Summary:

- Verizon is scheduled to report its FY Q3 earnings report on October 22, 2024.

- In terms of business operations, I will pay close attention to updates on its wireless equipment revenue and upgrade volumes.

- Another key issue I will tune into is debt management and capital allocation.

- I expect debt reduction to continue in Q3, translating into about 3.3% of shareholder yield when annualized.

- Together with its 6.2% FWD dividend-yielding, VZ is a solid hold amid an expensive and volatile market.

ryasick

VZ stock: previous thesis and Q3 earnings

In my last article on Verizon stock (NYSE:VZ), I analyzed some of the growth challenges facing VZ with a focus on the potential impacts of the Frontier acquisition. The title of that article, Verizon: Market Likely Overestimated Frontier Impacts, already gave away my sentiment on this topic. As the title suggests, I’m not optimistic that the acquisition could solve VZ’s growth challenge. Furthermore, I also argued that “the acquisition price represents a 44% premium and this overpayment could offset some of the anticipated accreditive benefits for shareholders.”

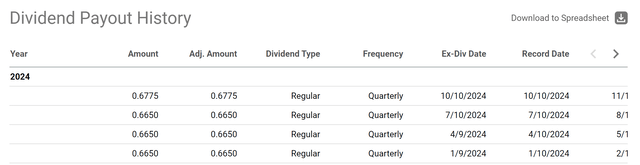

Although there are some positive developments since my last writing that support a better sentiment for the stock. First and foremost, the stock continued its consistent quarterly dividend growth. As you can see from the chart below, the most recent dividend payment (on Oct. 10, 2024) was raised to an amount of $0.6775 per share. This represents an increase of about 1.9% from the previous quarter’s dividend of $0.6650 per share. With this raise, the stock is yielding about 6.2% on an FWD basis at its current price, a quite attractive yield both in absolute terms and relative terms. I will revisit this topic later to better contextualize it.

Seeking Alpha

The discussion of dividends also leads me to the central topic of this follow-up article: Its upcoming FY Q3 earnings report. This article will serve as a preview of its Q3 earnings report (“ER”) and I will point out a few key issues that I will be looking closely at in the ER. I will explain why the top two issues on my list are its debt situation and the implied total shareholder yield (“TSY”). As attractive as its dividend yields are, the TSY is what truly matters to shareholders in my mind.

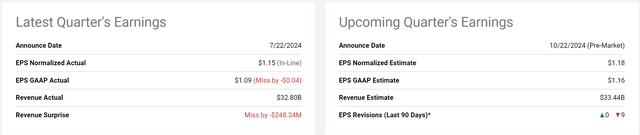

To prime the subsequent discussion for readers who don’t follow the earnings calendar closely, VZ is scheduled to report its FY Q3 earnings next week, on Oct 22, 2024. In Q2, VZ reported a normalized EPS of $1.15, which was in line with analysts’ expectations. However, both GAAP EPS and revenue missed the estimates. As discussed in my earlier article, these results were largely a reflection of the unevenness in the growth across its segments. Its service and other revenue did well in my view. However, these positives were offset by a dip in wireless equipment revenue due to lower upgrade volumes. These are the issues that I will pay close attention to in the Q3 ER. And they will be the key factors to determine if VZ can reach analysts’ projected numbers. To wit, for Q3, analysts project a moderate recovery of its GAAP EPS ($1.16 per share) from the previous quarter’s $1.09.

Besides these operational issues, another – and an even bigger issue on my list – is its debt and capital allocation, as detailed next.

Seeking Alpha

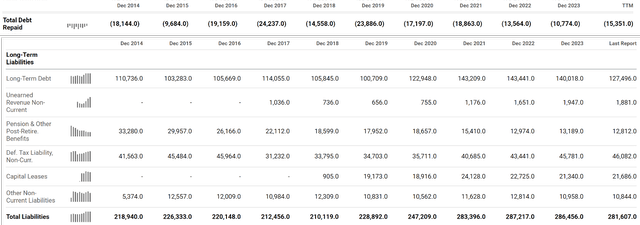

VZ stock: Debt in focus

The company has been putting its spare cash to good use in recent years. Besides raising dividends as just mentioned, the company has also paid down its debt by a good amount, as you can see from its following cash statement and balance sheet. To wit, the company has allocated over $10 billion of its cash toward debt repayment in 2023 and over $15 billion as of TTM 2024. As a result, its long-term debt and total debt have been trimmed at a good pace. As seen from its balance sheet below, its total liabilities peaked at about $287 billion by the end of 2022 and have decreased to about $281 billion currently.

Looking ahead, I expect Verizon to keep allocating its spare cash to pay down its debt (besides bolstering its dividend and making acquisitions like Frontier). Verizon ended the second quarter with more than $2.4 billion in cash and equivalents. If the company can generate the level of earnings that the above consensus expects, I expect the company to reduce its debt by another $5 to $6 billion in FY 2024. At its current market cap of around $184 billion, such a reduction would translate into another 3.3% of shareholder yield, not a negligible component of shareholder yield compared to its 6.2% cash dividends.

The debt reduction also helps to make the company’s valuation more attractive, as elaborated on next.

Seeking Alpha

VZ stock: Debt-adjusted valuation

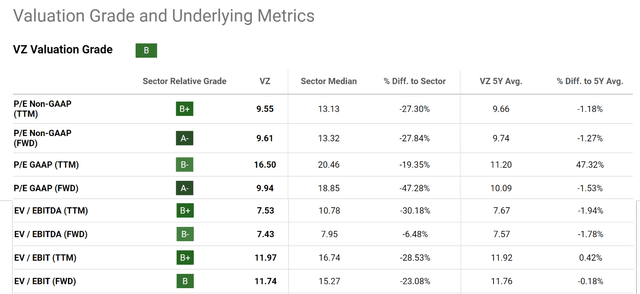

A lower debt level directly leads to a lower enterprise value (“EV”) with everything else being equal. Thus, from a business owner’s perspective, the company becomes more attractive to hold even if its P/E points to a different direction. This is what exactly VZ’s valuation situation is in my view.

As seen in the next chart, VZ’s current P/E ratios send a mixed signal. These ratios could suggest either a small discount or a large valuation premium compared to its historical levels. For example, on a TTM and non-GAAP basis, its P/E is 9.59x and is about 1% below its five-year average of 9.66x. However, on a GAAP basis, its TTM P/E is 16.5x and is about 47% above its five-year average of 9.66x.

However, if we switch to EV-oriented multiples and take its debt reduction into consideration, the picture becomes quite consistent. To me, VZ’s debt-adjusted valuation ratios, such as EV/EBITDA or EV/EBIT ratios, all point to fair valuation under current conditions when compared to its historical averages. For instance, its current FWD EV/EBITDA ratio is 7.43x, about 2% below its five-year average. And its FWD EV/EBIT ratios are within 1% deviation from its five-year averages.

Seeking Alpha

Other risks and final thoughts

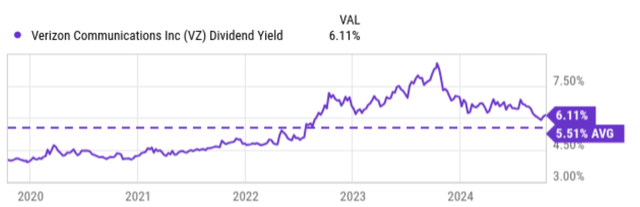

An article on VZ won’t be complete without praising its dividend yields, a key upside risk for VZ. As aforementioned, VZ currently yields about 6.2% on an FWD after its recent dividend raise. This is very attractive both in absolute terms and relative terms. To better contextualize things, the chart below shows its dividend yield in the past decade. As seen, the yield peaked in 2023 at nearly 8%. It has declined from this peak thanks to the stock price recovery and currently hovers around 6.11% on a TTM basis (or 6.2% on an FWD basis). These levels are still substantially above the 5.51% average observed in the past decade.

Seeking Alpha

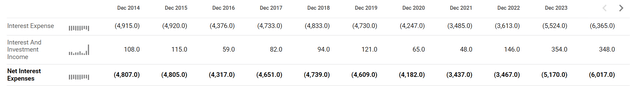

To conclude, I consider VZ a solid hold under current conditions. The negatives are largely the growth challenge in some of its segments, as mentioned earlier. Also, note that even though it has been reducing its debt burden recently, its interest expenses have increased as seen from its income statement below, largely because of higher borrowing rates. To balance these negatives, the stock A) is trading at a fair valuation judging by its EV-based multiples, B) provides an above-average cash yield, and C) an even higher total shareholder yield when its debt reductions are considered. These positive offers sizable downside protection amid a very expansive overall market.

Seeking Alpha

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

Join Envision Early Retirement to navigate such a turbulent market.

- Receive our best ideas, actionable and unambiguous, across multiple assets.

- Access our real-money portfolios, trade alerts, and transparent performance reporting.

- Use our proprietary allocation strategies to isolate and control risks.

We have helped our members beat S&P 500 with LOWER drawdowns despite the extreme volatilities in both the equity AND bond market.

Join for a 100% Risk-Free trial and see if our proven method can help you too. You do not need to pay for the costly lessons from the market itself.