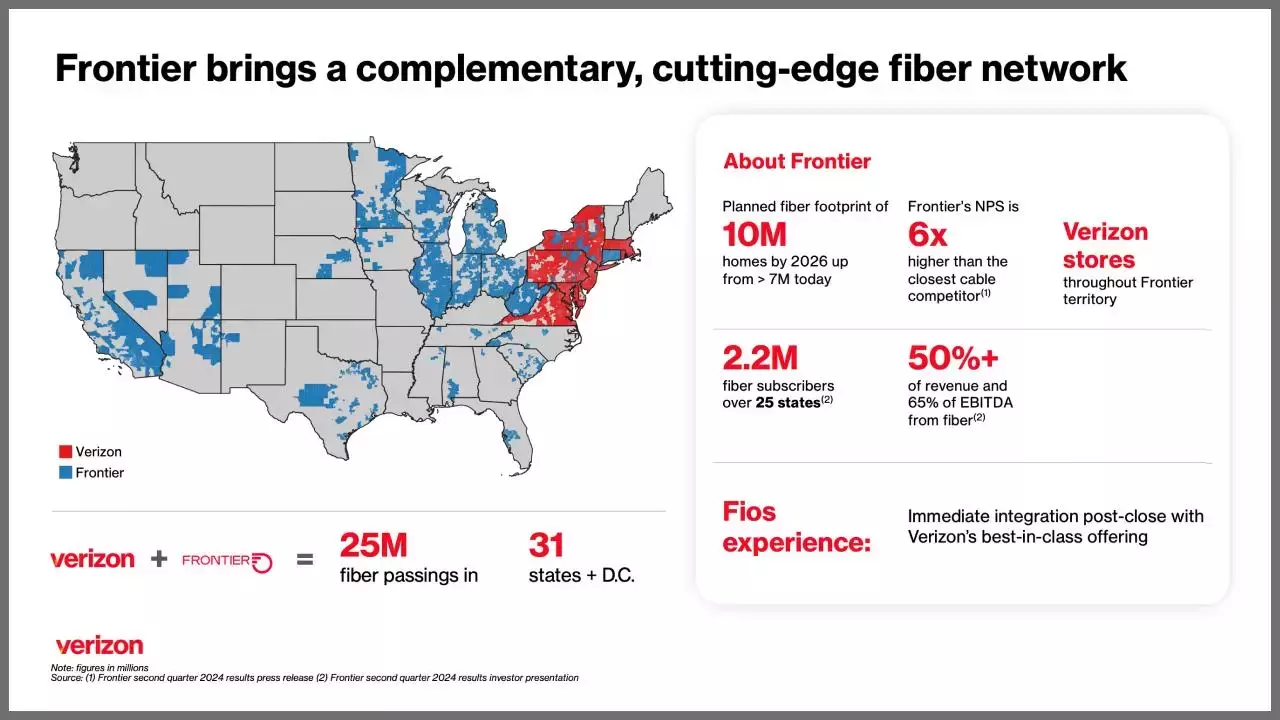

Management stated the goal was to bring in a complementary fiber network, and it’s true the networks are complementary.

Frontier Network (VZ Investor Relations)

However, I was immediately concerned by the deal.

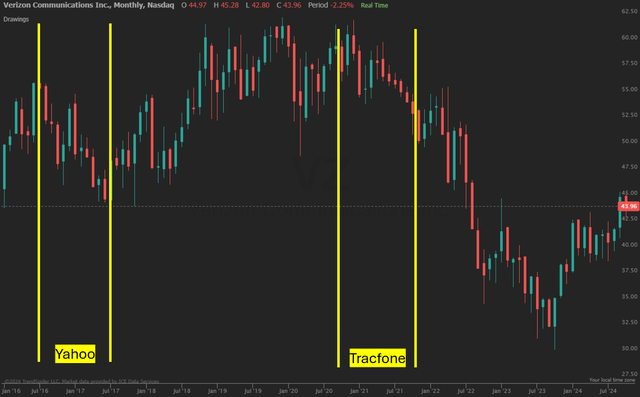

Most important in my mind is that Verizon doesn’t have a great track record with major acquisitions. Both Yahoo and TracFone deteriorated shareholder value from announcement to close date. Not to mention Verizon’s purchase of Blue Jeans, which they shut down just a few years later.

Verizon M&A Impact (TrendSpider)

The deal also seemed very expensive. Frontier was trading at $28.04 before the deal was announced, with $11 billion of debt (on $6 billion of revenue). The offer price of $38.50 per share represents a premium of 44% over the 90-day average value.

While management committed to $500 million of synergy value, it hardly justifies the price.

It is interesting to note that Frontier is still trading below offer value, indicating investor pessimism of the deal going through. And they are right to be pessimistic because the deal is now in jeopardy. Major shareholders, including the second-largest shareholder, are expected to vote no as they feel the deal is actually undervalued.

In my opinion, this is another expensive and unnecessary distraction for Verizon that will not add shareholder value, and may actually decrease it if history is any indication.

Upside Potential And Downside Risk

On the upside, Verizon still maintains a sizeable lead over competitors in pricing power and premium perception. In addition, their business unit has announced several large contracts with enterprise/government customers and more on the way. If management continues to execute in this space and drive the core business forward, there could be notable upside as my price target is highly sensitive to the revenue growth rate as I currently assume costs outpace revenue in the near term.

On the downside, the Frontier deal could play out like Yahoo, Blue Jeans, and TracFone, distracting from the core business and not driving value. This comes when management has already pulled every cost and margin lever available, so there may not be more to squeeze out. These factors could come together and depress margins, reducing shareholder value.

All in all, the upside potential and downside risk are balanced, especially in light of the Frontier deal being challenged by shareholders.

Verdict

I continue to struggle with Verizon’s value proposition as they pursue one distraction for another, and seem to come out the other side at the same or lower value. Earnings are likely to be just fine now that consensus has been lowered. However, the Frontier deal is a wild card that requires caution.

At a DCF-generated price target of $39.27, slight downside from today, with balanced risk-reward and a healthy dividend, I cautiously maintain my hold rating on Verizon. Further underperformance in the core business as earnings are released could undercut this rating, and I will be monitoring closely next week.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of VZ either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.