Summary:

- Verizon’s $20 billion acquisition of Frontier will expand its fiber offerings, enhancing its position in the U.S. telecom market.

- Strong financial performance with a 3.5% increase in wireless service revenue and a double-digit FCF yield of ~$23 billion annually.

- Operational growth includes substantial postpaid phone net adds and a turnaround in prepaid net adds, despite a decline in broadband net adds.

- Verizon’s manageable debt load and over 6% dividend yield support continued shareholder returns, making it a compelling investment despite competition.

RiverNorthPhotography

Verizon (NYSE:VZ) is one of the largest telecommunications companies in the world, with a market capitalization of almost $200 billion. We last recommended the company as a once-in-a-lifetime opportunity 4 months ago, and despite its double-digit total returns since then, the company’s performance and acquisition of Frontier will support future returns.

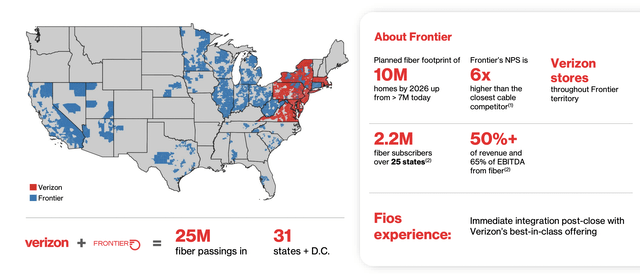

Verizon + Frontier

Verizon is making a $20 billion all-in (counting debt) acquisition of Frontier. The price is coming in at roughly $9 billion for equity and $11 billion in assumed debt, which the company will refinance.

The acquisition will enable Verizon to substantially expand its fiber offerings with 25 million combined fiber passing, 10 million of which is coming from Frontier. Frontier is building a strong fiber asset, which is the next generation of home internet technology, and Verizon is working to solidify its position in the United States.

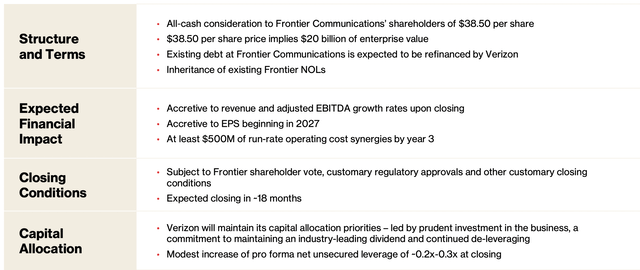

The details of the acquisition price are above, as discussed already. The transaction is expected to take a while given the utility like footprint, but be accretive to revenue and adjusted EBITDA growth on closing. The transaction is expected to be accretive to EPS in 2027 not particularly surprising given the acquisition close time.

In a capital intensive industry, receiving $500 million of run-rate operating synergies will be huge for continued success. The leverage addition is modest, and we much prefer a cash-based acquisition the company can pay off versus rising interest rates.

Verizon Financial Performance

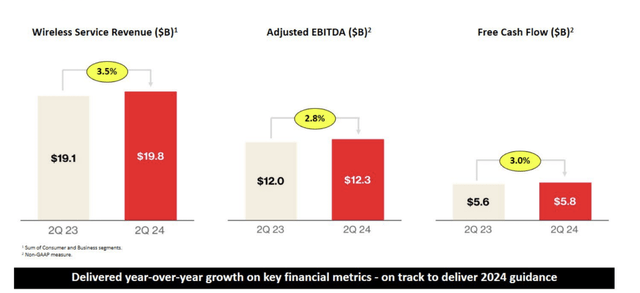

Financially, in the 2nd quarter, Verizon showed continued strength in its performance for a $190 billion company.

The company saw a 3.5% increase in wireless service revenue to almost $20 billion. Adjusted EBITDA margins remained strong, with 3% growth in adjusted EBITDA, and the company managed to translate that down to FCF growth of 3% at $5.8 billion. On an annualized basis, that’s ~$23 billion in annual FCF, which is a double-digit FCF yield for the company.

It shows the company’s strong ability to generate cash despite hefty debt and interest expenditures.

Verizon Operational Performance

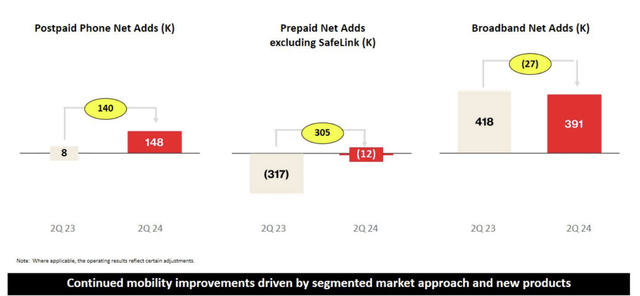

From an operational performance, the company has continued to perform well, and as discussed above, the company’s Frontier acquisition should help support this.

The company’s postpaid phone net adds grew substantially YoY to almost 150K, and the company’s prepaid net adds turned around a hefty reversal last year. The company’s broadband net adds declined substantially; however, it still represents a strong set of growth for the company. The company returning to growth after a difficult 2023 is impressive for the company.

It should also enable the company’s revenue and cash flow growth to continue going forward.

Verizon Cash Flow

The company’s future success is based on cash flow and managing the company’s debt load. Declining interest rates will help the company out.

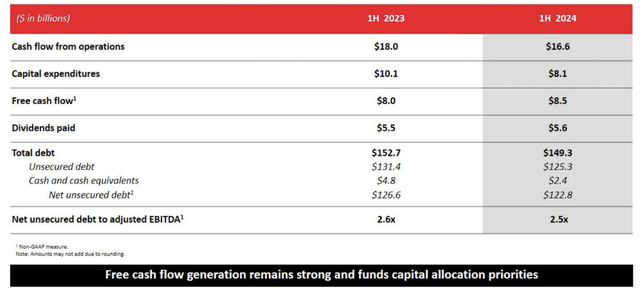

For the first half of the year, the company earned almost $17 billion in CFFO. Investments in its business remained high at $8 billion, and the company’s more than 6% yield cost it almost $6 billion. The company can comfortably afford its dividend as seen with its FCF, and its additional cash has gone to improving its debt.

The company’s net unsecured debt has gone down by $4 billion YoY, and we’d like to see continued reductions there when possible. However, at current levels, share repurchases are also profitable. The company’s debt to adjusted EBITDA ratio of 2.5x is more than manageable for the company and its continued cash flow.

Thesis Risk

The largest risk to our thesis is the competition Verizon faces. AT&T is making strong moves in the fiber business, and other companies such as Google are also expanding in fiber with minimal need to profit. At the same time, in cellular, T-Mobile and AT&T remain strong competitors. This combined with a slower growing industry could hurt Verizon’s ability to drive long-term shareholder returns.

Conclusion

Verizon is a strong company. It has an incredibly strong position in the U.S. market, and its acquisition of Frontier Communications will enable it to expand its cellular strength into broadband and fiber strength. That will enable the company to continue generating long-term cash flow that it can use for a variety of shareholder returns.

The company continues to have a dividend yield of more than 6%, one that it can comfortably afford, while reducing the debt yield. The company’s double-digit FCF yield enables strong shareholder returns. Overall, Verizon is not an investment to be missed, even with recent share price strength.

Analyst???s Disclosure: I/we have a beneficial long position in the shares of VZ either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

You Only Get 1 Chance To Retire, Join The #1 Retirement Service

The Retirement Forum provides actionable ideals, a high-yield safe retirement portfolio, and macroeconomic outlooks, all to help you maximize your capital and your income. We search the entire market to help you maximize returns.??

Recommendations from a top 0.2% TipRanks author!

Retirement is complicated and you only get once chance to do it right. Don’t miss out because you didn’t know what was out there.

We provide:

- Model portfolios to generate high retirement cash flow.??

- Deep-dive actionable research.

- Recommendation spreadsheets and option strategies.????